Evidence - Shetland Islands Council

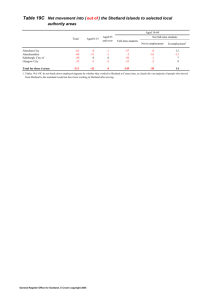

advertisement

Shetland’s Commission on Tackling Inequalities Session 2: Household Finances 24th August, 2015 Introductory Session • Welcome and Apologies • Note of Last Meeting – Approval – Matters Arising • Terms of Reference: for approval • Report of Session 1 • Media Q & A Purpose of Session 2 • To hear evidence about the challenges faced by households in Shetland on a low income • To discuss and understand this evidence, and develop solutions to issues faced • Ongoing business of Commission Household Finances An Introduction Household Finances • Income – Benefits – Earnings (Salary / Self-Employment) • Expenditure / Outgoings – – – – – – – – – – – Housing Food and Drink Clothing Household Goods Health and Personal Care Communications and Technology Social and Cultural Participation Transport Household Fuel Childcare Debt Repayments Individual Income in Shetland: 2015 Weekly Monthly Annual JSA, income-based (18-24) (2013/14) 57.90 251.86 3,022.38 JSA, income-based (25+) (2013/14) 73.10 317.98 3,815.82 JSA, contribution-based (similar to ESA, support group) (2013/14) 109.00 474.15 5,689.80 ESA, work-related (2013/14) 102.15 444.35 5,332.23 Minimum Wage, 37 hours (2013) 233.47 1,015.60 12,187.13 Living Wage, 37 hours 283.05 1,231.27 14,775.21 Full time, Mean (2013) 506.95 2,205.25 26,463.01 Household Income in Shetland: 2010 & 2014 Bottom 10% Bottom 10-20% Top 80-90% Top 90% 2010 2014 £0-£9,261.71 £0-£9,175.49 £9,261.71-£14,487.32 £9,175.49-£13,564.13 £52,058.26-£68,609.54 £50,864.80-£66,225.45 £68,609.54 or more £66,225.45 or more Ratio between top earner of bottom 10% and bottom earner of top 10%: 7.2 Ration between top earner of bottom 20% and bottom earner of top 20%: 3.7 Household Income in Shetland: comparison with elsewhere Mean Income Median Income Lowest Quartile Aberdeen City £38,612 £30,321 £16,117 Aberdeenshire £42,422 £34,362 £18,421 Eilean Siar £30,117 £24,159 £13,734 Glasgow City £30,667 £23,167 £12,781 Highland £32,721 £26,333 £14,644 Orkney £29,808 £24,236 £13,791 Shetland £33,934 £28,068 £15,697 Scotland £34,619 £26,992 £14,659 UK £36,400 £28,621 £15,423 Poverty Levels in Shetland Relative poverty equates to a household income which is less than 60% of the UK average Severe poverty equates to a household income which is less than 50% of the UK average Extreme poverty equates to a household income which is less than 40% of the UK average In Scotland, living in relative poverty if you are a single person means a household income of £9,200 per year; for a couple with two children, you have a household income of £21,000. Poverty Levels in Shetland Shetland’s Mean Household Income is £33,934.23 Relative Poverty Severe Poverty Extreme Poverty Calculation Annual Income Number of Households 60% of £33,934.23 50% of £33,934.23 40% of £33,934.23 £20,360.54 3700 £16,967.11 2906 £13,573.69 2087 Numbers on a Low Income Locality Lived in Properties Considered Low Income % Considered Low Income Social Rented Lived in Properties West 735 80 11% 110 43 39% South 1693 135 8% 231 72 31% North Mainland 1411 167 12% 360 109 30% North Isles 1217 166 14% 224 84 38% Lerwick & Bressay 3426 623 18% 1295 559 43% Central Mainland 1694 85 5% 300 45 15% 11010 1256 12% 2520 912 36% TOTAL Considered % Low Considered Income Low Income Household Outgoings Weekly Food Basket, by Area Type (MIS) £57.44 £43.48 £40.67 £40.98 £40.75 B) Accessible settlement C) Inaccessible mainland settlement £36.91 English rural town A) Remote Scottish town D) Less accessible island settlement, E) Remote island settlement MIS – additional costs Household Outgoings Weekly Food Basket, by Area Type (MIS) Household Outgoings % of MIS 140 Income Relative to MIS (Single Person) MIS 120 100 English urban 80 Highland town 60 Remote island settlement 40 20 0 Income Support Minimum Wage Average earnings Use of MIS ..... • To calculate Shetland’s Living Wage: – £8.63 to £10.99 England urban, £198 (£7.85) England rural town, £214 English hamlet, £245 Highland town, £265 (£10.52) Highland settlement, £271 (£10.75) Island settlement, £277 (£10.99) Challenges Faced in Shetland Focusing on Those with the Lowest Income The UK Benefit System • Many different benefits – Majority are currently responsibility of UK Government – Complex / Serve different purposes • Employment Status / Income – Out of Work: e.g. Job Seekers Allowance / Employment Support Allowance – In Work: Tax Credits – Housing Costs: Rent / Council Tax – Universal Credit • Disability: Disability Living Allowance / Personal Independence Payment • Age: Pensions / Pension Credit / Cold Weather Payments 17 The UK Benefit System • Weekly Income for Key Benefits, 2015/16 – JSA: • Single / Lone Parent, Under £25: £57.90 • Single / Lone Parent, 25 or over: £73.10 – ESA / Income Support • similar to above – Severe Disablement Allowance: • Basic Rate: £74.65 – State Pension: £115.95 – Pension Credit: • Single: £151.20 • Couple: £230.85 18 19 DWP Annual Report and Accounts 2014 - 2015 Welfare Spend Ref: Universal Credit Universal Credit helps to ensure people are better off in work than on benefits by: • Removing the limit to the number of hours someone can work each week • Reducing a claimant’s Universal Credit payment gradually as their earnings increase, so they won’t lose all their benefits at once if they’re on a low income Universal Credit • • • • • Income-based Jobseeker’s Allowance Income-related Employment and Support Allowance Income Support Working Tax Credit Child Tax Credit • Housing Benefit 21 Universal Credit: key differences • • • • • Available to people who are in work and on a low income, as well as to those who are out-of-work Most will apply online and manage their claim through an online account (still being developed) Will be responsive: as people on low incomes move in and out of work, they will get on-going support Most claimants on low incomes will still be paid UC when they first start a new job or increase their part-time hours Claimants will receive a single monthly household payment, paid into a bank account in the same way as a monthly salary; support with housing costs will usually go direct to the claimant as part of their monthly payment 22 Universal Credit: the claim process People will usually make a claim for Universal Credit on-line at https://www.gov.uk/apply-universal-credit during which initial claim verification will take place. After making a claim, claimants will attend an interview with their Work Coach at the jobcentre, eligibility for Universal Credit will be confirmed, and the claimant will accept a Claimant Commitment. 23 Universal Credit: the claim process To receive Universal Credit, claimants will need to accept a Claimant Commitment. In most cases a Claimant Commitment will be drawn up during a conversation with a JCP Work Coach. The Claimant Commitment will set out what a claimant agrees to do to prepare for and look for work, or to increase their earnings if they are already working. It will be based on personal circumstances and will be reviewed and updated on an on-going basis. Jobcentre Plus Work Coaches will give claimants all the support they need to prepare for work, move into work, or to earn more. 24 Universal Credit: in Shetland Preparations and Ongoing Work: Delivery Partnership Agreement between DWP & SIC In place to mitigate the effects of the introduction of Universal Credit and includes : • Personal Budgeting Support (including debt management) • Digital On-line support • Administration of Housing Element Universal Credit Operations Forum: DWP, SIC, Hjaltland Housing Association In place to address local DPA issues, the Forum: • Meet regularly • Monitor claim numbers • Progress local administration issues • Agree Citizen communications 25 Universal Credit: in Shetland, since 11th May 2015 • Initially for single “jobseekers” only – this will increase during national roll-out to couples and families • Claims made = 35 • Of 35 claims made, claimants not receiving top-up payment of Universal Credit = 7 (started or increased work) • Referrals to Personal Budgeting Support = 1 • Housing Element of UC in payment = 7 26 Number of Claimants in Shetland Oct 14 Jan 15 Apr 15 Jul 15* JSA 107 83 118 109 ESA (Total) 590 618 N/A 601 ESA (WRAG) 120 118 N/A 107 Lone Parents N/A 62 56 45 27 Challenges to Accessing the Benefit System Budgeting Difficulties • Monthly payment • Includes housing costs • Delay in initial payment (normally 5 weeks) • More difficult to budget • Increase in housing arrears • Cycle of indebtedness Digital by Default • • • • • Presumption that claimants will apply online Presumption that claimants will carry out job-seeking online Requires regular computer access and internet connection Requires IT skills Evidence that sanctions are being applied because of problems accessing /using IT • Adequacy of Universal Jobmatch? • Digital exclusion is about more than access to hardware Claimant Conditionality • Claimants have to comply with a range of “conditions” to keep their benefit • “Looking for a job should be a job in itself” – claimant can be required to evidence 35 hours weekly job-search • Evidence of unrealistic conditions placed on people • Not taking account of personal circumstances • Are job search requirements genuinely supporting people to find work? • Sanctions = reduction in benefit paid, often to nil • Sanctions are cumulative (can last for up to 3 yrs) Room for Error • System is new for all: DWP, claimants, local authorities, housing associations, support agencies • Errors in processing of claims by DWP • Misleading information from DWP, local authorities, HMRC etc • Good quality advice is crucial Disabled People • • • • Disabled people are hit hardest Work Capability Assessment: nature of questions People with mental health problems PIP – aimed at reducing number of claimants across UK by half a million • Delays in assessment process: stress and financial hardship; debt • Knock on impacts for carers (who are already poorly recognised and compensated); if disabled person does not get PIP, unpaid carer will not get Carers Allowance Children and Families • Families with dependent children are one of the biggest losers due to cumulative impact • In particular, larger families e.g. no tax credit for 3rd child • Increasingly benefits provide bare minimum – can miss out on educational/social opportunities • Paid to one person in household - will the person getting the money spend it to the benefit of the whole family? Not Enough to Live On • National benefit levels – do not take account of cost of living • Benefit levels have been steadily reducing in real terms: uprating reduced from RPI to CPI from 2011; then 1% cap from 2013; now 4 year freeze from 2016 • Scottish Government calculated in 2014 that impact of cuts would mean £4 million loss to Shetland economy per annum Budget Tax and Benefit Reforms Measure What is the Impact? Freezing all working age benefits and tax credits for four years from 2016/17 to 2019/20 This will reduce the real terms value of the benefits received by most working age recipients. This will affect the claimants of a wide range of benefits in Scotland, including around 577,000 families who currently receive child benefit. From April 2016, reduction in income thresholds in tax credits and work allowances in Universal Credit (UC) This will reduce the amount of income an individual can earn before their tax credits start to be withdrawn from £6,420 to £3,850. This reduces incentives to work. Between 200,000 and 250,000 households in Scotland will be affected. Increase the tax credits taper rate from 41% to 48% from April 2016 This increases the speed at which tax credits start to be withdrawn once an individual earns over £3,850. A higher taper means that the rewards for an individual from working more hours, or moving into work, are reduced. Same number of households affected as for reduction in income thresholds. Restrict eligibility for child tax credit to the first two children, from April 2017. This will reduce the value of tax credits for future claimants with 3 or more children. There are currently 50,000 households in Scotland with 3+ children receiving tax credits. From April 2017, those out of work aged 18 to 21 making new claims to Universal Credit will no longer be entitled to the housing element. In Scotland there are currently 2,149 claimants aged between 18-21 on Housing Benefit and JSA with no children. If they were all subject to these new rules, the reduction in housing benefit in Scotland would be around £4.5 million. What Works • Accessible, high quality advice (on benefits, debt, employment etc) • Tackle high levels of unclaimed benefit - stigma issue • Income maximisation – £832,531 client financial gain in Shetland in 2014/15 • Many people need support to apply and challenge • Holistic approach and referrals for other support • Small, easy to access grants for families • Highlighting social policy issues, eg ESA delays In-Work Poverty Get a Job • Work is not a guaranteed route out of poverty • The majority of working-age adults in poverty in Scotland are living in working households (52%) Particular problems for: • Those with additional barriers to getting (full time) work - disabled people, lone parents, carers • Young people - not eligible for minimum wage increase • Self employed people on low incomes – UC assumes they are earning 35 x minimum wage In-Work poverty Why? • Low wages • High cost of living, even higher in Shetland • Also high cost of working • Cost of childcare or lack of childcare • Zero Hours contracts • Part time working • Gaps in in-work benefits • Cuts to tax credits Shetland’s Wages? • We know median wage • We know some folk are earning very high wages • We know 700 households receive benefits due to low income But we don’t know: • Number on Minimum Wage • Number below Living Wage • Number below Minimum Income Standard • Number on Zero Hours contracts Not Working Hard Enough? • Claimant conditionality will also apply to those in work – if earning less than 35 hours x minimum wage, will be expected to seek more hours/higher pay • Likely to affect women more than men (more likely to be working part time, on lower wage) • What about folk who can just manage limited hours health issues; caring responsibilities; transport problems • May lead to under-claiming • Barriers to employment – childcare, transport, skills and experience; mental and physical health problems Reaching Out • Partnership working to reach most vulnerable (whether in work or out of work) With NHS With support organisations • Benefits of approach recognised by all • Strategic support is not enough; need ongoing buy-in from busy practitioners • Outreach provision: takes time to establish • Being there is not enough • Direct referral works • Scope to develop ... Q&A Hubert Hunter, DWP Karen Eunson, CAB Catherine Harper, CAB Debt and Money Management Who is in Debt? • There is no stereotypical debt client. Carer (inc. family) Employment 8% 1% 6% Full-time employed 6% Ill health/disability 3% 33% Part time employed 13% Retired School/Higher/Further Education Self employed 30% Unemployed-seeking work Who is in Debt? £6,000 or less Income 7% 2% £6,001 - £10,000 7% 24% £10,001 - £15,000 4% £15,001 - £20,000 5% 24% £20,001 - £25,000 £25,001 - £30,000 27% £30,001 - £40,000 Over £40,000 Who is in Debt? Health 4% 6% 3% 17% 17% 53% Learning disabilty Long term illness Mental ill health None Other (inc. addiction) Physical disability Who is in Debt? 1% 9% 3% Housing Homeless 12% Not householder 31% Owner-Occupier Rent - Local Authority Rent - Social Landlord Rent - Private Rent 44% Why do People get into Debt? • • • • • • • • • • Relationship Breakdown Employment Issues Illness / Disability Having Children Retirement Becoming a Student Leaving Home / First Tenancy Addiction – alcohol / drugs / gambling Money Mismanagement / Inability to Budget High Cost of Living What Debts do They Have? £350,000.00 £300,000.00 £250,000.00 £200,000.00 2014/15 £150,000.00 2013/14 £100,000.00 £50,000.00 £- Bank loan Credit card Rent Council Tax Store credit Utilities Income Tax Other What is the Impact of Debt? • • • • • • • Financial hardship / Fuel poverty Housing arrears; homelessness Physical and mental health problems Absence from work; unemployment Social isolation Impact on relationships and wider family Difficulties getting credit in future 67% of our clients were having difficulty sleeping 61% said debt problems were impacting on their physical health 44% were having mental health problems as a result 50% were unable to manage their money How We Help • Identify all of the debts they currently owe and the creditors to whom they are indebted • Check if they have received Court papers • Identify Priority and Non-Priority debts • Produce income and expenditure calculations • Maximise their income • Identify any affordable disposable income How We Help • • • • • Discuss options available Negotiate repayment plans with creditors Negotiate to stop interest and charges being added Carry out regular reviews Access legal remedies available - Debt Arrangement Scheme (DAS) & Bankruptcy • Impartial and confidential advice; independent of creditors – especially important in small community Not Just About Crisis • Support with managing money: income and expenditure • Taking control and planning • For individuals e.g. at times of change • For groups – we are working to develop financial education programmes for young people • Working closely with Credit Union; encourages saving and provides access to affordable credit when it is needed What Works • Early referrals through CAB advisers; through links with SIC Housing and Hjaltland; developing links with NHS • Face-to-face support: taking time; removing stigma; applying appropriate remedies; negotiating on client’s behalf • Holistic approach: income maximisation • Referrals to CAB’s Money Adviser • Referrals to Credit Union – access to affordable credit What is the Cost for Shetland of not Providing Debt Advice • Negative impact on individuals • Loss of revenue from payments of council tax and increase in rent arrears • Lower rate support grant due to lower levels of welfare benefits being claimed • Increased costs in dealing with evictions, re-housing, homelessness • Negative impacts on health and well-being for families; additional costs to health and social care • Negative effects on local economy due to debts not being paid to local businesses and disposable income being reduced Food Poverty Food Poverty in Shetland • There are two main types of food poverty in Shetland: – people who cannot afford to eat, usually as result of a short term crisis; – people who cannot afford to eat enough and/or healthily. 59 Food Poverty in Shetland: Statistics Year Total No. / Month 2011* 38 8 2012 163 13.5 2013 268 22.3 2014 283 23.6 2015** 178 29.7 * August to end of December ** January to end of June 60 Food Poverty in Shetland: Why? Some examples: • Sanctions • Fuel Bills • Mental Ill-health • Travel to Appointments • Illness • Recently out of hospital or prison 61 Food Poverty in Shetland: Why? • Cost of Living for Essential Items • Cost of Travel if Living in Remote Areas • Cost of Pre-Payment Meters 62 Food Poverty in Shetland: How? • Referrals (96% last year) • Parcel – 1 Week – Approx £50 – Quickly Heated • Cost of Fresh Fruit and Vegetables 63 Q&A Hubert Hunter, DWP Karen Eunson, CAB Vivienne Tulloch, CAB Angela Nunn, Salvation Army Solutions & Challenges Solutions • Recognising the Needs of the Most Vulnerable – Debt Advice / Money Advice – Education / Early Intervention – Communication – Access Solutions • Enabling older people to access cheaper goods, through access to internet (links with intergenerational activity) • Provision of Broadband, readily accessible (including not too technological + skills) • Collaborative purchase of food / co-ops 67 Challenges • Reducing Public Sector Resources • Increase Household Incomes by Payment of Higher Wages, e.g. Living Wage • Enable Parents to More Readily Work: Provision of Affordable Childcare Tailored to Needs of Parents • Reduce Transport Costs and Time Travelling: Employment Closer to Home / at Home / Flexible Working 68 Questions for Session • What are the inequalities? (including age, gender, opportunities etc.) • What is the impact on individuals, households and communities of these inequalities? Think about inequality of opportunity, too. • What is the impact on Shetland, thinking about the economy, society (including health, housing and crime), and environment? • What are the big issues, and key challenges in terms of Shetland’s inequalities? • What is the root cause / or causes of these inequalities? • What needs to be achieved to overcome these issues and challenges? What needs to be achieved to mitigate? • What are the solutions? • What would you like to know more about? Developing Recommendations • Feedback • Discussion • Proposed Recommendations Next Steps • Outputs: Note / Report • Media Q & A • 21st September, 1pm, Islesburgh • 28th October, North Isles?