entry

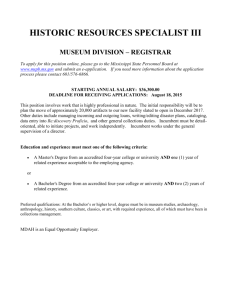

advertisement

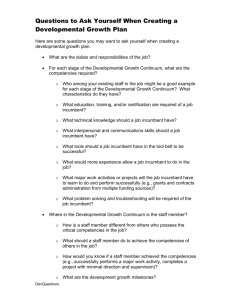

Entry and Exit Introduction Incumbent firms formulate strategy taking into account the possibility of entry by new firms Entry has two effects reduced market share intensified market competition Can take two forms entry by a new firm entry by an existing firm diversifying into a new market Exit is the reverse process Acquisition is not entry: merely change of identity Some Stylized Facts Entry and exit is pervasive over a five year period in most industries 30-40% new firms enter 30-40% of existing firms exit entrants are generally small if they are new most entrants do not survive 10 years if they survive they grow rapidly: 60% fail, the remainder at least double in size patterns vary across industries Strategic Implications Firms should plan for entry by unknown firms realize that diversifying entrants can threaten incumbents expect most new ventures to fail quickly but survivors will grow quickly in planning entry focus on how to manage rapid growth know the industry Strategic implications (cont.) Entrants should consider costs of entry and exit: are there sunk costs? likely reaction of incumbents: aggressive or passive what has been the history of the market? barriers to entry of various types Barriers to Entry Barriers can take two forms Structural incumbents have natural cost advantages cost location regulatory environment Strategic through deliberate actions of incumbents A Taxonomy Entry conditions can be classified into three types blockaded entry structural conditions preclude entry without strategic actions accommodated entry structural barriers are low and there are no effective strategic barriers to entry deterred entry incumbents use specific strategies to deter entry Structural Entry Barriers control of strategic resources patents if not deliberately anti-competitive economies of scale and scope cost advantage of incumbency ability to sustain a price war leave no “holes” in the market requires that some part of entry costs is sunk Structural entry barriers (cont.) marketing advantages of incumbency exploit reputation and brand name risky if a new product does not meet expectations access to distribution based on reputation Barriers to Exit Exit if cannot make an acceptable return on assets Do not enter unlessassets but consider only recoverable $ PENTRY expected price is at An illustration of the least PENTRY Do notMC exit if priceExit barriers entry/exit decisions is greater than PEXIT ATC exist AVC PEXIT Quantity when there are fixed costs when there are relationshipspecific assets Strategic Entry Deterrence An incumbent will adopt entry deterring strategies if monopoly is preferred to accommodated entry if the strategies affect expectations of potential entrants about post-entry competition First condition is obvious unless the market is perfectly contestable Second condition requires that strategies are credible Entry deterrence There are several potential strategies that have been suggested limit pricing predatory pricing capacity expansion Limit pricing Charge a low price before entry entrant is put off by the low price An illustration suppose demand is P = 100 - Q marginal cost is $10 per unit fixed costs are $800 per annum incumbent has monopoly in year one; faces potential entry in year 2 market closes at the end of year 2 The Example $ 100 55 An incumbent monopolist produces Q = 45 units; price = $55 Profit p.a. = (55 - 10)x45 - 800 = $1,225 Monopoly profit per Suppose an entrant in period 2 with the Demandperiod ignoring fixed costs same costs Assume that the incumbent and entrant are Cournot (quantity) competitors MC 10 MR 45 100 Quantity The Example Each firm produces 30 units in period 2; price = $40 Profit to each firm = (40 - 10)x30 - 800 = $100 $ 100 Demand Given this expectation entry will occur The incumbent’s profit in period 2 is sharply down 40 10 MC MR 60 100 Quantity The example (cont.) Can the incumbent deter entry? use the reasoning price low in period 1 the entrant will then expect an even lower price in period 2 entry will not happen I can then charge the monopoly price in period 2 suppose the incumbent charges $30 in period 1 the incumbent then expects a price no higher than $30 in period 2 suppose that the price is actually $30 The example (cont.) aggregate demand is 70 units suppose that this is split equally the entrant expects profits of (30 - 10)x35 - 800 = -$100 Limit pricing would appear Monopoly with a lower price are even greater to be successful in Profitlosses in theprofit inincreasing the profits periodsecond so the potentialfirst entrant should periodnot enter the incumbent then has profits (30 - 10)x70 - 800 + $1,225 = $1,825 The Example (cont.) But this outcome is wrong: the logic is flawed why only two years? if more periods then the limit price might have to be sustained over a very long time for this to be acceptable the incumbent needs a strong cost advantage over potential entrants the supposed equilibrium is not credible technically, it is not subgame perfect the entrant’s supposed expectations regarding the incumbent’s post-entry actions are unreasonable consider the full game in extensive form The Entry Game IncumbentEntrant sets thedecides whether to enter limit price Incumbent chooses Out its pricing strategy pI = $1,825; pE = 0 PL PL pI = $500; pE = -$100 Entrant In Incumbent Incumbent PC Incumbent sets the monopoly price Out Entrant PM In pI = $700; pE = $100 pI = $2,450; pE = 0 PL pI = $1,125; pE = -$100 Incumbent PC pI = $1,325; pE = $100 The Entry Game If the Incumbent sets the limit price the Entrant If the Entrant enters the will enter Incumbent will choose The Incumbent Out Cournot will set the pI = $1,825; pE = 0 monopoly price P PL L pI = $500; pE = -$100 Entrant In Incumbent If the Incumbent sets the Incumbent If the Entrant enters the ppII == $700; $700; ppEE == $100 $100 monopoly price the PC Incumbent will choose Entrant will enter Out Cournot Limit pricing is not pI = $2,450; pE = 0 Entrant a credible strategy PL pI = $1,125; pE = -$100 PM In Incumbent PPCC pI = $1,325; pE = $100 Limit Pricing Rescued Can limit pricing be rational? what if the entrant is uncertain of the incumbent’s costs high-cost incumbent - enter low-cost incumbent - stay out then the low-cost incumbent can signal a price that induces the entrant to stay out but a high-cost incumbent might send the same signal for this to work the price signal by a low-cost incumbent must be impossible for a high-cost incumbent or there is additional uncertainty e.g. about demand Predatory Pricing Pricing intended to eliminate rivals more aggressive than limit pricing charge low price to drive out rivals then subsequently raise price Has similar credibility problems chain store paradox incumbent will not fight in a “last” market so will not fight in all previous markets Predatory pricing (cont.) Paradox can be resolved if there is uncertainty about the incumbent’s “type” if “easy” then entry is profitable if “tough” then entry is unprofitable incumbent wants to develop a tough reputation Wal-Mart American Airlines develop routines that make managers tough reward on market share not profits Excess Capacity Firms carry excess capacity capacity use generally around 80% economic reasons to cope with unexpected fluctuations in demand as a result of competition from new firms strategic reasons to deter entry • convince potential entrants of toughness of incumbents • potential entrants know that incumbents can expand output at low cost Entry at limited scale Potential entrants may be able to enter at low scale deterrence is costly incumbent may be inclined to ignore a small entrant so entrant needs credible mechanism to convince incumbents of small-scale entry “puppy-dog ploy” modern manufacturing techniques may help micro-breweries War of attrition Firms have been accused of charging low prices to eliminate competition Standard Oil Toyota Wal-Mart but price wars are costly and uncertain firm with “deep pockets” will win but at the expense of considerable profits create exit barriers to influence rivals