full version ( ppt ) - Institute for Fiscal Studies

advertisement

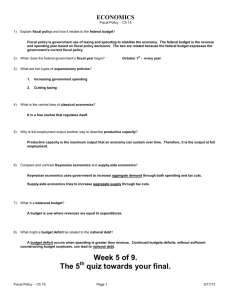

Pre-Budget Report 2008: A return to bust? Carl Emmerson Institute for Fiscal Studies BBC Seminar, Monday 17th November 2008 (updated for new monthly public finance data on Thursday 20th November 2008) www.ifs.org.uk/budgets/pbr2008/index.php Summary conclusions • March 2008 Budget forecast – borrowing to fall from combination of increased tax burden and cuts in spending as a share of national income – on course to continue to meet both fiscal rules • Sharp deterioration in outlook for economy and public finances – borrowing and debt to rise – on course to break one or both fiscal rule(s): rules suspended and new ones expected • Possible fiscal stimulus package – effective package would have to be targeted, timely and temporary • Future fiscal tightening? – expected combination of new tax raising measures / deeper cuts in public spending as a share of national income © Institute for Fiscal Studies, 2008 The big picture: going forwards Percentage of national income March 2008 Budget projections for receipts and spending Labour I 42% Labour II 41% 40% 39% 38% 37% 36% Total expenditure 35% Current receipts 34% 13–14 12–13 11–12 10–11 09–10 08–09 07–08 06–07 05–06 04–05 03–04 02–03 01–02 00–01 99–00 98–99 97–98 96–97 33% Financial year © Institute for Fiscal Studies, 2008 Note: Budget 2008 GDP projections adjusted for FISIM. Source: HM Treasury; ONS; Author’s calculations. Public spending Real increase (LH axis) 42% 6% Level (RH axis) 41% 13–14 12–13 11–12 10–11 34% 09–10 -1% 08–09 35% 07–08 0% 06–07 36% 05–06 1% 04–05 37% 03–04 2% 02–03 38% 01–02 3% 00–01 39% 99–00 4% 98–99 40% 97–98 5% Percentage of national income 7% 96–97 Percentage real increase March 2008 Budget projections for Total Managed Expenditure Financial year © Institute for Fiscal Studies, 2008 Note: Budget 2008 GDP projections adjusted for FISIM. Source: HM Treasury; ONS; Author’s calculations. X No return to boom and bust? Output gap since 1979 8% March 2008 Budget Percentage of trend output 6% Alternative ouput gap 4% 2% 0% -2% -4% -6% 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 -8% Year and quarter © Institute for Fiscal Studies, 2008 Note: Alternative output gap assumes 2½% trend growth and constant interest rates at 3%. Sources: HM Treasury; Bank of England; Author’s calculations. Worsening government finances (1) Cyclically-adjusted public sector net borrowing Percentage of national income -6% March 2008 Budget European Commission (November 2008) -4% -2% 0% 2% 4% 6% 8% 1974-75 1975-76 1976-77 1977-78 1978-79 1979-80 1980-81 1981-82 1982-83 1983-84 1984-85 1985-86 1986-87 1987-88 1988-89 1989-90 1990-91 1991-92 1992-93 1993-94 1994-95 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 10% Financial year © Institute for Fiscal Studies, 2008 Note: Inferred from European Commission forecasts for general government borrowing. Source: HM Treasury; European Commission; Author’s calculations. Worsening government finances (2) Public sector net debt, excluding Northern Rock, Bradford & Bingley, and other bank recapitalisations Percentage of national income 60% 50% 40% 30% 20% 40% ceiling March 2008 Budget European Commission (November 2008) 10% 1974-75 1975-76 1976-77 1977-78 1978-79 1979-80 1980-81 1981-82 1982-83 1983-84 1984-85 1985-86 1986-87 1987-88 1988-89 1989-90 1990-91 1991-92 1992-93 1993-94 1994-95 1995-96 1996-97 1997-98 1998-99 1999-00 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 0% Financial year © Institute for Fiscal Studies, 2008 Note: Inferred from European Commission forecasts for general government debt. Source: HM Treasury; European Commission; Author’s calculations. Fiscal stimulus could help? • Usually rely on interest rates to manage demand – but might be less effective during a credit crunch • ‘Automatic stabilisers’ also help – increased benefit spending and depressed tax receipts in a downturn – but unlikely to be optimal • New measures so far: – increased income tax personal allowance (£2.7bn in 2008–09); fuel duties frozen from September (£550m per six months); 1 year stamp duty cut (£600m) • Further active fiscal loosening could help, if: – targeted (boost spending on domestic goods) – timely (during the recession) – temporary (increased long-term borrowing risks higher interest rates) • Long-term fiscal tightening – expected combination of spending cuts as a share of national income and further tax raising measures © Institute for Fiscal Studies, 2008 Opposition proposals Conservatives • Temporary NI cut for some firms hiring individuals who have been receiving out-of-work benefits for 3 months or more – might not get enough extra into work to be self-financing – but any net giveaway could help economy Liberal Democrats: • Abolish council tax, increase tax on polluters, those making large capital gains, and higher income pension savers (on average lower national income tax offset by new local income tax) – redistribution from savers to spenders could help economy – unclear that package is revenue neutral: any net giveaway would boost economy but would need subsequent action © Institute for Fiscal Studies, 2008 Further options • Increase public investment – ensures giveaway spent domestically – difficult to spend well quickly • Giveaways to those on lower incomes – more likely to spend extra income & compensates 10p losers further – difficult to make temporary: requires subsequent tax increase elsewhere? • Boost firms investment allowances – might be a sensible long-term reform – again requires subsequent tax increase elsewhere • Temporary VAT reduction followed by permanent VAT increase – strong encouragement to spend now and improve public finances – not politically viable? © Institute for Fiscal Studies, 2008 Summary conclusions • March 2008 Budget forecast – borrowing to fall from combination of increased tax burden and cuts in spending as a share of national income – on course to continue to meet both fiscal rules • Sharp deterioration in outlook for economy and public finances – borrowing and debt to rise – on course to miss one or both fiscal rules: rules suspended and new ones expected • Possible fiscal stimulus package – effective package would have to be targeted, timely and temporary • Future fiscal tightening? – expected combination of new tax raising measures / deeper cuts in public spending as a share of national income © Institute for Fiscal Studies, 2008 Pre-Budget Report 2008: A return to bust? Carl Emmerson Institute for Fiscal Studies BBC Seminar, Monday 17th November 2008 (updated for new monthly public finance data on Thursday 20th November 2008) www.ifs.org.uk/budgets/pbr2008/index.php Some numbers • Economic growth (%) – Budget 2008 forecasts: 2008 = 1¾ to 2¼; 2009 = 2¼ to 3; 2010 = 2½ to 3 – November 2008 BoE: 2008 = –1½; 2009 = ½ • Public sector net borrowing – Budget 2008 forecast: 2008–09 = £42.5bn – trend from first seven months + new measures: 2008–09 = £68bn • Public sector net debt (% of national income, excluding Northern Rock, Bradford and Bingley and other bank recapitalisations) – Budget 2008 forecast: 2008–09 = 38.5%; peaking at 39.8% in 2010–11 – could break 40% this year © Institute for Fiscal Studies, 2008