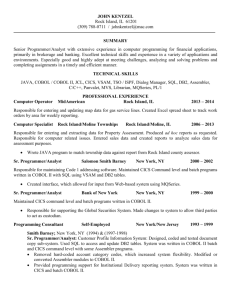

MS Word Resume - The Stevens Computing Services Company, Inc.

advertisement

STEVEN G. LANDOVITZ 360 West 22nd Street, Apt. 6R New York, NY 10011-2630 (212) 924-7708 steven@stevenscs.com SOFTWARE COBOL370, COBOL II, HLASM, VSAM, OS/MVS JCL & Utilities, TSO/ISPF, CICS Command Level, BMS, EDF, Intertest, DB2, SQL, IMS/DB, MQSeries, MS Word, MS Excel, HTML, Javascript HARDWARE IBM Mainframe, Windows-based PC EXPERIENCE July 2015 to November 2015 BROADRIDGE FINANCIAL SERVICES, INC., Jersey City, NJ Consultant Advanced Order Management System (AOM) – COBOL II/CICS/DB2 Made enhancements, that affect only new client, Scottrade, to on-line brokerage system that performs entry, validation, inquiry, and management of orders to trade equity, fixed-income, and options securities. Modified the process for broker-assisted orders to include new features. Accept closing trades that reduce both long and short positions in accounts marked as closed, rather than block all activity. Require authorization for trades of securities priced below 5 dollars, or issued by firms in which client holds more than 10 percent equity or has management relationship. Modified the processes for new orders, executions, modified orders, and modified executions to include new commission type. Commission computed by increasing or decreasing standard commission by entered amount. Also provided ability to charge extra commission of this type to options trades. Modified database and system to carry new commission data through to back-office. August 2013 to March 2014 CITIGROUP, Jersey City, NJ Consultant Commercial Credit Cards/Core File Delivery – DFSORT/JCL/OPCH/NDM/FTP Developed batch jobs to encrypt and transmit files to client-side servers. Developed batch jobs to scan and extract files from external servers. Executed file transfers in test and production environment. Established new transfer accounts on Citibank servers. Researched inquiries for clients. August 2010 to May 2013 BROADRIDGE FINANCIAL SERVICES, INC., Jersey City, NJ Consultant Tax Lot Engine System (TLE) – COBOL II/DB2 Researched and corrected program bugs reported by clients and internal testing group. Wrote batch SPUFI queries to restore corrupted production data after turnover of bug fixes. Master Security Description (MSD) – COBOL II/HLASM/CICS/DB2 Made enhancements to security master system. Developed called module that formats fields updated in real-time into XML record to be sent via MQ to outgoing server for delivery to clients. Modified HLASM programs that produce generations of files of daily high, low and closing prices to correct errors in computations involving available U.S. dollar quotations or converted Canadian dollar quotations. S. Landovitz pg 2 Data Masking Project – COBOL II/HLASM Developed programs and jobs that produce test versions of production files, having encrypted (masked) values for sensitive data. Single driver program can convert any file by using control cards to ascertain format of input file and displacement and type of target fields. Program then selects and calls appropriate I/O modules and encryption routines developed in-house. Modified I/O modules written in HLASM to copy DCB attributes from input file to output file, to provide for generic jobs requiring no DCB parameter for the output file. Brokerage Processing Services/Advantage (BPS/A) – COBOL II/DB2 Made enhancements to system that extracts back-office data processed by Broadridge, and formats it into normalized database-layout records for transmission to outgoing servers. Records may be grouped for distribution by branch or other criteria. Records then sent to client-owned servers for database upload. Developed jobs to extract and format data from various internal systems, such as G/L, Tax Lots, Name & Address, and Security Master, for new clients. December 2009 to May 2010 BANK OF AMERICA/ MERRILL LYNCH, Jersey City, NJ Consultant Regulatory List Screening Utility System – COBOL II/DB2/CICS Made enhancements to system that performs textual screening on all new account, security settlement, and funds transfer data in order to interdict transactions involving entities included in a watch list complying with OFAC requirements. Designed Scanned Threshold sub-system that compares each client’s volume of scan requests in prior week to average weekly volume over 13-week period preceding it, the prior rolling quarter benchmark. Distributed system selects clients with weekly volume varying from benchmark by more than appointed percentage and sends e-mail notification with attached spreadsheet showing daily request detail of prior 14 weeks. Distributed system also provides inquiry function. Wrote business requirements document, coded batch process to compile volume statistics in a DB2 table, wrote DB2 query for spreadsheet, coordinated test planning with quality assurance group. December 2007 to October 2009 MERRILL LYNCH/BANK OF AMERICA, New York, NY Consultant Merrill Lynch Professional Clearing Corp. (MLPro) – COBOL II/CICS/tableBASE Made major enhancements to systems supporting business that provides services, including prime brokerage, securities financing, and brokerage and clearing, to professional traders: broker-dealers, hedge funds, specialists, and market makers. Modified Arranged Financing Project Made enhancements to system that accounts for client holdings to permit the firm to lend funds and securities to clients who may then trade at higher leverage than Reg T stipulates. Unleveraged clients hold long and short positions in separate accounts. Leveraged clients hold net position in single account, borrowed funds in another account, and securities pledged against loan in third account. Modified programs and tableBASE tables to accommodate new account types. Commission Profile Renovation Project Made enhancements to system that determines and reports commissions and fees to accommodate new fees and provide more accurate collection, classification and computation of existing data. Wrote section of project’s technical specifications document dealing with data collection and reporting. Modified programs. Implemented efficiency enhancements to reduce batch run time. S. Landovitz pg 3 Cross-Margin Project Made enhancements to system that performs reconciliation of options positions between MLPro’s books and the OCC. Modified programs to permit reconciliation across clearing numbers. Rewrote programs to eliminate redundant code. Ran OPC job streams in pseudo-production environment on test platform. Investigated and corrected errors until streams completed. May 2006 to August 2007 ADP/BROADRIDGE FINANCIAL SERVICES, INC., Jersey City, NJ Consultant Advanced Order Management System (AOM) – COBOL II/CICS/DB2 Made major enhancements, for ADP’s new client, RBC Dain, to on-line brokerage system that performs entry, validation, inquiry, and management functions for orders to trade equity, fixed-income, and options securities. AOM accepts input from both its own 3270-based screens and from the Phase IV proprietary middleware system. Phase IV is a Java-based server engine that accepts XML messages from front-end systems of various clients, and invokes AOM’s interface modules. AOM invokes the Order Match system to send trades to the exchanges. AOM receives confirmation of executions from Order Match and provides on-screen notification to the user. Made enhancements to AOM’s 3270-screens, interface modules to Phase IV, and DB2 I/O modules. Enhancements provide additional filters for selection of trades for inquiry or update, and new line commands that select individual trades for modification or execution. Also wrote utility module that formats data from the new Executions screen into message to be sent to Order Match for routing to the stock exchange. P&S Trade Balancing System – COBOL II/CICS Made enhancements, to on-line purchase-and-sales trade reconciliation system that resolves discrepancies between customer orders and executions. System accepts input from user entry and downloads from clearing services, reconciles customer and streetside records overnight, and then presents unresolved “breaks” in printed reports and 3270 screens. System transfers selected data via MQ transmission to the Workflow system which provides a similar function to web-based users. Wrote programs that extract and transmit to Workflow data pertaining to “break” items, ex-clearing, pairoff, and options. January 2005 to January 2006 MORGAN STANLEY, INC., New York, NY Consultant Fixed-Income System – COBOL II/CICS/MQ Series Made enhancements to mainframe system that maintains inventory and offering balances of fixed-income securities. System communicates with front-office desktop trading system via MQ series. Developed sub-system that does automatic setup of characteristic data on the system for municipal bonds bought from The Muni Center (TMC). Sub-system also enables the new securities to be reoffered to retail customers. Made enhancements that extract schedules of multiple calls and step-up/step-down coupons from the Security Master system to be used in an improved bond figuration process. Implemented integration of the TIPS standard bond figuration package into the system to replace in-house routines. Developed routines for comparing price and yield results of TIPS figuration to old figuration process for various classes of bonds and CDs. Investigated discrepancies at Bloomberg terminal. S. Landovitz pg 4 September 2004 to November 2004 LEHMAN BROTHERS, INC., Jersey City, NJ Consultant Commodities System – COBOL II/CICS/DB2 Made major enhancements to mainframe commodities system that interfaces between outsourced AS400-based bookkeeping system, named RISC, and other mainframe systems. System sends trades and account data to RISC and receives back master files of positions, balances, and accounts. System then produces feeds to the P&L, commissions, and other companywide systems, and it produces reports. Modified both nightly client sweep, and P&L feed for customer accounts, to produce output in native currency instead of U.S. dollars. Developed new P&L feed for firm trading accounts. June 1995 to April 2004 CITIBANK, N.A., New York, NY Consultant U.S. Cash Money Transfer System – COBOL370/BAL/CICS/DB2/MQSeries Made major enhancements to money transfer system that regulates flow of transactions from customers to Federal Reserve Bank of NY to internal accounting system then back to customers. Mainframe system connects to customers in three ways: over LU6.2 link to customer mainframes; over LU6.2 link to mini-computer that receives dial-in from customer desktops running Citibank's proprietary software; via MQSeries messaging to server that hosts CitiDirect commercial account management web-site. Transactions are messages in SWIFT format-type. DB2 databases store history of all transactions affecting customer accounts, and history of daily account balances. Main accomplishments were enhancing and maintaining systems that produce and deliver outbound posting confirmation messages. CitiDirect Project Modified on-line MT942 intra-day posting reporting system and batch MT940 end-of-day posting reporting system to deliver output, for eligible accounts, via MQ Series remote queues to CitiDirect client/server system that formats data into web pages for Internet access by customers. Redesigned MT942 generating program to deliver all output for all accounts via MQ Series, using local queue for each non-CitiDirect destination. Wrote delivery modules that are triggered by each local destination queue to drain it and deliver messages to appointed destination, allowing quicker execution and more secure error recovery. Wrote batch program that streamlines MT940 output by grouping it into 4-megabyte records for most efficient MQ transmission to CitiDirect. Wrote batch utility module that deblocks MQ input records too long for browsing in MQ Utility Panel into 1,000-byte QSAM output. Created MQSeries version of check stop placement module for CitiDirect customers. Event-Driven MT942 Project Designed and coded on-line sub-system that produces and delivers MT942 intra-day transaction posting confirmation messages in SWIFT format-type. Replaced old process, activated by timer every few minutes, that collected all available confirmations from a file, by new process that generates and dispatches each confirmation upon the event of posting the transaction to an account’s books. Messages sent over four possible streams (channels) from IBM Mainframe to cross-site communications system resident on Tandem computer. Sub-system determines which streams are free and coordinates simultaneous transmission of large volume of messages. Wrote proposal favoring the technical design described above to enhancements to the old design. Modified system to produce extra MT100, MT202, MT900, and MT910 statements in standard SWIFT format and transmit them over SWIFT FIN network to eligible customer accounts. S. Landovitz pg 5 End-of-Day MT940 Project Made major enhancements to batch system that sends each customer account an MT940 or MT950 end-of-day report of opening and closing balances and all daily transactions, in SWIFT-format-type records. Rewrote and debugged system for greater accuracy and efficiency. Maintained BAL program that converts internal format to SWIFT formattype output. Other Projects Remediated programs for Y2K compliance and recompiled them in COBOL370 to utilize built-in functions and Language Environment calls for modernized date routines. Modified programs to include additional intermediate party data on all money-transfer statements for compliance with Federal anti-money-laundering regulations. Maintained and enhanced date routine of BAL program for extracting data for offsite shipment. October 1994 to April 1995 BROWN BROTHERS HARRIMAN & CO., Jersey City, NJ Consultant Asset & Liability Management System (ALMS) Sweep Project – COBOL II/CICS Developed main portion of Sweep System that debits excess funds from client demand deposit accounts for overnight investment in Federal Funds or offshore (Cayman) deposits, and then returns principal and credits interest on next business day. Client account is credited interest in either cash or notional credit, reduction of monthly maintenance fees. For each account, the house makes the nightly random choice to either book swept funds as liabilities, or to act as client's agent to purchase overnight deposits with other banks. Such agency transactions reduce the firm's balance sheet. Sweep System feeds transactions to Client Accounting System to update balances of client account and offsetting accounts, and keeps ledgers in balance. Worked with internal accounting managers to ascertain system requirements. Wrote system specifications and developed system core. April 1994 to September 1994 AMERICAN EXPRESS BANK, LTD., New York, NY Consultant Corporate Electronic Funds Transfer System (CEFT) OFAC Project – COBOL II/CICS/LU6.2 Made enhancements to on-line global funds transfer system that handles SWIFT and CHIPS payments and suspends posting of payments directed to or through parties named in Specially Designated Nationals list of U.S. Office of Foreign Assets Control (OFAC). System sends name and address fields of payments ready for balance checking and posting over LU6.2 link to VAX computer for match against master file of restricted data maintained by Qualitran software package. Matching payments then placed in suspended status. Coded Qualify sub-system that provides review of each suspended payment which then may be posted or canceled by alteration of payment status, or else deferred for later inspection. Sub-system again sends payment data to Qualitran system to obtain set of matching fields for display above formatted payment detail. S. Landovitz pg 6 June 1993 to March 1994 LEHMAN BROTHERS, INC., New York, NY Consultant Foreign Exchange System – COBOL II/CICS/DB2 Made enhancements to on-line system that manages entry, correction, confirmation, and netting of foreign exchange trades. Modified trade confirmation system to accept VSAM KSDS file of historical trades in place of VSAM RRDS file containing only present day's trades. Rewrote on-line function that produces printed list of trades. Rewrote on-line netted trades inquiry function to display same format as printed list. Ascertained how to program derived rates for dollar-based and cross trades and their dollar or foreign amounts. Modified sub-system that maintains descriptive data, and settlement instructions by currency, for each counter-party. Added extra columns to DB2 table to store alternative settlement instructions effective at future dates. Wrote batch programs to remove expired settlement instructions. October 1992 to May 1993 SWISS BANK CORP., New York, NY Consultant Corporate Netting System – COBOL/CICS/DB2/IMS Developed on-line system that nets foreign exchange trades made over telephone with non-bank, corporate customers. System displays summary lines of net amounts of trades grouped in lots by customer and value (delivery) date. Payment instructions attached to each amount by connection to Payments System. Individual trades marked as confirmed by mass update of DB2 tables and IMS databases. Lot is then marked as paid. Worked with technical liaison manager in developing system requirements. Took part in table redesign, analysis, coding, maintenance and production implementation. February 1992 to October 1992 SHEARSON LEHMAN BROTHERS, INC., New York, NY Consultant Outside Mutual Funds System – COBOL II/CICS Made enhancements to system that manages client portfolios of non-proprietary mutual funds. Modifications enabled system to direct flow of dividends to accounts with unsettled positions purchased prior to dividend record date, and also permit reinvestment of dividends into fractional shares. Consolidated client dividend distribution preference data into file also used by equities systems. Converted Announcements File to convey this data on current basis. Modified on-line daily accrual funds interest rate data-entry system to require entry of separate rate for each day of period between record and payable dates, and to generate report of all user activity. S. Landovitz pg 7 September 1990 to January 1992 AMERICAN EXPRESS BANK, LTD., New York, NY Consultant Client Holdings System – COBOL II/CICS Developed private banking system that consolidates data for each client's portfolio from various investment companies that provide holdings. System provides on-line inquiry of client positions and monitoring and correction of nightly batch input feeds. Produces client statements and reports of balances by branch. Coded on-line programs for user authorization, rejects processing, report selection, and feed status inquiry, and batch programs for input data editing and balance reporting. Designed and coded portions of revenue reporting and inquiry segments of system. May 1990 to September 1990 CITIBANK, N.A., Long Island City, NY Consultant CITISMART Project – COBOL II/CICS Made enhancements to parts of large retail banking system that handles customer service requests. Rewrote programs that reprint non-current bank statements requested by customers, and that transfer statement data older than 13 weeks from magnetic disk to optical storage. Wrote on-line program that provides extra screen of data to new accounts sub-system. Converted PL/I program to COBOL II, in teller machine card replacement sub-system. November 1989 to March 1990 BANKERS TRUST COMPANY, INC., Jersey City, NJ Consultant Globe Net/World Markets Reconciliation – COBOL/VSAM Debugged and made enhancements to batch sub-system of securities custody application that reconciles client account data from New York office (Globe Net Division) and London/Scotland office (World Markets Division). Worked with internal auditors to identify errors in file maintenance and report output. Then, rewrote programs to their satisfaction. Handled analysis, programming, JCL modification, and production implementation. May 1987 to November 1989 AMERICAN INTERNATIONAL GROUP, INC., New York, NY Consultant Microfilm Index Project – COBOL/CICS Developed on-line system that provides index to specific, microfilmed workers compensation insurance statistical documents, and synopsis of them. System accepts input data in batch mode, and provides on-line inquiry, add, update, and delete functions. COMPAS Enhancements Project – COBOL/CICS Developed on-line extension to COMPAS batch system package that generates workers compensation insurance endorsements (changes in policy terms) and statistical documents. Each night in batch, new system recreates VSAM files for on-line system from COMPAS-format files, and generates extra reports. On-line system provides inquiry feature for tracking internal audits and rate changes based on loss experience and actuarial data. Also provides update feature that generates transactions for input to nightly run of COMPAS package to modify data or generate endorsement documents. S. Landovitz pg 8 August 1985 to May 1987 MERRILL LYNCH, PIERCE, FENNER & SMITH, New York, NY Sr. Programmer/Analyst Options Balancing System – COBOL/BAL/CICS/IMS Developed on-line, database application that handles back-office work for order, purchase and sale of equity and index options. IMS database maintains hierarchy of options series, orders, street and customer trades. Three daily cycles occur. In each one: AMEX and CBOE exchanges transmit input to database, then system processes data and transmits output to Options Clearing Corporation (OCC). On-line "breaksheet" application corrects errors between transmissions. Coded modules called by breaksheet processing program that reconcile discrepancies between customer and street trades, including BAL module that identifies transposed numbers. Coded module that monitors status of customer trade transmissions and activates breaksheet file update programs when data has been received. March 1984 to August 1985 FINANCIAL TRADING SYSTEM, New York, NY DREXEL BURNHAM LAMBERT subsidiary Sr. Programmer/Analyst Individual Clearance System – COBOL/CICS Developed portion of large on-line securities trading system being developed for sale as a package. Developed sub-system that provides entry, browse, update, and cancel functions for clearance data for government bonds. VSAM file maintains data pertaining to clearing agent and corporation, firm and customer location, book-entry or physical delivery, and delivery instructions. October 1980 to March 1984 AMERICAN INTERNATIONAL GROUP, New York, NY Programmer/Analyst Risk Management System – COBOL Developed batch system for new Risk Management department. Self-insurance clients remit promissory note in anticipation of claims, and agree to receive future cash settlements for incurred losses only for surplus amount over value of note. Clients also receive accounting, actuarial, and claims processing services. Coded COBOL programs that update VSAM master file and produce reports. Marine Agency System – MARKIV Designed and coded sub-system for yachts as part of larger marine agency system. Maintained premium and claims reporting sub-systems. Met with users, developed and maintained MARKIV programs. EDUCATION May 1980 Columbia Graduate School of Business, New York, NY M.B.A., Accounting and Finance May 1977 Columbia College, New York, NY B.A., Physics