Group Medical Insurance

Client

ASHOKA TRUST FOR RESEARCH IN ECOLOGY AND THE

ENVIRONMENT

Contents

Group Medical Insurance

Disclaimer:

This benefit summary will serve as a guide to the benefits provided by ASHOKA TRUST FOR RESEARCH IN

ECOLOGY AND THE ENVIRONMENT. The information contained here is only a summary of the policy

documents which are kept by the company. If there is a conflict in interpretation, terms & conditions of the

policy will prevail.

Prepared by

Emedlife Insurance Broking Services Ltd

No. 862, 3rdFloor

Prabhat Arcade, 80 Ft Road

Koramangala 8th Block

Bangalore – 560 095

Tel: 080-4265000 Fax: 080-4265000

Copyright © 2012. All rights reserved. No part of this publication may be reproduced, stored in the retrieval

system, or be transmitted in any form or by any means, electronic or mechanical, photocopying, recording or

otherwise, without the prior written permission of the publishers.

Help Line Numbers

For all queries and assistance, please contact Emedlife Insurance

Praveen Raj S. (Sr. Executive - Client Services) – 90081 44417 (Email: praveenraj_s@emedlife.co.in)

Arjun (Escalation 1) – 90081 44456 (Email: arjun_k@emedlife.co.in)

Ramani (Escalation 2) - 99808 11326 (Email: ramani_hs@emedlife.co.in)

The Insurance Third Party Administrator is Medi Assist India TPA and their contact details are:

Tel: 080- 26584811

Fax: 1 800 425 9559

Toll free number: 1-800-425-9449

Email: info@mediassistindia.com

Website: https://www.mediassistindia.com

Agenda

Group Medical Insurance

TPA Service Offerings

Log in Procedure

Process for Hospitalization

Escalation Matrix

Group Medical Insurance

Broker

Emedlife Insurance Broking Services Limited

Insurer

National Insurance Company Ltd

TPA

Medi Assist India TPA Pvt Ltd

Group Health Plan

Policy Holder

ASHOKA TRUST FOR RESEARCH IN ECOLOGY AND THE ENVIRONMENT

Period of the Cover

12 months

Inception Date

21th May 2015

Expiry Date

20 th May 2016

Insurer

National Insurance Company Ltd

TPA

Medi Assist India TPA Pvt Ltd.

Sum Insured Limits

INR 2 Lacs, 3 Lacs and 4 Lacs Sum Insured per Employee.

Members Covered

Self only

Geographical Limits

India (Covers treatment in India only)

Group Mediclaim Coverages

Pre-existing Diseases covered

Waiver of Time exclusion for diseases (30 days/1 Year/2 Years/4 Years )

Maternity Benefit of INR 25,000 for Normal and 35,000 for C-Section.

Maternity benefit covered from day one.

New Born baby cover.

30 and 60 days Pre & Post hospitalization covered.

Ambulance Charges covered up to 1% of Sum Insured with maximum limit of INR

1,000/- per incidence .

Room rent (Including Nursing charges) charges payable up to 1% of Sum Insured for

normal and 2% of Sum Insured for ICU with max limit of INR 5,000 per day.

Scope of Insurance Cover

Includes:

Only “in-patient” hospitalization expenses.

Active treatment with minimum 24 hours hospitalization.

Pre-hospitalization expenses of 30 days before admission and post hospitalization expenses for 60 days

after discharge for an eligible hospitalization

Cashless facility against Pre-Authorisation at Network hospital only

Excludes:

Non - Medical Expenses - Registration/Admission fees, hospital surcharge, food bills for attendants,

telephone charges, pharmacy charges for non-medical items etc.

Other standard exclusions

Stay in hospital without undertaking any treatment or where there is no active regular treatment

Standard exclusions to the Insurance Cover

Injury or disease directly or indirectly caused by or arising from or attributable to war or war like

situations and by nuclear weapons.

Circumcision unless necessary for treatment of diseases

Congenital ailments or defects/anomalies

Hospitalization for convalescence, general debility, intentional self-injury, use of intoxicating

drugs/ alcohol.

Venereal diseases, HIV and AIDS, Infertility treatment and Naturopathy

Cost of spectacles, contact lenses, hearing aids

Any cosmetic or plastic surgery except for correction of injury

Hospitalization for diagnostic tests only even if prescribed by a medical practitioner

Voluntary termination of pregnancy during first 12 weeks (MTP)

Pre and Post Natal expenses are not covered unless admitted in Hospital/Nursing

Home for active line of treatment

Unproven or experimental treatment not approved by Indian Medical Council

Any Dental treatment or surgery except arising out of an accident, which requires

Hospitalization for treatment

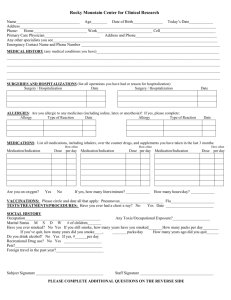

Enrollment in the program

• Existing employees are covered under the policy from 21th May 2015.

• All New joiners must enroll themselves within 20 days of joining the company.

Provide required

details of yourself to

the HR

HR sends the data to

the EMEDLIFE to

upload their system

EMEDLIFE will upload

this data and inform

ATREE on the

activation of all facility

for employees

Error in data

on E card

Send mail to

EMEDLIFE / HR with

ID Card Nos.

TPA will upload

E cards on their

Website for all

employees

Employee

verifies

details of

the E card

on TPA

website

E Card Ok

Use E card/Physical

card for cashless

hospitalization

authorization

Medi Assist India TPA Pvt Ltd – Service Offerings

•Online access to view self details, claim status and e card download

•Cashless Hospitalization

•SMS facilities for Pre-authorizations.

•24 hour telephonic Nurse line.

•Claims Administration.

Procedure for Online Access

Procedure for Online access

Please follow the below steps to Login

Log on to https//:www.mediassistindia.com .

Select “Login” option present on the top Right of the screen

Select “Corporate Employee”.

User ID:

Password:

How does the plan work ?

Hospitalization event can be:

Planned or Emergency

In a Network hospital or Out of Network

Hospitals have details of TPAs - please check with hospital helpdesk

if they accept Medi Assist Insurance card to avail cashless

hospitalization

For updated list of Network hospitals, see

http://www.mediassistindia.com

Network Hospitalization (Planned)

Fill up the Pre-Authorisation form with the help of

the treating Doctor and fax it to the Medi Assist

Nurse line with the assistance of the hospital staff 48

hours prior to Admission

Medical Management Team assesses the Preauthorisation request and after it is approved,

Medi Assist Nurse line sends Credit letter to

Network Hospital

All Medical Expenses including

Room Rent would be covered under

Cashless

Network Hospitalization (Emergency)

Call up Medi Assist Nurse line if

possible

Or else, get hospitalized into the

nearest Network Hospital with

the medical E- card/Physical card

Get the Patient treated and after the

patient has stabilized, complete the

Pre-authorisation process

You can also identify yourself as a member

of TPA so that they can assist you with the

Pre-authorisation formality.

Possibility of Denial of Cashless - examples

• Admission for investigations/ observation / evaluation only .

• Admission beyond a certain number of days apart from the normal package stay.

• Treatment not matching with disease mentioned on pre-authorisation form.

• Any treatment which otherwise could have been taken on OPD basis.

• Any congenital external disease.

• Hospital not sending proper query reply raised by TPA on time.

• Active line of treatment not mentioned in the pre-authorisation form

Non-Network Hospitalization (Planned & Emergency)

Claim Intimation has to be provided to

Emedlife/Medi Assist

Claim needs to be sent to

Emedlife within 20 days from the

Date of Discharge

Kindly make the arrangements for the

admission and pay all expenses at the

hospital

Collect all original documents from the

Hospital including the Hosp. & Doctor Registration No.

Pre & Post Hospitalization Bills

Pre Bills: 30 days prior to Date of Admission

Post Bills: 60 days after Date of Discharge

Procedure of Discharge & Claim without Cashless facility

The employee should arrange for the admission and all other payments required by the hospital.

Collect and submit to Emedlife the following documents (in original) after discharge

Discharge Card/Summary

Main pre-numbered Hospital Bill

Signed Claim Form

Pre-numbered payment Receipt

Prescriptions, reports and bills for all investigations done.

Prescriptions and bills for medicines consumed during hospitalization.

Break-up of the medicines bills amount of Rs. 200/- or more.

Sticker of lens in the case of cataract cases

GPLA certificate in maternity cases

Medico-legal certificate and FIR in accident cases

Hospital’s registration number is required and Mandatory

Claims will not be assessed if all the documents mentioned are not submitted.

• Claim Submission Timeline - All claims to be submitted to Emedlife within 20 days from date of discharge.

NOTE : Any delayed submission beyond the timeline mentioned above will not be processed. In such cases, letter

from the employee would be required with a valid reason for delay in submission. It is at the discretion of the

Insurer to provide the approval for such cases.

Claims Administration Process

•

Claims Administration Team

– Document handling

– Registration of claim with insurer

– Liaison with insurer for payment

– Explanation of paid amounts and rejection

•

Document Recovery Team (DR Team)

– Sends reminders for the missing/required document(s). In case of non-receipt of the same,

may send the entire claim back to the employee or deduct the appropriate amount and send

the balance claim for QC

•

Quality Check Team (QC Team)

– Re-assesses the claim to ensure that the claim is complete in all respect before sending it for

payment to the insurance company.

•

Claim settlement

– Approximate time to settle claim is 10 - 15 working days after receipt by TPA of complete

documentation

Some Important Do’s & Don'ts

• Submit the Reimbursement claim documents to Emedlife Helpdesk within 20 days from date of

Discharge

• Always carry photo ID proof along with your medical card.

• Photo ID proof can be: Driving license / PAN Card / Passport / Voter ID.

• For Planned hospitalization: take approval before getting admitted in hospital

• For Reimbursement cases, always collect all originals from Hospital including final bill with

break up and payment receipt.

• Any issues in getting cashless approval, please contact the Account Manager (Emedlife).

• On leaving ATREE, the Insurance card is to be returned to HR Deptt.

For any kind of clarification, please contact:

Emedlife

Medi Assist

Account Manager

Praveen Raj S.

Gajendra

Phone no

90081 44417

93425 33651

gajendra.jothimala@mediassistindia.com

Mail ID

praveenraj_s@emedlife.co.in

1st Escalation

Arjun K

Venkatakrishnan

Phone no

90081 44456

96861 95495

venkatakrishnans@mediassistindia.com

Mail ID

arjun_k@emedlife.co.in

2nd Escalation

Ramani

Phone no

99808 11326

Mail ID

ramani_hs@emedlife.co.in

THANK YOU