School of Education, Culture and Communication

Division of Applied Mathematics

MMA707 Analytical Finance

“Bermudan Options with the

Binomial Model”

Autumn 2011

Sheila Farrahi sfi09001@student.mdh.se

Amirhossein Heydarizadeh ahh09001@student.mdh.se

Oluwayinka Ogunniyi ooi08001@student.mdh.se

Instructor:

Jan Röman

Bermudan Options with the Binomial Model

Abstract

Bermudan option is a type of option which can only be exercised at specific dates

between the issue date and maturity. In this report we designed a GUI using MATLAB to

compute the value of Bermudan option with binomial model and compare the result

with European and American ones.

2

Bermudan Options with the Binomial Model

Contents

Introduction ………………………………………………………………………………………………………………4

Bermudan Option

Binomial Model……………………………………………………………………………………….5

American & European Options………………………………………………………….….….5

Example …………………………………………………………………………………………………7

Solution …………………………………………………………………………………………………9

Conclusion…………………………………………………………………………………………………………….…10

References ………………………………………………………………………………………………………………11

3

Bermudan Options with the Binomial Model

Introduction

Like Bermudian islands which are located between Europe and America, Bermudan

options are a combination of American and European options. Unlike the European

options which can be exercised only at maturity

and American option that can be

exercised at any time, Bermudan can be exercised at predetermined dates up to

maturity.

4

Bermudan Options with the Binomial Model

Bermudan Option

A Bermudan Option is a type of option with early exercise restricted to certain dates

during the life of the option. Bermudan Options have an “early exercise” date and

expiration date. Bermudan options act like both European options and the American

ones. It behaves like European options since it cannot be exercised at any time and it

behaves like American options due to the fact that it can be exercised at some specific

times. The value of Bermudan Option is always equal or greater than European and

equal or less than American ones.

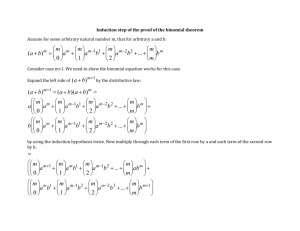

Binomial Model:

Binomial model is a very popular model for option pricing, Binomial tree shows

different ways that stock price can move during option’s life time based on certain

probability of moving up or either down. There are different formulas for the probability

of up and down but Cox-Ross-Rubenstein formula is the most common model for the

binomial tree so in our model we used Cox-Ross-Rubenstein formula:

{

𝑢 = 𝑒 𝜎√∆𝑡

(𝑢𝑝 𝑓𝑎𝑐𝑡𝑜𝑟)

𝑑 = 𝑒 −𝜎√∆𝑡 (𝑑𝑜𝑤𝑛 𝑓𝑎𝑐𝑡𝑜𝑟)

𝑒 𝜎∆𝑡 − 𝑑

p=

(risk neutral probability of moving up)

u−d

𝑞 = 1 − 𝑝(Probability of moving down)

American and European options:

Since Bermudan option is a combination of European and American option we describe

here shortly these two options:

To calculate European put or call option we should start from the end of tree at time T

(maturity) and calculate the max (𝑘 − 𝑠𝑇 , 0) for put and max (𝑠𝑇 − 𝑘, 0) for call at each

5

Bermudan Options with the Binomial Model

end node. Then it should be discounted back to calculate the option value by backward

induction at each node. The formula for European put and call option in the other nodes

is:

Vn = e-rΔt(pVu+(1-p)Vd)

Calculate American put or call option at the final nodes of the tree is exactly like the

European ones. But for the other nodes the formula is different as follow:

American put: Vn = max(𝑘 − 𝑠𝑇 , e-rΔt(pVu+(1-p)Vd))

American Call: Vn = max(𝑠𝑇

− 𝑘,e-rΔt(pVu+(1-p)Vd))

6

Bermudan Options with the Binomial Model

Example:

Consider the tree below which is a 6-step binomial tree with T=1.5 year and the

Bermudan option can only be exercised once a year. As you see in the picture below the

red nodes are the nodes that Bermudan option can be exercised at that time. For those

nodes option value should be calculated like European ones due to the property of

European option that it can be exercised only at that time, for the rest of the nodes, they

should be calculated like American options that can be exercised at any time.

t=3 months t=6 months t=9 months t=1 year t=15 months t=1.5 year

∆t=3 months

Calculate like American

options

Calculate like European

options

Calculate like American

options

7

Bermudan Options with the Binomial Model

Solution

We designed a GUI using MATLAB to calculate the value of Bermudan call and put option

not using any MATLAB build in functions according to the data given by a user and

compare it with the European and American options.

This is how the GUI looks:

When a user is inserting the data, the data is being checked to be valid, for example

settlement date cannot be greater than maturity. If there is any invalid input the user

will face an error message.

8

Bermudan Options with the Binomial Model

For example for the given data, you can see the value of Bermudan put option which is

exactly lies between European and American put option.

9

Bermudan Options with the Binomial Model

Conclusion

Bermudan Option is one of the popular kinds of option in financial world and in this

seminar, we considered a Bermudan Option with non-paying dividend using Binomial

model.

in comparing the price of the Bermudan option with the European and the American

Option, it was observed that it option price(Bermudan Option) lies in between the

European and the American Option prices, which is true from the mathematical model

presented above.

Conclusively, A Matlab GUI was designed to compute and compare the prices of this

options and a payoff diagram was shown.

10

Bermudan Options with the Binomial Model

References

Hull, John C. Options, futures, and other derivatives.6th ed. Upper Saddle River,

N.J. : Pearson Prentice Hall, cop. 2006

Wilmott, Paul, The Mathematics of Financial Derivatives, Cambridge :

Cambridge Univ. Press, 1995

11