Webinar for Students in PPRs on PER and PERT Feb 2015

Getting Started in PERT

PRE-APPROVED PROGRAM ROUTE

Disclaimer

CPA Public Accounting Requirements are currently being developed. Information presented relates only to

Certification.

Agenda

1.

Overview of standards

• What you need: depth, core, breadth

• Process

2.

Practical Experience Reporting Tool (PERT)

• Pending enrollment, Catch-up reports, ongoing assessments, prior experience reports.

• How to: mentor reviews, profession assessments

3.

Where to get additional information

Overview of the Practical Experience

Requirements

Technical Competency Requirements

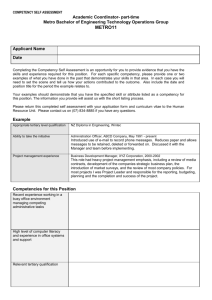

Future CPAs must develop a range of these competencies in accordance with four requirements: core , depth , breadth , and progression

Technical Competency Requirements:

Core

• Gain proficiency in any three competency sub-areas in Financial

Reporting and/or Management Accounting to at least Level 1 proficiency.

Technical Competency Requirements:

Depth

• Gain proficiency in all of the competency sub-areas of one discrete competency area

• At least two of the competency sub-areas must be at Level 2 proficiency; all others at Level 1.

Technical Competency Requirements:

Breadth

• Gain proficiency in at least eight competency sub-areas

• At least four of the competency sub-areas must be at Level 2 proficiency; all others at Level 1.

Technical Competency Requirements:

Progression

• Evolution of responsibilities during work term:

• Early stage: Confined to retrieving and comprehending information

• Middle stage: Analysis of information

• Final stage: Effective decision and problem solving, plus increasingly complex and less routine work

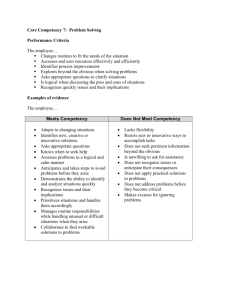

Enabling Competency Requirements

• By the end of the term of the practical experience, future

CPAs are required to develop all five enabling competencies to a Level 2 proficiency

• The development of the future CPA is supported by a CPA mentor

Getting into PERT

What’s Required

How’s it Done

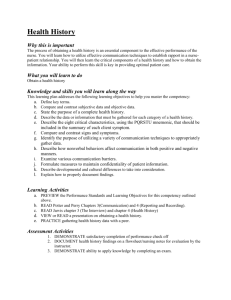

Current vs. Catch-Up

CATCH-UP + PRIOR + CURRENT 30 MONTHS

“Catch-Up” Report Period Current

Legacy

ATO

Sept 1/12

Transition to CPA

PER

Sept 1/14

Current vs. Prior Experience

CATCH-UP + PRIOR + CURRENT 30 MONTHS

Prior (max @ 12 months) Current

Start in

PPR

Sept 1/13

Register

June 1/14

PERT access

Sept 1/14

PERT In-

Progress

Nov 1/14

Walkthrough of PERT

Other Resources https://cpacanada.ca/en/become-a-cpa/cpa-designation-practical-experience-requirements-overview