44005 - Special Operations Summit Little Creek 2015

Introduction

• Taking our GBS Organization on the Next Step of its

Journey

• Tom Hallett, Vice President of Global Business

Services

• 9+ years at McGraw Hill

• Finance, Accounting, Consulting/Project

Management roles at Accenture and Ernst & Young

• CPA, PMP, MBA

McGraw Hill Financial | Presentation 0

McGraw Hill Financial is a Leading Provider of

Ratings, Benchmarks, Analytics & Research

Leading rating agency

Premier provider of high quality data, analytical tools and ratings information

The leading index provider

Principal provider of commodity price assessments and information

Primary quality benchmark provider with deep auto expertise

McGraw Hill Financial | Presentation

Leading Indian rating agency, analytics and knowledge process outsourcing

1

A Truly Global Company

~17,000 Employees

McGraw Hill Financial | Presentation

31 Countries 96 Global Offices

North America

Headcount 5,000

Revenue $ 3.1B

EMEA

Headcount

Revenue

2,000

$ 1.2B

Asia Pacific

Headcount 9,500

Revenue $ 0.5B

Latin America

Headcount

Revenue

500

$ 0.1B

2 2

From Transition to Transformation – A "Brief" History at

McGraw Hill Financial

2010 - 2015

ERP Implementation

• Core Financials

• 3 “go lives” in 18 months

• Legal entity restructuring

• New chart of accounts

• No customization

Outsourcing and Op Model Standup

• 350+ positions in scope

• Contract signed in May; first transition in July

• “Lift and Shift” approach

Portfolio Rationalization

GBS?

CPI & Transformation

McGraw Hill Financial | Presentation 3

Moving to GBS?

If it worked the first time for Finance……

Transitioned from Lawson HR to a Workday solution; a mix of “fix and shift” and “lift and shift”

HR BPO on a smaller scale relative to finance focused on Workday capabilities, call centers and some other “odds and ends”

Applied learnings on vendor management and cutover planning from

FAO projects

Understood how to take a global system implementation and outsourced services live in a single deployment

McGraw Hill Financial | Presentation 4

Transition Learnings

PEOPLE: Assign a leader; manage expectations (e.g., the watermelon rule) , understand cultural differences; over communicate

TECHNOLOGY: Don’t underestimate connectivity lead times and application access requirements

PROJECT MANAGEMENT: Not everyone is cut out to be a Project Manager. Understand how a tollgate should work

PROCESS: Assess how your internal controls are impacted. If lifting and shifting don’t expect a different result

GEOGRAPHY: Understand international requirements (e.g., consultation, language and localizations)

GOVERNANCE: Assign decision rights, RACI’s are great tools

McGraw Hill Financial | Presentation 5

Governance starts early and runs through the entire transition process

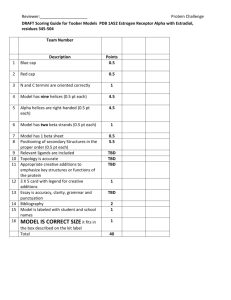

Key Deliverables and Timeline

38

22

USA

Phase 1 – “Baseline, Opportunities identification & RFP Development”

Baseline

MHF

MHE

60

HR Shared Services

Global In-scope FTEs

4

13

11

1

9

8

2

1

3

EMEA

86

60

26

MHF

MHE

$7.9

$5.0

$2.9

HR Shared Services

Global Cost ($M)

$0.3

$0.9

$0.7

$0.8

$0.6

$0.1

$0.1

$0.2

$0.2

$9.8

$6.6

$3.3

• Refreshed baseline

LATAM TOTAL APAC USA EMEA APAC LATAM TOTAL

Opportunity Identification

MM/DD MM/DD

BAFO

Site Visit

Solution session 2

Solution Session I 12.52

3.56

9.77

2.91

3.44

2.69

3.12

2.52

V3

1.65

2.40

V2

Phase 2 – “Provider Selection &

Contract Negotiation”

Providers Down Selection /

Reasons for Selecting ABC

14.96

3.85

3.74

3.70

3.67

ABC

Strategy &

Tools

Consistent

Leader

Transition Plan

Due Diligence

Through strategic investments in the F&A services, Genpact has operationalized a suite of superior tools to drive transformation:

Akritiv, Proflow and Questor

• Provider down select

Has outperformed all suppliers across all towers and all solution components during solution sessions, India site visits and BAFO solution responses

Transition plan targets completion in Q4 2012 & was supported by a very detailed knowledge transfer approach which minimizes risks by supporting Atlas launch1

• Provider due diligence

Transformation

Plan

Genpact’s Six Sigma approach has created a transformational culture that will drive continuous improvements (committed FTE productivity rate of 22%2)

• Deal economics

Contract Readiness / LOI

Phase 3 – “Transition

Planning”

MM/DD

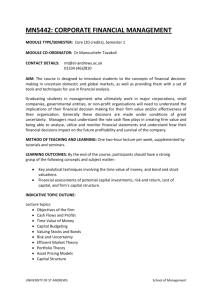

Governance Model Defined

Steering Committee

Jack Callahan

John Berisford

People Retention & Transition

TBD

Change Management &

Communications

TBD

Contract Negotiations

Kevin Giblin

Jeff Mitnick

BU

Presidents/

CFOs

Advisory

Board

Executive Sponsor

Michelle Ferguson

Finance & Accounting

Outsourcing

Bernie Drackwicz

50% Time

Commitment

Executive Sponsor

Michelle Ferguson

HR Outsourcing

Mary Beth Drake

Maryellen Valaitis

Transition Mgmt. Ofc.

Tom Hallett

Finance & Contracts Mgmt.

Rae Ann Wroblewski

100%

Commitment

50% Time

Commitment

MHE Specialty

Accounting Mgr.

TBD

MHE Order-to-

Cash Manager

TBD

Transition Lead

TBD

Transition Lead

TBD

MHF Order-to-

Cash Manager.

TBD

Transition Lead

TBD

MHF/MHE

Record-to-Report

Manager

TBD

MHF/MHE

Purchase-to-Pay

Manager

TBD

Transition Lead

TBD

Transition Lead

TBD

MHE Payroll

Manager

TBD

Transition Lead

TBD

MHE HRMS

Manager

TBD

Transition Lead

TBD

MHF Payroll

Manager.

TBD

MHF HRMS

Manager

TBD

Transition Lead

TBD

Transition Lead

TBD

HR

Leadership

Team

• Governance structure, processes, decision rights

Transition Plan & PMO Stand Up

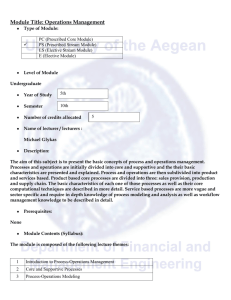

# of FTEs

11.6

Revised HR

SS Baseline

100

HR Estimated Savings ($M)

2.3

Includes call center, payroll

Service delivery is assumed onshore

PRELIMINARY

MHE

Contributes to ~ 25% of annual work volume

1.2

Re-grade existing positions above grade

21

Six positions are impacted

0.4

7.7

Right size to support post spin workload

23

Push Envelope on Outsourcing

30

Reset

Levels/Optimize

Spans & Layers

0

Future State

47

-33%

• Preliminary opportunities

• Business Case

• Outsourcing scope

RFP Issued

• Vendor Shortlist

• RFP released

• Key deal terms

• BAFO

• Letter of intent executed

Retained Organization Right-sized, Right

Process

Call Center

Data Mgmt

HRIS Admin

HRIS Admin

Payroll Services

Other

Processes

Sub - Total

Workload driver

Remedy

Tickets

Request handled

Simple

Request

Handled

Complex

Request

Handled

[Total

Annual

Payments

2011]

N/A

# of

FTEs

7

5

3

3

11

Total

Annual

Volume

20195

11802

11015

8629

2367

MHF

Annual

Volume

13127

7671

7490

5868

1184

Total Manhours requirements per year

12950

Manhour per unit

0.6

9065

5550

5550

20350

0.8

0.5

0.6

8.6

1

6

1

2

2

Reduced

FTE skilled

• Target state design

6

18

• Detailed Transition plan/timing

• Risks & Mitigation

Plans

McGraw Hill Financial | Presentation 6

Moving to GBS

McGraw Hill Financial | Presentation

So what’s next?

7

Our focus is to move from a “back office” service provider to trusted partner

Develop relationships and credibility with the business; help business understand the value proposition

Go beyond SLAs and leverage process health metrics to evaluate performance

Provide self service tools that are intuitive and easy to use

Leverage data to produce insight and analytics to support decision making

Design for global, localize where supported by legal and regulatory requirements

Create transparency around costs and services; run like a business, benchmark against peers

Look at the process through an end to end lens; standardize and automate

McGraw Hill Financial | Presentation 8

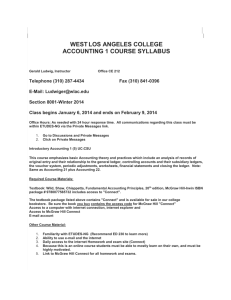

Project Priorities

Process

S2P

Focus Areas

• Consolidate Procurement and Disbursements teams to support E2E process

• Redesign internal website to simplify buy, pay and travel for employees

• Expand Ariba footprint

• Implement master data management solution

• Provide tools to increase transparency and enhance business unit reporting and analysis

RTR

• Transition from regional model to COEs

• Deploy BlackLine to enhance visibility and control over account reconciliations

• Create operational dashboards to drive better decision-support capabilities

McGraw Hill Financial | Presentation 9

Reporting and Analytics Focus (sample)

• Create Transparency across the company, awareness of policy and processes to take action and manage spend

McGraw Hill Financial | Presentation 10

Project Priorities

Process

OTC

Focus Areas

• Reorganize to reflect as a global business service

• Implement self service tools (electronic invoicing and payment)

• Consolidated end-to-end OTC operations for some key businesses

• Transition strategic accounts to offshore collections team

• Implement and enforce suspension policies

• Prepare for the big one…

Overall

• Evaluate shift from FTE to piece based pricing approach

• Revisit business continuity planning

• Evaluate impact of incentive programs on attrition and performance

• Develop service catalogs to communicate with the business and measure our performance

McGraw Hill Financial | Presentation 11

In addition to optimizing existing scope, we expanded and adjusted the portfolio

Added “smart” T&E Audits

Transitioned Financial System Security offshore

Moved customers off “do not call list” into collections scope

Closing our Latin America delivery center

Established a buying center to support compliance, tactical buying, system management and helpdesk support

McGraw Hill Financial | Presentation 12

Looking Further Ahead

Make Six Sigma and Lean a part of our DNA

Evolve metrics beyond SLAs and process health to focus on customer experience and satisfaction

Redefine what “talent” means in shared services / GBS

Manage knowledge vs. attrition

Become a destination for enterprise services across the organization

McGraw Hill Financial | Presentation 13