from operations

advertisement

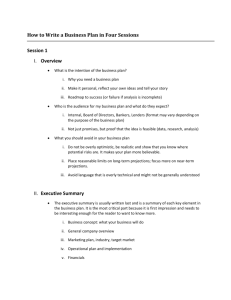

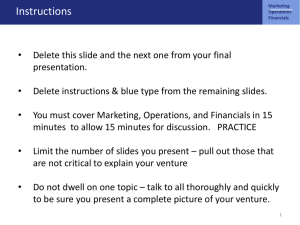

Instructions Marketing Operations Financials • Delete this slide and the next one from your final presentation. • Delete instructions & blue type from the remaining slides. • You must cover Marketing, Operations, and Financials in 15 minutes to allow 15 minutes for discussion. PRACTICE • Limit the number of slides you present – pull out those that are not critical to explain your venture • Do not dwell on one topic – talk to all thoroughly and quickly to be sure you present a complete picture of your venture. 1 Instructions Marketing Operations Financials • Feel free to change the font, but make sure it is legible. • Don’t use a font size less than 20 points—your audience will not be able to read it. • You can change the background and format, but make sure your slides are easy to read and cover the content. • We encourage you to use a light color for the background and a dark color for your text. • Be consistent in the punctuation of your slides. • Check your spelling. 2 Marketing Operations Financials Venture Name Here Venture Team Member Names Here Venture Description Marketing Operations Financials Company: Insert the complete first sentence of your venture description. First Product: Describe your first product (service). Target Market: Describe the target market for first product (service) and the size of this market. Future Products: Briefly describe future products (services) (Use your Idea Fair slide here) 4 Marketing Operations Financials Marketing Plan Venture Name Here Marketing Strategy Marketing Operations Financials Category: Describe the category in which you compete. Key Benefit: Describe the key benefit that will be the focus of your product platform and explain why this benefit matters to your target segments. Benefit Rationale: Describe the rationale for the key benefit you have selected Customer Appeal Competitive Differentiation 6 Marketing Strategy Marketing Operations Financials Brand Promise: Your Brand Promise Here. Rationale: Explain how this promise articulates your key benefit to your target customers and gives them a compelling reason to buy from you instead of from your competitors. Brand Name: Your Brand Name Here. Rationale: Explain how your brand name is designed to reinforce your brand promise in the minds of target customers. 7 Marketing - Strategic Pillars Marketing Operations Financials Strategic Pillars In one sentence each, describe your pillars. Give each pillar a label. Be prepared to explain how your pillars relate to your brand promise. • Pillar 1 Label: One sentence explanation. • Pillar 2 Label: One sentence explanation. • Pillar 3 Label: One sentence explanation. (be prepared to explain why these are your strategic pillars to mentors) 8 Marketing - Strategic Pillars Marketing Operations Financials Product Platform In one sentence each, describe your product line (the products in your product platform).. • Product 1 Label: One sentence explanation. • Product 2 Label: One sentence explanation. • Product 3 Label: One sentence explanation. (be prepared to explain the key attributes/features of each product/service to mentors and how these products will reflect your strategic pillars) 9 Marketing Strategy Marketing Operations Financials Primary Target Describe your primary target, which refers to the potential customers who will be the focus of your marketing efforts in Year 1. Secondary Targets Describe your secondary targets, which are the customer groups once you will approach after Year 1. Explain when you expect to start aggressively marketing to each secondary target. Secondary Target 1 Secondary Target 2 (use photos etc to describe your customers and their charactertistics ) 10 Pricing Strategy Marketing Operations Financials Pricing Strategy For each product or service in your product platform, identify your price and explain why target customers will buy from you at the retail prices you have chosen. • Product/Service 1 • Product/Service 2 • Product/Service 3 11 Distribution Strategy Marketing Operations Financials Distribution Strategy • Year 1 Channels How will first year target customers obtain your product or receive your services? Where will they go? From whom will they buy? • Channel Expansion When and how will you expand your distribution over time? • Partner Motivations (if relevant) If you are selling through other firms, explain why these firms will carry your products or offer your services. How much money do they make on each unit they sell? How does this compare with the money they make selling 12 competitive products? Communication Strategy Marketing Operations Financials Communication Strategy: Primary Target • Tool 1: Describe fit with primary target, your customization of the tool to focus on your primary target, and cost. • Tool 2: Describe fit with primary target, your customization of the tool to focus on your primary target, and cost. • Tool 3: Describe fit with primary target, your customization of the tool to focus on your primary target, and cost. (List the key tools you will use to reach your primary target (e.g., a web site, e-mail marketing, a sales force, trade shows, ads, public relations, etc.). 13 Marketing Operations Financials Operations Venture Name Here Operations Strategy Marketing Operations Financials Materials: What are the important goods and raw materials you will need to create and deliver your products or services? Be sure to address: • Prices, shipping costs, and payment terms; • Minimum order sizes (is there a minimum required order size?); and • Estimated time between orders and deliveries. Your estimates should reflect the time required for: • Subcontractors to obtain needed materials; • Manufacturing (if relevant); and • Shipping from subcontractor to your firm (Modify the above elements if you need to better reflect the nature of your operations) 15 Operations Strategy Marketing Operations Financials Production: •Given your revenue estimates, how much will it cost you to produce the products or deliver the services that will generate these revenues? Be sure and include the cost of packaging. •How many labor hours will be required to produce these products or deliver these services? •How much will this labor cost? (These are recurring variable costs – not your startup or one time product development costs) 16 Operations Strategy Marketing Operations Financials If You Are Outsourcing Production or Services: •What is the rationale for outsourcing? •What are the costs (including costs of changes in your product line & the costs of vendor management)? •How will you ensure quality? •Timely delivery (production & shipping times) •What will you do if your supplier can’t deliver or goes bankrupt? Plan B? •How will you protect your intellectual property? 17 Operations Strategy Marketing Operations Financials Order Fulfillment • How will you fulfill orders from customers? • How much staff time will order fulfillment require? • What is the cost of preparing goods for shipping (materials and labor)? • What are shipping costs? • If you outsource order fulfillment, how much will this cost? How quickly will orders be filled? 18 Operations Strategy Marketing Operations Financials Customer Service • What customer services will you provide (e.g., training, user support, and handling complaints, returns, and repairs)? • How much will the provision of these services cost? • How much staff time will these services require per month? 19 Operations Strategy Marketing Operations Financials Team Members • Backgrounds • Fit • Roles and Responsibilities 20 Marketing Operations Financials Financial Model Venture Name Here Venture Team Member Names Here Key Assumptions Marketing Operations Financials 1. Size of target market + % of customers aware of your venture + % of those aware who you expect will buy from you 2. Your costs to produce a salable unit of your solution, the price your customer pays, the gross margin you get 3. The quantity of product/services you can make ready to sell each quarter, each year 4. Your costs to sell product in Year 1/2/3/4/5 5. Your sales growth each year. How fast you will reach new customers, how much you will grow revenue for each customer 22 Five Year Revenue Forecast Marketing Operations Financials For each revenue stream, forecast sales monthly for the first five years (monthly for Years 1 and 2, quarterly for Year 3, annually for Years 4 and 5). 1) List your total number of customers in each time period. 2) List the total units sold of each product or service in each time period. 3) Compute dollar sales of each product or service in teach time period Finally, for each time period, compute total revenues by summing the revenues from each of your revenue streams. 23 Marketing Operations Financials Startup Expenses DEPRECIABLE ASSETS Machinery/Equip/Office Computer & Related Equip Buildings Leasehold Improvements Other TOTAL EXPENSE ITEMS (short term) Supplies Legal & Accounting Rentals/Leases/Utilities Temp Employees/Contractors TOTAL WORKING CAPITAL (initial current assets) Supplies Inventory Product Inventories Prepaid Expenses TOTAL TOTAL STARTUP EXPENSES Operating Exp x 4 Months Prod/Serv Cost of Sales x 2 Months TOTAL ACCOUNTS PAYABLE Short Term Debt Long Term Debt Equity Investment Before Pmt of Expense Items TOTAL Your one-time development costs for your market ready solution • Equipment • Materials • Employee time • Outsourced services for product development • Rent & facility costs • Web design / software • Other things ? 24 Marketing Operations Financials Income Statement Year 1 Year 2 Year 3 Year 4 Year 5 NET SALES DIRECT COSTS CONTRIBUTION MARGIN CONTRIBUTION MARGIN % GENERAL & ADMIN COSTS Salaries/Consult/Fees Rent Marketing All Other Expenses Total G&A Expenses EBITDA EBITDA % Breakeven Revenue Cumulative Net Income Cum Net Inc – StartUp Costs Non Discount Payback (Yrs) 25 Marketing Operations Financials Balance Sheet Year 1 Year 2 Year 3 Year 4 Year 5 ASSETS Ending Cash Accounts Receivable Inventory Total Current Assets Real Estate Equip & Deprec Assets Net Fixed Assets TOTAL ASSETS LIABILITIES Accounts Payable Short Term Debt Long Term Debt Total Liabilities OWNER’S EQUITY Invest by Owner Retained Earnings Net Equity TOTAL LIAB + OWN EQTY 26 Marketing Operations Financials Statement of Cashflows Year 1 Year 2 Year 3 Year 4 Year 5 FROM OPERATIONS Net Income Change in Acct Receivables Change in Acct Payable Change in Prepaid Exp Change in Inventory Depreciation Net From Operations FROM INVESTING Purch of Real Estate Purch of Equip Net from Investing FROM FINANCING Invest by Owners Short Term Debt Long Term Debt Net From Financing NET CASH Beginning Cash Ending Cash 27