Precious Metals Business: Where next for Dubai?

advertisement

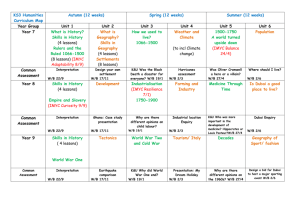

Precious Metals Business: Where next for Dubai? 30th April 2012 1 Dubai continues to play an important role in the Gold trade • The Gold business, has witnessed very strong growth in Dubai over the past decade • World supply of gold in 2011 was ~ 4000 tonnes from mine production and recycled Gold • In 2011 an impressive 750 tonnes (18.5% of world gold supply) of physical gold is estimated to have traded through Dubai, most re-exported to other physical gold centres – primarily India and Turkey 2 There has been a shift in Gold consumption pattern over the past decade 2002 Total demand 3,374 tonnes 2011 Total demand 4,068 tonnes • Jewellery 2,662 tonnes • Jewellery 1,963 tonnes • Investments bars and coins 352 tonnes • Investments bars and coins 1,487 tonnes • Technology 358 tonnes • Technology 464 tonnes • ETFs 154 tonnes There has been a shift in gold usage from jewellery to Investment gold consumption – Bars, coins and ETFs have grown by over 5 fold 3 There are 5 key drivers to Dubai’s continues growth as a dominant center of Gold trade 1 Well developed logistics infrastructure 2 Proximity and alignment to large demand market 3 Mature and competitive retail as well as wholesale market 4 Holistic presence across value chain 5 Government focus on growing the sector 4 1 Dubai’s well developed logistics infrastructure Airline Network World class transport firms ▪ The distribution capabilities for precious metals are very strong through Dubai International Airport, with the extensive Emirates Airlines destination network ▪ Several world class operators including Transguard, Brinks, G4S and Viamat, offering secure transportation facilities for precious metals ▪ Massive Storage/Vaulting capacities in Dubai are massive and Secure storage Streamlined government process Multiple trade finance channels with Transguard, G4S, Viamat and Brinks are all having their own secure facilities ▪ The streamlined government process for the movement of precious metals into and out of Dubai, are is also a major reason for the seamlessness of operations ▪ mulitiple channels of trade financing as well as solutions for the Corporate and Retail trade are instrumental in providing a firstclass logistical infrastructure. 5 2 Proximity and alignment to large demand market India • India is the biggest consumer of gold in the world (excluding China) with demand of nearly 1000 tonnes per annum • Dubai’s proximity and relationship with India allows storage centrally in Dubai and shipment to various Indian cities within a few hours • Dubai’s Good Delivery standard is a 995 finesse market, and that is the same standard as India and other South East Asian region Turkey • Dubai maintains close relationships with Turkey which is another potentially large off-taker for physical Gold • Dubai’s Good Delivery standard is a 995 finesse market, and that is the same standard as Turkey 6 3 Mature and competitive Retail as well as Wholesale market Presence of local and multinational retailers, trading houses, and finance groups. Presence of a popular gold souk Safe and secure environment provided to buy and sell, with police and security officers present at all times Competitive pricing due to relatively low making charges applied to jewellery and bars, coupled with stringent and reliable hall marking testing increases trust in the products Mature and Sustainable Gold Market Popularity of Gold including in promotions and festivals drive demand and create continuous buzz around the commodity 7 4 Holistic presence across the value chain Refining Wholesale Distribution • Primarily scrap refining - has led to a significant growth in volumes and international acceptance of the goods from Dubai based refineries, namely Emirates Gold and Kaloti • Wholesale distributing companies like Bin Sabt Jewellers, INTL FC Stone and Swiss Gold • These companies operate both in the domestic and international arena, thereby extending and expanding Dubai’s capabilities to a global platform • Niche local retailers as well as multinationals like Damas, Joyalukkas, Sky Jewellery and Malabar Gold Retail Distribution 8 5 Government focus on growing the sector • The DMCC provides the regulatory framework for the precious metals business inside the Jumeirah Lake Towers Freezone. • Services provided to the members include due diligence and documental support, as well as providing an extremely flexible and professional trading environment. • The DMCC in liaising with the OECD and contributing to the drafting of the OECD Guidelines, will further enhance Dubai`s position as a major participant in the global physical precious metals business. 9 What’s Next? Dubai is in need for a different kind of bullion bank • A dedicated Bullion Bank that will look for and provide answers to all aspects and necessities arising out of the needs of its professional precious metals customer base. • This would require all or most of the following: • OTC Spot market making to its customers and other local bank participant • Providing OTC forward trading capabilities in line with individual credit line requirements for its customer base • Buying and selling OTC precious metals with loco Dubai delivery • Opening metal accounts for customers in order to facilitate loco Dubai trading, • OTC precious metals business clearing loco Dubai • Provide financing for potentially all participants of a loco Dubai trading operation. IN A NUTSHELL : CASH FOR GOLD 10