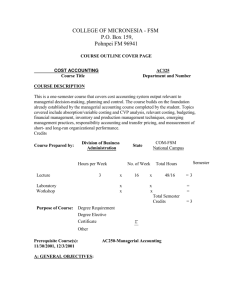

AC-325 - College of Micronesia

advertisement

AC 325 COST ACCOUNTING Course Syllabus Marian Gratia G. Medalla, CPA,MBA F-103, Building F. 3202480 ext. 110 e-mail address: marian_gratia@comfsm.fm Class Day and Time/Room: M 5:30-7:00 WF 5:30-8:30/Room 5 Course Description: This is a one-semester course that covers cost accounting system output relevant to managerial decision-making, planning and control. The course builds on the foundation already established by the managerial accounting course completed by the student. Topics covered include absorption/variable costing and CVP analysis, relevant costing, budgeting, financial management, inventory and production management techniques, emerging management practices, responsibility accounting and transfer pricing, and measurement of short- and long-run organizational performance. A. PROGRAM LEARNING OUTCOMES (PLOs): The student will be able to: 1. Demonstrate an understanding of intermediate accounting principles by describing the financial reporting environment and the conceptual framework of financial accounting, analyzing financial statements in detail, and accounting for cash and receivables, inventories, property, plant and equipment, intangibles, liabilities, stockholders’ equity, and other special areas. 2. Demonstrate an understanding of cost accounting systems relevant to managerial-decision making, planning and control by solving problems involving various costing and budgeting methods; by applying financial, inventory and production management techniques in cost accounting; and by accurately measuring short- and long-term organizational performance. 3. Demonstrate competence in analyzing and recording various transactions for state and local governments, the federal government, colleges and universities, and other nonprofit organizations; in preparing and interpreting financial statements; and in explaining differences between public and private sector accounting. 4. Demonstrate an understanding of wide range of tax concepts with special focus on the taxation of business entities in the United States and the Federated States of Micronesia and a minor emphasis on the individual taxation in the two countries. 5. Demonstrate an understanding of the statistical methods of sampling and estimating population statistics and competence in using computer software to calculate point estimates and confidence intervals and use statistical methods to test hypotheses, recognize trends and make forecasts to support decisions in the business/economics environment 6. Apply knowledge acquired from accounting and other courses by solving real world accounting and general workplace problems in a particular organization in the COM-FSM Internship Program. B. STUDENT LEARNING OUTCOMES (SLOs) – GENERAL: The student will be able to: 1. Develop a deeper understanding of managerial information needs and processes in an organization. 2. Describe the role of cost accounting in providing planning, controlling, decision-making and performance evaluation information needed by the organization. SLO PLO1 PLO2 PLO3 PLO4 PLO5 PLO6 1 IDM 2 IDM I = Introduced D = Demonstrated M = Mastered C. STUDENT LEARNING OUTCOMES (SLOs) – SPECIFIC: The student will be able to: General SLO 1. Develop a deeper understanding of managerial information needs and processes in an organization. Student learning outcomes 1.1 Identify and calculate the following: 1) Cost accumulation / cost presentation. 2) Absorption / variable costing. 3) Product / period costs. 4) Cost-volume-profit analysis. 5) Contribution margin in units and dollar. 6) Break-even point in unit dollars. 7) Sale cost of goods sold, gross profit and net income. 8) Profit before and after taxes based on fixed cost. 9) Incremental analysis. 10) Degree of operating leverage. 1.2 Explain the concept of relevance and sunk costs by the following: Association with decision. Importance to decision maker Bearing on the future Outsourcing, scarce resources, sales mix and product line decisions 1.3 Describe the Master Budget and prepare the following components of budgets: Operating / financial Sales / production Personnel Capital Cash Budgeted financial statements 1.4 Explain the purpose of capital budgeting and calculate the following: 1) Cash flow using time-lines and payback period. 2) Discounted cash flow using NPV, profitability index, and IRR. 3) The effect of depreciation on after-tax cash flows. General SLO 2. Describe the role of cost accounting in providing planning, controlling, decision-making and performance evaluation information needed by the organization. Student learning outcomes 2.1 Identify and describe the various elements of cost control: · Cost control systems and cost changes. · Committed vs. discretionary costs. · Use of budgets as a cost control tool. · Activity-based budgeting. · Program budgeting. · Zero-based budgeting. 2.2 Explain the following: 1) The importance if inventory management. 2) Production flow. 3) The use of flexible manufacturing systems and how they relate to computer-integrated manufacturing. 4) The theory of constraints. 5) Purchasing costs and carrying costs and how they are computed. 6) Pull systems of production control work. 7) Product life cycles and how they affect product costing and profitability. 8) Target costing/just-in-time philosophy and how they affect production. 2.3 Explain the concepts of the following: 1) Business reengineering and change. 2) Competitive force/diversity in the firm. 3) Enterprise resources planning and its potential benefits to the firm. 4) Open-book management. 5) Environmental cost control. 2.4 Explain the following: 1) The differences among various types of responsibility centers. 2) The allocation of services department costs. 3) Transfer pricing and how it is calculated. 4) The advantages and disadvantages of service transfer prices. 2.5 Describe the following: 1) The importance of a vision statement to the firm. 2) Long-run objectives vis-à-vis short-run objectives. 3) Non-financial performance measure. 4) How activity-based costing is used in long-run performance evaluation. 5) Performance measurement constraints. D. COURSE CONTENT 1. Absorption/Variable Costing and Cost-VolumeProfit analysis 2. Relevant Costing 3. The Master Budget 4. Capital Budgeting 5. Financial Management 6. Innovative Inventory and Production Management Techniques 7. Emerging Management Practices 8. Responsibility Accounting and Transfer Pricing in Decentralized Organizations 9. Measuring Long-Run and Non financial Organizational Performance E. METHODS OF INSTRUCTION · Lectures, Discussions, and Demonstrations (Illustrative Problems) · Problem Solving and Case Analysis, with emphasis on problem solving and encouraging to think critically about business decisions · Individual and Collaborative Activities – Research and Reporting · Guest lecturer/resource speaker F. REQURIED TEXTS AND MATERIALS Kinney, M.R. & Raiborn, C.A. (2011). Cost Accounting: Foundations and Evolutions. Ohio: South-Western Cengage Learning (or most recent edition). G. REFERENCE MATERIALS Hansen, D.R., Mowen, M.M., & Guan, L. (2009). Cost Management: Accounting and Control. . Ohio: South-Western Cengage Learning (or most recent edition). Maher, M.W., Stickney, C.P., & Weil, R.L. (2008). Managerial Accounting: An Introduction to Concepts, Methods and Uses. Ohio: South-Western Cengage Learning (or most recent edition). VanDerbeck, E.J. (2008). Principles of Cost Accounting. Ohio: Thomson South-Western (or most recent edition). Walther, L. (2011). Principles of Accounting. Retrieved October 25, 2011, from http://www.principlesofaccounting.com H. COMPOSITION OF FINAL GRADES HOMEWORK CLASSWORK QUIZZES EXAMINATION PERIODIC (MIDTERM OR TENTATIVE FINAL) GRADE 10% 20% 30% 40% 100% MIDTERM GRADE TENTATIVE FINAL GRADE TOTAL DIVIDED BY NUMBER OF GRADING PERIODS AVERAGE: FINAL GRADE XX% XX% XX% 2 XX% 90%-100% A 80%-89% B 70%-70% C 60-69% D 59% AND F BELOW I. ACADEMIC HONESTY Any form of cheating is prohibited. Cheaters will get ZERO on that particular evaluation, and possibly be subjected to further disciplinary actions. J. CLASS POLICIES 1. No late assignments/class-works will be accepted. Home-works must be done at home, and not in school. 2. No special quizzes will be given, unless the reason for absence include is either to attend the funeral of a close relative; sickness; to represent the college in an off-campus activity; or if working, if required by the employer, and a valid documentation is presented. 3. Maximum allowable absence is 5. If your absences exceed this number, you will receive F from this class. 4. Cellular phones and other noise making devices must be set on silent mode while inside the class. Taking calls is prohibited inside the class. 5. Tardiness from class is discouraged. 6. Anyone can get an “A”, provided he/she worked hard to deserve it. 6. Changes in the syllabus will be immediately communicated to the class. Date 1-21 Chapter 3 Topic Cost Behavior, Absorption vs. Variable Costing Cost-Volume Profit Analysis Activity Class Discussion/Activity: Exercises 21, 22, 26, 27, 28, 30, 31, and 35 Class Discussion/Assignment due today: Exercises 8, 12, 16, 24, 28, and 32 1-23 9 2-02 3, 9 Review and Quiz 10 Absorption vs. Variable Costing, CVP Analysis Relevant Costing 2-04 2-06 2-09 2-11 2-13 10 10 8 8 Relevant Costing Relevant Costing Master Budget Master Budget 2-16 2-18 8 15 Master Budget Capital Budgeting 2-20 2-23 15 Capital Budgeting 2-25 2-27 3,8,9,10, 15 16 3-02 16 3-04 18 3-06 18 3-09 13 3-10 13 3-11 12, 17, 19 3-12 3-13 Managing Costs and Uncertainty Managing Costs and Uncertainty Inventory and Production Management Inventory and Production Management Responsibility Accounting, Support Department Cost Allocations, and Transfer Pricing Responsibility Accounting, Support Department Cost Allocations, and Transfer Pricing CMS, Implementing Quality Concepts and Emerging Management Practices Class Discussion/Assignment due today: Exercises 12, 13, 15, 19, 20 Class Discussion/Assignment due today: 22, 23, 25, 26, 27, 28 Review and Quiz Class Discussion/Assignment due today: Exercises 15, 16, 19, 22, Class Discussion/Assignment due today: 26, 30, 33, 34, 35, 42, 43, 44 Review and Quiz Class Discussion/Assignment due today: Exercises 12, 13, 15, 19, 20 Class Discussion/Assignment due today: 22, 23, 25, 26, 27, 28 Review and Quiz for Chapter 15 Review for Midterm Examinations Midterm Examinations Class Discussions/Assignment due today: Class Discussions/Assignment due today: Quiz Class Discussions/Assignment due today: Class Discussions/Assignment due today: Quiz Class Discussions/Assignment due today: Class Discussions/Assignment due today: Quiz Group Reporting/Assignment due today: Exercises 11 (p. 294), 14 (p. 495), 19 (p. 495), 22 (p. 495), 24 (p. 495); 15 (p.715), 31 (p. 719), 12 (p. 793), 16 (p. 794), 17(p. 794), 19(p. 794), 22 (p. 795) Quiz Chapters 12, 17, 19 Review for Final Examinations Final Examinations