cash receipts journal

advertisement

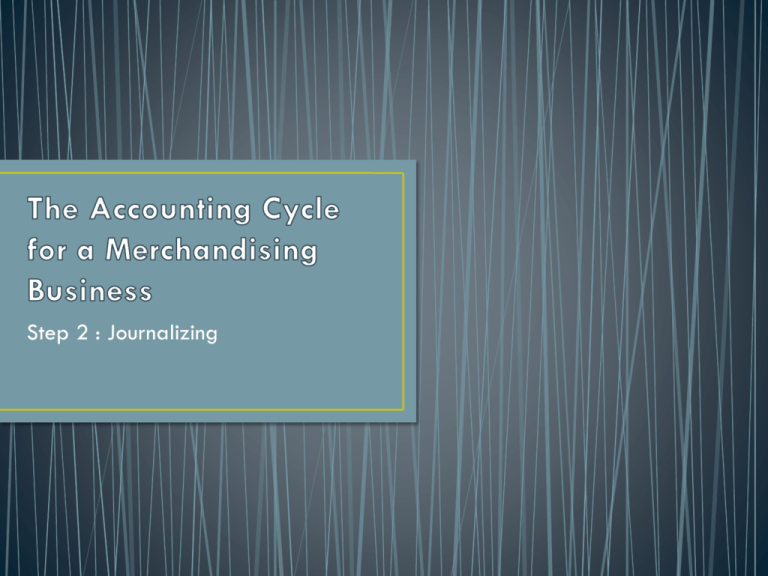

Step 2 : Journalizing 7. Post-Closing Trial Balance. 1. Originating data; for example, sales and purchase Journalize: related invoices, 2. cash receipts, credit and debit cash payments, memos, etc. sales, purchases, general, or combination journal. Accounting Cycle For A Merchandising Business 3. Post to Ledger: general and subsidiary. 6. Adjusting and Closing Entries. 5. Financial Statements: Classified Balance Sheet and Income Statement with Cost of Goods Sold. 4. Trial Balance and Worksheet. • Journalizing is the process of analyzing each source document and enter the transaction into the appropriate book of original entry used in a merchandising firm. • When journalizing there are many different types of journals that can be used in a merchandising business. • • • • • • General Journal Combination/Synoptic Journal Sale Journal Purchases Journal Cash Receipts Journal Cash Payments Journal • The general journal is used to record the opening, adjusting, and closing entries, entries for Sales and Purchases Returns and Allowances, and other miscellaneous items. • To journalize the opening entries, you look at the balance sheet. From there you will journalize them in the following order. 1. 2. 3. All of your debit accounts All of your credit accounts Source document is the balance sheet GENERAL JOURNAL Page_1___ GENERAL DATE July 1 ACCOUNT TITLE Cash Bank Balance Bicycle Stereo Ski Equipment A/P Phillip A/P Dad Overdue Fines Chris Turner Capital Balance Sheet Doc No. Post. Ref. DEBIT 55.00 215.50 185.00 250.00 100.00 CREDIT 80.00 200.00 12.50 713.00 • You would use the general journal to journalize transactions in the following situations. • You are returning merchandise that you paid for. • To complete the journal do the following 1. Write the date 2. Write the account title and vendor name. A diagonal line is placed between the account title and the vendor name. • Accounts Payable/LeBlanc Company 3. Place a diagonal line in the post ref column to show that the single debit amount is posted to two accounts. 4. Write the debit memo in the doc no. columns (Purchases Returns and Allowances source document will usually be a debit memo) 5. Write the amount in the debit column. 6. Go to the next line and indent, write purchases returns and allowances in the account title. 7. Write the amount in the credit column on the second line. November 28. Returned merchandise to Crown Distributing, $252.00, covering Purchase Invoice No. 80. Debit Memorandum No. 78. 2 5 1 3 4 6 7 • You would use the general journal to journalize transactions in the following situations. • Customers are returning merchandise that they purchased March 11. Granted credit to Village Crafts for merchandise returned, $58.50, plus sales tax, $3.51, from S160; total, $62.01. Credit Memorandum No. 41. 2 4 1 3 5 7 1. Write the date. 2. Write Sales Returns and Allowances. 3. Write CM and the credit memorandum number. 4. Write the amount of the sales return. 5. Write Sales Tax Payable. 8 6 9 6. Write the sales tax amount. 7. Write the accounts to be credited. 8. Draw a diagonal line in the Post. Ref. column. 9. Write the total accounts receivable amount. • New Century 21 Text • Page 258 – Working Together and On Your Own 9-4 • Page 287 - Working Together and On Your Own 10-3 • A service business generally has a large number of cash transactions and a limited number of noncash transactions. Non cash transactions are those the do not involve either the receipt or payment of cash. The combination journals that you are used to seeing in Accounting 10 would not be as accurate as it should be, as it would require far too many transactions in the general debit and credit columns. • To save time and space we will use the expanded combination journal, which includes special amount columns to record frequently occurring noncash transactions. In the Extended Combination Journal special amounts columns are provided to record frequently occurring transactions related to the purchasing and selling of merchandise. The columns are arranged to make accurate recording and posting easier. Debit and Credit Columns for Cash, A/R, and A/P are arranged in pairs. • Normal Balance for Merchandise Merchandise Normal Balance Increase Decrease • Purchasing Merchandise With Cash Merchandise was purchased for $465.00 cash on March 12th, 2014. C295 • Purchasing Merchandise on Account Merchandise was purchased for $385.00 on Account on March 14th, 2014. PI21 Merchandise $385.00 Accounts Payable $385.00 *Remember that when you journalize and there is a special column amount for both totals no account title is needed, instead you put only a in the account title column. Also, you put a if the amount does not need to be posted individually in your ledger (only when you are suppose to post the special account totals). Normal Balance for Sales Sales Decrease Normal Balance for Sales Tax Payable Sales Tax Payable Normal Balance Increase Decrease Normal Balance Increase • Sold Merchandise For Cash • Merchandise was sold for cash $465.00 sales tax was 5% on March 12th, 2014. T5 Cash $488.25 Sales $465.00 Sales Tax Payable $23.25 • Sold Merchandise on Account • Merchandise was sold on Account for $485.00 sales tax was 5% on March 14th, 2014 SI12 Accounts Receivable $509.25 Sales $485.00 Sales Tax Payable $24.25 - To prove your cash use the following formula: Beginning Cash + Cash Received – Cash Paid Out = Cash on Hand - Ruling the Journal - To carry forward a total add up each column make sure Dr=CR and single underline the totals. Place the date of the last transaction in the date column and the term ‘carried forward’ in the account title. To bring the total forward on the next page, write the date of the last transaction, put ‘brought forward’ in the account title and transfer the totals into each column from the previous page. - At the end of your journal, total each column, ensure DR=CR single rule above the totals, and double rule under the totals. Enter the date of the last transaction and the word ‘totals’ in the account title. - See page 264 and 265 in the C21 Old Text for more an example Assignment: Century 21 Old Text • Page 255 – 13-M • Page 269 – 14-M • Reference Pages – 240-266 Century 21 New Text • Page 291 10-5 • Sales Journals contains all transactions involving sales of merchandise on account. The source documents used for this journal may be sales invoices, credit invoices, and charge sales slips depending on whether the journal used is a one-column journal or a columnar sales journal. • The credit terms and/or invoice number may be recorded as well as the amount. Separate columns for GST and PST must be established in a Sales Journal as liability accounts. November 3. Sold merchandise on account to Village Crafts, $540.00, plus sales tax, $32.40; total, $572.40. Sales Invoice No. 76. 1 2 3 4 1. Write the date. 2. Write the customer name. 3. Write the sales invoice number. 4. Write the total amount owed by the customer. 5. Write the sales amount. 6. Write the sales tax amount. 5 6 • Read 272 -274 • Page 275 – Questions 1, 2, 3, 4 • Define: • Customer • Sales Tax • Sales Journal • Complete Working Together 10-1 and On Your Own 10-1 • Purchases Journals contains all transactions involving purchases of merchandise on account. • The source documents used for the Purchases Journal are purchase invoices if using a one-column journal; however, many businesses keep a multi-column journal to record all acquisitions on account. The asset accounts would have special columns. The purchase invoice number may be written into the journal. November 2. Purchased merchandise on account from Crown Distributing, $2,039.00. Purchase Invoice No. 83. 2 1 1. 2. 3. 4. Write the date. Write the vendor name. Write the purchase invoice number. Write the amount of the invoice. 3 4 1 3 4 5 2 1. Rule a single line across the amount column. 2. Write the date. 3. Write the word Total. 4. Add the amount column. 5. Write the total. 6. Rule double lines across the amount column. 6 • Page 262 – 9-6 • Page 291 10-5 • Reference Pages - Chapters 9 and 10 • All money received into the business must be carefully controlled and deposited promptly. Any cash that is received can be entered into the cash receipts Journal. pages 276- 277 UPC (Universal Product Code) Cash Register Receipt Point-of-Sale (POS) Terminal Receipt (continued on next slide) 33 LESSON 10-2 page 277 Terminal Summary Batch Report (continued from previous slide) 34 LESSON 10-2 page 278 35 LESSON 10-2 page 279 November 4. Recorded cash and credit card sales, $5,460.00, plus sales tax, $327.60; total, $5,787.60. Terminal Summary 34. 2 1 1. 2. 3. 4. 5. 6. 7. 36 4 3 5 Write the date. Place a check mark in the Account Title column. Write the terminal summary document number. Place a check mark in the Post. Ref. column. Write the sales amount. Write the sales tax amount. Write the cash amount. LESSON 10-2 6 7 page 280 November 6. Received cash on account from Country Crafters, $2,162.40, covering S69. Receipt No. 90. 1 1. 2. 3. 4. 5. 37 2 3 4 Write the date. Write the customer’s name. Write the receipt number. Write the credit amount. Write the debit amount. LESSON 10-2 5 page 282 November 7. Received cash on account from Cumberland Center, $1,176.00, covering Sales Invoice No. 74 for $1,200.00, less 2% discount, $24.00. Receipt No. 91. 1 2 3 1. Write the date. 2. Write the customer’s name. 3. Write the receipt number. 38 4 5 6 4. Write the original invoice amount. 5. Write the amount of sales discount. 6. Write the debit to cash. LESSON 10-2 page 283 39 LESSON 10-2 • Page 284 On Your Own 10-2 • All money paid from the bank accounts must be carefully controlled and recorded in the cash payments journal. It is sometimes called the cash disbursements journal.. page 242 43 LESSON 9-2 page 243 November 2. Paid cash for advertising, $150.00. Check No. 292. 1 1. 2. 3. 4. 5. 44 2 3 4 Write the date. Write the account title. Write the check number. Write the debit amount. Write the credit amount. LESSON 9-2 5 page 243 November 5. Paid cash for office supplies, $94.00. Check No. 293. 1 1. 2. 3. 4. 5. 45 2 3 4 Write the date. Write the account title. Write the check number. Write the debit amount. Write the credit amount. LESSON 9-2 5 page 244 November 7. Purchased merchandise for cash, $600.00. Check No. 301. 2 1 1. 2. 3. 4. 5. 46 3 4 Write the date. Write the account title. Write the check number. Write the debit amount. Write the credit amount. LESSON 9-2 5 page 245 November 8. Paid cash on account to Gulf Craft Supply, $488.04, covering Purchase Invoice No. 82 for $498.00, less 2% discount, $9.96. Check No. 302. 5 1 2 4 3 1. 2. 3. 4. 5. 6. 47 Write the date. Write the account title of the vendor. Write the check number. Write the debit amount. Write the credit amount. Write the credit amount. LESSON 9-2 6 page 246 November 13. Paid cash on account to American Paint, $2,650.00, covering Purchase Invoice No. 77. Check No. 303. 1 2 4 3 1. 2. 3. 4. 5. 48 Write the date. Write the vendor account title. Write the check number. Write the debit amount. Write the credit amount. LESSON 9-2 5 • Page 247 On Your Own 9-2, 9-3