File

advertisement

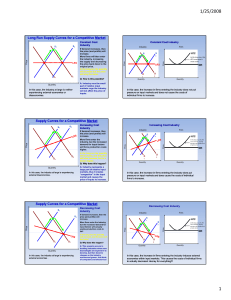

Perfect Competition A2 Economics Aims and Objectives Aim: • Understand perfectly competitive markets Objectives: • Explain the long run equilibrium of perfectly competitive firms. • Analyse the process of perfectly competitive firms making losses. • Evaluate the strategies of persistently loss making firms. Starter • Draw a firm in perfect competition making supernormal profit. MC Revenue & Cost of X ATC £80 D=AR=MR=P £60 0 10 Quantity Demanded and Supplied • Draw the diagram to show Supernormal profit being eroded away and explain. The Firm The Market Price of X Revenue & Cost S MC S1 £80 £60 ATC £80 D=AR=MR=P £60 D=AR=MR=P1 D 0 0 Quantity Demanded and Supplied 8 10 Long Run Equilibrium: Normal Profit The Firm Revenue & Cost MC ATC D=AR=MR=P P 0 Q Quantity Demanded and Supplied • The firm is in equilibrium in the long run, making normal profits where ATC = AR. • Equilibrium output at MC=MR is also where ATC is at its lowest point (productive efficiency). Long Run Equilibrium: Normal Profit The Firm Revenue & Cost MC ATC D=AR=MR=P P 0 Q Quantity Demanded and Supplied • This point is also allocatively efficient – best allocation of resources to meet demand. • Firms in perfect comp. are likely to be statically efficient – both allocative and productive efficiency. Dynamic Efficiency Definition: • Efficiency over time – new products, techniques and processes which increase economic growth. • Essential for building supernormal profits. • However, firms in perfect competition are unlikely to be dynamically efficient as supernormal profits cannot be maintained due to free barriers to entry/perfect knowledge. An Example of Perfect Competition? The Internet Economy: Towards A Better Future Is the internet economy an example of perfect competition? How many of the assumptions apply to this industry? Firms Making Losses The Firm The Market Price of X Revenue & Cost S MC ATC S1 £80 £60 £82 £80 D=AR=MR=P1 £60 D=AR=MR=P D 0 0 8 Quantity Demanded and Supplied 10 • At market price of £60 the firm is making losses as at output of 8 units , the ATC is £82 whereas the AR is only £60, therefore £22 losses are being made per unit. Firms Making Losses The Firm The Market Price of X Revenue & Cost S1 MC ATC S £80 £60 £82 £80 D=AR=MR=P1 £60 D=AR=MR=P D 0 0 8 Quantity Demanded and Supplied 10 • Firm producing at MC=MR- meaning it is making the smallest loss possible. • If firms are making losses some will leave the industry (S – S1). Firms Making Losses The Firm The Market Price of X Revenue & Cost S1 MC ATC S £80 £60 £82 £80 D=AR=MR=P1 £60 D=AR=MR=P D 0 0 8 Quantity Demanded and Supplied 10 • This will lead to higher price of £80. • Here the firm is making normal profit as ATC=AR (10 units) • The firms market share has increased as firms have left the industry. SPEED DATING Firms Entering and Leaving The Industry The Firm Revenue & Cost ATC MC TFC £60 AVC £50 D=AR=MR=P £40 0 100 Quantity Demanded and Supplied • Firm producing at MR=MC. • TR = £5000, TC = £6000, Firm is making losses of £1000 per week! Firms Entering and Leaving The Industry Does the firm shut down immediately? Or close down slowly? • Depends on relationship between AVC and P. • AVC = £4000, ATC = £6000, TFC = £2000. • Firm faces TFC of £2000 which must be paid whether the firm produces or not. • At present running the firm = £1000 Loss • Running firm paying £1000 towards TFC Firms Entering and Leaving The Industry • Shutting down immediately would result in shareholders paying TFC immediately - £2000. • Therefore if P is above AVC it pays the firm to continue production to offset some part of its fixed costs and close down slowly. • If P falls below AVC there is no point in carrying on and the firm should shut down immediately. Worksheet • Explain what level of output the firm will produce and why. • What is the firms’ level of losses at this output level? • You have been called in to advise the managing director as to whether the firm should close immediately. Write a brief to explain the costs/benefits of the firm’s options.