M Gibb - balance sheet as at 31 December 2007

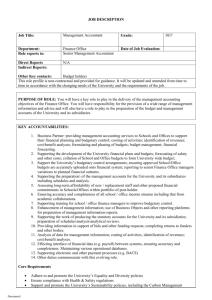

advertisement