Risk Management and Insurance Orientation For Municipal Officials

advertisement

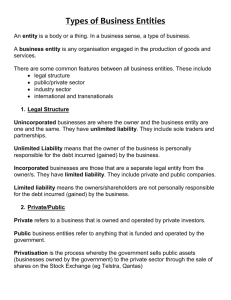

MUNICIPAL LIABILITY COVERAGE OR NOT? Risk Management and Insurance Orientation For Municipal Officials KENNETH J. HEINZ J. PATRICK CHASSAING PETER DUNNE August 22, 2013 Municipal Officials Training Academy WHAT'S SO SPECIAL ABOUT PUBLIC ENTITY INSURANCE AND RISK MANAGEMENT NEEDS? The Distinctive Legal Status of Public Entities and Elected Officials. Public entities face essentially the same liability risks that private businesses and individuals face, except the potential financial losses are public assets and monies. Public entities are protected by sovereign immunity in some situations, and governmental powers are subject to some constitutional limitations that do not restrict private businesses or individuals. Sovereign Immunity, based on old English law and designed to protect public assets, excuses a public entity from nearly any sort of liability. Laws do allow the sovereign immunity defense in some situations but impose varying degrees of monetary caps in an effort to preserve the financial integrity of a public entity while at the same time making it liable for damages it causes to others due to negligence. Missouri has a sovereign immunity statute (Section 537.600 RSMo), meaning there are a significant number of loss situations where a public entity cannot be held liable for resulting injury or property damage. In this statute there are two types of loss situations where the public entity may be held liable but the financial compensation is capped to protect public assets. These "waivers of sovereign immunity" are for 1) a dangerous condition of property and 2) negligent operation of a motor vehicle. The statutory caps are adjusted annually and insurance usually uses the caps as one of its limits of liability. The 2013 limits are $398,638 per person and $2,657,587 per occurrence. There is no annual aggregate. Public officials and employees have certain protection from personal liability and lawsuits— but not under sovereign immunity. Known as either “absolute” or "qualified" immunities, these immunities protect officials and employees acting in good faith and within the scope of their assigned duties. Officials acting in a legislative capacity have absolute legislative immunity and officials acting in an administrative or executive capacity have qualified immunity. Unfortunately the overlapping of governmental and proprietary functions leaves a very gray area for just when you are acting legislatively or administratively, and must sometimes be left to the courts to settle. This is the simplest of explanations for the most basic legal status of a public entity. Newly elected officials should review governmental and proprietary actions with legal advisors. The Distinctive Exposures for Missouri Public Entities and Elected Officials. The common exposure for public entities is the risk of monetary loss - be it general liability for premises and operations, employment practices activities, ownership and use of automobiles, law enforcement activities, medical malpractice, public officials' errors and omissions allegations, or loss of property assets such as buildings and equipment. But there are a multitude of exposures of a public entity to consider: public buildings and access, transportation, security, special events, human resources, contracts, law enforcement, recreational facilities and services, streets/road/bridges, sidewalks, utilities, bidding and other administrative procedures, elections, acts of governance, issuing licenses and permits, managing public funds, planning and zoning As elected officials you must help identify and implement risk management-local governments have a duty to identify and address risks that affect their communities. The Inherent Risks Associated with Providing Public Services. Risk is inherent in the delivery of all governmental services. For example, the activities of police and firefighters obviously are dangerous and involve potential bodily injury, to others as well as themselves. Most entities cannot manage risk by discontinuing a service. An entity cannot just decide to stop maintaining roads or holding elections or planning for disaster recovery. The scope of public sector services is enormous. Even a small city or village may provide a multitude of services, such as the purchase and preservation of physical assets, managing public funds and regulatory oversight, or public works and utilities. The general management procedures of public entities are open to public and political scrutiny much more so than the private sector. Geographically a public entity's footprint may include urban and rural communities, off-themain-road easements and rights of way, and multiple locations — making it the largest landowner in the jurisdiction. Realistically, officials cannot routinely monitor all activities within the public domain. Public entities sometimes lack total control over their own physical environments. During normal business hours for example entities don't restrict access to public buildings. Some public entity services/departments operate round the clock all the time. WHAT IS RISK AND RISK MANAGEMENT? "Risk" can be defined as the chance of a loss. Risk is present in the delivery of all public services, and these risks take a myriad of forms: lost or damaged property, citizen or employee injury, and even less tangible losses, such as the loss of public confidence in your leadership. Some risks have big impact (tornado) and some much less so (stolen office supplies). Elected officials and entity employees are in the risk management business whether they know it or not. "Risk Management" is the way entity officials identify risks, select and implement ways to address those risks in an organized and coordinated fashion, and then monitor for the positive results. Risk Management has several basic goals: To protect public interest To ensure as much as possible uninterrupted operations and services To prevent financial, human, and other types of losses to the entity And, when losses cannot be totally prevented, to ensure that the effect of the losses are as minimal as possible There are four fundamental steps to a good risk management plan: 1. 2. 3. 4. Identify the Loss Exposure Select Technique(s) to Handle Exposure Implement Monitor and Modify STEP 1 - IDENTIFY THE LOSS EXPOSURE: A loss exposure is the possibility of loss, financial or otherwise, whether or not a loss actually takes place. An example of a loss exposure would be a vehicle. It is subject to loss of the actual vehicle and bodily injury and/or property damage to your employee and third parties. You already have the tools to help you identify most of your loss exposures — budgets and other financial reports, asset inventories, inspections, contract clauses and terms, mutual aid agreements, project summaries, and equipment operation manuals, to name a few. Even your insurance provider's loss runs (detailed history of the claims for your entity) can help you spot problem exposures. A very effective way to identify loss exposure is with the entity's personnel — ask them what they do and how they do it. Sources of Risk for Public Entities: Physical Environment: Legal Environment: Operational Environment: Political Environment: Social Environment: Economic Environment: Cognitive Environment: weather, acts of God federal, state and local laws, legal precedents day-to-day activities legislative activity, elections cultural composition of community, social attitudes market trends, interest rates absence of information, attitude of individuals toward risk Example: Legal Environment Source of Risk: Federal Laws > ADA Requirements >Non-Compliance> Discrimination Lawsuit Example: Physical Environment Sources of Risk: El Nino > Heavy Rains and Thunderstorms >Water Over Road > Vehicle Loss Each of these Sources of Risks produces one or more types of losses. These types of losses are interrelated in that many accidents and claims involve several types of losses. The five basic types of losses for public entities are: Property Losses: Accidental loss or damage to both real and personal property. Losses may result from a number of causes such as carelessness, natural disasters, faulty equipment, fire and theft. Additional Expenses: After some losses local governments must incur additional expenses to function normally or to maintain services. Additional expenses could result from cleanup or repair of damaged property, overtime, or hiring and training replacement personnel. For example, if a bridge is destroyed during a storm, the local government would not only have to pay for replacing the bridge, it would also assume costs for cleaning up any debris and for rerouting traffic until a new bridge is built. Loss of Income: This exposure is often overlooked. Many local governments operate revenue-generating facilities such as recreational centers, ballfields, and festivals. If these facilities were destroyed or damaged the jurisdiction would lose the income that they normally generate. Local governments also receive income through taxes, charges for services, licenses and permits, fines and other sources. Any disruption in a public entity's ability to collect this revenue could create a financial loss. Tornados, such as the ones in Joplin, can ruin businesses whose tax generating ability are essential to the City’s budget. Workers Compensation: Job-related illnesses and injuries can cause not only direct losses stemming from medical and hospital expenses but also indirect costs of replacing workers and from decreased productivity until workers return to work or new employees are trained. Governments are liable for workers’ compensation liability the same as an employer in the private sector. Liability to Others: The risk of liability claims resulting from injuries and property damage is one of the most serious loss exposures faced by public entities. A private citizen or company may claim a loss because of the actions of any employee or a public official. Claims may arise out of intentional acts or unintentional negligent acts. Many public entities are exposed to contractual liabilities since many jurisdictions contract for services and products and enter into cooperative service agreements and mutual aid arrangements with other local governments. STEP 2 - SELECT TECHNIQUE(S) TO HANDLE EXPOSURE: There are four basic techniques to manage the exposures you identified for your entity, and using at least two, and sometimes three, is the most effective way to handle each exposure. These four are: Risk Avoidance: One of the primary differences between private and public sector risk management is the ability to avoid risk. Because of regulations, public demands, or political pressures, public entities usually do not have an option to avoid inherently dangerous exposures. Police and fire are obvious examples of this point. Occasionally a local government can avoid risk by deciding not to undertake a project or activity that creates a new risk. For example, a town may decide not to build a skatepark because of the safety and liability exposures involved. On the other hand, avoiding one risk may create others. If the town does not build a skatepark, kids may ride skateboards on public streets and sidewalks, endangering themselves and others. So officials should always review the benefit of a project or activity in relation to increased risk and cost of loss. Risk Reduction: Risk reduction does not prevent losses from occurring — it minimizes the impact of losses that do occur. This technique is most often used for Workers Compensation. Rarely are officials diligent about reviewing the technique for property and liability exposures. For example, a seasonal worker hired to mow roadsides is given safety goggles, ear plugs, and instructions on how to use mower — but may never be told to mow away from the road to prevent throwing trash and rocks that crack windshields. The most effective way to employ this technique is to have officials and employees respond to this question: Based on what you know now about the potential for loss and circumstances of any loss that has occurred, what are you currently doing or not doing in your day-to-day activities that, if changed, might reduce the likelihood of a loss? Loss Control: Reduction concentrates on the potential for a loss. Control acknowledges that losses will occur and a risk management technique is needed to contain the costs and impact of those losses. It is essentially the effective administration of a loss exposure. Public entities usually focus on the same loss exposure categories when employing this technique: natural disasters, employee health and safety, and automobile liability. While these exposures may produce severe (expensive) losses, the frequency is comparatively low. Officials should review loss control for both high severity/low frequency losses and low severity/high frequency losses, because both can impact an entity's financial status. Risk Transfer: The most used method of risk management is to transfer the risk. The two most common ways to transfer risk are contractual transfer and buying insurance. It is normal business practice for mortgages and other contracts to include clauses that make one party responsible for any financial loss incurred regardless of fault. And with the purchase of insurance, an entity transfers the uncertain risk of financial loss to the insurance provider. Unfortunately, sometimes entities believe this transferring of risk nullifies any need for risk management. STEP 3 - IMPLEMENT RISK MANAGEMENT PROGRAM: Although a combination of risk management techniques may be reviewed by entity officials, more often than not only one technique gets implemented — buying insurance. There are several reasons for this: sometimes reduction and control techniques require more time and perhaps expense to implement; officials are uncertain about their understanding of the potential risk; or they simply do not know how to implement a risk management program or where to go for assistance. Larger entities often have access to risk managers, but it is more usual for a midmanagement employee to take on the risk management role. Effective risk management begins at the management level. Top officials must set the tone and hold others accountable. At a minimum, officials should establish a risk management policy statement and oversee ways in which accountability can be maintained. In lieu of a full-time risk manager, officials should seek information and assistance from insurance agencies and providers. The internet offers multiple sites offering risk management tools. Other entities and entity associations will have risk management information. Well run insurance companies often offer assistance in establishing risk management programs. STEP 4 - MONITOR AND MODIFY: Once a Risk Management Plan has been determined and implemented, it should not be forgotten. Routine and random monitoring of the risk management techniques employed will reinforce the importance of risk management within the infrastructure, and will help officials evaluate the cost-to-risk involved. To effectively monitor a risk management program, officials might schedule routine meetings with their insurance representatives (agents and provider) to review loss experience and subsequent actions. Establishing a safety committee could be useful, but may not be productive as a risk management technique if it does not include some personnel with insurance coverage expertise. Reviewing incident reports, following a loss development from incident to settlement (not just lawsuits), even reviewing the minor details with the employee or official involved should be most helpful. Ask your entity’s various departments to assist in monitoring risk management techniques. For example, if the city fire department does routine inspections, officials could review those for potential building risks; public works personnel are well informed about the maintenance required for their equipment. Make supervisors part of the risk management team and hold them accountable for monitoring their department's cost of risk. Give them reports on deductibles and how much of a good/bad loss experience can be attributed to their department. Officials often do this for workers compensation, even though the average workers compensation losses are much smaller and have less financial impact on an entity than third party losses, i.e. losses to others caused by the actions of the entity. Flexibility is vital to a productive Risk Management Program. There will always be exposures that become obsolete — and new exposures will be added. Procedures and processes, along with inherent liability risk, will change with technology. Legal precedents and new laws and regulations may set up more or less potential for financial loss. The attitude toward risk management may change as the results of a good risk management plan are noted, or with the eventual turnover of new officials and employees. Even the impact of a catastrophic loss that could have prevented will influence the modification of a poor risk management plan. Coverages, both those available and those that become unavailable, will influence a risk management program. Cyber exposure is a good example of a developing risk potential that is causing many risk management programs to make significant adaptations. Flexibility is also important to the ongoing commitment to risk management. When money is available it is easy to implement loss prevention tools such as training and maintenance programs. But as money tightens up it becomes even more important for officials to adhere to a risk management plan. Instead of doing away with loss prevention tools, look at revising the plan. As budgets tighten, the cost of loss increases in value to a claimant. An entity's risk management program should be reviewed by officials at each coverage renewal. INSURANCE COVERAGES The insurance policy sets out the contractual obligations of two parties, the insured and the insurer, in a loss-sharing arrangement. The insured pays a known (presumably affordable) sum of money (premium) in exchange for the insurer paying unknown and potentially catastrophic sums of money in the event of a covered loss. In general, there are two major types of insurance coverages that might be referenced in a policy or coverage form — liability and property. And there are two primary criteria for coverage to apply — legal liability and insurable interest. Liability Coverages: A liability policy is a “third party” coverage, meaning that the financial reimbursement following a loss is not made to either the insured or the insurer, but to a third party who has incurred bodily injury or property damage because of the actions or inactions of the insured. The criteria for coverage to apply is that it be a covered loss under the terms of the policy and that the insured entity is determined to have Legal Liability for the loss. In the simplest of tests for legal liability: 1) there must be a duty of care obligation; 2) there must be negligence, or a breach of that duty of care obligation, by the insured (official or employee); 3) there must be bodily harm or property damage; and 4) the bodily harm and/or property damage must be a result of negligence. Sometimes the determination of legal liability is easily discernible and sometimes it takes a court of law to establish legal liability. General Liability is a primary coverage and forms the foundation for other primary and minor coverages attached to it. There can also be optional coverages associated with liability. Here is a list of the liability coverages usually made available: General Liability Employment Practices Liability Employee Benefits Liability Public Officials Errors and Omissions Liability Law Enforcement Liability Automobile Liability Automobile Physical Damage Auto Medical Payments Uninsured Motorists Liability Hired and Non-Owned Auto Liability Medical Malpractice Garage Keepers Liability Other than General Liability, the primary coverages include: Public Officials Errors and Omissions Liability — Covers defense costs for claims alleging negligent action or inaction, mistake, misstatement, error, negligence, inadvertence, or omission by a covered party in the discharge of an official's or employee's duties. Employment Practices Liability — Covers employment-related losses such as discrimination, harassment, wrongful termination, retaliation, and other workplace torts. Law Enforcement Liability — Coverage includes jail premises and operations. Covers any lawfully elected, appointed or employed officer and includes discrimination, violation of civil rights, sexual harassment, auxiliary/reserve officers, bike patrols, animal control, and canine officers. Automobile Liability — Covers bodily injury and property damage claims from a third party alleging negligent operation of a motor vehicle. Auto Physical Damage —Covers physical damage to your entity’s scheduled vehicle. Who is Insured: The insured is defined as the legal entity; any past, present or future elected/appointed officials acting within the scope of their duties; past, present, and future members of boards/committees, commissions acting within the scope of their duties; employees; and authorized volunteers. What is the Limit of Liability: Some liability coverages and/or losses are subject to the statutory Sovereign Immunity waivers. The caps are most applicable to General Liability losses for the "known dangerous condition of property" and to Automobile Liability for "negligent operation of a motor vehicle". The limit of the coverage is controlled by the statutory capped limit in effect at the time of the occurrence. Deductibles: Deductibles are a risk management tool to help control losses and to keep the cost of coverage down. When an entity opts to retain a certain portion of a potential loss there is more emphasis within the infrastructure to control those types of losses. When a company mandates a deductible on a line of coverage, it is asking the entity to establish a risk management plan for those kinds of losses. When an entity does take on more of the cost of loss, the insurer can apply credits to reduce the entity's cost of coverage. Exclusions/Extensions/Conditions: Exclusions, Extensions and Conditions are always a part of an insurance policy, and should be carefully reviewed by officials. Insurance policies are written with a beginning, a middle, and an end. Typically the beginning describes what is covered in very broad terms. In the middle, the exclusions “take away” some significant aspects of that broad coverage. Then the extensions give back a little and may even add some additional coverage. The conditions at the end give the contractual terms both the insured and insurer have agreed to. Property Coverages: A property policy is a “first party” coverage, meaning that the financial reimbursement following a loss is made to the insured for a covered loss. The purpose of property coverage is to put an insured back in the same position as it was before the property loss. The criteria for coverage to apply is that the loss be a covered loss caused by a covered peril and the insured entity have Insurable Interest in the property covered by the policy. Sometimes other entities also have an insurable interest in the condition of covered property, in particular mortgagees and loss payees. An entity often has to provide a Statement of Coverage to show the third party interest in insured property. Property is very specific coverage — more tangible than liability. Usually covered property must be scheduled to be covered. This means any item of property you desire covered must be listed, described, and valued. Like liability, property has ancillary coverages included, or which may be added. Here is a list of typical property coverages written or available for your entity: Buildings/Structures Contents Earth Movement Flood and Water Damage Electronic Data Processing Equipment and Media Business Interruption Extra Expense Contractors' Equipment Other Mobile Equipment Cost of Construction (Builders Risk) Equipment Breakdown Debris Removal Fine Arts/Accounts Receivable/Valuable Papers and Records Crime (Computer Fraud, Employee Dishonesty, Forgery, Money & Securities) Additional property coverage extensions and options are listed in the Coverage Highlights in the appendix. Valuation is very important on a property policy because you do not want to under -or-over insure your properties. So policy language should be reviewed to understand how a property loss would be reimbursed to you. Property coverages have several different options for loss payments in the same policy; replacement cost, actual cash value, and time element are the most common. Your property valuation for buildings/structures/contents may be 100% Replacement Cost with a 15% Margin Clause. The limit of coverage you put on the schedule should be 100% of what you would need to replace the property in the event of a covered loss. Material costs and labor are always fluctuating, so the 15% Margin Clause pays you an additional 15% of the limit in the event of a total loss. In addition, to help maintain values, a 5% Value Protection Guard is automatically added to the scheduled limit of each building/structure at renewal. These provisions should not interfere with a seasonable review by appropriate entity personnel to ensure valuations are reasonably accurate. Scheduled Contractors and Other Mobile Equipment losses are valued at “Actual Cash Value.” Thus, a truck purchased in 1999 at a cost of $50,000, may only warrant a pay out at $5,000 if subjected to a total loss in 2013. It is important for officials to review property and equipment values at each annual renewal. There are some property losses that are valued in terms of a time element. For example, Service Interruption is covered starting at the time the interruption occurs and ending when services are fully restored, but only for the hours during which the entity would have used such services if they had been available. Extra Expense is provided only for the time the entity cannot use scheduled premises because of a loss. Property Perils: The magnitude of what might cause total or partial damage to scheduled property is enormous. And some causes of property damage are unseen and may take place over an unknown period of time before discovery. Basic covered perils are usually: Fire Lightning Explosion Windstorm or Hail Smoke Aircraft Vehicle Riot/Civil Commotion Vandalism Sprinkler Leakage Sinkhole Collapse Volcanic Action Falling Objects Weight of Ice, Snow or Sleet Water Damage The Exclusions/Extensions/Conditions in a property policy are even more important to review to gain a thorough understanding of what is covered. In addition to coverage exclusions, a property policy will have types of property excluded. For example, money and precious metals are types of property typically excluded from coverage. Property coverage extensions add, then modify and/or restrict, some of the most desired property coverages for a public entity. In the MOPERM Property Memorandum of Coverage, the coverage extensions are listed and then defined, explained, modified, and/or restricted in the actual coverage document. LOSS REPORTING/CLAIMS ADMINISTRATION: The insurance coverage document is a contract between an insurer and insured. As with most contracts, there are conditions and obligations assigned to each party and certain requirements to be met by the entity in the event of an occurrence, claim or lawsuit. None of these requirements are onerous but should be reviewed by officials. For the insured, the most important requirements in the event of an occurrence, claim or lawsuit are: Report occurrences and claims promptly to insurer. Officials and employees should not make any commitments to pay. Send all information available but don't delay reporting by waiting on police reports or estimates. A specific date of loss must be provided on claim forms. Provide as much information as possible regarding the occurrence or claim. Protect property from additional damage. Protect undamaged property from becoming damaged. When notified of an occurrence, claim or lawsuit, the insurer’s responsibilities include: Reviewing submitted information about the loss. Making prompt contact with the entity representative and claimant (if applicable). Assigning a qualified contracted field adjuster to investigate the loss circumstances. Negotiating loss settlement according to the insurance coverage documents. Litigation Management: The insurer typically has approved qualified law firms throughout the state which have experience in the types of lawsuits filed against public entities. Those firms are familiar with the various immunity defenses that may be applicable. Under the terms of most policies of insurance, the insurer retains the right to select counsel to handle covered lawsuits filed against member entities, as well as the right to determine how expenses of the claim are to be managed and whether to settle the claim, and for what amount. These policy rights are extremely important to the insurer, but can have significant consequences to the entity. LAWSUIT TO DO LIST There are several actions the entity must take with respect to lawsuits brought against it: It is essential that the entity refer lawsuits to the insurer promptly upon receipt. The exact date of service, the method of service (e.g., sheriff’s office deputy, or private process server) and the individual entity employee or representative should be noted and promptly provided to the insurer so that its assigned legal counsel will know when an answer is due with the court. It is recommended that a call to the insurer’s claims department be made, and the identity and address of the appropriate individual to which the suit papers are to be delivered. While there is a growing trend toward the use of electronic communications (email, even texting), the initial transmittal of suit papers to an insurer should be done in writing and by certified mail with a request that receipt of the suit papers be acknowledged. Once receipt of the suit is acknowledged, more expedient electronic communications can be considered. The insurer’s first step will be to make a decision about whether the claim is covered and whether it will provide a defense. As discussed elsewhere in this presentation, there are a variety of risks which can be covered by insurance. Some covered losses or claims will be obvious, both to the entity and to the insurer. Others may be less so. So, the insurer’s first step will be to review the language of its policy. If it is satisfied it has provided coverage for a claim, it will inform the entity that it has accepted coverage and identify the law firm to which it is referring the litigation for defense. This is sometimes referred to a s the insurer’s decision to provide a defense without a reservation of rights. The insurer’s obligations when denying coverage or defense. If the insurer believes the claim is not covered, it is responsible to promptly notify the insurer of its coverage denial and to identify its reasons for the denial of coverage. This may include taking a position that the type of claim is simply not provid ed for under the coverages in the policy(ies) it has issued to the entity. Also, it may determine that the type of claim apparently falls within the terms of a specific “Exclusion” set forth in the policy and will not provide indemnity (i.e., pay for the damages), but may provide a defense to the entity with what is known as a “reservation of rights,” meaning it is not accepting responsibility for paying any judgment or settlement on the claim. Typically, however, if the insurer finds there is no coverage, or that an exclusion squarely applies, it will deny coverage and refuse to provide a defense. When there is a denial or reservation of rights, get the city attorney involved. Whenever there is a denial of defense or of indemnity, it is imperative that the entity’s general counsel (e.g., city attorney) be made aware of the denial. When an insurer denies coverage, the insured entity may then manage the litigation as it sees fit as long as it acts in good faith and does so without collusion. The reference to “collusion” means improper defense of a claim or imprudent settlement with the claimant, with an understanding that the claimant will look solely to the insurer to collect on its judgment. State law (Section 537.065, RSMo) provides parties with specific rights to enter into a settlement which limits recovery to certain assets or insurance contracts, provided the settlement is not collusive. Such settlements may be in the entity’s best interests to protect it from having to subject its own assets to satisfaction of a judgment. If the entity’s general counsel determines the denial of defense or coverage is inappropriate, the best course is to nonetheless keep the insurer informed of the manner in which the case proceeds, to make and repeat demands for defense and indemnification, and to report settlement efforts. By denying defense or coverage, the insurer has no longer has right under the policy to control case strategy, defense costs, or settlement, but nothing is lost by keeping it informed as things proceed, and it may re-think its denial. An excellent case on the denial of defense and reservation of rights is Butters v. City of Independence, 515 S.W.2d 418 (Mo. 1974). A copy is in the handout materials. One option available to the entity and to the insurer is to seek a declaratory judgment with regard to the issue of coverage. General points about coverage denials. The decision regarding coverage must be based on the way the plaintiff has pleaded his/its lawsuit. It is often the plaintiff’s specific strategy that his/its claim is pleaded in such a way that at least part of the overall claim will fall within the entity’s insurance coverage. It is not a proper basis for denial of defense that a particular defense which is available, or that another set of facts will be established that would take the claim outside of the coverage provided in the policy. A very recent case involving claims based on alleged violations of the Telephone Consumer Protection Act (47 U.S.C. §227 et seq.) was handed done by the Missouri Supreme Court in a unanimous opinion in Columbia Casualty Company v. HIAR Holding, L.L.C., et al, No. SC93026, Slip Op. August 13, 2013. The lengthy opinion may be found at www.courts.mo.gov, using the link to Opinions & Minutes, then selecting the 08/13/2103 tab. It outlines the very deft strategy of the City of Independence after its insurer denied coverage of the a class action based on TCPA claims as uninsured because the statutorily afforded damages constituted penalties or fines. The opinion outlines the city’s ongoing communications to the insured, its repeated demands for defense and indemnification, and its eventual resolution of the class action via a settlement that limited the class’s recovery to the city’s insurance coverages. APPENDIX COMMON INSURANCE TERMS: Agency/Producer A member may have an independent insurance agency representing it for all or any part of its coverage. A Producer is the individual who works for the agency. Agent of Record Is an insurance term denoting the agency representing a member. In the event a member wishes to change its agency representation, there is a certain process to be followed including timelines. Actual Cash Value Replacement cost of property at time of loss, less depreciation based on age, condition, time in use, and obsolescence. Additional Insured Person, business or entity, other than the member, that is protected by the member's coverage, often in regard to a specific interest or event. Aggregate Limit The maximum dollar amount of coverage in force. Contribution Means same as "premium". Direct Liability Member An entity having no agency representation for its liability coverages Endorsement Form attached to a policy that adds, subtracts or modifies coverage. Loss Adjustment Expense Costs involved in the investigation and settlement of a claim. Loss Ratio Compares premiums paid to losses paid — helps underwriter determine the potential cost of loss a member might have —calculated by dividing total amount paid on losses by the total amount of premium paid. Memorandum of Coverage The insured’s coverage document. Occurrence See definition in policy forms under "Special Words and Meanings" Package Account Having both liability lines of coverage and property lines of Coverage. Prior Acts Necessary for covering a claim made during a current policy period for an event that happened before a policy was in force. Replacement Cost Cost to replace without deduction for depreciation. Reservation of Rights Letter Notification to a member that coverage for a claim may not apply and that determination is subject to our investigation without waiving our right to later deny coverage. Time Element Loss Loss resulting from an inability to use a property for a specific length of time. TABLE OF PERTINENT CASES Columbia Casualty Company v. HIAR Holding, L.L.C., et al, No. SC93026, Slip Op. August 13, 2013. Butters v. City of Independence, 515 S.W.2d 418 (Mo. 1974) United States Fidelity and Guaranty Company v. Housing Authority of the City of Poplar Bluff, Missouri, 885 F. Supp. 194 (E.D. Mo. 1995), affirmed, 114 F.3d 693 (8th Cir. 1997). Topps v. City of Country Club Hills, 272 SW3d 409 (Mo. App. E.D. 2009). Kunzie v. City of Olivette, 184 SW3d 570 (Mo. banc 2006). Epps v. City of Pine Lawn, 353 F.3d 588 (8th Cir. 2003). MOPERM COVERAGES Liability Coverage Highlights Liability coverage that can be provided by MOPERM includes General Liability, Public Officials Errors and Omissions Liability, Employment Practices Liability, Law Enforcement Liability, Automobile Liability, and Physical Damage. Liability coverage is provided on an "occurrence" basis and is divided into two parts to recognize statutory defenses. The MOPERM Liability Coverage Form is the only one written specifically for Missouri public entities. 1. Protects members against claims established by Missouri law. It is limited to claims for which immunity has been waived. The waivers are (1) known dangerous condition of property, and (2) negligent operation of a motor vehicle, the MOPERM limits applicable to this coverage part are the Sovereign Immunity caps established by RSMo 537.610. 2. Protects members against claims other than those established by Missouri law. It also protects public officials and employees for all types of claims (subject to coverage exclusions). The MOPERM limit for these claims is $2,000,000 per occurrence with NO ANNUAL AGGREGATE. Liability coverages include: Exposure Premises Operations Contractual Liability Broad Form Property Damage Personal Injury Employees and Volunteers Defense in Addition to Limits Supplemental Defense Costs Pay On Behalf Duty to Defend Boards, Commissions, and Committees Liquor Liability Included/Optional Included Included Included Included Included Included Included Included Included Included Included Additional Costs Exposure Watercraft under 26' Special Events/Fireworks Skateparks Sewer Backup Legal Liability Sewer Operations Failure to Supply Employment Practices Liability Discrimination Violation of Civil Rights Sexual Harassment Wrongful Acts incl Wrongful Termination Employee Benefits Liability Prior Acts Coverage Planning and Zoning Jail Premises/Operations K-9 Officers Meth Officers Meth Mobile Response Units Police Ride-Along Programs Non Owned/Hired Auto Liability Uninsured Motorists Liability Auto Med Pay All Other States Minimum Coverage Requirements Fellow Employee Exclusion Incidental Med Malpractice IEP (Due Process) for Schools GarageKeepers Liability Aquatic Centers/Swimming Pools with Diving Boards Entity-Sponsored Day Camps Entity-Sponsored Websites Included/Optional Additional Costs Included Included Included Included Included Included Subject to coverage conditions — No Additional Charge No Additional charge Included Included Included Included Included Optional Coverage Optional Coverage Optional Coverage Included Included Included Included Included Additional Charge Additional Charge Additional Charge Additional Charge Included $50,000 included Optional Coverage Additional Charge Included Included Optional Coverage Optional Coverage Optional Coverage Additional Charge Additional Change Additional Chafe Included Included Included As is typical with traditional liability policies available for public entities, the MOPERM Memorandum of Coverage excludes certain exposures. These exposures may remain uninsured or they may be covered by a separate policy purchased from commercial carriers. Such excluded exposers include: Aircraft Physicians Malpractice Airport Operations Hospital Malpractice Watercraft over 26' Pollution Workers Compensation Nuclear Hazards Fines, Punitive Damages or Injunctive Relief Eminent Domain/Inverse Condemnation Coverage Placement Requirements: The following coverages must be placed together: General Liability, Public Officials Errors and Omissions, and Employment Practices. If the entity has Law Enforcement or Medical Malpractice exposures, these liability coverages are required to be placed with MOPERM. Property Coverage Highlights: Property coverages provided by MOPERM include Real and Personal Property, Equipment Breakdown, Business Interruption, and Crime. MOPERM does not have a co-insurance requirement or penalty for property values. A 15% Margin Clause Endorsement provides for a total loss payment up to 15% more than the scheduled value of a building or contents. In the event of a loss, MOPERM will use the following valuation basis: Property Damage Time Element Contractor Equipment Mobile Equipment Replacement Cost Actual Loss Sustained Actual Cash Value Actual Cash Value Equipment Breakdown coverage includes state inspection requirements. Earthquake and Flood Damage coverages are included. MOPERM does not provide blanket coverage. Exposures must be scheduled to be considered covered. A Crime Endorsement includes Employee Dishonesty including Faithful Performance, Computer Fraud, Forgery and Alteration, and Money and Securities. The limit is $5,000 for each of the coverages. Full Crime coverage includes Employee Dishonesty including Faithful Performance, Computer Fraud, Forgery and Alteration, and Money and Securities. Higher limit option and deductible options are available. Property coverages include: Coverage Deductible Included/Optional Buildings/Structures Contents Earth Movement Flood Damage Water Damage Accounts Receivable Automatic Coverage Brands and Labels Consequential Reduction in Value Contractor Equipment Other Mobile Equipment Cost of Construction (Builders Risk) including Soft Costs and Transit Debris Removal Decontamination Costs Demolition and Increased Cost of Construction Electronic Data Processing Equipment and Media Errors & Omissions Equipment Breakdown Exhibitions, Fairs and Trade Shows Fine Arts Fire Department Service Fees Land and Water Cleanup Misc Unnamed Locations Per schedule Per schedule Fixed Dollar Fixed Dollar Per schedule Per schedule Per schedule Per schedule Included Included Included Per schedule Included Included Per schedule Per schedule Included Per schedule Per schedule Condition Additional charge 90-day reporting must be scheduled must be scheduled Included Included Included Included Per schedule Per schedule Per schedule Per schedule Included Included Included Per schedule Included Included Included Additional charge 6 Coverage Professional Fees Protection & Preservation of Property — Time Element Service Interruption Temporary Removal of Property Terrorism $2,500,000 limit Transportation Valuable Papers Extra Expense Ordinary Payroll 90-days Business Interruption Expediting Expenses Rental Insurance Contingent Time Element Impounded Water 30 days Ingress/Egress Deductible Included/Optional Condition Included Included Included Per schedule Included Included Included Per schedule Included Included Per schedule Included Included Included Included Included Additional Charge Additional Charge ** This explanation of MOPERM coverage and much of this seminar is based on a risk management seminar prepared by Jenny Morrison of MOPERM. Thanks to her for letting us use much of it. LIST OF MUNICIPAL INSURERS OR POOLS and CONTACTS Interested entities may contact Policy Administration Manager, Brenda Gibson. Her contact information is brenda-gibson@moperm.com or 888-389-8198 ext 127. or Jenny Morrison, CISR MOPERM Risk Management 1-888-389-8198 ext 123 jenny-morrison@moperm.com Steve Wicker Daniel and Henry Company 1001 Highlands Plaza Drive West, Suite 500 St. Louis, MO 63110 314-444-1937 wickers@danielhenry.com 7 Matthew Brodersen Executive Director 3002 Falling Leaf Ct Columbia MO 65201 (573) 817-2554 (573) 441-0515 fax mbrodersen@mirma.org