Fair price

advertisement

Stochastic methods in Finance

Nikos SKANTZOS

2010

Fair price

What is the fair price of an option?

Consider a call option on an asset

Delta hedging:

Δ1

Δ2

Δ3

Δ4

Δ5

For every time interval:

Buy/Sell the asset to make

the position:

Call – Spot * nbr Assets

insensitive to variations of

the Spot

Fair price is the amount

spent during delta-hedging:

Option Price =

=Δ1+ Δ2+ Δ3 + Δ4+ Δ5

It is fair because that is

how much we spent!

Black-Scholes: the mother model

Black-Scholes based option-pricing on

no-arbitrage & delta hedging

Previously pricing was based mainly on

intuition and risk-based calculations

Fair value of securities was unknown

Black-Scholes: main ideas

Assume a Spot Dynamics

S0 S1 St St t ST

The rule for updating the spot has two terms:

Drift : the spot follows a main trend

Vol : the spot fluctuates around the main trend

Black-Scholes assume as update rule

St t St St t St Wt

main trend

fluctuations

This process is a “lognormal” process:

dSt St dt St dWt

σ: size of fluctuations

μ: steepness of main trend

ΔWt: random variable (pos/neg)

“lognormal” means that drift and fluctuations are proportional to St

Black-Scholes: assumptions

No-arbitrage drift = risk-free rate

Impose no-arbitrage by requiring that

expected spot = market forward

Calculations simplify if

fluctuations are normal:

Wt

is Gaussian normal of zero mean, variance ~ T

Volatility (size of fluctuations) is assumed constant

Risk-free rate is assumed constant

No-transaction costs, underlying is liquid, etc

Black-Scholes formula

Call option = e–rT ∙ E[ max(S(T)-K,0)]

= discounted average of the call-payoff

over various realizations of final spot

C e r1T S N (d1 ) e r2 T K N (d 2 )

Solution

ln

d1

S

1

r2 r1 2 T

K

2

T

ln

d2

S

1

r2 r1 2 T

K

2

T

Interpretation of BS formula

r1 T

C S e

N (d1 )

Delta of the option:

number of shares to go long

e

r2 T

K

N (d 2 )

probability that spot

finishes in the money

Price = value of position at maturity – value of cash-flow at maturity

How much does the portfolio value

change when spot changes?

portfolio value

S

Delta neutral position,

∂Portfolio/∂S=0

S+dS

S

Δ=0, Delta-neutral value:

if S S+dS then portfolio value does not change

Vega=0, Vega-neutral value:

if σ

σ+dσ then portfolio value does not change

“Greeks” measure sensitivity of portfolio value

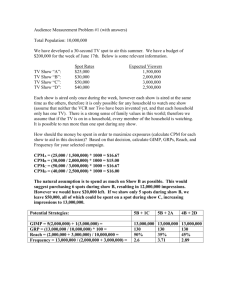

Black-Scholes vs market

Comparison with market:

BS < MtM when in/out of the money

Plug MtM in BS formula to calculate volatility smile

Inverse calculation “implied vol”

Call on EURUSD

80000

Smile

Black-Scholes

70000

15.00%

Black-Scholes

Market

60000

Market

30000

14.00%

20000

Volatility

40000

USD cash

14.50%

50000

13.50%

10000

0

1.2000

Strike

strike

1.2500

1.3000

1.3500

1.4000

1.4500

1.5000

1.5500

13.00%

1.2000

1.2500

1.3000

1.3500

1.4000

1.4500

1.5000

1.5500

1.6000

Spot probability density

Distribution of terminal spot

(given initial spot) obtained from

PST S0 e

r2 T

2Call mkt

K 2

Market observable

Fat tails:

Market implies that the probability that

the spot visits low-spot values is higher

than what is implied by Black-Scholes

Main causes:

•Spot dynamics is not lognormal

•Spot fluctuations (vol) are not

constant

What information does the smile give ?

It represents the price of vanillas

Take the vol at a given strike

Insert it to Black-Scholes formula

Obtain the vanilla market price

It is not the volatility of the spot dynamics

It does not give any information about the spot dynamics

even if we combine smiles of various tenors

Therefore it cannot be used (directly) to price path-dependent options

The quoted BS implied-vol is an artificial volatility

“wrong quote into the wrong formula to give the right price” (R.Rebonato)

If there was an instantaneous volatility σ(t), the BS could be interpreted as

2

BS

T

1

2

d

T t t

the accumulated vol

Types of smile quotes

The smile is a static representation of the

implied volatilities at a given moment of time

What if the spot changes?

Sticky delta: if spot changes, implied vol of a given

“moneyness” doesn’t change

Sticky strike: if spot changes, implied vol of a

given strike doesn’t change

Moneyness: Δ=DF1·N(d1)

Spotladders: price, delta & gamma

0.4

1

0.8

0.3

3.5

3

2.5

2

1.5

1

0.5

0

0.6

0.6y

1y

0.2

0.4

0.1

0.2

spot

0

spot

0

0.8

1

1.2

1.8

0.6y

1y

spot

0.8

0.8

1

Knock-out

price

0.0045

0.004

0.0035

0.003

0.0025

0.002

0.0015

0.001

0.0005

0

1.6

1.2

1.4

1.6

1.8

0.9

1

1.1

1.2

1.3

1.4

0.03

0.02

0.01

0

-0.01 0.8

-0.02

-0.03

-0.04

-0.05

-0.06

Spot is far from barrier and far from OTM:

risk is minimum, price is maximum

0.6y

1y

spot

0.8

1

1.2

1.4

1.6

1.8

spot=1.28 strike=1.25 barrier=1.5

0.4

delta

1.4

0.6y

1y

gamma

price

0.5

1.2

Linear regime: S-K

0.2

0.9

1

spot

1.1

1.2

1.3

0.6y

1y

0.6y

1y

0

-0.2

-0.4

-0.6

Δ<0, price gets smaller

if spot increases

gamma

0.6

Vanilla

delta

Sensitivity of Delta to

spot is maximum

1 underlying is

needed to hedge

0.8

1 spot

1.2

Spotladders: vega, vanna & volga

Vanna: Sensitivity of Vega with respect to Spot

Vanilla

Volga: Sensitivity of Vega with respect to Vol

2

0.00004

0.6y

1y

0.00001

0

0.8

1

1.2

1.4

1.6

0.000004

0.000002

spot

0

vega

-0.000004

1.8

0.8

1

1.2

-2

1

1.2

0.6y

1y

1.4

1.6

1.8

spot

Knock-out

-0.000002 0.8

0

-1

spot

0.6y

1y

0.6y

1y

spot

0.8

1.5

2

1

1.5

0.5

0.6y

1y

1

0.8

-0.000006

-0.000008

-1

1.2

1.4

1.6

0.9

1

1.1

0.6y

1y

0.5

spot

0

-0.5

1

spot=1.28 strike=1.25 barrier=1.35

vanna

0.00002

1

vega

0.00003

3.5

3

2.5

2

1.5

1

0.5

0

volga

0.00005

vanna

3

0.00006

volga

1.2

1.3

0

-0.5 0.8

-1

1

1.2

spot

1.8

Simple analytic techniques: “moment matching”

Average-rate option payoff with N fixing dates

1

Asian max

N

Si K ,0

i 1

N

Basket option with two underlyings

S1 T

S 2 T

Basket max a1

a2

K ,0

S 2 t

S1 t

TV pricing can be achieved quickly via “moment matching”

Mark-to-market requires correlated stochastic processes for

spots/vols (more complex)

“Moment matching”

To price Asian (average option) in TV we consider that

The spot process is lognormal

The sum of all spots is lognormal also

Note: a sum of lognormal variables is not lognormal. Therefore this

method is an approximation (but quite accurate for practical

purposes)

Central idea of moment matching

Find first and second moment of sum of lognormals:

E[Σi Si] , E[ (Σi Si)2 ],

Assume sum of lognormals is lognormal (with known moments

from previous step) and obtain a Black-Scholes formula with

appropriate drift and vol

Asian options analytics (1)

Prerequisites for the analysis: statistics of random increments

Increments of spot process have 0 mean and variance T

(time to maturity)

E[Wt]=0, E[Wt2]=t

If t1<t2 then E[Wt1∙Wt2] = E[Wt1∙(Wt2-Wt1)] + E[Wt12] = t1

(because Wt1 is independent of Wt2-Wt1)

More generally, E[Wt1∙Wt2] = min(t1,t2)

From this and with some algebra it follows that

E[St1 ∙ St2] = S02 exp[r ∙(t1+t2) + σ2 ∙ min(t1,t2)]

Asian options analytics (2)

Asian payoff contains sum of spots

1 N

X Si

N i 1

What are its mean (first moment) and variance?

1

E X E

N

EX

2

1

S

i

i 1

N

N

1

E 2

N

N

1

E

S

i

N

i 1

1

Si S j 2

i 1

j 1

N

N

N

N

E S0 e

r

N

i 1

N

1 2

2

t

i

1

E

S

S

i

j

N2

i 1 j1

ti N ( 0 ,1)

N

1

N

E S e

i , j 1

2

0

N

r ti

S

e

0

i 1

r ti t j 2 min ( ti ,t j )

Looks complex but on the right-hand side all quantities are known and can

be easily calculated !

Therefore the first and second moment of the sum of spots can be

calculated

Asian options analytics (3)

Now assume that X follows lognormal process, with λ the (flat) vol, μ the drift

dX t X t dt X t dWt

Has solution (as in standard Black-Scholes)

X T S0 e

T W

1 2

2

Take averages in above and obtain first and second moment in terms of μ,λ

EX T S 0 e T

S

EX

T

2

T

2

0

e

2 12 2 T

E e

2 WT

Solving for drift and vol produces

1

E X T

log

T

S0

E X e

2

T

1

E X T2

log 2

T

E X T

2T

Asian options analytics (4)

Since we wrote Asian payoff as max(XT-K,0)

We can quote the Black-Scholes formula

Asian DF e T S 0 N (d1 ) K N (d 2 )

With

S

1

ln 0 2 T

K

2

d1

T

ln

d2

S0

1

2 T

K

2

T

And μ, λ are written in terms of E[X], E[X2] which we have calculated as

sums over all the fixing dates

The “averaging” reduces volatility: we expect lower price than vanilla

Basket is based on similar ideas

Smile-dynamics models

Large number of alternative models:

Volatility becomes itself stochastic

Spot process is not lognormal

Random variables are not Gaussian

Random path has memory (“non-markovian”)

The time increment is a random variable (Levy processes)

And many many more…

A successful model must allow quick and exact pricing of vanillas to

reproduce smile

Wilmott: “maths is like the equipment in mountain climbing: too much

of it and you will be pulled down by its weight, too few and you won’t

make it to the top”

Dupire Local Vol

Comes from a need to price path-dependent

options while reproducing the vanilla mkt prices

Underlying follows still lognormal process, but…

Vol depends on underlying at each time and time itself

It is therefore indirectly stochastic

dSt St dt St St , t dWt

Local vol is a time- and spot-dependent vol

(something the BS implied vol is not!)

No-arbitrage fixes drift μ to risk-free rate

Local Vol

Technology invented independently by:

B. Dupire Risk (1994) v.7 pp.18-20

E. Derman and I. Kani Fin Anal J (1996) v.53 pp.25-36

They expressed local vol in terms of market-quoted vanillas

and its time/strike derivatives

2 St , t

CT r1 C K r2 r1 C K

2

1

K

C KK

2

K S t ,T t

Or, equivalently, in terms of BS implied-vols:

2 St , t

1

2

BS

T t0

BS

K r2 r1 BS

T

K

2

2

1

d

d1d 2

2

BS

BS

BS

1

1

K

2

2

2

2

K

T

t

K

K

K

K

T

t

BS

BS

0

BS

0

K S t ,T t

Dupire Local Vol

Contains derivatives of mkt quotes with respect to:

Maturity, Strike

The denominator can cause numerical problems

CKK<0 (smile is locally concave), σ2<0, σ is imaginary

The Local-vol can be seen as an instantaneous volatility

depends on where is the spot at each time step

Can be used to price path-dependent options

S1 ,t1

S 2 ,t 2

ST 1 ,tT 1

S1 S2

ST

Local Vol rule of thumb

Rule of thumb:

Local vol varies with

index level twice as fast

as implied vol varies with

strike

Sfinal

Sinitial

(Derman & Kani)

Local-Vol and vanillas

By design the local-vol model reproduces automatically vanillas

No further calibration necessary, only market quotes needed

EURUSD market

Lines: market quotes

Markers: LV pricer

Example:

Blue: 3 years maturity

Green: 5 years maturity

Take smile quotes

Build local-vol

Use them in simulation and

price vanillas

Compare resulting price of

vanillas vs market quotes

(in smile terms)

Analytic Local-Vol (2)

Estimating the numerical derivatives of the Dupire Local-Vol can

be time-consuming

Alternative: assume a form for the localvol σ(St,t)

Do that, for example, by:

From historical market data calculate logreturns

log

S t t

S t , t

St

These equal to the volatility

Make a scatter plot of all these

Pass a regression

The regression will give an idea of the

historically realised local-vol function

Analytic Local-Vol (2)

A popular choice is

2

Ft

Ft

S , t 0 1 1 1 S

F0

F0

Ft the forward at time t

Three calibration parameters

σ0 : controlling ATM vol

α: controlling skew (RR)

β: controlling overall shift (BF)

Calibration is on vanilla prices

Solve Dupire forward PDE with initial condition C=(S0-K)+

Stochastic models

Stochastic models introduce one extra source of randomness,

for example

Interest rate dynamics

Vol dynamics

Jumps in vol, spot, other underlying

Combinations of the above

Dupire Local Vol is therefore not a real stochastic model

Main problem: Calibration

minimize

(model output – market observable)2

Example

(model ATM vol – market ATM vol)2

Parameter space should not be

too small: model cannot reproduce all market-quotes across tenors

too large: more than one solution exists to calibration

Heston model

Coupled dynamics of underlying and volatility

dSt St dt v t St dW1

dvt v vt dt vt dW2

EdW1 dW2 dt

Interpretation of model parameters

Processes

Lognormal for spot

Mean-reverting for variance

Correlated Brownian motions

μ : drift of underlying

κ : speed of mean-reversion

ρ : correlation of Brownian motions

ε : volatility of variance

Analytic solution exists for vanillas !

S L Heston "A Closed form solution for options with stochastic volatility" Rev

Fin Stud (1993) v.6 pp.327-343

Effect of Heston parameters on smile

Affecting overall shift in vol:

Speed of mean-reversion κ

Long-run variance v∞

Affecting skew:

Correlation ρ

Vol of variance ε

Local-vol vs Stochastic-vol

Dupire and Heston reproduce vanillas perfectly

But can differ dramatically when pricing exotics!

Rule of thumb:

skewed smiles: use Local Vol

convex smiles: use Heston

Hull-White model

It models mean-reverting underlyings such as

Interest rates

Electricity, oil, gas, etc

drt rmean a rt dt dWt

3 parameters to calibrate

obtained from historical data:

obtained from calibration:

rmean (describes long-term mean)

a: speed of mean reversion

σ : volatility

Has analytic solution for the bond price P = E[ e-∫r(t)dt ]

Three-factor model in FOREX

Hull-White is often coupled to another underlying

Three factor model in FOREX:

spot + domestic/foreign rates

dS rd rf S dt FX S dW

r

dt

drd rdmean ad rd dt d dWd

drf

mean

f

af rf

f

dWf

To replicate FX volatilities match

FX,mkt with FX,model

2

FX,

model

T

1

2

s ds

T t t

Θ(s) is a function of all model

parameters: FX,d,f,ad,af

Common calibration issue: "Variance squeeze“:

FX vol + IR vols up to a certain date have exceeded the FX-model vol.

Solution (among other possibilities):

Time-dependent parameters (piecewise constant)

parameter

time

Two-factor model in commodities

Commodity models introduce the “convenience yield” (termed δ)

δ = benefit of direct access – cost of carry

Not observable but related to physical ownership of asset

No-arbitrage implies Forward: F(t,T) = St ∙ E [ e∫(r(t)-δ(t))dt ]

δt is taken as a correction to the drift of the spot price process

What is the process for St, rt, δt ?

Problem:

δt is unobserved

Spot is not easy to observe

for electricity it does not exist

For oil, the future is taken as a proxy

Commodity models based on assumptions on δ

Gibson-Scwartz model

Classic commodities model

dSt St rt t dt t St dWt1

d t t dt dWt 2

Spot is lognormal (as in Black-Scholes)

Convenience yield is mean-reverting

Very similar to interest rate modeling

(although δt can be pos/neg)

Fluctuation of δ is in practise an order of magnitude higher

than that of r

no need for stochastic interest rates

Analysis based on combining techniques

Calculate implied convenience yield from observed future prices

Miltersen extension:

Time-dependent parameters

Merton jump model

This model adds a new element to the

stochastic models: jumps in spot

Motivated by real historic data

Advantages

Can produce smile

Adds a realistic element

to dynamics

Has exact solution for

vanillas

Disadvantages

Risk cannot be eliminated

by delta-hedging as in BS

Hedging strategy is not

clear

Merton jump model

Extra term to the Black-Scholes process:

If jump does not occur

dS t

dt dWt

St

dSt

If jump occurs

dt dWt Y 1

St

Then,

St Stafter jump Stbefore jump Stbefore jump Y 1

Stafter jump Stbefore jump Y

Therefore, Y: size of the jump

Model has two extra parameters:

size of the jump, Y

frequency of the jump, λ

Jump size & jump times:

Random variables

Merton model solution

Merton assumed that

The jump size Y is lognormally-distributed,

Can be sampled as Y=eη+γ∙g; g is normal ~N(0,1) and η,γ are real

Jump times: Poisson-distributed with mean λ, Prob(n jumps)=e-λT(λT)n /n!

Jump times: independent from jump sizes

The model has solution a weighted sum of Black-Scholes formulas

Call price e

- T

n 0

T n BSS

n!

0

, K , T , n , rn

S

S

2

2

log 0 rn 12 n T

log 0 rn 12 n T

K

K

e rn r1 T K

BSS0 , K , T , n , rn e r1T S

n T

n T

σn , rn , λ’ are functions of σ,r and the jump-statistics given by η, γ

12

e

2

n

2

2 n

T

12 2

rn r2 r1 e

1

n

12 2

T

Merton model properties

The model is able to produce a smile effect

Vanna-Volga method

Which model can reproduce market dynamics?

Market psychology is not subject to rigorous math models…

Brute force approach: Capture main features by a mixture model combining jumps,

stochastic vols, local vols, etc

But…

Vanna-Volga is an alternative pricing “recipie”

Difficult to implement

Hard to calibrate

Computationally inefficient

Easy to implement

No calibration needed

Computationally efficient

But…

It is not a rigorous model

Has no dynamics

Vanna-Volga main idea

The vol-sensitivities

2 Price

Price

Vega

Vanna

S

Volga

2 Price

2

are responsible the smile impact

Practical (trader’s) recipie:

Construct portfolio of 3 vanilla-instruments which

zero out the Vega,Vanna,Volga of exotic option at hand

Calculate the smile impact of this portfolio

(easy BS computations from the market-quoted volatilities)

Market price of exotic = Black-Scholes price of exotic

+ Smile impact of portfolio of vanillas

Vanna-Volga hedging portfolio

Select three liquid instruments:

At-The-Money Straddle (ATM) =½ Call(KATM) + ½ Put(KATM)

25Δ-Risk-Reversal (RR) = Call(Δ=¼) - Put(Δ=-¼)

25Δ-Butterfly (BF) = ½ Call(Δ=¼) + ½ Put(Δ=-¼) – ATM

KATM

KATM

K25ΔP

ATM Straddle

KATM

K25ΔC

25Δ Risk-Reversal

RR carries mainly Vanna

K25ΔP

K25ΔC

25Δ Butterfly

BF carries mainly Volga

Vanna-Volga weights

Price of hedging portfolio P = wATM ∙ ATM + wRR ∙ RR + wBF ∙ BF

What are the appropriate weights wATM ,, wRR, wBF?

Exotic option at hand X and portfolio of vanillas P are calculated

using Black-Scholes

vol-sensitivities of portfolio P = vol-sensitivities of exotic X:

X vega ATM vega

X vanna ATM vanna

X

ATM

volga

volga

solve for the weights:

RR vega

RR vanna

RR volga

BFvega w vega

BFvanna w vanna

BFvolga w volga

-1

w A X

Vanna-Volga price

Vanna-Volga market price is

XVV = XBS

+ wATM ∙ (ATMmkt-ATMBS)

+ wRR ∙ (RRmkt-RRBS)

+ wBF ∙ (BFmkt-BFBS)

Other market practices exist

Further weighting to correct

price when spot is near

barrier

It reproduces vanilla smile

accurately

Vanna-Volga vs market-price

Can be made to fit the market price of exotics

More info in:

F Bossens, G Rayee, N Skantzos and G Delstra

"Vanna-Volga methods in FX derivatives: from theory to market practise“

Int J Theor Appl Fin (to appear)

Models that go the extra mile

Local Stochastic Vol model

Jump-vol model

Bates model

Local stochastic vol model

Model that results in both a skew (local vol) and a convexity (stochastic

vol)

dSt St dt t St , t Vt dWt1

dVt Vt dt Vt dWt 2

For σ(St,t) = 1 the model degenerates to a purely stochastic model

For ξ=0

Calibration: hard

Several calibration approaches exist, for example:

the model degenerates to a local-volatility model

2

2

Construct σ(St,t) that fits a vanilla market, Dupire LV St , t St , t Vt

Use remaining stochastic parameters to fit e.g. a liquid exotic-option market

2

Jump vol model

Consider two implied volatility surfaces

Bumped up from the original

Bumped down from the original

These generate two local vol surfaces σ1(St,t) and σ2(St,t)

Spot dynamics

dSt St dt St St , t dWt

p

1 St , t with prob

St , t

2 St , t with prob 1 - p

Calibrate to vanilla prices using the bumping parameter and the

probability p

Bates model

Stochastic vol model with jumps

dSt St dt t dWt1 dZ t

d t t dt Vt dWt 2

Has exact solution for vanillas

Analysis similar to Heston based on deriving the

Fourier characteristic function

More info:

D S Bates “Jumps and Stochastic Volatility: Exchange

rate processes implicit in Deutsche Mark Options“

Rev Fin Stud (1996) v.9 pp.69-107

Which model is better?

Local Vol

Pros

Good for Skew

smiles

Good for simple

exotics

Heston

Vanna-Volga

Good for convex Fast + accurate

smiles

for simple

exotics

OT,KO,DKO,…

Allows fat-tails

Good for barrier

options <1y

Cons

Not good for

convex smiles

Not good for

Skew smiles

Approximates

numerical

derivatives

outside mkt

quotes

Often needs

time-dependent

params to fit

term structure

Cannot be used

for pathdependent

options

TARF,LKB,…

Multifactor

Good for

maturities>1y

Good if product

has spot & rates

as underlying

Not useful if

rates are

approx.

constant

Local-Stoch Vol

Can price most

types of

products (in

theory)

Often unstable

Choice of model

Model should fit vanilla market (smile)

and a liquid exotic market (OT)

Model must reproduce market quotes across

various tenors (term structure)

No easy answer to which model to use!

W. Schoutens, E. Simons, and J. Tistaert,

"A Perfect calibration! Now what?“ Wilmott Magazine, March 2004

One-touch tables

OT tables measure model success vs market price

OT price ≈ probability of touching barrier (discounted)

Collect mkt prices for TV in the range:

0%-100% (away-close to barrier)

Calculate model price – market price

The better model gives model-mkt≈0

OT tables depend on

OT table

3.00%

2.00%

nbr barriers

Type of underlying

Maturity

mkt conditions

mkt - model

1.00%

0.00%

-1.00%

0

0.2

0.4

0.6

0.8

-2.00%

-3.00%

-4.00%

VannaVolga

-5.00%

LocalVol

-6.00%

-7.00%

Heston

TV price

1

Numerical Methods

Monte Carlo

PDE

Advantages:

Easy to implement

Easy for multi-factor processes

Easy for complex payoffs

Disadvantages

Not accurate enough

CPU inefficient

Greeks not stable/accurate

American exercise: difficult

Depends on quality of

random number generator

Disadvantages

Hard to implement

Hard for multi-factor processes

Hard for complex payoffs

Advantages

Very accurate

CPU efficient

Greeks stable/accurate

American exercise: very easy

Independent of random numbers

Monte Carlo vs PDE

Monte Carlo

Based on discounted average payoff over realizations of spot:

Option Price e r T Epayoff S T

e

r T

nbr Paths

1

payoff ST(i )

nbr Paths i 1

Outline of Monte Carlo simulation

For each path:

At each time step till maturity

Draw a random number from Normal distribution N(0,T)

W

Update spot St t St St t St

t

Calculate payoff for this path

random number

Calculate average payoff across all paths

Monte Carlo vs PDE

Partial Differential Equation (PDE)

Based on alternative formulation of option price problem

P

P 1 2 2 P

S

2 r P

t

S 2

S

Idea is to rewrite it in discrete terms, e.g. with t+=t+Δt, S+=S+ΔS

P(t ) P(t )

P ( S ) P ( S ) 1 2 P ( S ) 2 P ( S ) P ( S )

S

rP

2

t

2 S

2

S

Spot

Apply payoff at maturity and solve

PDE backwards till today

S0

K

today

time

maturity

Issues on simulations

Random numbers

Barriers and hit probability

Simulating american-exercise options

Likelihood ratio method

Random numbers

Simulations require at each time step a random number

Statistics: for example, normal-Gaussian (for lognormal process) mean=0

variance=1

This means that if we sum all random numbers we should get 0 and st.dev.=1

In practise, we draw uniform random numbers in [0,1] and convert them to

Normal-Gaussian random numbers using the normal inverse cumulative function

A typical simulation requires 105 paths & 102 steps: 107 random numbers

Deviations away from the required statistics produce unwanted bias in option

price

Random numbers do not fill in the space uniformly as they should !

This effect is more pronounced as the number of dimensions (=number of steps *

number of paths) increases

Pseudo-random number generators

RNG generate numbers in the interval [0,1]

With some transformations one then converts the sampling space [0,1] to

any other that is required (e.g. gaussian normal space)

Random numbers are not truly random (hence “pseudo”):

there is a formula behind taking as input the computer clock

After a while “random numbers” will repeat themselves

Good random numbers have a long period before repetition occurs

“Mersenne” random numbers have a period that is a Mersenne number,

i.e. can be written as 2n-1 for some big n (for example n=20000)

Mersenne numbers are popular due to

They are quickly generated

Sequences are uncorrelated

Eventually (after many draws) they fill the space uniformly

“Low-discrepancy” random numbers

These numbers are not random at all !

“low discrepancy” = homogenous

LDRN fill the [0,1] space homogenously.

Passing uniform numbers through the cumulative of the probability

density will produce the correct density of points

homogenous numbers

form [0,1]

1

Gaussian cumulative

function

Gaussian probability

function

0

Non-homogenous numbers

in (-∞ ∞)

Higher density of points here

“Peak” implies that more points

should be sampled from here

Sobol’ numbers

Sobol’ numbers are low-discrepancy sequences

Quality depends on nbr of dimensions = nbr Paths x nbr Steps

Uniformity is good in low dimensions

Uniformity is bad in high dimensions

Are convenient because … they are not random !

Calculating the Greeks with finite difference requires the same

sequence of random numbers

Price S S Price S S

2 S

The calculation of the Greeks should differ only in the “bumped” param

Random number quality

Plot pairs of columns

Draw (n x m) table of Sobol’ numbers

Nbr Steps

(1,2)

Nbr Paths

Pair( 10 , 20 )

1.000

1.000

1

0

0.5

0.25

0.75

0.875

0.375

0.125

0.625

0.6875

0.1875

0.4375

0.9375

0.8125

0.3125

0.0625

0.5625

0.59375

0.09375

0.34375

0.84375

0.96875

0.46875

0.21875

0.71875

0.65625

0.15625

0.40625

0.90625

2

0

0.5

0.75

0.25

0.875

0.375

0.625

0.125

0.8125

0.3125

0.5625

0.0625

0.6875

0.1875

0.9375

0.4375

0.96875

0.46875

0.71875

0.21875

0.59375

0.09375

0.84375

0.34375

0.65625

0.15625

0.90625

0.40625

3

0

0.5

0.25

0.75

0.125

0.625

0.875

0.375

0.8125

0.3125

0.0625

0.5625

0.4375

0.9375

0.6875

0.1875

0.34375

0.84375

0.59375

0.09375

0.96875

0.46875

0.21875

0.71875

0.03125

0.53125

0.78125

0.28125

4

0

0.5

0.75

0.25

0.625

0.125

0.875

0.375

0.1875

0.6875

0.4375

0.9375

0.0625

0.5625

0.3125

0.8125

0.90625

0.40625

0.65625

0.15625

0.78125

0.28125

0.53125

0.03125

0.34375

0.84375

0.09375

0.59375

(10,20)

5

0

0.5

0.25

0.75

0.375

0.875

0.625

0.125

0.0625

0.5625

0.8125

0.3125

0.9375

0.4375

0.1875

0.6875

0.78125

0.28125

0.03125

0.53125

0.15625

0.65625

0.90625

0.40625

0.34375

0.84375

0.59375

0.09375

6

0

0.5

0.75

0.25

0.375

0.875

0.125

0.625

0.6875

0.1875

0.9375

0.4375

0.3125

0.8125

0.0625

0.5625

0.84375

0.34375

0.59375

0.09375

0.21875

0.71875

0.46875

0.96875

0.90625

0.40625

0.65625

0.15625

Non-uniform filling for large dimensions!

7

0.900

0

0.800

0.5

0.700

0.25

0.75

0.600

0.625

0.500

0.125

0.375

0.400

0.875

0.300

0.5625

0.200

0.0625

0.3125

0.100

0.8125

0.000

0.6875

0.000

0.1875

0.4375

0.9375

0.03125

0.53125

1.000

0.78125

0.900

0.28125

0.15625

0.800

0.65625

0.700

0.90625

0.40625

0.600

0.09375

0.500

0.59375

0.400

0.84375

0.34375

0.300

,2 )

0.900

0.800

0.700

0.600

0.500

0.400

0.300

0.200

0.100

0.200

0.400

0.600

0.800

1.000

0.000

0.000

(13,40)

0.400

0.600

0.800

1.000

(20,881)

Pair( 20 , 881 )

Pair( 13 , 40 )

1.000

0.900

0.800

0.700

0.600

0.500

0.400

0.300

0.200

0.200

0.100

0.100

0.000

0.000

0.200

0.200

0.400

0.600

0.800

1.000

0.000

0.000

0.200

0.400

0.600

0.800

1.000

Barrier options

Consider a (slightly) complex barrier pattern

Payoff at maturity is alive if

Barrier A has not been hit

Barrier B has been hit

Barrier options

There is analytic expression for “survival probability”

=probability of not hitting

We rewrite the pattern in terms of “not-hitting” events:

rule

ProbB is hit AND A is not hit Bayes'

ProbB is hit GIVEN A is not hit ProbA is not hit

1 ProbB is not hit GIVEN A is not hit ProbA is not hit

ProbA is not hit ProbB is not hit AND A is not hit

This is equivalent to the replication formula: KIAKOB = KOB – DKOA,B

Option price = DF ∙ payoff at maturity∙ Prob(A is not hit AND B is hit)

Barrier option replication

Prob(A is !hit) =

Prob(A is !hit in [t1,t2])∙

Prob(A is !hit in [t2,t3])

Prob(A is !hit AND B is !hit) =

=Prob(A is !hit in [t1,t2])∙

Prob(A AND B are !hit in [t2,t3]) ∙

Prob(B is !hit in [t3,t5])

Barrier options formula

Barrier option formula

American exercise in Monte Carlo

When is it optimal to exercise the option?

S0

K

today

t

maturity

Naïve approach. If at any time t:

Spot is out-of-the-money, it is not optimal to exercise. Stop

Spot is in-the-money then

start new simulation from this spot

if (on average) final spot finishes more in-the-money, do not exercise now

if (on average) final spot finishes less in-the-money, exercise now

Least-squares Monte Carlo

Since this has to be done for every time step t:

Naïve Monte Carlo is clearly impractical

Methodology for american exercise provided by

Longstaff & Schwartz (2001) Rev Fin Studies v.14 pp.113-147

Method is not exact but quite accurate (versus e.g. PDE)

Is not hard to implement

But not as CPU-efficient as standard monte carlo

Central idea

Work backwards starting from maturity

At each step compare immediate exercise value with expected

cashflow from continuing

Exercise if immediate exercise is more valuable

Least-squares Monte Carlo (1)

Generate spots for each path & for each time-step

Make an NpathsxNsteps table of spot paths (according to some dynamics)

Make an NpathsxNsteps empty table of cashflows (CF)

Cashflows

Spot Paths

Npaths

Nsteps

Out-of-the-money

In-the-money

0

0

0

0

0

0

0

0 0

0

0 0

0

0 0

0 0 0

0

0 0

0

0 0

0

0 0

0

Least-squares Monte Carlo (2)

If spot at maturity is

in-the-money: assign for this path CF=payoff value,

out-of-the-money: assign for this path CF=0,

Cashflows

Spot Paths

Out-of-the-money

In-the-money

0

0

0

0

0

0

0

0

0

0

0

0 0

0 0

0

0 0

0

0

0

0

0

* CF=(Sthis path(T)-K)+

Least-squares Monte Carlo (3)

Go one time-step backwards. If spot is

in-the-money: option holder must decide whether to exercise now or continue.

Calculate Y=discounted cashflow at next step if option is not exercised now

out-of-the-money: assign for this path CF=0

Cashflows

Spot Paths

Y1(T-Δt)

Y3(T-Δt)=0

Y5(T-Δt)=0

Y6(T-Δt)

Ypath(T-Δt) = DF(T-Δt,T) ∙ CF(T)

0

0

0

0

0

0

0

0

0

0

0

0 0

0 0

0

0 0

0

0

0

0

0

Least-squares Monte Carlo (4)

On the pairs {Spath i,Ypath i} pass a regression of the form

E(S) = a0+a1∙S +a2∙S2

This function is an approximation to the expected payoff from continuing

to hold the option from this time point on

Y

E(S)

S

If E(Spath(T-Δt)) < (Spath(T-Δt)-K)+ :

exercise the option at this time step

Assign CF at this step = (Spath(T-Δt)-K)+ and for all larger t set CF=0

If E(Spath(T-Δt)) > (Spath(T-Δt)-K)+ :

Do not exercise the option at this time step

Maintain same value of cashflow at next steps

Least-squares Monte Carlo (5)

Proceed similarly till the first time step

and populate the matrix of cashflows

There should be one non-zero cashflow

per path!

(the option can be exercised only once)

Amer

1

N paths

N paths

0

0

0

0

0

0

0

0 0 0 0 0

0 0 0 0 0

0 0 0 0 0

0 0 0 0 0

0 0 0 0 0

0 0 0 0 0

0 0 0 0 0

DF today, t iexer CF Si t iexer

i 1

Callables are priced with the same idea

Least-squares Monte Carlo (5)

Proceed similarly till the first time step

and populate the matrix of cashflows

There should be one non-zero cashflow

per path!

(the option can be exercised only once)

Amer

1

N paths

N paths

0

0

0

0

0

0

0

0 0 0 0 0

0 0 0 0 0

0 0 0 0 0

0 0 0 0 0

0 0 0 0 0

0 0 0 0 0

0 0 0 0 0

DF today, t iexer CF Si t iexer

i 1

Callables are priced with the same idea

Greeks in Monte Carlo

To calculate Greeks with Monte Carlo:

Bump sensitivity parameter (spot, vol, etc)

Recalculate market data with the bumped parameter (smile, curves, etc)

Re-run Monte Carlo

Calculate Greeks as finite difference

For example,

Price S S Price S S

2 S

Vega

Price S S 2 Price S Price S S

S 2

Price Price

This requires at least 12 Monte Carlo runs for all Greeks !

Not ideal for impatient traders

Likelihood ratio method (1)

This method allows us to calculate all Greeks within a single Monte Carlo

Main idea:

Express Greeks as payoffs

Price the new “payoffs” with the same simulation

Note:

The analytics of the method simplify if spot is assumed to follow

lognormal process (as in BS)

The LR greeks will not be in general the same as the finite difference

greeks !!

This is because of the modification of the market data when using the finite

difference method

Likelihood ratio method (2)

Consider an exotic option with a path-dependent payoff

Its price will depend on all spots in the path

Exotic DF dS1 dS m PDFS1 ,, S m Prob surv S1 ,, S m Payoff

PDF: probability density function of the spot

m

m

i 1

i 1

PDFS1 ,, S m PDFSi

1 12 zi2

e

2

S

2i ti i

zi the Gaussian random number used to make the jump Si-1

log

zi

1

Si

Si

1

r i2 ti

Si 1

2

i ti

Probsurv the total survival probability for the spot path (given some barrier levels)

m

i 1 t i

Prob surv Prob tsurv

i 1

For explicit expressions for the surv.prob. of KO or DKO see previous slides

Likelihood ratio method (3)

Sensitivity with respect to a parameter α (=spot, vol, etc)

PDFS1m Prob surv S1m

Exotic

DF dS1m Payoff

PDFS1m

Prob surv S1m

1

1

DF dS1m Payoff

Prob surv S1m

PDFS1m

This is simple derivatives over analytic functions (see previous slide)!

For example,

Delta becomes the new payoff

DF Payoff

0 t1

PDFS1m

Prob tsurv

1

1

0 t1

PDF

S

S

S 0

Prob tsurv

1m

0

To be priced with the same spot path as the Payoff itself

Similarly for other Greeks: more lengthy expressions but doable!

References

Options

“Options, Futures & other derivatives” John C Hull, (2008)

Prentice Hall

“Paul Wilmott on Quantitative Finance 3 Vol Set” Paul

Wilmott, (2000) Wiley

Numerical methods:

PDE: "Pricing Financial Instruments: The Finite Difference

Method", D Tavella and C Randall, (2000) Wiley

Monte Carlo: “Monte Carlo methods in Finance", P Jäckel,

(2003) Wiley

Monte Carlo: “Monte Carlo methods in Financial

Engineering", P Glasserman, (2000) Springer