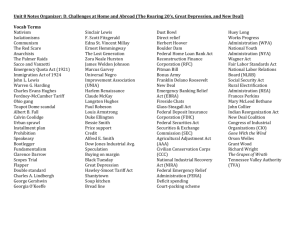

The causes of the great depression

advertisement

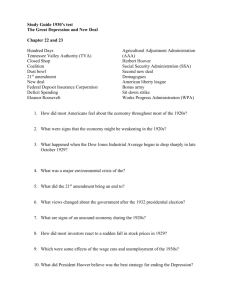

THE CAUSES OF THE GREAT DEPRESSION WAIT… WHAT’S THE GREAT DEPRESSION? THE GREAT DEPRESSION Date: 1929-1939 Definition: a period of economic depression in the United States and the rest of the world Economic depression occurs when an economy produces fewer goods and services and employs fewer people Significance Huge cost to human well-being Transformed the role of the US federal government in people’s daily lives FIVE LONG-TERM CAUSES OF THE GREAT DEPRESSION Monetary policy Day 3 Overproduction Inequality Speculation Trade Day 1 Day 2 Day 4 DAY 1: OVERPRODUCTION AND INEQUALITY OVERPRODUCTION In your notes: Is it possible for an economy to produce too much stuff? What might be the positive and negative consequences of producing too much? MARKET SIMULATION Some of you are producers – your job is to sell golf pencils (provided by me) for as much profit as possible Some of you are consumers – your job is to buy golf pencils from the producers for as little money as possible Some of you are observers – be ready to answer questions on the worksheet ROUND 1 One producer with one golf pencil to sell Five consumers, with budgets of 20 cents each ROUND 2 Two producers with five golf pencils each Five consumers with budgets of 20 cents each ROUND 3 Ten producers with ten pencils each Three consumers, with budgets of 5-25 cents each ROUND 4 Two producers with five golf pencils each Ten consumers Eight consumers get two cents each Two consumers get 50 cents each ROUND 5 Five producers with five golf pencils each Ten consumers Eight consumers get two cents each Two consumers get 50 cents each But consumers are going to get some bad news before buying begins… SO WHAT DOES THIS HAVE TO DO WITH THE DEPRESSION? BASIC ECONOMIC PRINCIPLES Prices are set by the combination of supply and demand When demand > supply, prices go up When supply > demand, prices go down The balance of power depends on the distribution of wealth When wealth is equally distributed, individual crises (like tuition or medical bills) don’t hurt the economy much When wealth is heavily concentrated, a crisis for the rich means a crisis for the whole economy OVERPRODUCTION IN THE GREAT DEPRESSION Agricultural overproduction Farmers increased production significantly during WWI – and took on huge debts to do this After WWI ended, demand fell sharply and farm prices crashed Individual farmers kept production high, since profits were low Similar problem in industry – factory methods made production increase, but eventually Americans ran out of money for new goods INEQUALITY IN THE 1920S In the 1920s, the rich became far richer while the poor became only slightly less poor Made worse by tax cuts for the rich under Herbert Hoover Result: limited demand for consumer goods EXIT TICKET 1. How did overproduction make the American economy unstable in the 1920s? 2. How did inequality make the American economy unstable in the 1920s? DAY 2: SPECULATION SOME KEY TERMS Stock: partial ownership of a company Stock market: a place where shares of companies are openly traded Speculation: investing in stocks or other ventures in the hope of profit, but with the risk of loss THE STOCK MARKET IN THE 1920S Two trends in the 1920s: Stock prices went way up – a boom More and more Americans invested in stock People saw the stock market as a way to get rich quick STOCK MARKET SIMULATION It’s January 1, 1920 You’ve pooled $200 with your friends to invest in the stock market You will invest at least half of the money today and meet periodically to reconsider your investments You agree to sell everything on December 31, 1929 and divide the profits equally STOCK MARKET GAME, ROUND 1 AT&T: $20 Ford Motors: $25 General Electric: $15 Montgomery Ward: $12 US Steel: $40 STOCK MARKET GAME, ROUND 2 AT&T: $20 (no change) Ford Motors: $23 (-2) General Electric: $25 (+10) Montgomery Ward: $15 (+3) US Steel: $38 (-2) STOCK MARKET GAME, ROUND 3 AT&T: $25 (+5) Ford Motors: $21 (-2) General Electric: $30 (+5) Montgomery Ward: $20 (+5) US Steel: $42 (+4) STOCK MARKET GAME, ROUND 4 AT&T: $30 (+5) Ford Motors: $20 (-1) General Electric: $35 (+5) Montgomery Ward: $30 (+10) US Steel: $55 (+13) STOCK MARKET GAME, ROUND 5 AT&T: $2 (-28) Ford Motors: $4 (-16) General Electric: $5 (-30) Montgomery Ward: $7 (-23) US Steel: $10 (-30) MARGIN BUYING Margin buying: the practice of borrowing money from a broker to purchase stock “You lend me money now, I’ll pay you back later when I sell my stock at a profit” Great way to take advantage of a boom market (prices going up) 1920s brokers allowed buyers to purchase stock with as little as a 10% down payment But what do you think happens when the market goes down…? DAY 3: MONETARY POLICY SPECULATION REVIEW QUESTIONS FOR 11.1 1. What are the possible risks of investing in the stock market? 2. What are the possible rewards of investing in the stock market? 3. What are the advantages of margin buying (taking out a loan from your stockbroker in order to buy more stock)? 4. What are the disadvantages of margin buying? FINAL NOTES ON SPECULATION Investing in stock can be rewarding, but it always carries risks The stock market was especially risky in the 1920s for two reasons: Not much information about companies Not much regulation from the government – for instance, over the down payment required for margin buying By 1929, the market was overvalued and ready for a crash KEY TERMS Inflation: an increase in the general price of goods and services Deflation: a decrease in the general price of goods and services Money supply: the amount of money available in an economy Purchasing power: the amount of goods or services that a given amount of money can buy; “the worth of a dollar” THE FEDERAL RESERVE (“THE FED”) Central bank of the United States, established 1913 Can choose to lend more or less money to banks (by varying the interest rate) Influences inflation/deflation WHAT CAN THE FED DO? If the Fed lends more money to banks, what happens? Inflation If the Fed lends less money to banks, what happens? Deflation EXIT TICKET Explain: what should the Fed have done to boost the economy, and why? DAY 4: TRADE AND TARIFFS REVIEW: WHY INFLATION WOULD HAVE HELPED Inflation = prices going up People spend more during inflation, since they expect prices to rise Therefore, inflation stimulates demand The government could have produced inflation by increasing the money supply Instead, the government decided to keep the money supply stable Result: continued low demand, low wages, and high unemployment WHAT DID THE US NEED TO AVOID AN ECONOMIC DEPRESSION? Key to economic recovery = more demand for American products Prices would increase Wages would increase One possible solution: demand could come from overseas SO WHY DIDN’T OTHER COUNTRIES BUY AMERICAN? After World War I, most European countries were economically devastated Physical devastation War debts Most countries, including the US, wanted to protect their economies by raising tariffs – taxes on imported goods THE SMOOT-HAWLEY TARIFF Date: 1930 Definition: huge increase in tariffs (import taxes) charged on goods imported to the US Goal: to protect US firms against competition from manufacturers in other countries Results: Hurt European economies, so people could afford fewer US goods Encouraged other countries to raise tariffs, reducing demand for US goods