vfacts industry summary- january 1995

advertisement

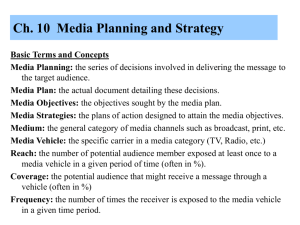

VFACTS INDUSTRY SUMMARY - April 2014 The Federal Chamber of Automotive Industries issues the following summary for the retail sales performance of the automotive industry for April 2014. Key Points: The April 2014 market of 80,710 new vehicle sales is a decrease of 4,407 vehicle sales or 5.2% on April 2013 (85,117 vehicle sales). April 2014 had 2 less selling days (22) as April 2013, resulting in an increase of 122.10 vehicle sales per day. The April 2014 industry volume is down 16,557 or 17.0% on March 2014 (97,267 vehicles). In seasonally adjusted terms the April monthly volume equates to a 0.3% increase versus March. The Passenger Vehicle Market is down by 3,817 vehicle sales (-8.9%) over the same month last year. The Sports Utility Market is up by 966 vehicle sales (4.0%). The Light Commercial Market is down by 1,362 vehicle sales (-8.8%), and the Heavy Commercial Vehicle Market is down by 194 vehicle sales (-7.8%) versus April 2013. Toyota was market leader in April, followed by Holden and Mazda. Toyota leads Holden with a margin of 6,920 vehicle sales, or 8.6 market share points. Total Vehicle Sales - Year to Date 1,200,000 2012 2013 2014 Vehicle Sales 1,000,000 800,000 600,000 400,000 200,000 Jan Feb Mar Apr May Jun Jul Aug Sales Month Sep Oct Nov Dec YEAR TO DATE RESULTS The year-to-date 2014 market of 347,080 vehicles is running 11,085 vehicle sales or 3.1% behind the same period in 2013. This equates to a YTD SAAR of 1.114 million vehicles. There were 2 less selling days available as in April 2013, however the daily selling rate has increased by 122.10 vehicles per day. The Passenger Market at 171,383 vehicles is down by 5,420 vehicle sales (-3.1%). This equates to a YTD SAAR of 0.544 million vehicles. Mixed results by segment were evident with the Light car segment, down 5,745 (-14.9%); the Sports car segment, down 661 (-7.4%); the Micro car segment, down 2,103 (-25.2%); the Upper Large segment, down 18 (-1.4%); and the Medium car segment down 802 (-3.6%). Showing gains were the Small car segment, up 778 (1.0%); the Large car segment, up 2,217 (16.3%) and the People Movers segment up 914 (35.0%). The Sports Utility Vehicle Market at 107,863 vehicles is running ahead of the same period in 2013 by 874 vehicles (0.8%), in year-to-date terms. This equates to a YTD SAAR of 0.346 million vehicles. The one segment contributing positive results was the SUV Small segment, up 3,060 vehicle sales (13.2%). Showing negative results were the SUV Large down 1,018 (-2.5%); the SUV Medium segment, down 133 vehicle sales (-0.3%); and the SUV Upper Large segment, down 1,035 vehicle sales (-21.2%). The Light Commercial Market at 58,866 vehicles is running 6,025 vehicles (-9.3%) below the same period in 2013, in year-to-date terms. This equates to a YTD SAAR of 0.193 million vehicles. This loss was driven by the Pick-up/Cab Chassis 4x4 segment which is down 5,798 vehicle sales (-13.3); the Vans/CC <=2.5t down 51 vehicle sales (-5.0%); the Pick-up/Cab Chassis 4X2 segment, down 7 vehicle sales (-0.0%); the Van/CC 2.5-3.5t segment, down 274 vehicle sales (-5.3%) and the Light Bus => 20 seats segment, down 37 vehicle sales (-15.2%). Showing a positive result was the Light Bus <20 seats segment, up 142 vehicle sales (18.8%). The Heavy Truck Market at 8,968 vehicles is down on the same period in 2013 by 514 vehicle sales or -5.4%. This equates to a YTD SAAR of 0.031 Million vehicle sales. MONTHLY RESULTS The Passenger Vehicle Market is down 3,817 vehicle sales or -8.9%. This was driven by losses in the Small car segment, down 1,665 (-8.2%); the Micro car segment, down 1,003 (-46.1%); the Light car segment down 1,273 vehicle sales (-14.5%); the Medium car segment down 565 vehicle sales (-10.2%); and the Sports car segment down 275 vehicle sales (-14.0%). All other segments contributed positively with the Upper Large car segment up 91 vehicle sales (35.8%); the Large car segment, up 603 (18.8%); and the People Movers segment, up 270 (44.3%) on 2013 volume levels. The Sports Utility Vehicle Market is up 966 vehicle sales or 4.0% versus April 2013. With the exception of the SUV Upper Large segment, down 305 (-25.8%); and SUV Large segment, down 766 vehicle sales (-7.6%), all other segments returned positive results with the SUV Small up 2,014 (47.5%); and the SUV Medium segment, up 23 vehicle sales (0.3%), versus April 2013 volume levels. The Light Commercial Market is down 1,362 vehicle sales or -8.8% versus April 2013. Segments returning negative results were the Pick-up/CC 4x4 down 1,115 (-11.1%); the Pick-up/CC 4x2 up 142 vehicle sales (-4.1%); the Light Buses =>20 seats segment, down 1 vehicle sales (-2.0%); the Van/CC 2.5t-3.5t segment, down 215 vehicle sales (-14.9%); and the Vans/CC <=2.5t segment, down 51 vehicle sales (-18.3%). Returning a positive result was the Light Buses <20 seats segment, up 162 vehicle sales (91.0%) The Heavy Truck Market is down 194 vehicle sales or -7.8%, when compared with the same month in 2013. TOP TEN MAKES Toyota retains the top sales position in the April monthly market with 14,930 vehicle sales, ahead of Holden with 8,010 and Mazda third with 7,000. Toyota, with a market share of 18.2%, holds market leadership in year to date terms. Holden’s April result sees it in second position with a market share of 10.2%, with Mazda's market share of 10.0% placing it third. Hyundai, with a market share of 9.0%, is in fourth position. Ford is in fifth position with share of 7.7%, ahead of Nissan with 5.4% market share in year to date terms. Report for the Month of Apr-14 Marque Standings 1 ▼ Toyota 2 ▲ Holden 3 ▲ Mazda 4 ▲ Hyundai 5 ▼ Ford 6 ▼ Nissan 7 ▼ Mitsubishi 8 ▲ Volkswagen 9 ▼ Subaru 10 ▼ Honda Year to Date Apr-14 Volume Share 63,051 18.2% 35,429 10.2% 34,785 10.0% 31,186 9.0% 26,577 7.7% 18,882 5.4% 18,615 5.4% 17,056 4.9% 12,887 3.7% 9,789 2.8% Year to Date Apr-13 Volume Share 64,947 18.1% 32,771 9.1% 34,585 9.7% 30,038 8.4% 27,574 7.7% 28,972 8.1% 21,061 5.9% 16,907 4.7% 12,982 3.6% 14,743 4.1% Month Apr-14 Volume Share 14,930 18.5% 8,010 9.9% 7,000 8.7% 7,626 9.4% 6,449 8.0% 4,157 5.2% 4,360 5.4% 4,019 5.0% 2,903 3.6% 2,352 2.9%