China Curtain Wall Market

advertisement

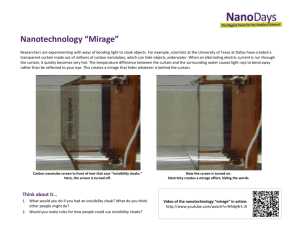

(Stock Code: 2789 ) Disclaimer The slides/materials used in this presentation are strictly confidential. The information contained in this presentation is being furnished to you solely for your information and may not be taken away, reproduced, redistributed, or passed on, directly or indirectly to any other person (whether within or outside your organization/firm), or published, in whole or in part, for any purpose. The slides/ materials do not constitute an offer of securities in the United Kingdom, Australia, the PRC, United States, Canada or Japan. In particular, neither the information contained in this presentation nor any copy hereof may be transmitted, reproduced, taken or transmitted into the United Kingdom, Australia, the PRC, United States, Canada or Japan or redistributed, in whole or in part, directly or indirectly, within the United States or to any U.S. person. By attending this presentation, you are agreeing to be bound by the foregoing restrictions and to maintain absolute confidentiality regarding the information disclosed in these materials. Any failure to comply with these restrictions may constitute a violation of applicable securities laws. These slides/ materials do not constitute an offer or invitation to purchase or subscribe for any securities and no part of it shall form the basis of or be relied upon in connection with any contract, commitment or investment decision in relation thereto. The shares of Yuanda China Holdings Limited (the “Company”) have not been, and will not be, registered under the U.S Securities Act of 1933, as amended (the “U.S Securities Act”) or the securities laws of any state of the United States and may not be offered or sold within the United States, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the U.S. Securities Act and any applicable state or local securities laws. There will be no public offering of the Company’s shares in the United States. This document shall not constitute an offer to sell or a solicitation of an offer to buy the Company’s securities nor shall there be any sale of such securities in any state or country in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or country. In Hong Kong, no shares of the Company may be offered to the public unless it is conducted in compliance with the Securities and Futures Ordinance, Chapter 571 of the laws of Hong Kong and a prospectus in connection with the offering for subscription of such shares has been formally approved by the Stock Exchange of Hong Kong Limited and duly registered by the Registrar of Companies of Hong Kong which contains all the information as required under the Companies Ordinances (Cap. 32) of the laws of Hong Kong and the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited. Any decision to purchase securities in any offering should be made solely on the basis of the information contained such prospectus or international offering circular to be published in relation to such offering. This presentation may contain forward-looking statements. Any such forward-looking statements are based on a number of assumptions about the operations of the Company and factors beyond the Company’s control and are subject to significant risks and uncertainties, and accordingly, actual results may differ materially from these forward-looking statements. The Company undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates. The information in this presentation should be considered in the context of the circumstances prevailing at the time of its presentation and has not been, and will not be, updated to reflect material developments which may occur after the date of this presentation. The information is not intended to provide, and you may not rely on these materials as providing a complete or comprehensive analysis of the Company's financial or trading position or prospects. Some of the information is still in draft form. This presentation also contains information and statistics relating to the plastic pipes industry. The Company has derived such information and data from unofficial sources, without independent verification. The Company cannot ensure that these sources have compiled such data and information on the same basis or with the same degree of accuracy or completeness as are found in other industries. You should not place undue reliance on statements in this presentation regarding the plastic pipes industries. The information contained in this presentation does not constitute a due diligence review and should not be construed as such. The information contained in these materials has not been independently verified. No representation or warranty, express or implied, is made as to, and no reliance should be place on, the fairness, accuracy, completeness or correctness of any information or opinion contained herein. None of the Company, or any of their respective directors, officers, employees, agents or advisers shall be in any way responsible for the contents hereof, or shall be liable whatsoever (in negligence or otherwise) for any loss or damage whatsoever arising from use of the information contained in this presentation or otherwise arising in connection therewith and none of them shall owe you any fiduciary duty in relation to this presentation. 2 Company Overview Shenyang Art Centre Shareholding Structure Mr.Kang Baohua (Chairman) Senior Management(1) 54.51% 9.04% Public 36.45% Yuanda China (Listed Company) BVI & HK Co Overseas Shenyang Yuanda 38 subsidiaries / branches Covering 30 provinces, autonomous regions and municipalities China Overseas 26 subsidiaries / branches (1) Management represents 6 directors and other senior management 4 Company Overview The Group is a provider of one-stop integrated curtain wall solutions including the design of curtain wall systems, procurement of materials, fabrication and assembly of curtain wall products, performance testing, installation of products at construction sites, and after-sales services. Global provider of integrated curtain wall solutions We also provide ancillary products related to curtain wall systems, including skylights, metal roofs, canopy systems, shading systems, balustrade and breast board systems, fire doors and rolling doors, and energy-saving aluminum alloy doors and windows. End customers to our curtain wall solutions mainly comprise non-residential and infrastructure developments both in domestic and overseas market, such as office building of government authorities or headquarters for leading companies from various industries, hotels, shopping center, center buildings for the use of conference, culture, sports, art and exhibition, airport, railway station and hospital and universities. World’s Largest: 2011 revenue at RMB10.80 billion (2011 market share(1) World: 7.84%; China: 23.0%) Fastest growth: 2008 – 2011 revenue CAGR at 22.2%; 2008 – 2011 Domestic and World Global leader in curtain wall industry curtain wall market CAGR at 16.5%, 6.2% respectively. Rooted in the fastest-growing curtain wall market: China, Undertaken projects globally in over 40 countries and regions Newly awarded 132 projects in 1H2012 with total contract value of approximately RMB8.0 billion. The value of backlog amounted to approximately RMB20.0 (1) billion in total as at 30 June, 2012 According to the Synovate report, Monitor analysis, and Cinda Securities, and expert interviews (calculated on 50million+ revenue curtain wall companies.) based on 2011 revenue 5 5 Company Overview (Con’d) Global leading curtain wall technology We believe we are a leading curtain wall provider with a comprehensive product portfolio. Through research and development, we have further developed various curtain wall products by using more complex designs, production and installation as well as combining the new curtain wall products with new materials, technology, energy, environment protection and energy conservation We are striking to realizing “Low-carbon, Function, Safety” of curtain wall products. Such products include double-skin curtain walls, photovoltaic curtain walls, ecologically friendly curtain walls, video curtain walls and membrane structure curtain walls One of the world’s largest R&D teams, with R&D centers in China, Switzerland, Japan and Australia, 600+ R&D professionals and 1,500+ designers Launched 80+ new products since 2008, pioneering the extensive use of curtain wall products Attained 548 patented items First brand in global curtain wall industry China‘s world-renowned curtain wall trademark First time on the ENR’s Top 225 International Contractors List as the only curtain wall supplier in 2011 Undertaken many Landmark projects all around the world Global marketing network, 38 Chinese and 26 overseas subsidiaries/branches 6 Milestones Rapid domestic growth Incorporation China 1993 Founded Shenyang Yuanda 1994 Undertook Shenyang ICBC Tower project 1997 Awarded the 1st Luban Award for the Beijing Xidan International Building 1993 – 1997 1998 Founded Shanghai Yuanda to strengthen the coverage in Eastern China market 2000 Shanghai and Chengdu production base completed 2005 Foshan production base completed By 2005, all 4 major production base s were completed 1998 – 2006 Completed landmark domestic projects 2006 China National Swimming Center “Water Cube” Beijing New Poly Plaza 2007 National Stadium of China “Bird’s Nest” 2008 Wuxi Shangneng R&D Building 2009 Theme Pavilion of Expo 2010 (1) No.1 in China : 23.0% market share No.1 in the world: 7.3 market share China‘s world-renowned curtain wall trademark Granted as the first chose curtain wall company by customer in the China Curtain Wall Net 2006 – 2009 Expansion of international business Overseas Leadership position in the Global and China curtain wall industry 2002 Signed the Huangjian Tower project in Singapore, representing the Group’s first overseas project 2004 – 2007 Established a number of overseas branches 2007 – 2010 Completed various overseas projects such as Cocoon Tower in Japan, the Legacy at Millennium Park in USA, Executive Towers at Business Bay in Dubai, Airrail Center Frankfurt in Germany, etc By 2010, became the world’s largest curtain wall company 2002 – 2009 600+ R&D professionals and 1,500+ designers Undertaken projects in 40 countries and regions Launched 80+ curtain wall products during the past few years Has 38 branches in China covering 30 provinces and autonomous regions; and 26 overseas branches 2010 7 Landmarks Projects in the World Beijing Galaxy SOHO China National Swimming Center “Water Cube” National Stadium of China “Bird’s Nest” Theme Pavilion of Expo 2010 Shanghai China Federation Tower Sales network R&D centers COCOON Tower The Legacy at Millennium Park Airrail Center Frankfurt Leadenhall Building in London Executive Towers at Business Bay Meydan Racecourse 8 Technology Concept Energy-saving Membrane Structure Introduced the “green” concept in curtain wall products Beijing Van Palace Microsoft (China) Headquarters Double-skin energy-saving curtain walls Improve the thermal insulation of the outer Safety Energysaving Shenyang Art Center “Water Cube” Membrane structure curtain walls Possess characteristics such as high building structure, indoor ventilation, sound insulation and daylighting transparency, light weight, high resistance to aging and long life Ecologically Friendly Photovoltaic Low Carbon Wuxi Shangneng R&D Theme Pavilion of Expo Building 2010 Shanghai China Theme Pavilion of Expo 2010 Shanghai China Photovoltaic curtain walls Integrate photo-voltaic system installed on the glass of the curtain wall to generate electricity from solar energy Theme Pavilion of Expo 2010 Shanghai China Ecologically friendly curtain walls Outer building structure covered by a botanical layer with a bioclimatic buffering layer, designed to achieve resource conservation and reduce pollution 9 Corporate Strategy Global marketing strategy Core technology strategy– Technology Leads Market Corporate strategy Brand Strategy– Build the world’s first brand Extension of industrial chain strategy– Vertical and horizontal integration M&A and restructuring strategy 10 Curtain Wall Market Dalian Hang Lung Plaza Curtain Wall Market Size Growth in China curtain wall market size Growth in global curtain wall market size 2,500 700 2,263 650 2,017 600 2,000 1,803 1,617 500 (Rmb 00'mn) 450 374 400 311 300 259 1,455 1,500 1,313 1,243 1,144 1,028 1,000 919 840 210 200 169 98 109 128 500 (1) 2015E 2014E 2013E 2011 2010 2009 2008 2007 2006 2005 2015E 2014E 2013E 2012E 2011 2010 2009 2008 2007 0 2006 0 2012E 100 2005 (Rmb 00'mn) 541 According to the Synovate report, Monitor analysis, and Cinda Securities, and expert interviews (calculated on 50million+ revenue curtain wall companies.) 12 Global Curtain Wall Market Distribution & Yuanda Curtain Wall Market Share U.S. market and the European market constitute each 1/4 of the global curtain wall market Brazil, Southeast Asia and other emerging markets are growing fast Australia, Russia and other markets still in great growth potential Low Market Share in the Blooming American Market by now Market share(1) around the world for Yuanda Other areas in the world 25% 4% 12% Global Market share Distribution Europe 30% USA 25% 23.0% 24.1% Global Market Share:7.4% China Middle East 20% Other areas in Asian 15% 10% 25% 5.8% 2.9% 5% 1.7% 0.1% 0% 13% China Regional Market Size(RMB bn) 21% (1) 31.2 Middle East Other areas Other areas in the world in Asia 6.0 17.3 18.7 Europe 36.8 USA 35.5 According to the Synovate report, Monitor analysis, and Cinda Securities, and expert interviews (calculated on 50million+ revenue curtain wall companies.) 13 based on 2011 revenue China Curtain Wall Market Three major driving factors of China curtain wall market development Inner driving force - Replacement needs New Driving Force - Energy saving construction Original driving force - Urbanization 12th Five-Year Plan: Expected production value of Rmb400 bn in the curtain wall market by 2015 (Rmb 00'mn) 4,500 4,000 3,500 3,000 2,500 4000 2,000 1,500 1,000 1500 500 620 0 2005 (1) According to Industry Association 2010 2015 14 China Curtain Wall Market Urbanization China's urbanization rate reached 51.27% in 2011(2) The rise of the Midwest, the second and third tier cities Continued strong demand for commercial real estate Urbanization Continued growth in the construction of public buildings expected that the urbanization rate will exceed 55% in 2015 80% 70% Regional average annual urbanization growth rate in 2005-2010 around the world(1) 60% 51.27% 50% Fastest urbanization rate in China 3% 2.0% 40% 2% 2% 30% 1% 20% 0.4% 1% 0.2% 0.4% 0.1% 0.2% 10% U.K. 0% (1) Source:Bloomberg (2) 2015E 2011 2010 2009 2008 2007 2006 2005 2004 U.S. 2003 Russia 2002 Middle Australia East 2001 China 2000 0% Source:National Bureau of Statistics 15 China Curtain Wall Market Urbanization - Commercial real estate & public buildings (con’d) Office building investment growth accelerating Completed investment value in office building (Bmb 100m) YoY growth (Right Axis) Investment in commercial business buildings growing fast Investment value in commercial business building (Bmb 100m) YoY growth (Right Axis) Completed Investment value of office building maintains rapid growth Completed investment value in real estate development: Office Building: Accumulated value (Rmb 100m) Accumulated YoY (Right Axis) Investment in commercial business buildings maintains rapid growth Completed investment value in real estate development: Commercial Business Building: Accumulated value (Rmb 100m) Accumulated YoY (Right Axis) 16 China Curtain Wall Market Urbanization - Commercial real estate & public buildings (con’d) Chart : …which account for more than 95% of the market in China Landmark projects awarded in 1H2012 (RMB 100m) 2007 – 2012 China curtain wall market breakdown 300 250 200 150 100 50 0 262 215 104 38 5 2007 8 2008 2009 Residential 9 2010F Commercial 107 89 74 62 48 7 176 146 122 11 2011F South Australian Institute of Health and Medical (RMB160 mn) BBVA Bank, Mexico (RMB220 mn) 13 2012F High-end Residential inYekaterinburg, Russia (RMB120 mn) Public(1) (1) Public buildings include government buildings, schools, libraries, pharmaceutical and public systems According to the Synovate report, Monitor analysis, and Cinda Securities, and expert interviews (calculated on 50million+ revenue curtain wall companies.) Dalian Henglong Plaza (RMB320 mn) Shenyang Art Centre (RMB190 mn) • The 12th Five-Year Plan driven further development on new energy, culture, tourism, health care, finance, electricity, logistics, automotive and other industries, which brings a new round of development of commercial real estate and public buildings Bohai Bank Tianjin Branch (RMB180 mn) Beijing Gezhouba Building (RMB120 mn) Fuzhou Administrative Center (RMB150 mn) 17 Operating information 财务摘要 World One Tower Shanghai Tower 632m 印度最高楼 444m Operation Scale Value of Backlog Backlog by Region Overseas China 20,015 20,000 17,186 32.6% 11,900 38.7% 12,488 20% 43.1% 45.2% 15% 51.1% 67.4% 48.9% 54.8% 10.64% 9.59% 10% China 56.9% 51.9% 11.77% 6.73% 61.3% 5,000 16.99% Overseas 48.1% 10,000 23.46% 13,196 (%) (RMB¥ mn) 25% 14,331 15,000 5% 6.05% 5.31% 4.28% 3.84% 1.33% 0% 0 MiddleEastFarEast Australia Europe American Others 2008 2009 2010 (For the year ended 31 Dec) 2011 1H2011 NortheastN orthern Eastern WesternSouthern 1H2012 (For 6 months ended 30 Jun) 19 Newly-awarded Projects Chart 2:Newly-awarded Projects by region Chart 1:Value of Newly-awarded Projects China 12,000 Overseas Overseas 40% China 37.24% 35% 10,000 (%) 25% 6,000 10,272 4,000 5,354 2,000 4,755 6,257 6,003 3,767 4,528 2,295 3,380 10% 2,054 1,786 17.32% 200 8 200 9 201 0 201 1 1H201 1H201 2 (For the 6 months ended 30 Jun) 200 8 200 9 201 0 201 1 1H201 1H201 2 (For the year ended 31 Dec) 4.16% 0% (For the 6 months ended 30 Jun) 8.50% 4.13% 3.01% 2.41% 5% 0 (For the year ended 31 Dec) 20% 15% 6,577 7.74% 9.16% 6.33% 0.00% Middle East Asia Australia Europe American Others NortheastNorthern Eastern Western Southern Chart 3: Newly-awarded projects sorted by end consumers 45% 40% 35% 42.2% Residential 5% Public buildings 25% IT 6.60% Office building by function 25% 19.9% 20% 15% 9.4% 2.5% 3.0% Office Building Hotel Tourism 1.9% Business District Governmental Institution Logistic Culture 0% 0.5% 6.2% Industrial Complex 5% 4.4% 4.7% Medical 5.4% Statium 10% House & Home Petrifaction 0.84% Commercial Real Estate70% 30% House & Home (RMB¥ mn) 30% 8,000 Finance 32.29% 2.89% Motor Electricity 0.82% 7.17% Media 3.43% Others 45.96% 20 Financial Stats South Australian Institute of Health and Medical Financial Abstracts 1H2012 (RMB¥ mn) Turnover 1H2011 Change (For the 6 months ended 30 Jun) 5,213.5 4,802.0 8.6% 18.8% 23.8% (5.0%) 402.7 647.9 (37.8%) 262.4 416.6 (37.0%) 4.2 8.9 (52.8%) (1,122.2) (204.9) 447.7% Debt/Equity ratio (%) 45.9% 45.8% 0.1% Liquidity ratio (times) 1.55 1.38 4.54% Gross profit margin (%) EBITDA Profit attributable to equity shareholders of the Company Basic and diluted earnings per share (RMB cents) Net cash used in operating activities 22 Turnovers Turnover Turnover breakdown by region Others1.61% 16,000 USA 0.11% Asia 1.97% 14,000 Australia 12,000 11.60% 10,797 (RMB¥ mn) 10,000 Europe 4.73%Middle 9,261 East 14.23% 33.5% 8,000 6,000 7,062 Overseas 35.5% 5,911 35.5% 4,802 33.2% 4,000 66.5% 34.3% 66.8% 61.4% 2008 2009 Turnover of 1H2011: RMB 4,802 mn 5,214 36.6% China Other 0.55% USA 1.39% 64.5% 2,000 65.7% 63.4% 1H2011 1H2012 Asia 8.55% Australia 0 2010 (for the year ended 31 Dec) China 65.74% 2011 (For the 6 months ended 30 Jun) 8.43% Europe 7.39% Middle East 10.50% China 63.40% Turnover of 1H2012 : RMB 5,214 mn 23 Profit Margin Chart 1: Gross profit and 图1:毛利润及毛利率 Gross margin 3,000 50% (RMB¥ mn) 2,500 2,306 40% 2,074 2,000 30% 1,657 1,143 1,500 1,148 1,000 23.5% 982 22.4% 21.4% 19.4% 20% 23.8% 18.8% 10% 500 0 0% 2008 2009 2010 2011 Gross profit 1H2011 Gross margin (for the year ended 31 Dec) (for the 6 months ended 30 Jun) Chart 3: Net Profit and Net Profit Margin Chart 2: EBITDA and EBITDA margin 1,500 50% 1,195 1H2012 1,000 806 1,205 1,000 30% 648 551 500 661 943 13.4% 12.9% 9.3% 11.2% 13.5% 403 7.7% 0 20% 10% 0% 2008 2009 EBITDA 2010 (for the year ended 31 Dec) 2011 1H2011 1H2012 EBITDA margin (for the 6 months ended 30 Jun) (RMB¥ mn)) (RMB¥ mn) 40% 20% 850 600 328 200 9.4% 8.7% 7.9% 422 8.8% 249 10% 5.5% 200 8 200 9 201 0 201 1 4.8% 1H201 1 1H201 2 -200 Net profit 0% Net profit mar gin (excl. n on-controllin g in terest) (for the year ended 31 Dec) (for the 6 months ended 30 Jun) 24 Cost of Sales & Operating Expenses Chart 2: Operating expenses (as % of revenue) continue to decrease steadily Chart 1: Stable cost of sales 100% 90% 1.6% 3.2% 2.9% 2.9% 3.0% 4.5% 1.3% 3.3% 2.9% 2.8% 2.7% 5.1% Others Taxation R&D Wages Transportation On-site 80% 6.0% 7.0% Processing 15% Selling Expenses Administrative Expenses 11.6% 12% 11.4% 11.6% 10.9% 11.8% 11.3% 70% 23.0% 60% Installation 25.0% 9% 50% 9.0% 8.7% 40% 9.6% 9.5% 9.1% 2.1% 2.1% 2.2% 2.2% 2010 2011 1H2011 1H2012 8.8% 6% Raw material 30% 52.9% 49.9% 20% 3% 10% 0% 2.6% 2.7% 2008 2009 0% 1H2011 1H2012 (for the year ended 31 Dec) (for the year ended 31 Dec) (for the 6 months ended 30 Jun) 25 Operating Turnover Days Chart 1: Inventory and trade receivables turnover days Chart 2: Account payables turnover days 160 149 150 200 140 180 126 130 120 160 110 140 100 183 (day) (day) 132 2007 2008 101 101 2009 2010 80 70 60 80 87 60 97 90 120 100 97 56 50 60 40 30 40 20 20 32 32 29 33 38 10 0 0 2008 2009 Inventory turnover days 2010 2011 1H2012 Net contract work receivables turnover days (For the year ended 31 Dec) (For the year ended 31 Dec) 2011 1H2012 (For the 6 months ended 30 Jun) (For the 6 months ended 30 Jun) Due to the influences of economies and tight credit policy, turnover days has slightly increased 26 Competitors Comparison BBVA Bank, Mexico Leading R&D Capabilities One of the world’s strongest R&D teams, with 600+ R&D professionals Possesses 187 proprietary patented technologies in 2012 1H; Newly applied for the registration of 388 patents; (included patents on 2011 for 2012); 548 patents have obtained the certificate. Global R&D network with 4 regional R&D teams located in China, Switzerland, Australia, and Japan, respectively No.1 in Terms of R&D Investment (1H2011) 5.0% 123.9 (Rmb mn) 120 100 123.9 80 3.0% 60 2.0% 40 150 4.0% 2.3% 26.0 19.7 1.0% 20 1.0% 0 0.0% 106.9 (Rmb mn) 140 R&D Investment Continues to Grow 100 50 0.6% 0 R&D Expenditure % of Total Revenue 1H2011 Source: Company Announcement, by the end of 2012, converted into RMB refer to the exchange rate in September 2012 1H2012 28