HSS-SECNegative - SpartanDebateInstitute

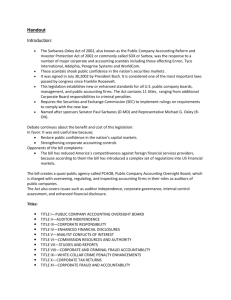

advertisement