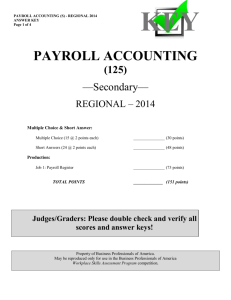

Preparing payroll records

advertisement

If you were the owner of a small business, how much would you pay your workers to work overtime? Why? What are some methods you would take to keep track of hours worked by employees? Payrollin' Chapter 12 Many businesses pay employees for number of hours each employee has worked Salary: money paid for employee services Pay period: period covered by a salary payment Employees paid every week, every two weeks, twice per month, or once per month Usually paid on the 15th and last day of each month Payroll: total amount earned by all employees for a pay period Reduced by state and federal taxes and other deductions, such as health insurance Used to prepare payroll reports for the government Time cards used by those who aren’t paid a salary Requires employees to record total hours worked each day by checking in at arrival and departure Page 341 shows example of time card Rounded to nearest quarter-hour Total earnings: total pay due for pay period before deductions Also referred to as gross pay/gross earnings Overtime pay includes “time-and-a-half” Hourly wage x 1.5 Add to regular work day compensation to receive total compensation for day Practice: Complete WT 12-1 Complete OYO12-2 Be prepared to review answers How some view Social Security... Payroll taxes: taxes based on payroll of a business Businesses required by law to withhold payroll taxes from employee salaries Federal and state governments charge businesses penalties for failure to pay correct payroll taxes when due Payroll taxes represent liability for employer until payment is made to government Amount of income tax withheld is identified on Form W-4, Employer’s Withholding Allowance Certificate Withholding allowance: deduction from total earnings for each person legally supported by taxpayer, including employee Employers hold W-4 for each employee Larger number of withholding allowances claimed, smaller amount of income tax withheld Turn & Talk: Why would married individuals or those with children be taxed less than those without any dependents or spouse? Exemption from withholding available for some low-income and part-time employees Cannot claim exemption if: 1. 2. Income exceeds $750 and includes more than $250 unearned income Another person can claim them as a dependent on their tax return IRS tables – pages 347 - 348 Federal Insurance Contributions Act (FICA) provides for federal system of old-age, survivors, disability, and hospital insurance Social security tax: federal tax paid for old-age, survivors, and disability insurance Calculated on employee earnings up to maximum paid in calendar year tax base: maximum amount of earnings on which tax is calculated $87,000 for Social Security Tax, as 6.2% Medicare tax: federal tax paid for hospital insurance Not tax base exists here Calculate don total employee earnings, at a rate of 1.45% Practice: Complete WT 12-2 Complete OYO 12-2 Be ready to review answers Why do you think taxes would be higher in some states than others? Think about the use of tax dollars paid to the government… In your notebooks: What is the sole purpose of savings accounts? What is the sole purpose of checking accounts? Do you have a checking account? If so, how do you deposit money into your account? 3 stations 3-4 people each station Team rotates after 2 minutes Station 1:What is the difference between gross pay and net pay? What does it mean when something is “tax-deductible”? Station 2:What is direct deposit? How is it more efficient than using paper checks? Station 3: If you owned a business, what methods would you use to keep track of how much each employee has earned during employment with your business? Payroll register: business form used to record payroll information Shows total earnings, payroll withholdings, and net pay of all employees Net pay: total earnings paid to employee after payroll taxes and other deductions Employee earnings record: business form used to record details affecting payments made to employee Business must send quarterly report to federal and state governments showing employee taxable earnings New earnings record prepared for each employee each quarter Look Familiar? Total earnings, not net pay, are added to previous accumulated earnings amount on earnings record Total earnings is amount compared to tax base to determine whether social security taxes should be withheld Other column represents amount voluntarily taken from paychecks by employees Charitable contributions Savings/investments In pairs: Complete 12-3 Work Together Complete 12-3 On Your Own Check written for total net pay, which is taken out of general checking account Net pay amount deposited into special payroll checking account Individual checks written to employees from special payroll checking account Amount of check is total Net Pay column of payroll register (excel) Check payable to Payroll Account #, the business’ special payroll checking account (given in problem to you) Payment for payroll period is the given two-week period (given in problem to you) Using separate checking account for payroll checks provides internal control and helps prevent fraud Information used to prepare payroll checks is taken from payroll register (excel) Special payroll check form used that has detachable stub for recording earnings and amounts deducted (in WP, similar to chapter 5) Employees keep stubs for record of deductions and cash received Read the following article As you do so, write down pros and cons to direct deposit with your partner Electronic funds transfer (ETF): computerized cash payments system that transfers funds without use of checks, currency, or other paper documents Today, most businesses deposit employee net pay directly to each employee bank account using ETF Payroll must still be calculated, but individual checks are not written and do not have to be distributed Each employee receives statement of earnings and deductions similar to detachable stub on payroll check In pairs: Complete 12-4 Work Together Complete 12-4 On Your Own If/when you have a part-time job, will you be more likely to use direct deposit via EFT, or are you more comfortable receiving a paper check? Why or why not?

![[Product Name]](http://s2.studylib.net/store/data/005238235_1-ad193c18a3c3c1520cb3a408c054adb7-300x300.png)