File

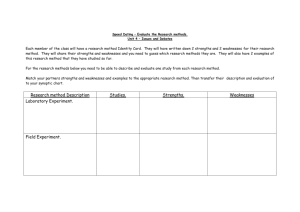

advertisement

MarketSim Implications of Integrated Decisioning In Bank Training – Invest in your best Topics of Discussion Strengths & Weaknesses of Humans in Decision Making Strategies Available to Retail Banking Linking the Financial Accounting Principles View of the World to the Balanced Scorecard 2 Strengths & Weaknesses • Pattern #1: 1, 2, 4, 8, ?, ? • Pattern #2: 1, 4, 7, 10, ?, ? • We’re pretty good at finding patterns and pushing them forward • We’re pretty good at finding patterns even when there aren’t any! • We’re pretty good a finding causation even when there isn’t any!!! 3 Strengths & Weaknesses • I’ve done this experiment for the last 9 events and so far it has turned up heads 9 times in a row… • Heads or Tails? • We’re not very good at estimating odds 4 Strengths & Weaknesses • Are you a better than average driver? • We are blindly optimistic. 5 Strengths & Weaknesses So, Bill Gates and Dwight Howard walk into this bar… ∅ 6 Strengths & Weaknesses • Natural versus Artificial Distribution • Height versus Wealth versus Losses 7 Strengths & Weaknesses • Behavioral Economics versus the Invisible Hand • Game Theory versus Homo Economus 8 9 What is fair? • A first player (the proposer) receives a sum of money and proposes how to divide the sum between himself and another player. • The second player (the responder) chooses to either accept or reject this proposal. • If the second player accepts, the money is split according to the proposal. • If the second player rejects, neither player receives any money. • The game is typically played only once so that reciprocation is not an issue. 10 Game Theory 11 Developing a Tolerance of Ambiguity • Being able to making decisions without a full set of information • Being able to make decisions quickly • Being able to taking measured action without understanding how everything works 12 How to Make Decisions 1. 2. 3. 4. 5. 6. 7. 8. Work on the right problem. Identify all criteria. Create imaginative alternatives. Understand the consequences. Grapple with your tradeoffs. Clarify your uncertainties. Think hard about your risk tolerance. Consider linked decisions. From Smart Choices: by Hammond, Keeney, and Raiffa 13 M. Porter’s Generic Strategies 14 Strategic Planning 15 Banking Strategy With… Rising Customer Acquisition Costs Burdensome Delivery Cost Issues Top Line Revenue Growth Issues New Entrant Competition Issues Risk Issues Regulatory Issues Profit Pressure to Carry the Bank Therefore you must... 16 Banking Strategy Know and Commit to your Strategy! Know your Customers Know your Numbers 17 Earnings Power Formula NIM NII NIM NII NIE PLL NIBT NIE PLL Net Interest Margin Non Interest Income Non Interest Expense Provision for Loan Losses Net Income Before Taxes 18 NIBT So… The financials tell the entire story… Right? Not Exactly! 19 Financial Views + Advantages Problems Numbers based Lagging indicator Balances to management and shareholders’ view of the #s Not really an accurate proxy of results Systems easily handle Financials Does not identify drivers of profits Allows a head of retail to stay one step ahead of accountability We can “manage” it. 20 - How Can We Use Financial Analysis? # of Customers Products per Customer Product Profitability (risk adjusted) Delivery Costs Profits Move GAAP out of the accounting area to the folks who generate profits Can be computed on a single customer, a geography, or a market segment Pushes to consider “drivers” 21 Drivers of Success Financials Customer Delivery Playing By Rules Product 22 Which Brings Us Back to BSI… 23 …Then Taking us to “Outcomes” Decide what you want to occur Long-run focused Predictable, logical Not just bottom line related Should drive Profitability 24 What Does All This Mean? Relative Market Share (Cash Generation) High Low Question Marks High Low (Cash Usage) Market Growth Rate Stars Dogs Cash Cows quickMBA.com 25 MarketSim Business Plan Instructions In Bank Training – Invest in your best Business Plan Preparation What kind of bank do you want to be? What will the financials look like? 27 Assignments 28 Assignment 29 Assignment 30 Assignment 31 Retail Bank Condition Consensus What is the overall condition of retail at the bank? What are the retail bank’s strengths and weaknesses? STRENGTHS WEAKNESSES Customer 1. 2. 3. 4. 5. 1. 2. 3. 4. 5. Product 1. 2. 3. 1. 2. 3. Channel 1. 2. 3. 1. 2. 3. Financials 1. 2. 3. 1. 2. 3. Retail Bank Condition Consensus MarketSim Business Plan INSTRUCTIONS In your last 3 decisions you operated based on your Management Direction Consensus. It is now time to be your own retail bank (BYOB). By team, prepare a business plan that you will use to guide your next 3 years’ decisions. STRATEGIC PLANNING Using the grid below, rank by attractiveness the various customer segments and your bank’s and competitor’s ability to compete. Draw conclusion based on your bank’s overall direction. Retail Banking Strategy Planning Grid MEDIUM HIGH TARGET HOLD Segment Attractiveness LOW DROP Business Strengths The Segments are: JS = Just Starting SIWC = Single Income White Collar WP = Working Poor PRE = Pre-retired through 65 FH = First House RET = Retired EA = Emerging Affluent HIMS = High Income Make & Spend BC = Blue Collar MM = Money Mogul MarketSim Business Plan List in order those segments that are the most attractive to you and why. Segment Why Attractive? 1. 1. 2. 2. 3. 3. 4. 4. List in order those segments that are the least attractive to you and why. Segment Why Attractive? 1. 1. 2. 2. 3. 3. 4. 4. 36 MarketSim Business Plan What do you think other banks in your community will be doing? If they are going after the same segment, what will make your team successful? Prepare below a Mission Statement identifying the broad purpose of your retail business. Please include targeted customer segments, acceptable risk levels, return levels, etc. 38 Management Direction Consensus Individually, consider the direction of the bank you will be managing in MarketSim. Then as a management team, come to a mutual agreement as to the changes that need to be made. List below your consensus of the 4 or 5 actions required over the next year to preserve the bank’s strengths and/or correct its weaknesses. This list forms the basis for your decision sets. What is the most important action required next year? CONDITION 1 2 3 4 5 ACTION Management Direction Consensus 41 Hints Strategy first Customers second Financials are derived from strategy Balanced Scorecard measures follow from strategy 42