PROPERTY TEST 3 OUTLINE

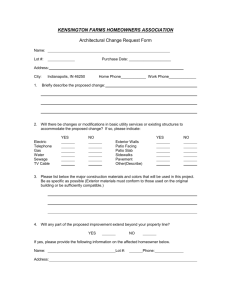

advertisement

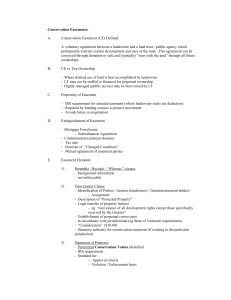

PROPERTY TEST 3 OUTLINE 1. Encroachers a. Pile rule: if you build on another’s land, you can be forced to move no matter how slight or expensive! (old unyielding rule); absolute right to injunction (threat of enforcement by court) 1. *even if enjoined, may still be Coasian bargaining after the fact ii. factory 1.5 inches under land of O because of inaccurate survey iii. no evidence of bad faith iv. offered to make party wall or pay for inconvenience but owners refused, said they had to tear down from their side of the wall v. held: must tear down the wall vi. *rationale: want to protect security in investing in the property vii. Golden Press court probably would have just ordered damages since all factors favored D except for fact they encroached b. Golden Press rule: relative hardship doctrine – shift from property rule to liability rule (E can stop with damages) where (1) removal expensive, AND (2) interference with use is insubstantial, AND (3) innocent mistake/good faith i. Foundation of neighbor’s house a few inches over property line ii. Do NOT give injunction here iii. Look at several factors, no uniform rule 1. High cost of removal? Good faith/unintentional? Impact on P’s use (look at current interference)? Slight encroachment? a. Note: could make argument there was not good faith here since surveyors disagreed iv. **do not apply Pile rule partly because concerned with potential bilateral monopoly Entitlement to land in O Entitlement to land in E Property Rule O can order tear down or keep structure; E must pay O’s price Pile Only if AP elements met Liability Rule Only if relative hardship elements met; E must pay damages set by court (disallows O’s extortion or holdout) Golden Press Sort of Somerville majority…but there O got to elect from 2 options so a little different 2. Improving Trespassers a. Somerville rule (not majority): entitlement of structure initially in improving E; O can choose to pay trespassing improver for value or can accept forced sale at court-set price i. Land worth $2,000, building worth $17,000 ii. Protects trespasser with liability rule only for the building itself iii. *no bad faith, just an error w/o negligence by anyone; P believed he was building on his own adjoining lot 1. might be concerned with incentives where there is bad faith iv. D spent little time in the area so no sentimental concern 1. Land here treated as basically fungible lots like money a. Fair market value here was stipulated b. If land really fungible, no one worse off with either option of remedy ~ no winners or losers created v. *holding justified by idea of unjust enrichment (unjust to let O keep the benefit, but not unjust for him to keep the land) and loss minimization (idea this remedy allows for no loss) 1. landowner can select the remedy 2. majority: this is different from encroaching cases because there, really small hardship but here, a whole building at stake vi. dissent: this is private condemnation~ P built on someone else’s land and is now taking it! 1. Says landowner should have option to buy or tear down but should not be able to use building unless he purchases it a. Ex-post bargaining likely here because O has interest in the land and E wants building 2. Would give advantage to landowner in the negotiations vii. **but if this has been a bad faith trespasser, could not get the surplus…but here, good faith improving trespasser gets the surplus viii. *leaves open possibility for different treatment in different circumstances 3. Adverse Possession of Chattels ~ different from land AP a. O’Keefe rule: discovery rule – clock starts when person should have discovered who to sue (“reasonable diligence” standard) i. Stolen painting, action for replevin to get it back 1. Did not report to police, reported to Art Dealers Assoc. many years later 2. Found out about Snyder around time of lawsuit a. Would have been fine under demand rule where clock starts when you ask for it back and are refused (allows Ps to sit on their rights) 3. *under discovery rule, P must show due diligence to recover a. remand for more fact-finding to see if she would have brought suit earlier with due diligence b. *discovery rule focuses on what the record owner was doing i. rationale: personal property different from AP whose purpose is to put record owner on notice ii. *transfers inform the discovery analysis but are not conclusive; clock not restarted with each transfer, not strict tacking like with land AP ii. Bona fide purchasers: general rule that thieves cannot transfer good title even to bona fide purchasers with 3 exceptions for: 1. Fraud (as opposed to theft) 2. Merchants under the UCC 3. Equitable exceptions (unclean hands, laches, estoppel) 4. *but O’Keefe does not fall under any of these exceptions, so need a different way to claim the painting… 4. Present and Future Interests a. Fee simple: if A (present interest holder) might have it forever i. Fee simple absolute: O to A (…and his heirs) 1. *no corresponding future interest 2. definitely infinite, A has ownership a. *note: infinite means nothing in the grant will dispossess A ii. Fee simple determinable: O to A so long as…and O has possibility of reverter 1. Future interest in O 2. O automatically takes back upon occurrence of condition 3. Uses durational language: so long as, until, unless iii. Fee simple subject to a condition subsequent: O to A, but if…then O has a right of entry 1. Future interest in O 2. But O just has a right to take, not automatic like FSD a. Until O retakes, A is still legitimate owner b. AP period begins when O demands land back (but may be barred by laches) 3. Language like but if iv. Fee simple subject to an executory limitation: O to A, but if/unless…then to B 1. Future interest in a third party B 2. May be springing (O’s) or shifting (B’s) executory interest b. Life estates: O to A for life = O has reversion and A has remainder interest or O to A for life, then to B = B has remainder i. Vested remainder interest: B (or B’s heirs) given a right to take when A dies; RAP will NOT apply 1. Absolutely vested: no condition on B’s taking a. O to A for life, then to B 2. Vested remainder subject to divestment: some event could divest remainderman a. O to A for life, then to B, but if B drops out of college then to C b. *comma rule – rule of interpretation i. if no comma, assume contingent interest ii. if comma separates “then to B” assume O meant to create vested remainder subject to divestment 3. Vested remainder subject to open: grant to B where Bs share could be diminished by new remainderman a. O to A for life, then to B where B are grandchildren and at least 1 already alive i. Class may close naturally (e.g. when B dies and cannot have more kids) or by the rule of convenience (at least 1 class member entitled to take Blackacre now) ii. Contingent remainder interest: unsure if when A dies the person mentioned will actually take Blackacre; RAP WILL apply 1. An uncertain event or person must precede the taking a. O to A for life, then to B if B has graduated from college (uncertain event) b. O to A for life, then to B’s heirs where B still alive (uncertain people) i. Remember, you only have heirs when you die 2. *reversion in O if the thing never happens 3. Not destroyed at the end of life estate but rather converted to springing executory interests c. Leaseholds: for a term of years 5. Interpretation & Construction a. Look at grantor’s linguistic meaning – WHAT DID O INTEND? i. Writing as the best evidence of intent ii. If unclear, may ask what O would do today b. 2 types of problems: i. ambiguity – use interpretation 1. when word has more than 1 possible meaning ii. vagueness – use construction 1. when word indefinite in scope (e.g. doing “well”) c. Wood rule: presumption in favor of granting the biggest interest possible; presumption against conditions i. Grant said it had to be a “county hospital” ii. *to overcome presumption, need to expressly say FSD or use durational language ~ none here, so assume fee simple absolute 1. court will only interpret, not create, a condition d. Cathedral rule: presumption against automatic forfeiture (but other courts may have wanted to see “right of entry”) i. Grant to cathedral without power to convey ~ restraint on alienation and restricted to particular use ii. This is a defeasible fee, but is it FSD or FSSCS? 1. Find it’s a FSSCS so Cathedral free of condition, can sell 2. *note: had condition been enforced, may have actually done something contrary to O’s intent! e. White v. Brown rule: presumption favoring fee simple absolute i. Will saying White to “have my home to live in and not to be sold” ii. Ambiguous what she meant to convey 1. Statutory presumption for fee simple absolute unless stated otherwise (did not say life estate in the will) iii. Hold it’s a fee simple absolute, she can sell 1. Unless clearly want life estate, give fee iv. Dissent: this was just a life estate f. Edwards v. Bradley rule: presumption against violating rules about unreasonable restraints on alienation (cannot have restraint on fee so interpret as life estate because then restraints ok) i. Looks like a FSSEI but court says it’s a life estate with remainder in fee simple to children 1. O wanted estate to be in tact – if interpret as life estate, condition is ok and creditors cannot attach it 2. Find O clearly intended to create a life estate ii. *White & Edwards come out differently on the same question because different grantor intents 6. Rule Against Perpetuities – future interests only valid if you can prove there will be no uncertainties after the life + 21 years period at the time of the grant a. *RAP either met or failed at the time of the grant; a regulatory rule i. limitation on what grantors can do ii. Rationale/Purpose: prevent too much dead-hand control, prevent problems of inalienability (socially undesirable) b. APPLIES TO: i. Executory interest ii. Contingent remainders iii. Vested remainders subject to open c. DOES NOT APPLY TO: i. Future interests in grantor ii. Vested remainders (absolute or subject to divestment only) iii. Charities iv. *may or may not apply to options and rights of first refusal… d. *either prove RAP satisfied or make a story where contingency/uncertainty still won’t be resolved within the period i. if RAP failed, redact e. Symphony Space rule: the RAP applies to bare options but does not apply to options directly connected to commercial lease (Texaco) i. Rationale: want to promote alienability, want people to invest in property at price they can predict ii. Broadwest let Symphony lease back for $1/yr. to avoid taxes and had option to re-purchase 1. Option could be exercised during certain years (or anytime Symphony defaults) 2. D wanted to exercise the option because value way up 3. Symphony refuses to sell back, says option invalid, violates the RAP iii. Ask whether purpose of the RAP would be advanced by applying it f. Texaco rule: “an option to purchase contained in a commercial lease, at least if the option must be exercised within the leasehold term, is valid without regard to the rule against perpetuities” g. Reforms to the RAP: still apply RAP first, but then may: i. “wait and see” approach (see if contingency still remains, don’t invalidate grant initially based on crazy hypothetical) ii. uniform statutory RAP – if you violate the RAP, still get to wait 90 yrs. and then if you violate, you’re done iii. cy pres – try to get as close as possible to O’s intent (redact) 7. Restraints on Marriage a. Lewis v. Searles rule: “reasonable restraints” on marriage ok i. Grant says P gets property as long as the stays single but if she marries, property to nieces and nephews ii. This is a fee simple subject to an execturoy limitation 1. No mention of life estate so presume fee simple iii. Complies with the RAP (can prove contingency will be gone, P is very old) iv. **2 possible reasons to make such a condition: 1. OK – to support your wife until she remarries 2. NOT OK – as a kind of penalty v. *here, this is OK vi. look at whether the provision serves a “legitimate purpose” b. Shapira rule: if gift over, probably OK (not a punishment) i. Dad’s stuff goes to sons only if married to Jewish girl with Jewish parents and if not (after 7 yrs.), then to State of Israel ii. Ok to restrict marriage to a particular group so long as group big enough it’s not a religious constraint iii. Where there is a gift over, general intent expressed iv. This isn’t about detriment to other faiths, just about favoring of 1 group 8. Waste a. Permissive waste: failure to exercise reasonable care to prevent deterioration (negligent inaction) b. Voluntary waste: commission of some deliberate act that advances deterioration c. Old view: any change in Blackacre was waste d. *modern view: waste occurs where there is: i. permanent injury to the inheritants that 1. diminishes value, or 2. increases burdens, or 3. destroys the identity of the property, or 4. impairs evidence of title e. Moore rule: permissive waste is a continuing course of conduct so that the statute of limitations does not start running until you are entitled to take the property i. Clear waste here ~ permissive waste conceded 1. *both parties worse off! The socially worst result because both present and future stream diminished ii. Negligent upkeep actionable during lifetime or after so long as ongoing (don’t want to make old lady suffer) iii. Alleged laches (waiting too long + prejudice) but no prejudice claim f. Melms rule: ameliorative waste ok if no contract agreeing to particular use or return in same condition AND complete, permanent change to surroundings that results in a total wipe-out i. Value here actually increased ~ both present and future streams increased g. Baker v. Weedon rule: standard for a forced sale is necessity (protect remainderman’s interest with a liability rule) i. Old legal rule of strict necessity not actually applied, go to equity land and look at what is most fair to all parties… 1. Neither’s property rights can be fully accommodated ii. Order a partial forced sale 1. Remainderman think market price too low, want to wait to sell (but maybe this is irrational) 2. Note: courts less likely to force sale if sentimental attachment 9. Present Value ~ all about interest a. A dollar today worth more than $1 in the future 10. a. b. c. d. e. f. g. Landlord-Tenant Law Types types of leaseholds: i. term of years (landlord holds reversion unless they specify 3rd party to take it…death of either party does not terminate it) ii. periodic tenancy or tenancy at will ~ month to month…require notice to end it (only difference that death ends tenancy at will) iii. tenancy at sufferance (lease expired, but still there…not a trespasser…if landlord accepts rent check, most courts say this is converted to periodic tenancy) iv. note: statute of frauds~ oral lease for less than 1 yr. usually ok – includes periodic tenancy where less than 1 yr. at a time even if total greater than 1 yr., month-to-month does not violate statute of frauds either Self-help: i. Common law: self-help allowed as long as not violent ii. Modern trend: no self-help allowed iii. Berg rule: no self-help allowed when tenant stays too long 1. Rationale: a. Want people to resort to judicial process, not self-help b. Easy and efficient to do summary process (less than 10 days) c. Legislature punishes wrongful/forceful evictions harshly 2. *court says even under common law, would have lost because any attempt at self-help susceptible to violence Sommer v. Kridel rule: leases are like contracts so that landlord has duty to cover damages i. Tenant decided not to move into apartment he leased ii. If this were pure K law, easy case but leaseholds were viewed like interest in real property so that landlords could not interfere 1. But court now says landlord has duty to cover damages Note: tenant’s options when tenant wrongfully breaches (doesn’t pay rent): i. surrender – damages for rent unpaid before surrender, search costs, and rent minus fair market value (standard expectation damages) ii. re-let – like a forced sublease ~ tenant still on the hook if the new tenant breaches iii. do nothing – landlord doesn’t do a thing (not ok under Sommer) *remember, you can only convey what you have, no more! Blackett v. Olanoff rule: landlord has duty to provide quiet enjoyment – if breached, constructive eviction i. Noisy nightclub case ii. If landlord himself disturbing, then easy case but here 1 tenant disturbing another…but landlord responsible because: 1. * CLASH FORESEEABLE and he leased anyway, 2. and he had the RIGHT & POWER TO CONTROL iii. *constructive eviction lets tenant get out of duty to pay rent Minjak rule: partial constructive eviction possible but must show complete deprivation of part of the property (can’t be just that all of it a little worse off ~ a portion must be totally unusable); tenant need not leave to win on constructive eviction 11. i. They stayed and didn’t leave = no actual eviction but argue constructive eviction for 2/3 of property that was unusable ii. Don’t need to leave or be constructively evicted from the entire property to get damages! But must be totally deprived of use of at least part of it h. ***standard for quiet enjoyment: must be “substantial interference with the use” or Restatement standard of “more than insignificant”~ focus on keeping de minimis violations out i. Javins rule: there is an implied warranty of habitability implied in all leases; leases are subject to contract law i. Allege landlord failed to meet Housing Regulations – clearly violated ii. But problem that nothing about housing code in the K 1. *court will read in these requirements for public policy reasons 2. abandon old rule where concerned with land itself, not so much the bundle of things a. 3 reasons for shift: i. old assumptions no longer true (not agrarian) ii. harmonize with consumer protection cases and implied warranties of contract law iii. nature of urban housing today iii. also problem that housing code itself says nothing about private remedies… 1. but hold it does contain a private right of action because if they don’t comply with Code, then illegal K iv. order new trial to see when non de minimis violations occurred to determine when rent owed v. *note: landlord must have notice of the problem! vi. Potential remedies when implied warranty of habitability breached: rescission (unwind, get out of lease), abatement or withholding of rent, make repairs and deduct from rent, damages, injunction, administrative remedies, criminal penalties even Tenancies a. Tenancy in Common – O to A and B – the default assumption i. undivided interest (equal right to possess the whole) ii. but shares can be different (like 1/5, 2/5) iii. each co-tenant can sell his interest but no more (X can step into A’s shoes) iv. co-tenants cannot be ousted ~ if they are, you owe them rent 1. *rent only owed to ousted co-tenant v. can always seek partition of the property - may be by value or acres vi. Olivas v. Olivas rule: no presumption of constructive ouster when a spouse moves out; constructive ouster may be by conduct (things you do denying other person right or ability to live there like changing the locks) or by character of property (such as to make joint occupancy impossible or impracticable like if not big enough) 1. Husband moved out to live with new gf, now says ex-wife constructively ousted him and wants rent a. Spouse moving out bears the burden 2. Do not need moral wrong to have ouster 3. If marital discord is ouster, court says it is character (but Turner says conduct might make more sense) 4. *spouse moving out bears the burden of proving ouster 5. *if left voluntarily by choice, no ouster & no rent owed a. **it’s not enough that one moved out! b. Not ouster just if wife refused to host gf vii. Carr rule: tenants in common do not need co-owner’s consent to lease 1. Father and son own agricultural land in common, father leases to third party and paid in kind but son wants cash 2. Son arguing lease invalid w/o his consent but court disagrees 3. Court says just partition if son really hates it! 4. But note: if son wanted to grow crops, then maybe ouster viii. Thompson v. Crownover rule: landlord has a duty to keep premises in reasonably safe condition b. Joint Tenancy – require something extra beyond tenancy in common to make this because of unique difference – this has right of survivorship i. Require clear intent to create this or to destroy it 1. Tenhet v. Boswell rule: joint tenancy tenancy in common if 1 of the 4 unities destroyed (but not so here) a. Here, joint tenancy remained in tact and right of survivorship continued because did not take any of the easy steps to sever b. Courts are divided on whether lease (with reversion in joint tenant) severs or not – some say the interest unity is conceptually different and so broken, this court doesn’t c. * Assume you did not mean to sever if no clear intent d. joint tenant cannot lease away more than they have ii. Right of survivorship created by 4 unities but some courts may want to see “right of survivorship” iii. Can be severed by conveyance or by sale (destroys 1 of the unities) 1. If A severs by conveying, B and C are still joint tenants with respect to each other so that when C dies, all C’s interest goes to B but not to A 2. Person you sold to becomes a tenant in common 3. Riddle rule: dispense with “strawman” strategy, you can convey to yourself and sever joint tenancy a. Rationale: save time b. Counterargument: generally don’t let people transfer to themselves c. *all states let you get out of joint tenancy with “strawman” but some states like here make it even easier and let you do it yourself! c. Tenancy by the entirety – like joint tenancy but for married couples only i. Less easily unilaterally burdened and not easily severed ii. Sawada rule: equal rights given to women in property held during marriage so that husband could not unilaterally encumber as before (Married Women’s Property Acts) 1. Husband negligent in car crash, he and his wife then transfer house to son but continues to live it in = clear attempt to protect home from tort creditors 2. *tort creditors could not reach this property! But could have before when wife was unable to encumber property a. Could not reach during lifetime but can reach right of survivorship once other spouse dies b. *Court treats tort and regular creditors the same (fair?) i. chose policy favoring spouses over creditors 3. * “under the Married Women’s Property Acts the interest of a husband or a wife in an estate by the entireties is not subject to the claims of his or her individual creditors during the joint lives of spouses” d. Key points: i. Fractional rent paid only to an ousted co-owner ii. Can generally lease without co-owner’s consent 1. But can only lease what you have – an equal, not sole right to possess the whole 2. Expenses (taxes) generally shared according to proportion of share but no duty to share in major improvements a. Co-owner in exclusive possession must bear all expenses up to reasonable level of rent iii. Spouse moving out bears burdern of showing ouster ***in all these co-ownership types, the tenants have an equal right to all of Blackacre Tenancy in Joint Tenancy Tenancy by the Common entirety How it’s created Default: O to A Require the 4 unities to Sometimes the and B (as create: time, title, default for married tenants in possession (equal right couples, where it common) to occupy the whole – exists (not always present), and everywhere) interest ***interest must be created at the same time by the same interest Distribution of Co-Os may have All interests identical Interests identical interests differing shares (always half/half) Right of No Yes Yes survivorship? (when 1 co-tenant dies, look at heirs to see who gets the interest) Alienable? Yes *Alienation severs joint Only sold or tenancy, yielding burdened if both tenancy in common spouses agree (but (easy to sell/gift) ~ not may be affected by locked in! Yes statute) Only in divorce Partition? (may be Yes conceptual or physical divide) – physical or by sale **why choose a joint tenancy? – takes time to probate will even if it’s clear, and right of survivorship is automatic = way to avoid probate by immediacy of right of survivorship 12. Marital Property – relationship-based (as opposed to property-based) a. Marriage as an economic partnership i. Assume each spouse gains utility by the other, expect to share in each other’s success b. 2 categories of states: i. separate property states – most states; creditors of one spouse cannot get at other spouse’s property 1. equitable distribution on divorce 2. forced share on death a. statutes saying spouse must get at least X but can dispose of property intervivos w/o spousal consent, subject to duty to maintain and support ii. community property states – all about fiduciary duty ~ whatever property acquired during marriage is communal 1. courts divided on whether creditors can reach 2. mechanical rule – often just equal 50/50 split upon divorce, but sometimes equitable 3. no forced share on death 4. anything owned before marriage is separate property but anything during marriage (except gifts) is communal c. types of remedies: i. restitution – give back benefit conferred 1. in marriage, give back contribution (e.g. A quit job and became homemaker) ii. reliance – puts you back in position you were in 1. try to get back to what would have been had marriage never happened iii. expectation – give the benefit of the bargain (standard contract remedy) iv. equitable – look at need, status, contribution, rehab, even fault d. examples: i. In Re Marriage of King rule: fairness may let wife keep house where husband’s income uncertain (gambler) 1. Give home instead of worry about hubby making payments 2. Say this is the equitable remedy ii. Behrens rule: general favor to let children stay in home unless unaffordable 1. Better for house to be sold because can no longer afford this standard of living 2. Long Island just as nice! 13. iii. Stolow rule: do what’s equitable, wife and kids don’t need such excess; weigh need for custodial parent to stay against financial situation of parties 1. Mansion with very expensive up-keep 2. Impossible to give husband 50% of house value w/o selling it 3. Move to more modest house in same community iv. Stallworth rule: standard of review for equitable distribution factor-weighing is abuse of discretion 1. Here, find abuse of discretion because no evidence they used any of the factors! Should have weighed them 2. Broad discretion ~ look at several factors to consider whether to force sale like adverse economic consequences, emotional and social needs of child, economic detriment to out of home spouse 3. **fact that child special ed. not enough to overcome presumption to split up house 4. idea that husband needs fresh start as much as wife a. hard to maintain parties in same or better position 5. dissent: would defer sale of the home because letting her keep for a while would help her become financially independent (would promote purpose of equitable distribution statute) v. O’Brien (minority) rule: professional degrees/licenses acquired during marriage value split upon divorce 1. Strong expectation interest a. Idea that wife deserves benefit of the bargain, husband shouldn’t get sole benefit b. She worked and sacrified c. Quasi-K unjust enrichment remedy d. Expected income from professional degree not barred by the statute e. Calculate based on his expected earnings, not her contributions 2. Husband’s argument: this is not property at all (cannot sell a degree) a. Court’s response: just because no exchange value doesn’t mean it’s not valuable marital property i. *split value of joint partnership 3. why not just give restitution? – once you conclude this is the kind of property that can be split, equal right to proceeds of jointly acquired property 4. but problems: a. giving wife future interest in a person’s labor (indentured servitude?) b. inefficient labor-leisure balance c. dissent says you could just modify annually Unmarried Couples a. Why insist on actual marriage? – want clear showing you meant to! b. Watts rule: unmarried couples may have different claims available after splitting up i. Lived together as husband and wife, had kids, filed taxes together ii. Wife’s claims: 1. Statute dividing property between married people should apply; says “family” includes them (not explicitly defined) a. But statute says “marriage” a lot so court limits “family” to married couples 2. Breach of contract – oral promises alleged, wife says he promised they would share wealth created equally a. Hubby tries to argue that if you let people enjoy benefits of marriage w/o ceremony, less likely to marry – but court says opposite probably true b. Hubby also argues the consideration for the K was sex so that it’s invalid (illegal) i. But court disagrees – more consideration than just sex (stayed home with kids, helped business) 1. However, sexual relationship may indicate intent to share more strongly 2. Sex is one part of the whole relationship 3. Sex separate from the K so ok ii. Note: some courts require promise in writing 3. Unjust enrichment 4. Partition doctrine – wife says they were tenants in common and so she can seek partition regardless of status relationship a. This claim is available to her c. Un-Marriage Gone Bad! i. Some courts: no rights 1. Worry about fraud 2. Legal process arguments – legislature should handle ii. Some courts: look at express intent of parties 1. Some say oral promises ok, some need writing iii. Some treat intimate cohabitants as married couples by implied intent 1. Like a business partnership 2. May have equitable division but no share of pre-relationship property d. Bars on Marriage i. Grant rule: opposite of Watts; sex is sole consideration and K illegal so neither can recover 1. Oral promise he would leave her ½ estate but didn’t and she promised not to marry, let him use her home a. No denial of this agreement b. But court says this K violates state statute preventing intermarriage (illegal) & is contrary to public policy = unenforceable c. *do not care about unjust enrichment! d. Contrast with Watts that said even if K illegal, enforce partially to prevent unjust enrichment e. Children’s Claims on Family Assets i. Bayliss rule: dad can be forced to pay for college! 1. Kid over 18, usually support ends there… 2. But court says he must pay because: a. College education is a necessary i. Standard: what other kids like this one tend to get ii. *not basic needs but rather type of expectation! b. Court has already held parents on the hook for minor children’s education…times change so extending obligation i. Age of majority is a flexible idea 3. Strong expectation idea driving holding a. Dad has no duty while married but now say he does! i. *when family intact, really respect their autonomy but when they split, maybe suspicious b. Court basically doesn’t believe dad’s argument i. Most families like this send kids to college, no reason to think they would be different 14. Licenses: permission to use the land of another; freely revocable a. Ex: inviting someone over for dinner 15. Servitudes: regulatory/use interests in property; special contracts that can run with the land ~ include EASEMENTS & COVENANTS 16. Easements: right to use the land of another a. Irrevocable ~ need consent to get out; cannot unilaterally rescind b. These are contracts between 2 landowners: servient holder (burdened) & dominant holder (benefited) i. Ex: right of way, right of power co. to put utility lines up c. Must be in writing (subject to the statute of frauds) UNLESS: i. Equitable reasons – 1. Easements by Estoppel (someone did something making them incapable of now claiming no easement) a. *require reliance + some investment while certain conduct by the owner i. size of the investment matters ii. present in Holbrook v. Taylor b. courts are split on whether to recognize these 2. Irrevocable license (a misnomer) a. Ex: sort of Rase 3. Easement by prescription (easement by AP) a. Ex: NOT Holbrook v. Taylor ii. Implication (intent but somehow left off) – ex: Van Sandt v. Royster 1. Prior use 2. Necessity (no access to public road) Ex: Finn v. Williams, NOT Othen v. Rosier d. REQUIREMENTS FOR EASEMENT BURDEN TO RUN: i. Writing ii. Intent – express or implied; readily found unless contrary intent iii. Notice – actual, inquiry (reasonable to have asked?) or record 1. *measures successor-predecessor agreement e. REQUIREMENTS FOR EASEMENT BENEFIT TO RUN: i. Writing ii. Intent iii. *benefits run readily – may be: 1. appurtenant: easement meant to run with land, or 2. in gross: easement specific to that holder iv. ***PRESUMPTION IN FAVOR OF APPURTENANT EASEMENT (will run with land on benefited side) ~ Green f. 3 types of unwritten easements: i. easements by estoppel ii. easements by prior use (implied easements – somehow left off despite parties’ intent) iii. easements by necessity g. Easement cases: i. Holbrook v. Taylor rule: tacit approval by landowner with lots of reliance by another creates easement by estoppel 1. Road/right of way, permission to use and improve road a. Widened and graveled b. No easement by prescription because not hostile (maybe continuity problems too) 2. But now steel cables and no trespassing sign up 3. Easement by estoppel found = IRREVOCABLE LICENSE a. Stood by and watched ~ at least tacit approval + b. Lots of reliance and $ spent 4. Turner says sensible to make easement seeker pay fair market value for use but courts don’t take this approach ii. Henry v. Dalton rule: no easement by estoppel; need writing 1. Joint hedge constructed between neighbors, fine for a while 2. Seems like easement by estoppel but court distinguishes this from Holbrook by saying here, grant not for any particular period, seems indefinite (there, grant of license for set time) 3. *court argues easement by estoppel is bad a. oral agreements easily misunderstood b. writing requirement gives security & certainty to titles iii. Rase v. Castle Mountain Ranch rule: reliance must be reasonable to find a sort of unwritten easement 1. Ranchowners gave permission for people to build cabins a. Didn’t mind people around, just wanted it on their terms b. Avoided AP claims by license agreements c. Violations and agreement not enforced before.. 2. New owner wants to kick them off now a. Interprets license literally b. Wants to exercise option to kick off with 30 days notice 3. *cabin owners had a license agreement (freely revocable unlike a lease where you have right to occupy for a time) 4. clear error standard of review 5. *court: license agreement was about preventing AP claims, not wiping people off so they were reasonable in their investments a. compromise holding: can stay in cabins for some time (6 yrs. remaining now) or can force the sale iv. Van Sandt v. Royster rule: when grantor conveys quasidominant property, readily find implied easement…but when grantor conveys quasi-servient part, presumption against burden running 1. Rationale for rule: grantor should have been more careful if he didn’t want benefit to run, must be clear if wants to reserve implied reservation (some courts require strict necessity!) a. *bargaining power argument 2. Underground sewage; find easement by implication 3. Private sewage land across 3 adjoining lots, 1’s basement floods so wants drains removed 4. Lot owner says easement implied, intended 5. Problem: cannot have an easement on your own land a. Quasi easement: before severance of land when one part used to benefit another b. Implied reservation claim by grantor – court applies RESTATEMENT FACTORS: i. Who’s claiming the easement? 1. If grantee, favor 2. If grantor, presumption against ii. Terms of grant iii. Consideration exchanged? iv. Extent of necessity? v. How land used before easement vi. Extent prior use could have been known c. *HERE, not strict necessity but easement necessary for the “comfortable enjoyment of lot 4 i. often, the more obvious the benefit of use, the less necessity required by the court ii. some courts would say reasonably convenient enough 6. *person trying to get out of easement claims no notice a. but court says he had inquiry notice!!! ~ this was an appurtenant easement i. should have known there were underground pipes since they had plumbing! 7. Conclusion: parties here really did intent to make easement v. Finn v. Williams rule: if severance and no access to public road, then infer easement because of strict necessity 1. Formerly unified land split up so that now P isolated a. no access to public road 2. permission to use private road not enough! a. Infer the easement 3. A sort of private condemnation vi. Othen v. Rosier rule: to get easement by necessity, must be necessity (landlocked) at time of the severance 1. Single original grantor, land split up a lot 2. P now landlocked, D denies easement 3. Problem: at time of severance, no necessity = no implication a. *no easement by prescription either (permission) vii. Cox v. Glenbrook rule: if writing clear, don’t look beyond it to determine intent but if unclear, ok to bring parol evidence; appurtenant easement benefits are divisible; easements limited by overburdening and scope qualifications 1. The “Quill easement” – originally paid $10 for right of way use 2. Language of grant: “easement and right of way, with full right of use over the roads of the grantor as now located or as they may be located hereafter” a. Explicitly permits relocation of easement! 3. Here, trial court erred in allowing parol evidence! a. “full right of use” was clear, unambiguous 4. TC also erred about whether easement could be divided a. *benefit of easement can be subdivided to successors if appurtenant 5. key question: did original parties intend widening to be allowed? – grant silent on this issue… a. some courts say if silence, per se rule against it b. but this court says it’s possible, even if grant silent, to find widening intended/allowed i. but if cars now twice as wide as time of easement, then maybe different ii. maybe widen if easement’s purpose could be fulfilled only by widening 6. original intent: DO NOT OVERBURDEN a. peaceful area, case really about development of new subdivision and concern with lots more traffic b. *cannot be measured yet – must wait and see what intensity use will be! i. Allowed to build but at their peril = special weapon for those resisting subdivision! 7. Note: traditionally, no change in location if easement did not allow it but now Third Restatement allows change in easement location even w/o consent in grant if servient owner pays for costs and the character of the burden and benefit not drastically changed viii. Green v. Lupo rule: presumption in favor of appurtenant easement (if possible to interpret as benefiting landowner rather than just individual, do so) ~ idea that people generally tend to enter these agreements as landowners 1. Motorcycle case 2. *issue: whether easement personal to the quiet couple who got benefit (in gross) OR was it appurtenant easement meant to benefit anyone owning the land (now mobile home motorcyclists)? a. Was it intended to run with the land? If in gross, no, but if appurtenant, yes b. Need to interpret the text of the grant 3. HOLDING: divisible appurtenant easement, qualified by overburdening test… a. Remand to see if motorcycling exceeds scope of agreement for ingress/egress transportation ix. Henley rule: easement owner can grant license to a third party w/o consent so long as consistent with use… EXCLUSIVE (to dominant holder) = APPORTIONABLE 1. Ps are subdivision members suing cable co., seek injunction 2. Ps says they only gave easements to certain guys who could not then share with others w/o their consent… a. But court disagrees 3. HOLDING: easement can be shared w/o servient holder’s consent if exclusive (meaning use only for the dominant holder) and if exclusive, then apportionable a. ***must be the kind of use contemplated by the easement b. ***cannot overburden i. HERE, 1 additional single wire is not overburdening (though Ps argue it’s a cable wire not specifically mentioned in the grant) 1. This is within scope of easement! 2. Originally for phone lines, but cable lines close enough ~ say intent for communication generally a. Still, maybe Ps could make argument this interferes with retained use rights even if does not interfere with actual use; or could say parties would not have included this today c. Note: wouldn’t have been exclusive if both used path d. Note: Third Restatement eliminates exclusivity test (just says must be consistent with intent and not overburden) h. HOW TO TERMINATE AN EASEMENT: i. By agreement, terms of easement, merger of land, or destruction of servient land ii. Abandonment (need act + intent), failure to re-record, estoppel iii. End of necessity (if created by necessity) iv. Prescription (AP) v. Frustration of purpose or changed circumstances (Restatement) 17. Covenants: right to force you or to stop you from doing something on your property = regulatory rights in the land of another a. A kind of private lawmaking i. Special Ks with consideration on both sides ii. *look at the promises separately to see if they run b. Ex: cutting trees, building 2 stories, commercial building, maintain a wall c. Real covenants: enforced by damages d. Equitable servitudes: enforced by injunctions e. DOES THE COVENANT RUN WITH THE LAND? i. Ex ante requirements FOR BURDEN TO RUN: 1. Writing a. Oral covenants generally don’t run b. Need a writing but writing maybe be outside deed 2. Intent a. Presumed if writing and touch & concern met 3. Notice (actual, inquiry or record) a. Some courts say you should check other grants by your grantor around the same time b. Inquiry notice less likely than with easements 4. Privity a. Horizontal – measures relationship between promisor and promisee i. Not needed for injunction! ii. *exists when covenant initially granted if at all b. vertical – measures relationship between promisor and successor i. not needed for injunction! ii. Relaxed – if successor is possessor of same piece of land as promisor 1. Rules out neighbor who is not bound iii. Strict – where promisor retains no interest in the land 1. Ex: NOT landlord tenant 5. Touch & concern a. Ex: painting a fence b. *3 types of touch & concern i. physical test – covenant physically burdens one side and physically benefits other side 1. ex: maintaining a common wall, noncompete agreements (Davidson Bros) 2. ex: NOT billboards because no physical benefit even though physical burden ii. NY test – does the covenant impose locationspecific burdens and benefits? 1. Flexible test asking if agreement entered because of the land they owned – if so, it should run iii. Third Restatement Reasonableness Test – like Davidson Bros. except this also requires appurtenance 1. Seems to move away from touch & concern but in reality, must retain the idea some 6. *can sue to demand benefit only if all these met ii. Ex ante requirements for BENEFIT TO RUN: 1. Writing 2. Intent 3. Touch & concern 4. Vertical privity (only for real covenants, not for injunction) f. Davidson Bros. rule: shift from old touch & concern test to modern reasonableness test to see if covenant runs (“reform” doctrine) i. Grocery store covenant not to compete ii. 40 yr. restriction, bought with actual notice by Authority then to CTown who had no notice iii. *calls touch & concern requirements “technical” like the privity requirements – no longer meaningful 1. if you have notice, then it’s fair iv. *shift to 8 MULTI-FACTOR BALANCING TEST (p. 279) 1. intent? 2. consideration exchanged? 3. clear expression of restrictions? 4. Writing? Recorded? Actual notice to grantee? 5. Reasonable in time, area, and duration? 6. Unreasonable restraint on trade? Monopoly created? 7. Interference with public interest? 8. Whether “even if the covenant was reasonable at the time it was executed, ‘changed circumstances’ now make the covenant unreasonable” 9. critique: this mixes separate questions of whether original K was good idea with when successor should be bound v. rationale: everyone else hates our law so overrule and change 1. also, efficiency justification for letting them run ~ minimize transaction costs and maximize welfare by using reasonableness test vi. here, need more information to see if reasonable g. SHOULD THE COVENANT RUN WITH THE LAND? i. Efficiency – does it make economic sense? 1. Bilateral monopoly concern = less costly to make people pay who want to end covenant (the cheaper guess) a. Especially true where deals with ownership of land so that most people would want it to continue (expensive to renegotiate each time) ii. Distributive justice – is the burden fair now? 1. Problem in Davidson Bros. a. Solution: changed conditions or relative hardship doctrines iii. Instrumentalism – covenants closely related to public policy (acting like a lawmaker) h. IMPLIED COVENANTS i. Sanborn rule: when there is a common owner and common scheme with lots of other lots subject to restrictions, may find inquiry notice to successor so that reciprocal obligation imposed 1. Ds bought house in residential area, now want to build gas station in back yard…Ps want to enjoin them 2. D’s property did not have written restriction on it but residential restriction on 53/91 of the lots… a. Inquiry notice established here (need notice because D is successor) based on the character of the development i. Should have checked other titles for covenants! ii. Riley v. Bear Creek rule: strong statute of frauds – no writing = no deal! (keeps out condition) 1. There was actual notice 2. But w/o writing, no binding covenant TEST 3 REVIEW AP-Related Doctrine: personal property, encroachers, improvers Encroachments: deck partly on your property, you want it removed o Traditional rule: Pile – must move it! o Modern rule: Golden Press using relative hardship doctrine, a way to move from injunction to damages! Encroachers who qualify might just have to pay damages 3 factors (generally must have all 3) good faith, insubstantial interference with P’s use, really hard/expensive to remove improving trespassers: o Somerville – built entire structure on another’s lot; in good faith Question of who gets the benefit Majority here said person who built gets the surplus! Landowner can pay the surplus or sell land – alternative remedy o But some courts have tough luck attitude More likely to see as pure surplus where property more fungible Rule for good faith improving trespassers – this was just a screw-up *unjust enrichment was the legal basis – if structure allowed to stay with no compensation, landowner unjustly enriched AP of personal property o O’Keefe’s stolen paintings now shown up, wants them back after long time Generally, thief cannot transfer good title (could have argued that bona fide purchaser – meaning in good faith and paying $ - gets exception if fraud instead of theft or merchant in which case could get good title ~ though thief still liable!) Exceptions do not seem to apply though o So no good title when they bought it…if they keep it, because O’Keefe waited too long! Under AP or laches How do you measure how long is too long? NY = demand rule – can wait if your property stolen, clock starts when you demand it back But use NJ discovery rule here – in exercise of due diligence, when cause of action should have been discovered o When should he have known who and where to sue? – clock starts at that point Court decides not to use an AP standard that would look at what possessor was doing ~ instead, say that for personal property, look at what true owner was doing to get it back because unlike land, open and notorious requirement not appropriate Present and Future Interests Naming interests o Automatic if durational language o Many courts have presumption against automatic forfeiture (Cathedral), but some want to see “right of entry” o All courts have presumption against conditions – read as precatory rather than burden if possible (Wood) o “reversion” when future interest in O for life estate (contingent remainder are in third parties) Interpretation o Comma rule Part of clause = contingent remainder Separate clause = vested remainder subject to divestment o Ambiguity (word could mean 2 different things, or ambiguous what type of grant it is) v. vagueness (word has range of meaning ~ e.g. “it’s cold outside”) Cure ambiguity by interpretation Cure vagueness by construction (adding your own stuff) o Wood: presumption against conditions! (“for purposes of county hospital” – read as precatory) o Cathedral: clear intent; presumption against automatic forfeiture so read as FSSCS (so future interest is right of entry but at time done, against the law so conclude church unburdened! – also state statute allowing court to uphold charitable purpose) o Edwards & White - restraints on alienation that would have rendered the restraint void if it were found a fee…cannot restrain a fee though so if they are fees, no restraint White: presumption in favor or biggest estate possible; if you want less, be clear – so because unclear here, say it’s a fee = condition now void! (end up doing something grantor did not want) Edwards: general presumption for fee but here, read as life estate because if not, she loses restriction preventing creditors from reaching family estate which O cared a lot about *cannot get exact result O wanted either way no right answers here, only arguments Regulation o RAP Don’t need to apply Gray’s rule Just know what the RAP is – a constraint on remote vesting; attempt by courts and legislature to prevent chopping up timeline so that uncertainty remains too far in the future! (war between past and future) Know when it applies and when it doesn’t *free standing options may violate RAP if restrain alienation (Symphony) does not apply to rights of first refusal or options co-existent with the lease like Texaco o Restraints on marriage Lewis: reasonable restraints ok if about support for widow (not ok if about punishing widow) Shapira: ok because not restriction on grantee’s religion, only must marry Jewish person Grantor cared not in punitive way because general intent to promote Judaism and gift over to Israel o Restraints on alienation – NOT ON TEST THOUGH Waste o Present Value matters o Moore: permissive waste (old lady died, place deteriorated), claim they didn’t sue in time and should’ve sued sooner Waste owing to negligence (permissive) Court says because negligent waste (continuing course of conduct), statute doesn’t start running until course of conduct finished No reason to make old lady suffer o Melms: ameliorative waste (actually improved!) – total wipeout Everything changed, value basically zero Complication: what would reasonable owner do? – a different standard o Baker: life tenant wanted to sell property (Anna) Kids from earlier marriage don’t want to sell Irrationally claim property will be worth more later Not very profitable as farmland STANDARD = can sell when necessity Traditionally meant land so worthless could not even pay taxes But this court says equity analysis needed, ask what’s in best interest of all parties ~ so suggest partial sale Leaseholds – landlord tenant (another kind of present interest) Types: o Term of years o Tenancy at will o Periodic tenancy Oral leases generally ok if less than 1 yr or if period less than 1 year (month to month period tenancy) Tenant duties (eviction) o Duty to pay rent and perform lease obligations – eviction if you don’t Landlord options: may re-let (but you’re still liable if subtenant messes up), surrender, or do nothing – but now rule that lease treated like K and must cover damages and look for someone else o Berg: landlord cannot use self-help to kick you out, must go to court because summary process quickly available; require resort to summary process *concern for risk of violence – say always risk of violence when you throw someone out! Landlord duties o Quiet enjoyment Violation called constructive eviction Traditional standard: substantial interference Restatement: more than insignificant standard Partial eviction ok if you totally meet standard for that part; don’t have to leave (recognition difficult to find a new place) Blackett: if LL has right and ability to control, maybe should have foreseen conflict with night club Traditional rule said LL never liable for third parties o Warranty of habitability Javins: problem before that lease seen as transfer of land with attached covenants, seen as separate from the transfer Court now says this is a K for housing services so that obligation breach can excuse performance ~ these are connected agreements!!! So if breach, may not have to pay rent Obligation to provide dwelling providing with housing code ~ implied into residential lease! Read in private right of action for rent abatement or cancellation on basis of violation Concurrent Ownership: co-ownership, relationships & sharing, and servitudes Obligation to pay rent to co-tenant only when there’s ouster (not just if they don’t live there by choice) Olivas: no ouster because he chose to leave, not pushed out Carr: old dad renews lease, young son wants cash not crops – son says cannot enter lease unilaterally but court says father can! Each co-tenant can lease w/o co-tenant’s consent but leasee only gets was lessor could give Joint tenancy: right of survivorship (you get everything if you outlive the other! The ultimate gamble ~ but can easily get out by selling and breaking 4 unities so that now property transfers by will) o Does leasing sever joint tenancy? Selling does…but Boswell asks whether intended to get out and leasing not an unambiguous way to get out of joint tenancy Marital property: separate v. community, division of family home (different approaches – restitution, equitable balancing, reliance, expectation) o King: awarding wife home guarantees child support = equitable distribution Insurance against risk gambling dad couldn’t pay o Barrons = too expensive to stay in family home, could not afford it and kids are young enough to adjust o Stolow: o O’Brien: division of professional degree ~ tests expectation against restitution idea Unmarried couples o Treat like married economic partnership or nothing at all o Grant & Butts cases