Nov 12 Chapter 7 Reproting cash BAT4M

advertisement

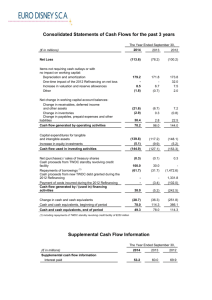

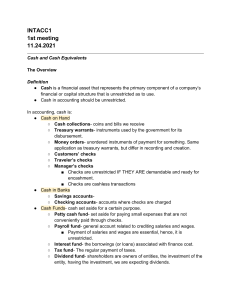

CHAPTER 7 INTERNAL CONTROL AND CASH Chapter 7 Quiz (Unit 3 Quiz#1) will occur on Monday, Nov 17 I will allow only one page formula sheet (double sided) It is not open book nor group quiz Summary Bank Statement Balance You add or subtract items which appeared in the book but they did not appear on Bank Statement of this month. If the item increased Book Balance, then you add this item to BSB. Book Balance You add or subtract items which appeared the bank statement, but they did not appear on Book. If the item decreased BSB, then you subtract this item from Book Balance. Reconciling Journal Entries Accounting Books Each reconciling item in determining the adjusted balance per books MUST be journalized and posted Bank Statement Do NOT journalize any entries on bank side (because they are already recorded in accounting records) REPORTING CASH The term “Cash” does not mean just “cash”. We debit cash if customer pay by: 1. Cash (such as coin, bill) 2. Check 3. Debit card 4. Bank credit card IOU (informal document indicating who owes whom) from employees and stamps are not cash. REPORTING CASH Cash reported on the Balance Sheet includes: 1. Cash on hand 2. Cash in banks (checking account and savings account) 3. Petty cash All three forms of cash can be combined and reported as Cash in the balance sheet in some companies. Cash is listed first in the balance sheet because it is the most liquid asset. CASH EQUIVALENTS More than 75% of Canadian public companies combine cash with cash equivalents in Balance Sheet. Cash equivalents are highly liquid investments, with maturities of three months or less when purchased, that can be converted into a specific amount of cash. Examples include money market funds, short-term notes, (GIC or CD) and treasury bills. CASH EQUIVALENTS More than 75% of Canadian public companies present their cash in this manner in Balance Sheet: Assets Current Assets Cash and short term investments $875 CASH EQUIVALENTS Bank overdraft occurs when withdrawals or payments (debit payment or check payment) are more than the amount in the bank account. This becomes a short term loan from the bank. Most companies have overdraft protection up to a certain amount. CASH EQUIVALENTS In an overdraft situation, the Cash account shows a credit balance in the general ledger and is reported as a current liability called bank indebtedness. USING THE INFORMATION IN THE FINANCIAL STATEMENTS Management must perform a difficult balancing act to properly manage cash. On one hand, it is critical to ensure that enough cash is available to pay bills or to buy inventory. On the other hand, too much cash on hand may indicate that management is not maximizing its return on assets. Classwork / Homework P381 E7-9 and E7-10 P386 P7-7 Ex 7.13 (P383)