Chapter 7

advertisement

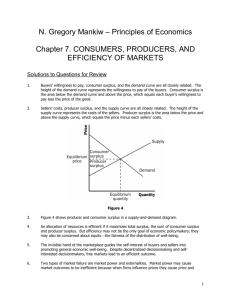

3 SUPPLY AND DEMAND II: MARKETS AND WELFARE 7 Consumers, Producers, and the Efficiency of Markets Revisiting The Market Equilibrium • The theory of supply and demand shows how markets allocate scarce resources among competing needs. • But are the equilibrium price and quantity the right price and the right quantity from society’s point of view? • Do they maximize the total welfare of buyers and sellers? • Whether the market allocation is desirable or not is the topic of welfare economics. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 3 Welfare Economics • Welfare economics is the study of how the allocation of resources affects economic well-being • It shows that: – Both buyers and sellers receive benefits from taking part in the market – The equilibrium outcome—that we saw in Chapter 4—maximizes the total welfare of buyers and sellers CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 4 Welfare Economics: two main concepts • Consumer surplus measures economic welfare of the buyer. • Producer surplus measures economic welfare of the seller. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 5 Willingness to pay • To define consumer surplus we first need to define “willingness to pay.” • Willingness to pay is the maximum amount that a buyer will pay for a good. • It measures how much the buyer values the good. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 6 Willingness to pay • Assume there is a commodity such that every additional unit of it increases a consumer’s happiness by the same amount – In other words, the consumption of additional units of this commodity induces neither boredom nor addiction – Possible examples: potato chips? candy? • Then the consumer’s willingness to pay for a product is an accurate measure of the happiness that he or she gets from it CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 7 Willingness to pay • continuation from previous slide • If a bag of potato chips provides an unchanging amount of happiness, and • if your willingness to pay is – 4 bags of potato chips for a shirt and – 2 bags for a cup of coffee, then – one can safely say that the shirt makes you twice as happy as the cup of coffee – In other words, your willingness to pay for a commodity is an accurate measure of how much you like that thing • For a given dollar price of a bag of potato chips, your willingness to pay can also be expressed in dollars CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 8 Willingness to pay • continuation from previous slide • For example, – if you are willing to pay $15 for a particular shirt, and – if a bag of potato chips always gives you 3 “haps” of happiness, and sells at the price of $0.50 each, then – the shirt gives you 90 “haps” of happiness. • In other words, your willingness to pay for the shirt is – a monetary measure of the happiness you get from the shirt, which is – proportional to the happiness you get from the shirt, as measured in “haps” CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 9 Table 1 Four Possible Buyers’ Willingness to Pay For a mint-condition recording of Elvis Presley’s first album Consumer Surplus • Consumer surplus is the buyer’s willingness to pay for a good minus the amount the buyer actually pays for it. – Example: If the Elvis album’s price is $75… Buyer Willingness Consumer Buy? to Pay Surplus John 100 Paul 80 George 70 Ringo 50 25 Yes 5 -5 -25 Yes No No 11 Market Demand • The market demand schedule/curve shows the various quantities that buyers would be willing and able to purchase at different prices. – Chapter 4 • We can use the willingness-to-pay numbers to calculate the quantities demanded at every price – That is, we can calculate the market demand schedule/curve from the willingness-to-pay numbers CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 12 The Demand Schedule Buyer Willingness to Pay John 100 Paul 80 George 70 Ringo 50 13 Figure 1 The Demand Curve Price of Album Buyer Willingness to Pay John 100 Paul 80 George 70 John’s willingness to pay $100 Ringo Paul’s willingness to pay 80 George’s willingness to pay 70 Ringo’s willingness to pay 50 Demand 0 50 1 2 3 4 The height of the demand curve at any quantity shows the willingness to pay of whoever bought the last unit. Quantity of Albums Copyright©2003 Southwestern/Thomson Learning Area of a Rectangle Area = Width × Height Height Width CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 15 Figure 2 Measuring Consumer Surplus with the Demand Curve Buyer Willingness Consumer (a) Price = $80.01 Price of Album Buy? to Pay Surplus John 100 20 Yes Paul 80 0 No George 70 -10 No Ringo 50 -30 No $100 1. The area under the demand curve measures the total willingness to pay for the quantity demanded. 80 70 2. It is also the maximum willingness to pay that could be generated from that quantity. 50 Demand 0 John’s willingness to pay ($100) 1 2 3 4 Quantity of Albums The market and the planner • Suppose the government has one copy of the Elvis album. The government’s goal is to give it to one of the four guys so as to generate the maximum happiness. • Who will get the government’s copy? • Obviously, John. • Lesson: The market does the best that the government could have done Price = $80 Buyer Willingness to Pay John 100 Paul 80 George 70 Ringo 50 CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 17 Figure 2 Measuring Consumer Surplus with the Demand Curve Buyer Willingness Consumer (b) Price = $70.01 Price of Album $100 to Pay Surplus John 100 30 Yes Paul 80 10 Yes George 70 0 No Ringo 50 -20 No 1. The area under the demand curve measures the total willingness to pay for the quantity demanded. 80 70 50 2. It is also the maximum willingness to pay that could be generated from that quantity. Demand 0 John’s willingness to pay Buy? 1 4 Quantity of Albums Paul’s willingness to pay 2 3 Interpersonal comparability • We just saw – that the total area under the demand curve is $180, and – that is also the total willingness to pay of John and Paul • But can we say it is the total happiness of John and Paul? • Yes, – if there is a commodity—say, a bag of potato chips—that provides an unchanging amount of happiness to the consumer, and – if John’s happiness and Paul’s happiness are comparable, and – if both John and Paul get the same happiness from a bag of potato chips • That’s a lot of if’s! • But we will make these simplifying assumption anyway – Not just for John and Paul, but for everybody CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 19 Utilitarianism • The idea that – the happiness of an individual can be measured numerically, – the happiness of a group of people can be measured numerically, – the happiness of a group of people is simply the sum of the numbers representing the happiness of the individual members of the group, and that – social policy should seek to maximize the total happiness of society, – is called utilitarianism • The welfare analysis in this chapter takes utilitarianism as its guiding philosophy CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 20 The market and the planner • Suppose the government has two copies of the Elvis album. The government’s goal is to give them to two of the four guys so as to generate the maximum happiness. • Who will get the government’s copies? • Obviously, John and Paul. • The market does the best that the government could have done Price = $70 Buyer Willingness to Pay John 100 Paul 80 George 70 Ringo 50 CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 21 Willingness to Pay from the Demand Curve (a) Willingness to Pay at Price P Price A The area under the demand curve also measures the maximum willingness to pay that could be obtained from Q1 units P1 B C Demand 0 Q1 Quantity Using the demand curve to measure willingness to pay • In general, the area under the demand curve up to the quantity demanded is a graphical measure of the total willingness to pay of the buyers. • It is also the maximum willingness to pay that can be obtained from that quantity – That is, the government could not give away that quantity in a way that generates higher willingness to pay. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 23 Figure 3 How the Price Affects Consumer Surplus (a) Consumer Surplus at Price P Price A Consumer Surplus (ABC) + Total Payment (OBCQ1) = Willingness to Pay (OACQ1) Consumer surplus P1 B C Total Payment 0 Demand Q1 Quantity Using the Demand Curve to Measure Consumer Surplus • In general, the area below the demand curve and above the price measures the consumer surplus. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 28 Figure 3 How the Price Affects Consumer Surplus (b) Consumer Surplus at Price P Price A Initial consumer surplus P1 P2 0 C B Consumer surplus to new consumers F D E Additional consumer surplus to initial consumers Q1 Demand Q2 Quantity Shifts in Demand • We have seen that the demand curve can shift, for reasons such as – a change in tastes, and – a change in the prices of related goods • See chapter 4 • Given that the demand for a product can shift as a result of a change in the price of a related good, does it make sense to say that the area under the demand curve measures the happiness consumers get from the product? CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 30 Shifts in Demand • Continued from the previous slide • Yes! – Keep in mind that the area under the demand curve is a monetary measure of the happiness obtained by buyers – The objective or psychological happiness obtained from a shirt may be unchanged even if the monetary willingness to pay for the shirt changes, perhaps because of a change in the price of a related good • In an earlier slide, a bag of potato chips was assumed to always provide 3 “haps” of happiness, and sold at a price of $0.50. Consequently, consumers were wiling to pay $15 for a shirt that provided 90 “haps” of happiness. • It follows that if the price of a bag of potato chips rises to $1, consumers would then be willing to pay $30 for the same shirt, leading to an upward shift in the demand curve for shirts. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 31 Producer Surplus • Producer surplus is the amount a seller is paid for a good minus the seller’s cost. • It measures the net benefit to sellers • It is almost but not quite the same as profit. – We’ll discuss this later CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 33 Cost of production • The cost of production is the market value of all resources used in production – By all, I do mean all. Even if some resources used in production were obtained for free, their market value must be included in cost. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 34 Table 2 The Cost of Painting a House for Four Possible Sellers The Supply Schedule and the Supply Curve Seller Cost ($) Mary 900 Frida 800 Georgia 600 Grandma 500 CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 36 Figure 4 The Supply Schedule and the Supply Curve The height of the supply curve at any quantity shows the production cost to whoever produces the last unit. Seller Cost ($) Mary 900 Frida 800 Georgia 600 Grandma 500 Producer Surplus • Producer surplus is the amount a seller is paid minus the seller’s cost – Example: If the going price for getting a house painted is $700 we get the following table. Seller Cost ($) Producer Surplus Sell? Mary 900 -200 No Frida 800 -100 No 100 200 Yes Yes Georgia 600 Grandma 500 CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 38 Using the Supply Curve to Measure Producer Surplus • The area below the price and above the supply curve measures the producer surplus. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 39 Figure 5 Measuring Producer Surplus with the Supply Curve (a) Price = $599.99 Price of House Painting 1. The area under the supply curve is the cost of the quantity supplied Supply 2. It is also the lowest cost for that quantity $900 800 600 500 Grandma’s Cost ($500) Seller Cost ($) Producer Surplus Sell? Mary 900 -300 No Frida 800 -200 No Georgia 600 0 No 100 Yes Grandma 500 0 1 2 3 4 Quantity of Houses Painted Is there a better alternative to the market system? • If the government had to get one house painted, who would get the job? • Grandma, of course, if the government had any sense. • And that’s exactly what happens in the market outcome. • The market achieves the best that the government could have achieved Seller Cost ($) Mary 900 Frida 800 Georgia 600 Grandma 500 CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 43 Figure 5 Measuring Producer Surplus with the Supply Curve (b) Price = $799.99 Price of House Painting Supply 1. The area under the supply curve is the cost of the quantity supplied 2. It is also the lowest cost for that quantity $900 800 600 500 0 1 Grandma’s cost Georgia’s cost 2 3 Seller Cost ($) Producer Surplus Sell? Mary 900 -100 No Frida 800 0 No Georgia 600 200 Yes Grandma 500 300 Yes 4 Quantity of Houses Painted Is there a better alternative to the market system? • If the government had to get two houses painted, who would get the job? • Grandma and Georgia, of course. • And that’s exactly what happens in the market outcome. • The market achieves the best that the government could have achieved Seller Cost ($) Mary 900 Frida 800 Georgia 600 Grandma 500 CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 45 Figure 6 How the Price Affects Producer Surplus (a) Producer Surplus at Price P Price Supply P1 B Producer surplus A 0 C Total Revenue (OBCQ1) = Production Cost (OACQ1) + Producer Surplus (ABC) Production Cost Q1 Quantity Figure 6 How the Price Affects Producer Surplus (b) Producer Surplus at Price P Price Supply Additional producer surplus to initial producers P2 P1 D E F B Initial producer surplus C Producer surplus to new producers A 0 Q1 Q2 Quantity MARKET EFFICIENCY • Consumer surplus and producer surplus may be used to address the following questions: – Is our free market system a good way of running our economy? – Could we design a better system? CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 49 MARKET EFFICIENCY Consumer Surplus = Value to buyers – Amount paid by buyers and Producer Surplus = Amount received by sellers – Cost to sellers CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 50 MARKET EFFICIENCY Total surplus = Consumer surplus + Producer surplus = Value to buyers – Amount paid by buyers + Amount received by sellers – Cost to sellers = Value to buyers – Cost to sellers CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 51 MARKET EFFICIENCY • In fact, we can go further and say that • Total Surplus = maximum willingness to pay – minimum production cost CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 52 MARKET EFFICIENCY • An economic outcome is efficient if there is no feasible way to make the total surplus any higher. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 53 Figure 7 Consumer and Producer Surplus in the Market Equilibrium Price A D Supply Consumer surplus Equilibrium price E Producer surplus B Demand C 0 Equilibrium quantity Quantity Figure 7 Consumer and Producer Surplus in the Market Equilibrium Price A Total Value (or, willingness to pay) Total Surplus D Supply Consumer surplus Equilibrium price E Producer surplus B Demand Cost C 0 Equilibrium quantity Quantity The best feasible outcome Price A Total Value (also, Maximum Value) Maximum Total Surplus D As long as we produce the equilibrium quantity, it would be impossible to increase the Total Surplus by reallocating production and consumption. Consumer surplus Equilibrium price E Producer surplus C 0 B Cost (also, Minimum Cost) Equilibrium quantity Supply Demand But is the equilibrium output the right output to produce? Quantity The best feasible outcome Price A Minimum WTP lost Equilibrium price D Society would be worse off if it produces less than the equilibrium quantity E Maximum Cost saved Supply B Demand C 0 Alternative Equilibrium quantity Quantity The best feasible outcome Price A D Equilibrium price C 0 Society would be worse off if it produces more than the equilibrium quantity E Maximum Value of extra output Minimum Cost Equilibrium quantity Supply B Demand Alternative Quantity MARKET EFFICIENCY • Three Insights Concerning Market Outcomes – Free markets allocate the goods produced to the buyers who value them most highly, as measured by their willingness to pay. – Free markets allocate production of goods to those who can produce them at least cost. – Free markets produce the quantity of goods that maximizes the sum of consumer and producer surplus. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 59 Figure 8 The Efficiency of the Equilibrium Quantity Price Supply Value to buyers Cost to sellers Cost to sellers 0 Value to buyers Equilibrium quantity Value to buyers is greater than cost to sellers. Value to buyers is less than cost to sellers. Demand Quantity The Invisible Hand • We pursue our self-interest, not the social interest • It is, therefore, natural to think that the free market would lead to chaos • And yet, as we just saw, the free market outcome is unimprovable • This idea was most famously proposed by Adam Smith (1723 – 1790), the father of modern economics. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 62 The Invisible Hand • ...[E]very individual … neither intends to promote the public interest, nor knows how much he is promoting it. … [H]e intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for the society that it was no part of it. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good. • The Wealth of Nations, Adam Smith, 1776 CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 63 Ticket Scalping • Ticket scalping is often frowned upon and sometimes considered illegal – See http://en.wikipedia.org/wiki/Ticket_resale • But a typical view among economists is that “consenting adults should be able to make economic trades when they think it is to their mutual advantage” • Scalping increases the economy’s efficiency CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 64 Market for organs • Should people be allowed to sell, say, their kidneys? • The efficiency of the economy will increase. • What about fairness? – Rich will buy the kidneys; the poor will not. But – Right now healthy people have extra kidneys while the sick have none. – The sale of organs may be more acceptable if organ purchases by the poor were paid for with taxpayers’ money so that rich and poor had equal access CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 65 WHEN MARKETS FAIL CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 66 However, markets can go wrong • Market Power • Externalities • Fairness CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 67 MONOPOLY • If a market system is not perfectly competitive, firms may have market power. – Market power is the ability to influence prices. – Market power can cause markets to be inefficient because it keeps price and quantity from the equilibrium of supply and demand. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 68 EXTERNALITIES • Externalities – are created when a market outcome affects individuals other than buyers and sellers in that market. – cause welfare in a market to depend on more than just the value to the buyers and cost to the sellers. • When buyers and sellers do not take externalities into account when deciding how much to consume and produce, the equilibrium in the market can be inefficient. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 69 FAIRNESS • In addition to market efficiency, a social planner might also care about equity – the fairness of the distribution of well-being among the various buyers and sellers. • The free market economic system is efficient but not necessarily fair CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 70 Health Care: a big exception • In most advanced countries, government policies regarding health care routinely disregard the idea that free markets are best • In the United Kingdom, the government builds hospitals, hires doctors and nurses, buys pharmaceutical drugs, and provides medical care to all residents • Patients get no bills; tax revenues are used to pay all costs • Fees of private doctors are paid by the government • Performance indicators are high • Costs are low • There is virtually no clamor for privatization CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 71 Video: Scroogenomics • Heard the one about the economist who gave cash as a Valentines Day gift? – Scrooge alert: Your holiday spending may result in an economic loss by Paul Solman, PBS Newshour, December 23, 2013. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 72 Summary • Consumer surplus equals buyers’ willingness to pay for a good minus the amount they actually pay for it. • Consumer surplus measures the benefit buyers get from participating in a market. • Consumer surplus can be computed by finding the area below the demand curve and above the price. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 73 Summary • Producer surplus equals the amount sellers receive for their goods minus their costs of production. • Producer surplus measures the benefit sellers get from participating in a market. • Producer surplus can be computed by finding the area below the price and above the supply curve. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 74 Summary • An allocation of resources that maximizes the sum of consumer and producer surplus is said to be efficient. • Policymakers are often concerned with the efficiency, as well as the equity, of economic outcomes. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 75 Summary • The equilibrium of demand and supply maximizes the sum of consumer and producer surplus. • This is as if the invisible hand of the marketplace leads buyers and sellers to allocate resources efficiently. • Markets do not allocate resources efficiently in the presence of market failures. CHAPTER 7 CONSUMERS, PRODUCERS, AND THE EFFICIENCY OF MARKETS 76