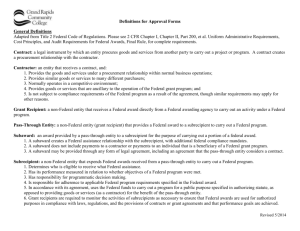

Uniform Guidance - University of Nevada, Reno

Uniform Guidance: Summary of Significant Changes

2 CFR PART 200 —UNIFORM ADMINISTRATIVE

REQUIREMENTS, COST PRINCIPLES, AND AUDIT

REQUIREMENTS FOR FEDERAL AWARDS

Erika Waday

Information and Training Specialist

University of Nevada, Reno ewaday@unr.edu

Background & Objectives

Issued by the Office of Management and Budget (OMB) on

December 26, 2013, the Uniform Administrative Requirements,

Cost Principles, and Audit Requirements for Federal

Awards (Uniform Guidance) is a major reform of the federal government's guidance on grants management.

Uniform Guidance Objectives

1. Streamline guidance for federal award management to ease administrative burden.

2. Strengthen oversight over federal funds to reduce risks of waste, fraud and abuse.

Effective Date & Applicability

Uniform Guidance takes effect December 26, 2014.

• Applies to federal awards issued on or after December 26,

2014.

• Applies to carryover funds (carryover funds will not follow rules from original award).

• Does not apply to federal awards issued prior to December 26,

2014.

Notices of Funding Opportunities (

200.203

)

Standardization of funding opportunity notices will ensure relevant program information is explicitly communicated to interested applicants.

Federal awarding agencies must make funding notices available to the public for at least 60 calendar days but not less than 30 calendar days unless exigent circumstances, as determined by the federal awarding agency, exist.

Summary information (precedes full text in notice) in funding opportunity notice must include the following:

1. Federal awarding agency name.

2. Funding opportunity title.

3. Announcement type (whether an initial announcement or a modification of a previous announcement).

4. Funding opportunity number (required, if applicable).

5. Catalog of Federal Financial Assistance (CFDA) number(s).

6. Key dates (due dates for applications or Executive Order 12372 submissions, as well as for any letters of intent or pre-applications).

Notices of Funding Opportunities Cont’d

Full text of funding opportunity notice must include the following:

• Full programmatic description of the funding opportunity.

• Federal award information, including sufficient information to help an applicant make an informed decision about whether to submit an application.

• Specific eligibility information, including any factors or priorities that affect an applicant's or its application's eligibility for selection.

• Application preparation and submission information, including the applicable submission dates and time.

• Application review information including the criteria and process to be used to evaluate applications.

• Federal award administration information.

Cost Sharing or Matching (

200.306

)

Policies regarding voluntary committed cost share have been clarified.

Voluntary committed cost share/match may only be solicited for research proposals when required by regulation and must adhere to the following:

• Cost share/match requirements must be specified in the notice of funding opportunity and must include applicable regulation.

• Cost share/match cannot be considered an evaluation factor during merit review.

Program Income (

200.307

)

Non-federal entities are encouraged to earn income to defray program costs where appropriate.

Use of Program Income

• Federal awarding agency may specify or give prior approval for how program income is to be used.

If sponsor does not specify how program income is to be used, the following applies to institutions of higher education:

• With prior approval of federal awarding agency, program income may be added to federal award by the federal awarding agency and the non-federal entity. The program income must be used for the purposes and under the conditions of the federal award.

Procurement Standards (

200.317-326

)

Guidance on procurement has been clarified to better mitigate the risk of waste, fraud and abuse.

Micro-Purchases (for supplies or services not exceeding $3,000 or $2,000 in the case of acquisitions for construction subject to the Davis-Bacon Act)

• Exempt from needing competitive quotes.

• Price must be reasonable.

Small Purchases (for services, supplies or other property greater than $3,000 but less than the Simplified Acquisition Threshold of $150,000)

• Price or rate quotations must be obtained from an adequate number of qualified sources, i.e., more than one price or rate quote.

Procurement by Sealed Bids (formally advertised to public)

• Must receive at least two bid responses.

• Must have public opening of bids.

• Bids must receive a cost-price analysis.

• Successful bid will result in firm fixed price contract.

• Sealed bids are preferred method for procuring construction services.

Procurement Standards Cont’d

Competitive Proposals (used when sealed bids not appropriate)

• Non-federal entity receiving proposals must have written procedures for evaluating proposals.

• Competition must be formally publicized and include evaluation criteria.

• Must receive at least two proposals.

• Cost-price analysis of proposals required.

• Contract must be awarded to firm whose proposal is most advantageous to the program, with price and other factors considered.

• Successful proposal will result in fixed price or cost-reimbursable contract.

Noncompetive Proposals (applicable only when one or more of the following situations apply)

• Desired item is only available from a single source.

• Public need does not permit time for competitive solicitation.

• Federal awarding agency or pass-through entity approves noncompetitive proposal in response to written request from non-

Subrecipient Monitoring & Management (

200.330-

332

)

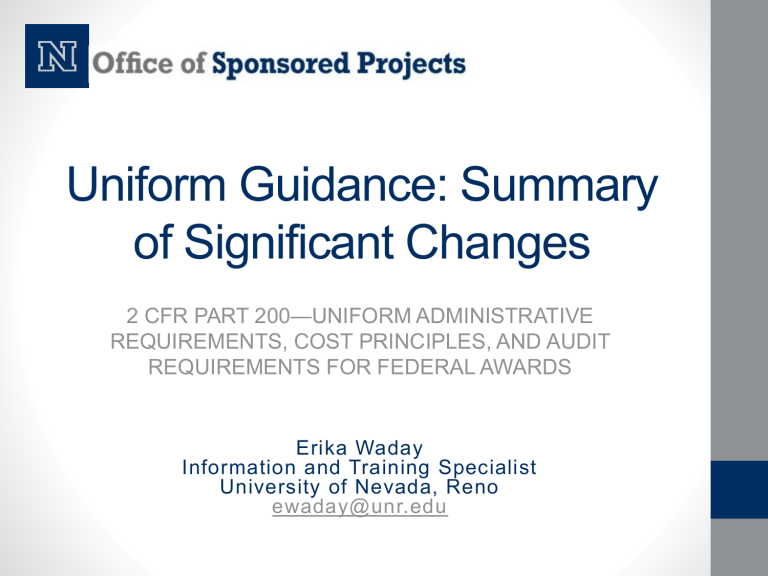

When disbursing federal funds, the pass-through entity must determine whether the party receiving the funds is a subrecipient or a contractor.

Subrecipient Characteristics Contractor Characteristics

Determines eligibility for receiving federal assistance

Performance measured by whether program objectives were met

Responsible for programmatic decision making

Must comply with applicable federal award terms and conditions

Carries out a program as opposed to providing goods and services to pass-through entity

Provides goods and services within normal business operations

Provides similar goods or services to many different purchasers

Normally operates in a competitive environment

Goods or services provided are ancillary to the operation of the federal program

Not subject to federal award terms and conditions

Subrecipient Monitoring & Management Cont’d

With prior written approval from the federal awarding agency, a passthrough entity may provide a fixed amount subaward up to the

Simplified Acquisition Threshold ($150,000) subject to the following conditions:

• Payment to subrecipient is based on meeting specific requirements of the federal award.

• A fixed amount award cannot be used in programs requiring mandatory cost share or match.

• At award end, the non-federal entity must provide the federal awarding agency or pass-through entity with written certification that the subrecipient’s work was completed or the level of effort was expended. If the required level of activity or effort was not carried out, the amount of the federal award must be adjusted.

• Periodic subrecipient reports may be established for each federal award.

• Changes in subrecipient principal investigator, project leader, project partner or scope of effort require prior written approval of the federal awarding agency or pass-through entity.

Subrecipient Monitoring & Management Cont’d

Non-federal entities must evaluate each subrecipient's risk of noncompliance with federal statutes, regulations and the terms and conditions of the subaward for purposes of determining the appropriate subrecipient monitoring.

Pass-through entity monitoring of a subrecipient must include the following:

1.

Review of financial and programmatic reports required from the subrecipient.

2.

Measures to ensure subrecipient takes timely and appropriate action when deficiencies pertaining to the federal award are detected

3.

Issuing of a management decision for audit findings pertaining to the federal award.

If the pass-through entity deems the subrecipient high risk, further monitoring may be imposed by the pass-through entity to ensure proper accountability and compliance with program requirements and achievement of performance goals.

Closeout (

200.343

)

Non-federal entities must take actions to complete the closeout process at the end of the period of performance as follows:

• Submit all required financial, performance and other reports within 90 calendar days of the end date of the period of performance.

• Liquidate all obligations incurred under the federal award within

90 calendar days after the end date of the period of performance.

• Promptly refund balances of unobligated cash from advance payments from the federal awarding agency or pass-through entity.

• Account for real and personal property acquired with the federal award funds or received from the federal government.

Clerical and Administrative Salaries (

200.413 (c)

)

Salaries of administrative and clerical staff should normally be treated as indirect (F&A) costs. Direct charging of these costs may be appropriate only if all of the following conditions are met:

1.

Administrative or clerical services are integral to a project or activity.

2.

Individuals involved can be specifically identified with the project or activity.

3.

The costs are explicitly included in the budget or have the prior written approval of the federal awarding agency.

4.

The costs are not also recovered as indirect costs.

The budget justification must provide the rationale for direct charging clerical and administrative salaries. Sponsor approval is not automatic.

Indirect (F&A) Costs (

200.414

)

Policy updates regarding indirect costs aim to provide more consistent and transparent treatment governmentwide.

• Federal agencies must accept an applicant’s negotiated indirect cost rate unless an exception is required by statute or regulation or is approved by a federal awarding agency head or delegate based on publicly documented justification.

• Pass-through entities must accept a subrecipient’s negotiated indirect cost rate unless the federal agency requires an exception.

• Subrecipients without a negotiated indirect cost rate may use the

“de minimis” indirect cost rate of 10% of modified total direct costs.

Cost Accounting Standards & Disclosure

Statement (

200.419

)

Requirements of the Cost Accounting Standards and Disclosure

Statement have been revised and streamlined.

• An institution of higher education (IHE) that receives aggregate federal awards totaling $50 million or more must comply with the Cost Accounting Standards Board’s cost accounting standards.

• A disclosure statement (DS-2) for the most recent completed fiscal year must be submitted to the IHE’s cognizant agency for indirect costs with copy to IHE’s cognizant agency for audit.

• The IHE is responsible for maintaining an accurate DS-2 and complying with its disclosed accounting practices.

• Amendments to DS-2 must be filed six months in advance of the change taking effect. The change can be implemented only if the IHE has not been notified by the federal cognizant agency of concerns.

Essential Computing Devices (

200.453

)

The definition of supplies has been broadened to include essential computing devices, and the treatment of computing devices has been clarified.

• A computing device may be directly charged to a federal award when it is deemed essential and allocable but not solely dedicated to the performance of a federal award.

• The budget justification must provide the rationale for considering the computing device to be essential and allocable to the project.

Participant Support (

200.456

)

Participant support costs are now a standard exclusion to the modified total direct cost base for calculating indirect costs.

• Participant support is defined as direct costs for such items as stipends or subsistence allowances, travel allowances and registration fees paid to or on behalf of participants or trainees (but not employees) in connection with conferences or training projects.

• Participant support costs are allowable with the prior approval of the federal awarding agency.

Audit Requirements (

200.501

)

Changes in the audit requirement threshold will reduce the audit burden for some non-federal entities.

• The audit requirement threshold will increase from

$500,000 to $750,000. An annual, single audit will be required for organizations with federal award expenditures of $750,000 or more per fiscal year.