Pharmasim Presentation

advertisement

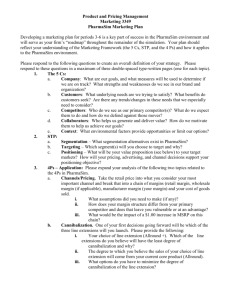

Pharmasim Presentation Group 2 Mission Statement Allright is a leading Pharmaceutical company founded in providing a quality product at a competitive value. Our success is attributed to an ongoing commitment from our management team and support from our stockholders. Providing over ten years of relief to our customers has been our highest priority. Our market shares have increased annually and research has yielded a new product to introduce every 4 years. Allright continues to provide promotional items for its retailers and clientele alike to help reduce costs and bring in new customers. Looking toward the future, Allright will continue its success with a well balanced marketing plan and remain an industry benchmark for years to come. Marketing Objectives Increase Brand Trials for Allround to 85% The company should focus on reaching that goal within three years Brand Trials for Allround is at 59.7%, and our most frequently purchased is at 21.8% – If the Brand Trials are increased to 85% then in ratio to how many people most frequently purchase Allround now, we can expect it to be around 31.04% – However the retention ratio is still the same in this case so you should focus on having the most frequently purchased to be at 35%, which makes the resulting retention ratio 41.2%. Reach a stock price of $150.00 Try and accomplish this in three years There has been a steady increase in our stock price over the last six years – Allstar’s stock price went from $30.94 to $110.00 in that time Allright’s Brand Awareness to be at 75%, and the Brand Trials to be at least 40% Since Allright is a product that is in a fairly new category of the market, and we have the same symptom relief as Defogg, we should get the Brand Awareness and Brand Trials for Allright to both be increased – This should be expected to occur over the next five years If Allstar can reach these numbers, then the most frequently purchased for Allright should hopefully increase to around 20% – This would help in getting Allstar to be a leader in the 4 hr Allergy Capsule segment of the market, especially since this is a new area Put competition out of business Our main competitors for Allright are Believe and Defogg – Believe is not as strong as Allright or Defogg which have the same ingredients – You should focus on putting Believe out of business within two years and Defogg out of business within five years Increase sales force Our company just opened up a new plant Within the first year the total sales force should be increased from 260 to 300 One way to figure out how to disperse direct sales force is to buy the channel of sales report – divide the sales in each category by the total sales and multiply that number by the total number of people in the sales force Increase Manufacturer sales to a billion dollars a year This should occur in the next two years. Our total Manufacturer sales our currently at 836.9 million dollars a year – With production up, if the sales force is in the right place then it should not be hard to accomplish this goal New Product With respect to the Product Life Cycle, a new product should be introduced within the next 2-4 years depending on how things are going with Allround+ and Allright – We can put money form Allround which is a star in the BCG Matrix and into the new product and hopefully get a cash cow or another star to come out of it. Increase Price The prices of Allround, Allstar. And Allround+ should all be increased annually, in correlation to inflation – Inflation should not outweigh the price increase for Allround at all because it is still our leading product and has the highest percentage of most frequently purchased along with having the most symptom relief The prices for Allround+ and Allright should not be outweighed by inflation either, but be more careful in how much the prices are raised each year, because these products are still fairly new and until the Most frequently purchased percentage is at least 40% the price should stay closer to inflation increase. SWOT Analysis Strengths Allstar brand’s well-known brand name – has brand awareness of 76.1% and Allround + has an awareness of 57.3%. – 15.9% purchased Allround, 5.8% purchased Allround +, and 5.7% purchased Allright Research and development team – Allround leading in symptom relief, Allround + is third and Allright in the top – Allstar brands’ have 3 of the highest 6 retention ratios at 36.5%, 32.5%, and 44.3% Strengths Cont. Promotions overall, especially trial sizes and coupons – Allround has the highest conversion ratio – For all three brands, about half of our coupons were redeemed – Higher percentage of people purchased all of our products than intended High capacity utilization of 105.9% – Decreases the per unit cost – Higher than that of competing companies – Helps balance out our high fixed costs Direct sales force – Highest average square feet of shelf space all channels – Allstar brands’ have highest percentage of retail sales compared to products in their categories Weaknesses Allstar’s pricing – Doing well in symptom relief and have the highest Retail and Manufacturer sales – Highest promotional allowance and cost of good sold – Gross margin is lower than both B&B and Ethik. Allright’s brand awareness at 28.5% – Other brands in the same category have higher awareness percentages – Our retention ratio is higher than Believe & Defogg – High unit cost, thus a higher brand awareness would help make profit Obtaining involvement from customers in co-op ads and point of purchase displays – – – – Allround has 0.4% participating in co-op ads & 1.3% point of purchase Allround + has 0.5% in co-op ads & 3.1% in point of purchase Allright has 0.8% in co-op ads & 4.2% in point of purchase Higher percentages result when we put in more money Weaknesses Cont. 90 7 (% of All Respondents) Brand Awareness 80 S&R 5 6 8 5 9 10 1 70 6 4 2 7 0 4 3 1 10 2 8 9 0 3 1 60 0 50 Allround Besthelp 40 30 20 10 0 0 10 20 30 Advertising Expenditures (Millions of Dollars) OCM group’s decision to drastically lower advertising expenditures on Allround from 20 million to 5 million between periods 4 and 7 – Besthelp raised their advertising, and their brand awareness rose to 6.7% higher than us – Allround is a star Opportunities Consumer demand to relieve symptoms – Product effectiveness is the most important in decision-making – In the past year the worst symptoms were aches, chest congestion, and coughing – Allround is the only product with analgesics, expectorants, and cough suppressants Produce a cough liquid – Allstar does not have available – None of the cough liquids have expectorants and cough suppressants – 61.6% people reported coughing as a symptom Opportunities Cont. Industry growth rate is at 10.1% – Health is a big trend – No invention is underway that would eliminate the need for OCM – Allround, Allround +, and Allright have 16.7%, 5.6% and 5.4% respectively – Allround is a star in the BCG Matrix, but Allround + and Allright are question marks Higher percentage increase in sales prices than the inflation rate of 4.4% – Our prices are already relatively low – Chance to make up for our high promotional costs and fixed costs without making a huge price jump compared to other brands Threats Ethik is a threat to Allstar – They have the highest gross margin and net income, and their stock price is second to ours – End + and Extra combined are receiving double the amount of manufacture sales than Allround + – Ethik may create products in other categories Besthelp is a specific threat to Allround – Its symptom relief fourth, but it is $1.20 cheaper than Allround – Not as many people intend to purchase Besthelp as Allround, but they are equal in percentage of sales – Besthelp has a greater brand awareness Threats Cont. Defogg is a threat to Allright – Have the same ingredients in the same form, and the same symptom relief – Defogg has a higher price than Allright, but they have better brand awareness and a higher conversion ratio. The close to full capacity utilization of Ethik, B&B and even Curall – May try to price aggressively or increase marketing to acquire more market share Marketing Activities Increase Brand Trials for Allround to 85% In order to achieve an increase in brand trials for Allround to 85%, we must use marketing tools to raise awareness and create a demand. – Coupons are effective for converting our competitors’ customers to our own product by offering a comparable product at a reduced price – Trial sizes are an efficient way of getting our product into the hands of the consumer Reach a stock price of $150.00 In order to achieve a stock price of $150.00 in the next three years, Allstar must promote is products proportionate to its sales Allround has now received a new formulation and will need to be promoted again as new & improved – This will revitalize Allround’s sales and improve the overall condition of the company as a whole – Taking this opportunity in to consideration, as well as two new products beginning to ascend through the industry an increased stock price is within reason. Allright’s Brand Awareness to be at 75%, and the Brand Trials to be at least 40% In order to achieve our objective of making Allright the industry leader in 4hr Allergy Capsules, we must divert as much sales as possible from the other two competing products – Believe’s brand formulation consists of only four units of Antihistamine, whereas Alright consists of the Antihistamine and a decongestant. Therefore comparison ads being run on Believe’s lack of effectiveness and the inferior formulation should be beneficial to Allright’s share of the market. – Alright and Defogg have similar brand formulations and similar symptom relief, therefore we must compare on the basis of price and benefit Defogg is currently over priced and continues to match inflation to consistently be just higher than the market average Increase sales force In order for Allstar to remain an industry leader and continue its growth and profit, its sales must also increase each year to consume its available market share Our sales force is crucial to our products success in the market place and in order to support them correctly, there must be a proportionate amount of personnel to handle the growing volume of orders – Using the information from the channel of sales report, a proper decision can be made to allot the correct amount of sale agents to each team handling the different sectors Increase Manufacturer sales to a billion dollars a year In order to increase total manufacturer sales to one billion dollars a year, a strategy of increasing plant size and sales force must be followed. For the past four years, Allright has been running its plants at or above capacity. Twice in the past four years Allright has seen an overage in capacity of 4-5% – This overage needs to be converted to income used to build larger and more efficient facilities – Growth in sales force as well as proper allotment of sales force has accounted for the substantial boost in Allstar’s income Introduce New Product In accordance with relative product lifecycles a new product should be introduced within the next four years in order to sustain market competitiveness and broaden growth throughout the industry – Possible new products could be a reformulated version of Allround with a decreased amount of alcohol marketed toward child use Increase Price In order for Allright to recover profits lost to inflation, the prices of its products must be reevaluated annually – Inflation has typically increased 3-6% yearly for the past ten years – We have found that the best strategy is to adjust each price to the previous year’s inflation rate. This allows Allright to remain competitive while recovering any potential “losses” due to rising inflation – Our industry trade-off grid has shown our prices have remained in the optimal zone for several years – Our customers are receiving a quality product at a comparable value Lessons Learned Stock Price The most obvious way to tell how well the company is doing is the change in the stock price Poor decisions will cause the stock price to drop, and as well as the opposite Poor decisions made by us early allowed us to ratify the situation and make our stock price climb out of the basement Stock Price Cont. 120 100 80 Price Early poor decisions caused our stock price to drop from 48.13 all the way down to 30.94 During fifth year, figured out problem and price rose from 30.94 all the way to 110.54 over the past five years Stock Price 60 Stock Price 40 20 0 1 2 3 4 5 6 Period 7 8 9 10 First Year Mistakes Lowered Price – We figured that if we were the leading company in the market for symptom relief we needed to lower our price in order to try and raise our most frequently purchased percentage, ultimately raising sales. – Not only did sales decrease, but lowering price caused a shortage in budget down the line. Increased Sales Force but not Advertising Budget. – We didn’t put any money into Advertising for Allround – Caused us to miss out on sales Decreased Promotional Allowance – Should have never decreased promotional allowance for a new product. – Allround was still a new product. Should have taken opportunity to get name out in the market but didn’t. Second Year Mistakes Made many of the same decisions as year one. – Should have learned form mistakes early Increased Price – Increased the price, but not even enough to deal with inflation so ultimately served no purpose Increased Promotional Allowance – Should have been done the year before, resulted in a catch up rather than company growth. Year Three Decided not to start a new product – This was not necessarily the incorrect thing to do, but it did contribute to the large drop in our stock price over the year – Starting a new product takes a lot of money and we didn’t think it would be beneficial to the company if we spent money we didn’t know weather or not we would make back quickly. Did not change Pricing Discounts – Our discounts weren’t large enough to make it worth buying larger quantities – Lost a lot of wholesaler business as a result of this Year Four Finally introduced Allround+ – Took money from budget of Allround in order to increase the promotion and advertising of Allround+ We changed our discount percentages to try and make up for the loss we incurred the year before Changed was our sales force lay out. – When looked at other companies, found we were concentrating on little areas like convenience stores and not as much on grocery stores and wholesalers. Year Four Cont. Dispersed Advertising Budget according to where the product fell in the Product Life Cycle. We made sure to push coupons for Allround because it had been on the market for awhile, and push trial sizes for Allround+ because it was a brand new product and we wanted people to try it. Didn’t raise the price of Allround – it was already on the best fit line for price and symptom relief – Caused us to have a loss the following year because didn’t recover initial cost of launching Allround+ Year Five Forced to make budget cuts – Took money away from the advertising budget of Allround but not Allround+ because it was still a new product. – Decreased our sales force as little as possible – If we had suffered a similar loss the following year, the cuts would have been a big problem. Increased Price – Decided that an increase of between 30 and 40 cents each year would keep us ahead of inflation and increase our budget from year to year We made sure to shift the advertising budget to focus more on benefit and comparison for Allround and primary and benefit for Allround+. Year Six through Ten Introduced yet another product, Allright. – The increase in our budget over the previous year allowed us to do so. – New products result in more sales in the long run Increased the price of all products every year. We changed the advertising allowance according to where the products were in their life cycles – This allows the correct type of advertisements for optimum sales Year Six through Ten Cont. We made sure to have at least a seven percent increase in the pricing discounts for all of the products. – We decided to give Wholesalers an extra couple of percent because they were generating most of our sales so we felt it was important to give them a bigger discount It is important to increase the advertising budgets proportionally every year – A large increase is not necessary because all of the products have been on the market for awhile and it is more important to increase your sales force every year Year Six through Ten Cont. As products get older, it is better to take money away from product displays and co-op advertising and put it into coupons – We found that co-op advertising is a waste of money. Only about one percent of the sales population utilized co-op advertising. – Trial sizes are only necessary early in the life of a product