Finance Training Manual - University of Northern Colorado

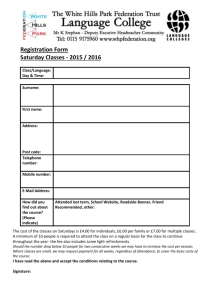

advertisement