Document

advertisement

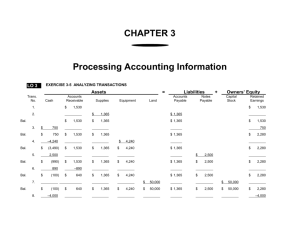

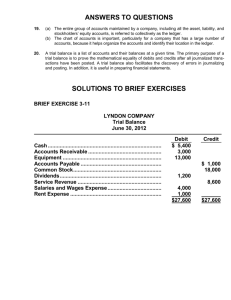

CHAPTER 8 THE CASH FLOW STATEMENT: ITS CONTENT AND USE 1 Chapter Overview Why is a company’s cash flow statement important? What are the types of transactions that may cause cash inflows and cash outflows for a company? What do users need to know about a company’s cash flow statement? How does a company report the cash flows from its operating activities on its cash flow statement under the direct method? 2 Chapter Overview How do users combine the changes in a company’s current assets and current liabilities with its revenues and expenses for the accounting period to determine the company’s operating cash flows? Why do internal and external users study a company’s cash flow statement in conjunction with its income statement and balance sheet? What cash flow ratios are used to evaluate a company’s performance? 3 Why the Cash Flow Statement is Important A company’s cash flow statement shows the changes in a company’s cash during an accounting period from operating, investing, and financing activities. It primarily provides information about a company’s ability to remain solvent (meet its obligations) and to grow. 4 Why the Cash Flow Statement is Important A cash flow statement can help users answer questions such as , “How much cash was provided or used by the company’s operating activities?”, or “What are the reasons that cash increased or decreased during an accounting period?” A company cannot survive without cash to operate day-to-day; and thus, studying the cash flow statement provides important information on a company’s financial stability. 5 Cash Inflows and Outflows A company’s cash flow statement shows the inflows (receipts) and outflows (payments) during an accounting period. The cash flow statement reconciles the beginning balance of cash from the balance sheet to the ending balance of cash on the balance sheet. 6 Cash Account and Cash Flows 7 Balance Sheet Accounts and Cash Flows 8 Inflows (Receipts) of Cash A decrease in an asset (other than cash) causes an inflow (increase) of cash when cash is received in exchange for the asset. This occurs when a company collects $200 on an accounts receivable from a customer. Assets = Liabilities + Owners' Equity Cash A/R Beg. Bal. $ 2,000 $ 800 When cash is collected, $ 200 $ (200) the asset accounts receivable decreases End. Bal. $ 2,200 $ 600 9 Inflows (Receipts) of Cash An increase in a liability may also cause an inflow (increase) of cash when a company receives cash in exchange for the liability. This occurs when a company borrows $4,000 from a bank and signs a note payable. Assets Cash Beg. Bal. $ 2,200 $ 4,000 End. Bal. $ 6,200 = Liabilities + Owners' Equity N/P When a company borrows $ 1,500 money in exchange for a $ 4,000 note payable, the liability $ 5,500 notes payable increases. 10 Inflows (Receipts) of Cash An increase in owners’ equity may also cause an inflow (increase) of cash when additional investments are made in the business. This occurs when a company’s owner invests an additional $1,000 into the business. Assets = Liabilities + Owners' Equity Cash Owners' Capital Beg. Bal. $ 6,200 $ 50,000 $ 1,000 $ 1,000 End. Bal. $ 7,200 $ 51,000 When an owner invests additional cash into the business, owners’ capital increases. 11 Outflows (Payments) of Cash An increase in an asset (other than cash) causes an outflow (decrease) of cash when a company pays cash for the asset. This occurs when a company pays $50 for purchased supplies. Assets = Liabilities + Owners' Equity Cash Supplies Beg. Bal. $ 7,200 $ 2,200 When cash is paid, the $ (50) $ 50 asset store supplies increases. End. Bal. $ 7,150 $ 2,250 12 Outflows (Payments) of Cash A decrease in a liability causes an outflow (decrease) of cash when a company pays cash for outstanding debts. This occurs when a company pays $500 to reduce its notes payable. Assets Cash Beg. Bal. $ 7,150 $ (500) End. Bal. $ 6,650 = Liabilities + Owners' Equity N/P When a company pay a $ 4,000 portion of its outstanding $ (500) notes payable, the liability notes payable decreases. $ 3,500 13 Outflows (Payments) of Cash An decrease in owners’ equity may also cause an outflow (decrease) of cash for owners’ withdrawals from the business. This occurs when an owner withdraws $300 from the company. Assets Cash Beg. Bal. $ 6,650 $ (300) End. Bal. $ 6,350 = Liabilities + Owners' Equity Owners' Capital $ 51,000 $ (300) $ 50,700 When an owner withdraws cash from the business, owners’ capital decreases. 14 Organization of the Cash Flow Statement The cash flow statement shows a company’s cash flows in three sections according to the type of activity that caused the increase or decrease in cash. Cash flow from operating activities Cash flow from investing activities Cash flow from financing activities 15 The Nature of Operating Cash Flows Cash flow from operating activities Operating cash flows include cash inflows and outflows related to the profit-making activities of a company. Collections from customers, payments for merchandise purchases, payments to employees and for other operating expenses are included in this category. 16 The Nature of Investing Cash Flows Cash flow from investing activities Investing cash flows include cash inflows and outflows related to lending activities, investing in other companies and long-term operating assets. Purchases and sales of property and equipment are included in this category. 17 The Nature of Financing Cash Flows Cash flow from financing activities Financing cash flows include cash inflows and outflows related to acquiring owner’s capital, rewarding owners by returning profits, and non-operating debt activities. Investments and withdrawals by owners and acquiring or repaying loans are included in this category. 18 Examples of Cash Flows Exhibit 8-4 19 Net Cash Flows from Operating Activities: Direct Method Cash Flows from Operating Activities Cash inflows: Collections from customers Collection of interest Other operating receipts Cash inflows from operating activities Cash outflows: Payments to supplies Payments to employees Payments of interest Other operating payments Cash outflows from operating activities Net cash provided by operating activities Under the direct method, a company identifies the underlying reasons for cash inflows and outflows, which provides a detailed picture of cash flow activity. Examples include collections from customers (cash inflows) or payments of interest (cash outflows). 20 Net Cash Flows from Operating Activities: Indirect Method Cash Flows from Operating Activities Net income Adjustments for differences between net income and cash flows from operating activities: Add: Depreciation expense [Net] decrease in accounts receivable Less: [Net] decrease in accounts payable [Net] decrease in salaries payable Net cash provided by operating activities Under the indirect method, a company starts with net income, adjusting this for non cash items (such as depreciation) and net changes in non-cash current assets and liabilities during the period.This provides less detail but an important reconciliation between net income on the income statement and cash flows from operations. 21 Net Cash Flows from Operating Activities: Direct Method Sweet Temptations Cash Account: January 2004 Jan 1 Bal 7,300 +300 Cash sales -1,620 Payments for inventory purchases Detailed +400 Receipts – saleinofthe equipment By carefully analyzing all of the changes cash cash -50 Owner withdrawal account, we can summarize the detail transactions that transactions -200 Payment for consulting bill cause Sweet Temptations’ cash to increase from occurring -300 January Payment2004 for advertising bill $7,300 to $11,030 during during -200 Payment for equipment purchases January -2,050 Payments for salaries 2004 -60 Payment for telephone bill -190 Payment for utility bill +7,700 Cash sales Jan 31 Bal 11,030 22 Net Cash Flows from Operating Activities: Direct Method Sweet Temptations Cash Account: January 2004 Jan 1 Bal After identifying the cash transactions, operating cash flows can be segregated. Jan 31 Bal 7,300 +300 -1,620 +400 -50 -200 -300 -200 -2,050 -60 -190 +7,700 11,030 Cash sales Payments for inventory purchases Receipts – sale of equipment Owner withdrawal Payment for consulting bill Payment for advertising bill Payment for equipment purchases Payments for salaries Payment for telephone bill Payment for utility bill Cash sales 23 Net Cash Flows from Investing Activities Sweet Temptations Cash Account: January 2004 Jan 1 Bal After identifying the operating cash flows, investing cash flows can be segregated. Jan 31 Bal 7,300 +300 -1,620 +400 -50 -200 -300 -200 -2,050 -60 -190 +7,700 11,030 Cash sales Payments for inventory purchases Receipts – sale of equipment Owner withdrawal Payment for consulting bill Payment for advertising bill Payment for equipment purchases Payments for salaries Payment for telephone bill Payment for utility bill Cash sales 24 Net Cash Flows from Financing Activities Sweet Temptations Cash Account: January 2004 Jan 1 Bal After identifying operating and investing cash flows, financing cash flows can be segregated. Jan 31 Bal 7,300 +300 -1,620 +400 -50 -200 -300 -200 -2,050 -60 -190 +7,700 11,030 Cash sales Payments for inventory purchases Receipts – sale of equipment Owner withdrawal Payment for consulting bill Payment for advertising bill Payment for equipment purchases Payments for salaries Payment for telephone bill Payment for utility bill Cash sales 25 Sweet Temptations’ Cash Flow Statement 26 Expanding Calculations under the Direct Method While a company can analyze every transaction in its cash account, this would be a time consuming process given the thousands of transactions recorded during an accounting period. Instead, under accrual-basis accounting, changes in non-cash current assets and liabilities can be defined in terms of operating cash inflows and outflows. 27 Cash Collections from Customers Sales revenues on the income statement arise from cash and credit sales to customers. By understanding the changes in the current asset accounts receivable during the year, sales revenues can be converted to cash collections from customers. When accounts receivable increases, a credit sale is made (but no cash is received). When it decreases, cash is collected (but no revenue is recorded). 28 Cash Collections from Customers Assume a company reports $500,000 in sales revenues on its income statement, and the following activity is recorded in accounts receivable during the year: Beg. Bal., Jan 1 Credit sales to customers Cash collections from customers End. Bal., Dec. 31 $ 31,000 $ 350,000 $ (352,500) $ 28,500 How can this be analyzed to determine the cash collections from customers on the cash flow statement? 29 Cash Collections from Customers 1. Accounts receivable (A/R) shows a net decrease during the year – what does it mean when A/R decreases? Beg. Bal., Jan 1 $ 31,000 Credit sales to customers $ 350,000 3. This is true; credit sales were $350,000 and cash collections were $352,500. From a cash flow perspective, sales on the income statement are understated when A/R decreases during the year. Cash collections from customers $ (352,500) End. Bal., Dec. 31 4. The net decrease of $2,500 must be added to net sales to obtain cash collections from customers $ 28,500 2. It means the company collected more cash from customers than it recorded in credit sales. 30 Cash Collections from Customers After we complete the analysis of the net changes in accounts receivable, cash collections from customers (under the direct method) is computed as follows: Net sales (income statement) $ 500,000 Add: net decrease in A/R during year $ 2,500 Cash collections from customers $ 502,500 Cash inflow from operating activities 31 Cash Payments to Employees Salary expense on the income statement arises when employees perform services and a company recognizes the expense in the period the services are performed. By understanding the changes in the current liability salaries payable during the year, salary expense can be converted to cash payments to employees. When salaries payable increases, expense is being recorded (but no cash is paid). When it decreases, cash is paid (but no expense is recorded). 32 Cash Payments to Employees Assume a company reports $25,000 in salaries expense on its income statement, and the following activity is recorded in salaries payable during the year: Beg. Bal., Jan 1 Salary expense recorded Salaries paid to employees End. Bal., Dec. 31 $ $ $ $ 10,000 25,000 (15,000) 20,000 How can this be analyzed to determine the cash payments to employees on the cash flow statement? 33 Cash Payments to Employees 1. Salaries Payable (S/P) shows a net increase during the year – what does it mean when S/P increases? Beg. Bal., Jan 1 $ 10,000 Salary expense recorded $ 25,000 3. This is true; salary expense was $25,000 and cash payments to employees were $15,000. From a cash flow perspective, salary expense on the income statement is overstated when S/P increases during the year. 4. Salaries paid to employees $ (15,000) End. Bal., Dec. 31 $ 20,000 The net increase of $10,000 must be subtracted from salary expense to obtain cash payments to employees 2. It means the company recorded more salary expense than cash paid to employees. 34 Cash Payments to Employees After we complete the analysis of the net changes in salaries payable, cash payments to employees (under the direct method) is computed as follows: Salary expense (income statement) $ 25,000 Less: net increase in S/P during year $ (10,000) Cash payments to employees $ 15,000 Cash outflow from operating activities 35 Calculation of Operating Cash Flows 36 Cash Flow Statement Usefulness A measure of a company’s liquidity - how much net cash is generated from each dollar of net sales generated by a company. A measure of how well a company uses its total resources to generate net cash from operating activities. A measure of how well a company uses its owners’ capital to generate net cash from operating activities. 37 Operating Cash Flow Margin Operating cash flow margin describes how much net cash a company generates from each dollar of net sales, providing an additional measure of a company’s liquidity. Net Cash Flow Provided by Operating Activities Net Sales 38 Cash Return on Total Assets Cash return on total assets measures how well a company is using its resources to generate net cash from operating activities. [Net cash flow provided by operating activities + Interest paid] Average Total Assets 39 Cash Return on Owners’ Equity A company’s cash return on owners’ equity measures how much net cash from operating activities the company generates with each dollar of owners’ capital. Net Cash Flow Provided by Operating Activities Average Owners’ Equity 40