Economic Development - Orange County Comptroller

advertisement

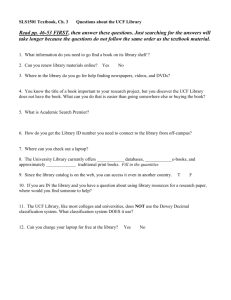

Office of Economic, Trade and Tourism FY 07-08 Budget Worksession July 19, 2007 Economic Conditions Economic Development Strategy Map UCF Institute for Economic Competitiveness • Goal: Become one of the top 10 centers for regional economic research. • New Institute Director Dr. Sean Snaith on survey panels of USA Today, Federal Reserve Bank of Philadelphia. • U.S. & Florida Forecasts • Forecasts for 12 Florida Metros • Forecasts coming for 4 Metro Orlando counties • Search under way for Orange County Endowed Chair www.iec.ucf.edu Visit the Institute’s website and see it featured on CNBC. UCF Technology Incubator • University-driven community partnership to support early stage technology companies. • 70,000 square feet. • Graduating companies = 21 • Jobs created by Incubator companies = about 800 www.incubator.ucf.edu • Average salary = $59,000 • Investment secured = $160,000,000 • Annual revenues = $250,000,000 • Incubator companies received 1/3 of all Dept of Defense SBIR/STTR R&D contracts awarded in Florida last year. UCF Technology Incubator Success Story: Cognoscenti Health Institute • Clinical diagnostic laboratory • Started with 2 employees and no revenues • Current employment = 82 • 2007 revenue = $10 million • Expanding and moving into a new building Assistance from the Incubator included: • Space / telecommunications • Financial management support • Connections to UCF faculty and students for business plan development and marketing analysis • Personal business skills training for management team UCF Technology Incubator Success Story: Rini Technologies • Innovative cooling system that improves performance of solid-state lasers. • Developing miniature personal cooler for soldiers and first-responders wearing protective clothing. • Founder came to UCF on a water skiing scholarship, received his PhD, and was one of the first Incubator clients. • Number of employees at startup = 1 • Current number of employees = 17 • 2007 Revenues = $3 million • Purchased a new building and is expanding. UCF Orange County Venture Lab • Purpose: nurture new company start-ups and spin-outs from within the university. • Important now that UCF exceeds $100 million a year in research. • 2,000 sf on first floor of College of Business Administration. www.venturelab.ucf • Director, 5 paid coaches, 2 volunteer coaches, and student interns in marketing, nano-science, computer science, engineering, and other areas — interdisciplinary teams. • Watch for these new companies in the news: Therigy, ePedigree Software, Stormwater Treatment Environments, Inc., and a yet unnamed company in the area of cancer bio-markers. UCF Small Business Development Center • In partnership with the SBA, provides business seminars and free one-onone counseling to small businesses in an 8 county area. • Orange County Economic Stimulus Package: Elevated level of seminars and workshops to Orange County businesses after 9/11. www.bus.ucf.du/sbdc • Advanced offerings in business strategy, marketing strategy, e-commerce, doing business with local government, and disaster planning — over 1,200 participants to date. Location of participants in Orange County-sponsored SBDC workshops UCF Advisory Board Council Program • Free advisory boards for companies in Orange County • 25 active boards in construction, manufacturing, retail, services, technology, and wholesale. • 106 advisors on active boards • 89 companies have had boards since 2003 • 383 advisors have participated • Advisors have contributed 8,096 hours of their time = $1 million • Selected as 2004 Program of the Year by the International Economic Development Council UCF Advisory Board Council Program Successes Screenworks USA • Employment increased from 36 to 43 • Revenues increased from $4.2 million to $5.8 million • Selected 2004 SBA Florida Small Business of the Year Apex Environmental Engineering & Compliance • Employment increased from 21 to 29 • Revenues increased from $3.1 million to $6 million • Selected 2007 SBA Florida Small Business of the Year American Home Companions • Employment increased from 92 to 140 • Revenues increased from $3.7 million to $6 million BBIF Black Business Investment Fund • Mission: To develop and promote Black business enterprises. • Founded through the Florida Small and Minority Business Act of 1985. • Direct loans, loan guarantees, technical assistance, and advocacy • Technical assistance and one-on-one counseling provided to 170 business persons in 2006 • 12 new loans funded through BBIF in 2006 = $2.3 million • Historically, BBIF has provided for over $32 million in loans with a loss rate of under 3.3%. BBIF Black Business Investment Fund • Free advisory boards for companies in Orange County • 25 active boards in construction, manufacturing, retail, services, technology, and wholesale. • 106 advisors on active boards • 89 companies have had boards since 2003 www.BBIF.com BBIF Black Business Investment Fund Success Story: BRS Group • Helped to hire key personnel • Assisted business in obtaining bonding that helped the company obtain new contracts • Reorganized financial statements • Developed payment tracking system that decreased receivables • Revenues increased by 56% in 2006 HBIF Hispanic Business Initiative Fund • The leading Hispanic nonprofit economic development organization in Central Florida. • Free bilingual technical assistance for starting and growing a business. • In 2006: Assisted 14,847 inquiries 97 “How to Start Your Business” orientations — 1,235 participants 43 seminars and training programs 69 business loans marketed • Assisted with $15 million in loans in the last 10 years HBIF Hispanic Business Initiative Fund www.HBIFOrlando.org HBIF Hispanic Business Initiative Fund Success Story: ASG Reprographics • “HBIF was there to help us write a business plan, obtain working capital, and make key contacts with local corporations.” • Started as a father and son operation with $100,000 in sales. • Company now has 11 employees, $70,000 in monthly sales, and 4,000 local and national clients. • ASG is now one of the strongest minority-owned businesses in the local reprographics industry. Minority / Women Business Enterprise Alliance (“The Alliance”) • Founded in 1994 as a nonprofit one-stop business resource center for the minority and women business community of Central Florida. • Certified SBA Micro Lender, Community Development Financial Institution (CDFI), and Community Development Entity (CDE) • Provides lending opportunities for small business owners who may not qualify for conventional bank financing. • Access to capital – Workshops – Networking – Technical Assistance to contractors • Assisted 1,821 contractors in 2006 and 1,002 to date in ’07 • > 1,500 persons attended Alliance Workshops in 2006 • The Alliance assisted in obtaining $918,000 in business loans in the first half of 2007 Minority / Women Business Enterprise Alliance (“The Alliance”) Success Story: SOHO Loan Event • April 25, 2007 – Disney Entrepreneur Center • In partnership with Innovative Bank (FDIC insured “Community Bank”) • Small Office Home Office Banking is a product developed by Innovative Bank to promote SBA Express Loan programs. • 48 companies applied for loans at this event • 36 companies received loans • Average loan = $19,000 • Use of loans: machinery and equipment, working capital, and inventory Minority / Women Business Enterprise Alliance (“The Alliance”) www.AllianceFlorida.com Office of Economic, Trade and Tourism FY 07-08 Budget Worksession July 19, 2007