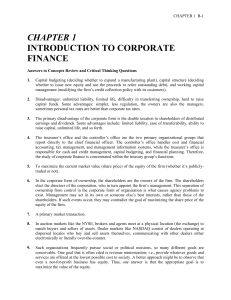

CHAPTER 1 An Overview of Financial Management

advertisement

CHAPTER 1 Introduction to Financial Management What is corporate finance? Forms of Businesses Goals of the Corporation Conflicts Between Managers and Shareholders 1-1 Careers in Finance Career Commercial Banking Loan Officer Department Manager Annual Salary $ 90,000 + $ 200,000 + Corporate Finance Financial Analyst Credit Manager Chief Financial Officer $ 61-78,000 $ 73-92,000 $ 222-367,000 Investment Banking (bulge bracket) First Year Analyst First Year Associate Assistant Vice President Director/Principal Managing Director/Partner Department Head $ 90-180,000 $ 200-350,000 $ 300-900,000 $ 500k - 2 mil $ 600k - 30 mil $ 1 mil - 70 mil Money Management Portfolio Manager Bank Trust Department $ 500,000 + $ 60k - 150,000 Course Overview Finance: what is it? Corporate Finance Corporations Money and capital markets Financial Markets: Banks, Stock Exchanges Investments Investors 1-3 If you are an investor In investments we seek to value securities and maximize the value of our portfolio (Valuation of bonds and stocks). 1-4 If you are the CEO of an industrial company In corporate finance we are concerned with making decisions that enhance firm value. you can make your company more valuable by choosing “better” projects (capital budgeting decision) you can make your company more valuable by changing the mixture of your financing, i.e. the ratio of debt to equity (capital structure decision) 1-5 Financial decisions Capital budgeting decisions (how to invest money) Real capital investments/Intangible Assets Mergers; acquisitions Capital structure decisions (how to raise and return money) Equity Debt Distribution (Dividend, share repurchase) 1-6 Balance-Sheet of the Firm The Capital Budgeting Decision Current Liabilities Current Assets Long-Term Debt Fixed Assets 1 Tangible 2 Intangible What long-term investments should the firm engage in? Shareholders’ Equity 1-7 Balance-Sheet of the Firm The Capital Structure Decision Current Liabilities Current Assets Fixed Assets 1 Tangible 2 Intangible How can the firm raise the money for the required investments? Long-Term Debt Shareholders’ Equity 1-8 Corporate finance: what is it? A set of concepts, theories and approaches that help the firm make financial decisions. Corporate finance boils down to the investment and financing decisions made by corporations. The Role of The Financial Manager (2) (1) Firm's operations Real assets Financial Manager (3) (4a) (4b) (1) Cash raised from investors (2) Cash invested in firm (3) Cash generated by operations (4a) Cash reinvested (4b) Cash returned to investors Investors (debt&equity) Financial assets FIN 351: course organization FIN 351 Module 1 Module 2 Fundamentals of valuation Fundamentals of PV Financial decision Interest rates Perpetuities and annuities calculation Valuing stocks and bonds NPV and other criteria Valuing risky investments Risk and return Module 3 Corporate financial decisions Portfolio theory Diversification and covariance Types of securities Stocks, bonds and other Tangency portfolio, CAPM risk and return Module 4 Market efficiency and options Weak, semi-strong and strong form efficiency Information and stock prices Modigliani-Miller theorems WACC and discount rate Course organization This course is broken-down into four modules Module 1: time value of money Module 2: risk and return Module 3: capital structure Module 4: financial markets Time value of money A basic building block We will soon have the necessary skills needed to value stocks and bonds In this module, we don’t consider risk It is assumed that future cash flows are riskless It is assumed that the discount rate is riskless Risk and return This part teaches us about uncertainty How do we measure risk? How much is a risky cash flow in the future worth (today)? conceptually more difficult Financing decisions If you are the CEO of an industrial company you can make your company more valuable by choosing “better” projects you can also make your company more valuable by changing the mixture of your financing (i.e. the ratio of debt to equity) The efficiency of financial markets We will look at how information gets absorbed into security prices We will learn three forms market efficiency We will examine the implication of market efficiency on financing Alternative Forms of Business Organization Proprietorship Partnership Corporation 1-18 Proprietorships & Partnerships Advantages Ease of formation Subject to few regulations No corporate income taxes Disadvantages Difficult to raise capital Unlimited liability Limited life 1-19 Corporation Advantages Unlimited life Easy transfer of ownership Limited liability Ease of raising capital Disadvantages Double taxation Cost of set-up and report filing 1-20 Organizing a Business Sole Partnership Proprietorship Corporation Who owns the business? The manager Partners Shareholders Are managers and owners separate? What is the owner’s liability? Are the owner & business taxed separately? No No Usually Unlimited Unlimited Limited No No Yes 21 A Comparison of Partnership and Corporations Corporation Partnership Liquidity Shares can easily be exchanged. Subject to substantial restrictions. Voting Rights Usually each share gets one vote Taxation Double General Partner is in charge; limited partners may have some voting rights. Partners pay taxes on distributions. Formation difficult easy Liability Limited liability Continuity Perpetual life General partners may have unlimited liability. Limited partners enjoy limited liability. Limited life 1-22 What should be the financial Goal of a company? Maximizing revenue, cut cost, secure market share? The primary financial goal is shareholder wealth maximization, which (generally) translates to maximizing stock price. 1-23 Is stock price maximization the same as profit maximization? No, despite a generally high correlation amongst stock price, EPS, and cash flow. Some actions may cause an increase in earnings, yet cause the stock price to decrease (and vice versa). E.g., cut R&D. 1-24 Factors that affect stock price Projected cash flows to shareholders Timing of the cash flow stream Riskiness of the cash flows 1-25 Agency relationships An agency relationship exists whenever a principal hires an agent to act on their behalf. Within a corporation, agency relationships exist between: Shareholders and managers Shareholders and creditors 1-26 Shareholders versus Managers Managers are naturally inclined to act in their own best interests (Shirking, empire building, corporate jets, entrenchment). To mitigate the problem: Bonus, stock options Direct intervention by shareholders The threat of firing The threat of takeover 1-27 Shareholders versus Creditors Shareholders (through managers) could take actions to maximize stock price that are detrimental to creditors. For example: taking too risky projects. (Are you willing to lend money to someone who gamble a lot?) 1-28 When the outcome is very good, shareholders enjoy the fruit. When the outcome is bad, shareholders are protected by limited liability. E.g., can get away by declaring bankruptcy. 1-29 1-30