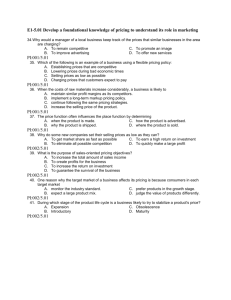

Cost-Based Pricing: Example

advertisement

Pricing Chapter 1. Strategic Pricing Stephan Sorger www.stephansorger.com Disclaimer: • All images such as logos, photos, etc. used in this presentation are the property of their respective copyright owners and are used here for educational purposes only • Some material adapted from: Nagle et al, “The Strategy and Tactics of Pricing,” 5th Edition © Stephan Sorger 2015: www.stephansorger.com; Pricing: Ch 1: Strategic Pricing; 1 © Stephan Sorger 2015: www.stephansorger.com; Pricing: Ch 1: Strategic Pricing; 2 Chapter Overview •Define Strategic Pricing and differentiate it from more tactical approaches such as cost-driven, market-driven or competitor-driven pricing •Introduce the identifying characteristics of strategic pricing •Proactive •Profit-driven •Value-based •Define the five elements of a pricing strategy and illustrate how they work in concert to maximize profitability: •Value creation •Price and offer structure •Value communication •Pricing Policy •Price setting © Stephan Sorger 2015: www.stephansorger.com; Pricing: Ch 1: Strategic Pricing; 3 Strategic Pricing Pyramid: 1-1 © Stephan Sorger 2015: www.stephansorger.com; Pricing: Ch 1: Strategic Pricing; 4 Strategic Pricing Pyramid: 1-1 Questions: -Why might customers say your prices are high? (Hint: Work from top to bottom on the pyramid) -33% of companies use cost-plus pricing even though managers know it is not effective. Why? -What is a problem with pricing for market share? © Stephan Sorger 2015: www.stephansorger.com; Pricing: Ch 1: Strategic Pricing; 5 Alternative Approaches to Value Creation: 1-2 Product Led Product Cost Price Value Customers Customer Led Customers Value Prices Costs Products © Stephan Sorger 2015: www.stephansorger.com; Pricing: Ch 1: Strategic Pricing; 6 Alternative Approaches to Value Creation: 1-2 Product Led Product Cost Price Value Customers Customer Led Customers Value Prices Costs Products Questions: -Name some recent product failures; Why did they fail? Google Glass; RIM Blackberry Q10; HP Chromebook 11; “The Lone Ranger” -How does this relate to customer-led pricing? -How does this relate to the feature-driven approach done by tech firms? © Stephan Sorger 2015: www.stephansorger.com; Pricing: Ch 1: Strategic Pricing; 7 Tactical Pricing Orientations Instead of strategic, value-based pricing, some managers choose tactical techniques: Cost-Driven Pricing (based on product cost) Customer-Driven Pricing (arriving at final price via negotiation) Competition-Driven Pricing(based on what competitors charge) Result: Lower profitability in almost all cases © Stephan Sorger 2015: www.stephansorger.com; Pricing: Ch 1: Strategic Pricing; 8 Cost-Driven Pricing “Price every product to yield a fair return over full cost” Total Cost Unit Cost Target Price Volume © Stephan Sorger 2015: www.stephansorger.com; Pricing: Ch 1: Strategic Pricing; 9 Cost-Driven Pricing Unit cost: Variable cost: Material and labor to make one unit of production Allocated fixed cost: Spread out fixed cost over many units Total Cost Unit Cost Target Price Volume © Stephan Sorger 2015: www.stephansorger.com; Pricing: Ch 1: Strategic Pricing; 10 Cost-based Pricing: Example Example: Acme plans to launch its new product, the X-1000. The sales department expects to sell 1 million units The finance department requires a minimum price of $9 to cover costs Projected Costs and Revenues at Expected Sales = 1,000,000 units Direct Variable Costs Direct Fixed Costs Administrative Overhead Full Cost Revenue Profit Total $3,000,000 $3,000,000 $1,500,000 $7,500,000 $9,000,000 $1,500,000 Per Unit $3.00 $3.00 $1.50 $7.50 $9.00 $1.50 Result: Make profit of $1.50 © Stephan Sorger 2015: www.stephansorger.com; Pricing: Ch 1: Strategic Pricing; 11 Cost-Based Pricing: Example But the X-1000 sells only 750,000 units, not 1 million Cost-based pricing says increase price to $10.50 ($9 + $1.50 “profit”) Actual Costs and Revenue at Actual Sales = 750,000 units Total Per Unit Direct Variable Costs $2,250,000 $3.00 Direct Fixed Costs $3,000,000 $4.00 Administrative Overhead $1,500,000 $2.00 Full Cost $6,750,000 $9.00 Revenue $6,750,000 $9.00 Profit $0 $0 What happens when we increase price to $10.50? © Stephan Sorger 2015: www.stephansorger.com; Pricing: Ch 1: Strategic Pricing; 12 Cost-Based Pricing: Example But raising price will decrease the number of units sold, impacting profit. Higher prices do not necessarily result in higher profits Current Price 5% Decline in Unit Sales 33% Decline in Unit Sales $9.00 $10.50 $10.50 750,000 712,500 500,000 Variable Costs $3.00 $3.00 $3.00 Fixed Costs $4.00 $4.21 $6.00 Admin. Overhead $2.00 $2.11 $3.00 Unit Cost $9.00 $9.32 $12.00 Unit Profit $0 +$1.18 -$1.50 Unit Sales Total Profit $0 $843,750 No competition -$750,000 Competitive market © Stephan Sorger 2015: www.stephansorger.com; Pricing: Ch 1: Strategic Pricing; 13 Cost-based Pricing Instead, Acme should decrease its price to boost sales volume. Lower prices do not necessarily result in lower profits Financial Implications of a 10% Price Cut Current Price 5% Increase in Unit Sales 33% Increase in Unit Sales $9.00 $8.10 750,000 787,500 Variable Costs $3.00 $3.00 $3.00 Fixed Costs $4.00 $3.81 $3.00 Admin. Overhead $2.00 $1.90 $1.50 Unit Cost $9.00 $8.71 $7.50 Unit Profit $0 -$0.61 +$0.60 Total Profit $0 -$480,375 $600,000 Unit Sales $8.10 1,000,000 © Stephan Sorger 2015: www.stephansorger.com; Pricing: Ch 1: Strategic Pricing; 14 Cost-based Pricing Instead, Acme should decrease its price to boost sales volume. Lower prices do not necessarily result in lower profits Questions: -Would cost-based pricing have suggested us to cut price? -Think of examples of profitable companies who emphasize low price: -Walmart; Southwest Airlines -Who else makes profits with low prices? © Stephan Sorger 2015: www.stephansorger.com; Pricing: Ch 1: Strategic Pricing; 15