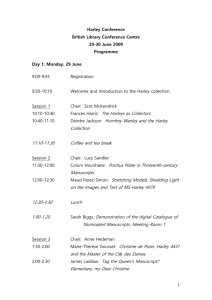

Harley Davidson Group 2

I.

Current Situation

A.

Current Performance

Arose from near demise as a company in 1985 back to the top of the motorcycle industry but are now being threatened by the current recession and have seen a slowdown in sales and stock price growth in 2007.

Opening a museum in 2008 (which is expected to attract 350,000 tourists a year)

Facing a challenge of growing 7%-9% (in an environment where the demand doesn’t seem to be keeping pace.)

B.

Strategic Posture

1.

Mission:

We fulfill dreams inspired by the many roads of the world by providing extraordinary motorcycles and customer experiences. We fuel the passion for freedom in our customers to express their own individuality.

Design, manufacture, and sell premium motorcycles for the heavyweight market

2.

Objectives:

Respond to market changes (in order to respond to the market changes

Harley designed its manufacturing process to increase capacity, improve product quality, reduce costs, and increase flexibility to respond to market changes. They also incorporated manufacturing techniques focused on the continuous improvement of its operations designed to control costs and maintain quality.)

Recruit riders of the younger generations. (Because the baby boomers who are Harley-Davidson’s biggest segment of riders are reaching their 60s, a need to recruit younger generations is being recognized and Harley is attempting to attract these younger riders by producing sleeker, faster bikes including the V-Rod which was introduced in

2001.)

Recruit women riders.

Have more say in the design and planning process. (To do so they formed strategic alliances with Harley’s top suppliers.)

Grow both their HOG and Buell Riders Adventure Group (BRAG) organizations

Utilize E-Commerce to increase sales ( www.harley-davidson.com

has been organized to make online orders possible, allows customers to

create and share product wish lists and find dealers in their general area.)

Survive the recession (critics believe that motorcycles are easily deferred purchases in times of crisis so Harley must somehow keep sales and stock price up through this tough time.)

Stay on top of the heavyweight motorcycle market. (Many competitors that are based outside the U.S. are introducing motorcycles that compete directly with Harley-Davidson’s products so this poses another threat to the company.)

Increase safety awareness (In 2000 Harley launched an instruction program called Rider’s Edge which was run through dealers. They did this in response to the growing number of Riders who were getting killed. This not only helped to increase safety but also brought in many first-time riders and secured them as Harley customers.)

3.

Strategies:

Acquired Buell Motorcycle Company in 1993. (Buell was a sport/performance motorcycle producer and was acquired in part to help improve the ride and reputation of Harley’s bikes as noisy, heavily vibrating, and hard to handle machines.)

Acquired Eaglemark Financial services to produce revenues from customer credit.

Internal makeover of the company (which helped to increase the productivity of the poorly managed supply-chain. There were nine different purchasing departments, fourteen different sets of representative terms and conditions and nearly 4,000 suppliers and the purchases were being done by Engineers with little or no expertise in supply management. So an internal makeover of the company was definitely necessary.)

Use technology to cut back on communication times and administrative trivia.

Introduce bikes that appeal to younger generations and international markets.

Introduced a new beginner rider’s course aimed at the first time Harley owner and rider.

Introduced 17 year old Jennifer Snyder as the newest member of the

Harley Davidson racing team. (Jennifer is a champion dirt bike racer and this was done in an attempt to attract the growing number female riders entering the market.)

Partnered with Jane magazine in 2005 (Again, this was done to attract the female customer by recognizing women who overcome fears and other obstacles to become Harley riders.)

Held Harley Owners Group rallies (HOG) (to allow customers the opportunity to ride their bikes alongside other owners.)

4.

Policies:

Maintain the quality Harley-Davidson image.

Traditional styling

Design simplicity

Durability

Ease of service

Evolutionary change

II.

Strategic Managers

A.

Board of Directors

1.

A substantial majority of the Directors on the Board (9 of 11) are independent . a.

Harley’s stock value has risen 23,000% since going public (1986-2006).

The Board capitalizes well on the core businesses strength Harley resonates w/ ‘motor heads and suits’ alike. However w/ the wholesale graying of its prime sector (med age= 47), the principal corporate experience base is shifting and tuning its focus to leverage into the younger and international sectors. The board is also well represented with

M&A, financial/credit, merchandising and marketing knowhow. This important due to its merger activity and the strengthening credit division

(including franchising) income stream it is bringing. During ’07, 96% of dealers in US/CA/EU used wholesale financial services. Several directors have been chosen specifically for their knowledge of e-business, high tech manufacturing, business applications and media/advertising. This has been instrumental regarding its pursuit of younger and sports riders and its purchase of Buell. They are rightly pursuing a growing international expansion beyond the diminishing N. American Ops, which has brought double digit growth. Their furthering growth potential by bringing on

European mkt experts for the target audience of younger customers desiring the Harley brand in Latin America, Asia (India/China) and the

EU. b.

Harley’s stock publicly traded stock symbol

; HOG . Each non management director receives an annual retainer of $100,000, at least half of which is to be paid in common stock. Annual Shareholder meetings are held during April, at the Harley-Davidson Museum, Milwaukee, WI. The

Securities and Exchange Commission (SEC) registration of the AN Rpt

(dated as of Feb) can be viewed via the Company’s Web site. Stock

Purchase and Dividend Reinvestment Plan can be interfaced by

Computershare’s web access.

c.

The Company maintains an environment that encourages senior management to interact with the directors. The Board votes by resolution adopted by the affirmative vote of a majority. The Audit, Human

Resources, Compensation and Nominating and Corporate Governance

Committee are all independent directors. The Audit Committee meets the independence and experience requirements set forth in the Sarbanes-Oxley

Act. Harley has taken steps to be compliant to environmental- emissions, noise and safety standards, which positions it well for EU and Japanese mkts.

2.

The following is a list of Harley’s Board of Directors

B. ALLEN (16yr) Sr. Advisor, Providence Equity Partners

(Specialized in recapitalization of family owned businesses/ buyouts/take-private planning & TelComs.) ($Comp- none published)

R. BEATTIE (20yr) Chair, Simpson Thacher & Bartlett LLP

(Specialist on M&A/Leveraged Buy-Outs / Corp Law experience w/

Time-Warner-AOL, JPMorgan-Chase mergers) Chief advisor to buy from AMF and then w/ public offering. ($Comp- none published)

**T. Bergman (2yr) CFO. (Financial, CFO Sears & Transportation &

Logistics Busn) ($Comp- none published)

Dr., J. BLEUSTEIN (30+yrs) Former Chair, Harley-Davidson, Inc.,

PhD in Engineering- Prof at Yale, VP Engineering, VP Parts&

Accessories, & President of several subsidiaries ($Comp= 200K)

G. CONRADES (4yr) Exec Chair, Akamai Technologies, Inc. (e-

Busn, Computing, IT, TeleCom, Media) ($Comp= 270K)

J. GREEN (4yr) Pres and CEO, NAVTEQ (Expert; Private to Public, expansion from core to broad range busn’s) ($Comp- none published)

D. JAMES (17yr) Founder, Chair & CEO, Deeley-Harley,

Canada/Fred Deeley Imports Ltd (31yr) (Dealer relationships).

($Comp = 130K)

Ms. S. LEVINSON (12yr) Former Pres of the Women's Group of

Rodale, Inc. (Mkting, Merchandizing- Macy’s, MTV & VHI- lead global expansion head, President NFL Properties – named ‘Women of the Yr’ by Women in Sports). ($Comp= 130K)

N. LINEBARGER (1yr) Pres and COO, Cummins, Inc. (Tech

Engineering / Power Generation Busn) ($Comp = 100K)

G. MILES, JR. (4yr) Pres & CEO, WQED Multimedia (PBS- Phily),

(Named as in top 50 most influential African Americans) ($Comp

=186K)

J. NORLING (15yr) Chair Chartered Semiconductor Mfg Ltd. (30 yr experience in Electronics / Motorola (EU/AF/Mid-East), w/ worldwide mgmt experience). ($Comp = 140K)

J. ZEITZ (1yr) CEO & Chair, Puma AG (International Mkting, Fin &

Ops, Voted ‘Entrepreneur of Yr in Germany’ & in ‘25 Young leaders in Europe’ ($Comp none published)

**J. ZIEMER (38yr) Pres and CEO, Harley, Inc. (VP & CFO Harley)

($Comp none published)

B.

Top Management

1.

Harley-Davidson Management today is a direct result of its painful lessons learned during the AMF years -1970’s through the early-80’s. The current

CEO and Board’s direction to Management is; intimately- know their customers, design and offer great products and utilize operational excellence in their production and manufacturing and overall Supply

Chain Management (SCM) efforts. 50% of all Harley employees ride the product. From the early 2000’s, the company received accolades ranking them in the ‘Top 100 Global Brands’ and in Fortune’s ‘Most Admired

Companies’ and Forbes ‘Company of the Year’. It also engendered market confidence buying back stock during a multi-year repurchase effort valued over $200M.

2.

However, Harley has also been accused of stock manipulation due to claims that they bolstered the price by forcing dealers to accept more stock, thereby allowing them to record corporate sales which pushed the stock price up. Conversely, the US dealers, 80% of which sold Harley’s exclusively were burdened to shoulder the costs until they reduced inventory = sold more bikes. Previous to the downturn of 2004, the retiring CEO made $40M w/ pay and stock options. Shortly thereafter the stock lost nearly 25% in value. The company also had several class action lawsuits filed against it in 2006 claiming Board and Management fraud. It also was troubled during 2007 by a complete shutdown by the mostly union and largest manufacturing site in York, PA. It also has stated that it must realign or relocate its Wisconsin operations to gain efficiencies to remain profitable.

3.

Harley has historically promoted from w/in. In fact, their present CEO is one that has risen from the ranks, starting as a freight elevator operator.

The following is an extensive list of the upper management. Next to no information is published regarding experience/backgrounds or compensation for the management team. According to Harley’s By-Laws,

Director and manager payments can come from stock included restricted stock, deferred, and nonqualified options.

4.

The AN Rpt identifies the following as management for HARLEY-

DAVIDSON, INC. LEADERSHIP;

T. BERGMANN, Exec VP, CFO

W. DANNEHL, Exec VP, Chief Org Transformation Officer

P. GLASSGOW, VP Treasurer

Ms. S. HENDERSON, VP, Communications

Ms. G. LIONE, Exec VP, Gen Counsel, Secretary & Chief

Compliance Officer

J. ZIEMER, Pres & CEO

MS J.BISCHMANN, VP, Licensing & Special Events

R. COPES, VP & Managing Director, Asia-Pacific

W. DAVIDSON, VP and Chief Styling Officer

W. DAVIDSON, VP Core Customer Marketing

K. EBERLE, Sr. VP Manufacturing

R. FARCHIONE, VP OE Engineering

F. GATES, VP & G-Mgr, York Vehicle Operations

J. HANEY, VP CIO

M. HEERHOLD, VP & G-Mgr, Power-train Operations

T. HOELTER, VP Government Affairs

R. HUTCHINSON, Sr. VP, Product Development

E. KRISHOK, VP Gen Counsel

M. KUMBIER, VP & GM, Materials Management

J. McCASLIN, Pres and COO

J. MERTEN, VP & GM, N. American Sales

J. OLIN, VP and Controller

S. PHILLIPS, VP Quality, Operational Excellence and Technical

Service

M. RICHER Sr., VP and Chief Marketing Officer

P. SMITH, VP General Merchandise

M. GENDEREN, VP and Managing Director, Latin America

2008 BUELL MOTORCYCLE COMPANY LEADERSHIP

E. BUELL, Chair and Chief Tech Officer, Buell Motorcycle Company

J. FLICKINGER, Pres and COO, Buell Motorcycle Company

2008 HARLEY-DAVIDSON FINANCIAL SERVICES LEADERSHIP

T. BERGMANN, Interim President, Harley-Davidson Financial

Services

2008 MV AGUSTA GROUP LEADERSHIP

C. CASTIGLIONI, Chair MV Agusta

M. LEVATICH, President and Managing Director, MV Agusta

III.

External Environment

A.

Natural Physical Environment: Sustainability Issues

Harley has been very wary of raw material usage and purchase recently. While there is very little waste and by-products from motorcycling manufacturing; Harley must still be aware of cost and availability of these raw materials. The current outlook of using fuel and fuel preservation has been on the forefront of automakers and has taken some hit from government regulation. Although a Harley will burn a minimal amount of fuel compared to an automobile, they must keep this sustainability issue in their back pocket as this becomes a more scrutinized subject.

The biggest concern for Harley when considering environmental issues will be seasonal changes. Although it hasn’t yet affected sales, many riders prefer to ride in the warmer spring and summer months. This doesn’t mean sales will not be made in cooler months, but they can expect a decrease in product usage during the winter months. Another consideration to riders in relation to location and weather would be rainy locations or tropical areas. Although you may choose to ride in the rain, many people will not due to the increased chance of hazardous driving conditions. These are just a few items corporate may need to consider when considering natural environment.

B.

Societal Environment

1.

Economic

The current recession will be a continual threat (T)

Expansion into China (O)

Growth in target rider market (O)

Restructuring cost could exceed $110 million (T)

Many wholesaler and retailer compete to carry the Harley name (O)

2.

Technological

Research and development of new motorcycles to appeal to different rider groups (O)

Development of faster, sleeker motorcycles to appeal to younger market (O)

Redesigned manufacturing process geared toward cost reduction and flexibility to market changes (O)

R&D bring professional and employees together to consider redesign and product creation (O)

R&D spent over $163 million (T)

Internet sales available to public market (O)

3.

Political/Legal

Regulations concerned with air, water, and noise pollution (T)

Product recall to ensure consumer safety (T)

Must rely on independent dealers for sales (T)

4.

Socio-Cultural

Restructuring will close numerous plants down (T)(O)

Reaching out to younger generation and female riders (O)

Offer for new riders to participate in Rider’s Edge program (O)

New product offerings for non-riding public (O)

Sponsorship of local events and races (O)

C.

Task Environment

Threat of new entrants – Low - Harley has the history to repel any new production or competitor

Bargaining powers of buyers – Medium – They are not the only motorcycle dealer, one bad experience from a consumer may send them looking toward Honda or Kawasaki.

Threat of substitute products or service – Low – No imitators known at this time

IV.

Internal Environment: Strengths and Weaknesses

A.

Corporate Structure

Bargaining power of suppliers – Medium

Rivalry among competing firms – High – Previously mentioned competitors jockey for market groups targeted by Harley

Power of unions, government, special interest groups – Low

Harley-Davidson has an 11 member Board of Directors consisting of 9 non-employee and 2 employee members. They serve in three-year staggered terms.

The president and CEO, James C. Ziemer has set three constants for success that he expects his employees to follow closely.

There is no information provided describing the decision making process or the timeline for major decisions to be made.

B.

Corporate Culture

Management pushes the employees to see what the customers see so they make the employees go through a dealer to purchase their bikes if they buy them. 50% of the employees ride Harleys, so this accounts for a great deal of training.

The employees are offered opportunities to obtain union representation to make sure they are taken care of for their hard work.

The CEO implements 3 main objectives for success: Passion for the business, sense of purpose, and operational excellence.

C.

Corporate Resources

1.

Marketing

Most marketing efforts are divided between dealer promotions, customer events, magazine and mail advertising, public relations, cooperative programs with dealers, and national television ads.

Harley-Davidson stays involved with all major motorcycle consumer shows and rallies, and also sponsors racing activities and different promotional events.

2.

Finance

Since Harley went public, its shares have risen over 23,000%. As of

February 2008, there are over 90,000 shareholders of Harley-Davidson common stock.

Due to the down economy in 2007, the company experienced their first declines in over 20 years. Motorcycle revenue dropped 1.27% and

total revenue fell 0.69%. The biggest decline during this time was a

10.74% drop in operating income.

Between 2003 and 2006, net income rose grew by over 30%.

3.

Research and Development

Harley strongly believes that research and development is a factor in keeping them in the front of the market for custom and touring motorcycles, and ready to develop products for the performance segment.

They have a Product Development Center (PDC) that brings employees from styling, purchasing, and manufacturing together with regulatory professionals, and supplier representatives to create a well rounded process development team.

Over the span of 2005 to 2007, research and development expenses averaged over $180.5 million a year.

4.

Operations and Logistics

Research and development leading to the company entering the market for both female and younger riders helped them stay at the head of the motorcycling industry.

Harley sells its products at wholesale to a group of around 684 independently-owned full-service Harley-Davidson dealerships.

5.

Human Resources Management

The relationships with unions and employees are typically very good.

As of the end of 2007, there are 9,000 employees working for the company. The majority of these employees are unionized and have representation from either the Paper Allied-Industrial Chemical and

Energy Workers International Union, or the International Association of Machinist and Aerospace Workers.

6.

Information Technology

IT systems are not mentioned in this case.

Garry Berryman, an intense procurement expert, brought Harley’s top suppliers into the design and planning process because he felt that new technology and the Internet would make it very easy to form bonds this way.

V.

Analysis of Strategic Factors

A.

Situational Analysis (SWOT)

1.

Strengths

Net income of 2003 was $760mn, its more than 30% as compared to the previous year.

The standard and performance segments of Harley Davidson make up

70% of the European heavy weight motorcycle market

Harley-Davidson operates in two segments: Harley-Davidson motorcycles & related products and HDFS (Harley-Davidson

Financial Services).

Harley-Davidson is the only major American heavyweight motorcycle manufacturer.

Strong brand name.

The HOG (Harley Owners Group), which have a 7,50,000 members world wide is the industry’s largest company sponsored motorcycle enthusiast organization.

Buell Riders Adventure Group (BRAG) was also formed recent

Customization of the bikes, this is Harley-Davidson’s major revenue maker.

Harley-Davidson have a good marketing division and its divided as dealer promotions, customer events, magazine and direct-mail advertising, and public relations.

2.

Weaknesses

High price

Harley-Davidson has problems in gaining more market share in some

European countries (That’s one of the main markets for Heavyweight motorcycles outside U.S).

They didn’t yet start its sales in India, one of the biggest markets.

Required production is not met, analyzing the future of Heavyweight motorcycle market

3.

Opportunities

The European demand for Harley Davidson is the highest in the international market and represents the single largest motorcycle market in the world.

Women and younger riders are increasing becoming interested in bikes

The international heavy weight market is growing and is now larger than the U. S. heavyweight market

Market share increasing in Europe and Asia for the last two years

Increasing demand in US markets for bikes

Customers value quality parts

4.

Threats

Harleys ongoing capacity restraints caused a shortage supply and a loss in domestic market share in recent years

Harleys average buying age is 42 years old and increasing

The European Union’s motorcycles noise standards are more stringent than those of Environmental Protection Agencies in the U.S and increased environmental stand

Some competitors of Harley Davidson have larger financial and marketing resources and they are more diversified

Environmental protection laws

Buell division needs to continue to produce a quality motorcycle under

Harley’s brand name.

B. Review of Current Mission and Objectives

Mission Statement

“We fulfill dreams through the experiences of motorcycling, by providing to motorcyclists and to the general public an expanding line of motorcycles, branded products and services in selected market segments”

Objective

To be branded as the best motorcycle in the world.

VI.

Strategic Alternatives and Recommended Strategy

A.

Strategic Alternatives

1.

Market development, marketing strategy, and product development are all being used well by Harley and contribute to their success as an industry leader in two wheeled sales. By increasing retailers and stores that sell their products, Harley is leading the way with annual sales of secondary products. Motorcycles continue to be the primary product and clothing following right behind. Next, Harley is reaching out to the younger generation and even the female sex for marketing their products. They just recently sponsored a 17 year old female as their first ever female racer. This will create the separation and consistency to attract the desired market. By developing the new V-rod, redoing the Softail Classic, and introducing the Dyna line; Harley has excelled in the product development arena.

2.

Possible alternative advantages and their pros & cons:

Operations strategy will definitely benefit the company by reducing the number plants performing various product creations. By

consolidating plants and services they will save money but will also have an effect on the local environment due to the possibility of local workers losing jobs. This is a win lose situation for all involved.

Purchasing strategy needs to be considered when selling and using raw materials. Purchasing too many raw materials than needed may leave them with excessive number and loss of revenue. But on the other hand, using multiple sourcing could lead to beneficial numbers by purchasing from the appropriate vendor.

Logistics strategy can also be seen when discussing the consolidation of plants and distributors. This style of centralization will benefit the corporation when considering upkeep prices of multiple facilities. The usage of the internet for sales and business practice is also an advantage of logistic strategy. The negative side of logistics was mentioned above in operations strategy.

B.

Recommended Strategy

Design to continuously improve product quality, increase productivity, reduce costs and increase flexibility to respond to changes in the marketplace

This market naturally wants something different from what the older generation rode. They are looking for more cool and sleek sport bikes

The Company continues to establish and reinforce long-term, mutually beneficial relationships with its suppliers. Through these collaborative relationships, the Company gains access to technical and commercial resources for application directly to product design, development and manufacturing initiatives

the Company must continue to be successful in promoting motorcycling to customers new to the sport of motorcycling including women, younger riders and more ethnically diverse riders

Harley has adopted several new marketing objectives to target the younger market with its new product line: expand its current market, diversify its product line, and modify its marketing mix to target a younger demographic

VII.

Implementation

A.

Harley is correct to pursue optimization of its production facilities and supply chain which will compliment the broadening of its customer base.

1.

Harley-Davidson is confronted with dated facilities and more efficient Asian competitor base. Therefore, Harley has initiated; cost reduction efforts, continuous product improvement (CPI), lean manufacturing and other business quality initiatives at its own production facilities and together with its

partners to better integrate throughout its supply chain. They have also reached out to local and international unions requesting higher performance targets, tiered pay scales and greater span of work categories and better process controls. Presently, it is in the throes of a full shut down strike at its largest production facility in York, PA.

2.

Harley’s future vision is to offset its rapidly diminishing demographic; a graying North American customer base. They seek to expand among younger global riders, those intrigued with the Hog culture, albeit a less expensive version. The company is banking on those riders wanting a range of motorcycles, starting with sport bikes and eventually trading up to full dressed upper mid-level rides. a.

Harley must take full advantage of its time tested culture to successfully execute the worldwide expansion. Tuned to various global ‘local’ markets, the HOG culture will translate and resonate which those that want the freedom of the riding experience. b.

The sequence of Latin America, Asia (Indian / Chinese) EU expansions will continue as the market warrants. Those areas should be utilized local trained managers, empowered and incentivized to execute it in a manner which best serves their customer base.

B.

These proposed programs are financially feasible. Its’ wholesale Harley-

Davidson Financial Services (HDFS) can affect the programmed expansion.

The board and the stockholders will welcome this expansion and greater efficiency. All plans, and specifically those of a global nature covering transcontinental expansion, require clear priorities and associated timelines to prove successful.

C.

New standard operating procedures (SOPs) must be developed that clearly cover the most important, most likely positive / negative operational guidelines. They then should be peer & aggressor gamed for the what-if’s and parsed via peer evaluations to prove them out prior to fielding.

VIII.

Evaluation and Control

A.

Sales information is tracked to the specific dealer where the product was sold.

Harley is able to record the age, gender, and even the household income of their buyers after most purchases.

B.

The company identifies its strengths, weaknesses, opportunities and threats by carefully evaluating their customer feedback, monitoring the competition, and using an extensive research and development group.

C.

Devising a system to suggest the most prominent locations for dealerships based on previously gathered information would be an effective way for Harley

Davidson to position their company most efficiently.

Exhibit #1

D. Summary of External Factors

External Factors Weight Rating

Opportunities

Weighted

Score

Comments

Huge opportunity in expanding westernized market

Expansion into

China 0.2 4.2 0.84

Chance to sell to younger generation and females

Marketing to different rider market

Redesign of manufactoring process

New product offerings

0.1

0.05

0.05

3

2.2

3.3

0.3

0.11

0.165

Eliminates unnecassary plants clothing lines are big sellers sportier bikes attract different markets

Product development

Threats

0.15 3 0.45 sales could be affected due to lack of finances

Current recession 0.15 4.3 0.645

Air,emissions, and noise pollution a factor

Regulations 0.05 2.8 0.14

Restructuring of operations 0.05 2.7 0.135 may lose local vendors/stakeholders

R&D expenses

Product recall

0.05

0.05

3.3

3.7

0.165

0.185 will extreme R&D expenses jeopardize revenue could blemish public image may affect pricing and sales income

Independent dealers

Totals

Exhibit #2

Table 5-2

Internal Factors

0.1

1

2.6 0.26

3.395

Strengths:

Employee unions

Male and female customers of all ages

Rider training and safety programs

Foreign operations

Harley Owners Group

(H.O.G.)

Internal Factor Analysis Summary

Weighted

Weight Rating Score Comments

0.05

0.2

0.1

0.15

0.15

3

4.5

4

4.2

3.9

0.15

0.9

0.4

0.63

0.59

Employee representation

Broad customer base

Offered by Harley

Quickly growing

Largest motorcycle club on Earth

Weaknesses:

Image of who rides

Harleys

Performance market

Expensive

Advertising

Total scores

0.15

0.05

0.1

0.05

1

4.2

1.2

3.1

1.9

0.63

0.06

0.31

0.1

3.77

Negative stigma assosiated with brand

Not involved enough

No options for lower-middle class

Don't reach put to potential riders

Exhibit #4

Liquidity Ratio

Current

(Current Assets/Current

Liabilities)

Quick

(current Assetsinventory/current liabilities)

Leverage Ratio

Debt to Total Assets

(Total Debt/Total Assets)

Debt To Equity

(Total Debt/Total Assets)

Activity Ratios

Inventory Turnover-sales

(Net Sales/Inventory)

Average collection (days)

(Inventory/COGS divided by

365)

Fixed Asset Turnover

(Sales/Fixed Asset)

Total Asset Turnover

(sales/total asset)

Profitability Ratios

Gross Profit Margin

(Sales-COGS/Net Sales)

Net Operating Margin

(Net Profit After taxes/Net

Sales)

Profit Margin on Sales

1-(COGS/Sales)

Return on Total Assets

(Net Profit After Taxes/Total

Assets)

Return on Equity

2008

1.3

0.401

42.30%

73%

51.7%

10.70%

35.08%

14.27%

24.92%

8.74%

55

3.77%

1.87%

(Net Profit After taxes/Shareholder’s equity)

Exhibit #5

Harley-Davidson_Exhibit 5A

(In thousands, except per-share amnts)

Income statement data:

Net revenue

Cost of goods sold

Gross profit

Financial services income

Financial services expense

Operating income from financial services

Selling, administrative and engineering expense

Income from operations

Investment income

Interest expense

Income before provision for income taxes

Provision for income taxes

Net income

Weighted-average common shares:

Basic

Diluted

Earnings per common share: (in dollars)

Basic

Diluted

Dividends paid per common share

Harley-Davidson_Exhibit 5B

(In thousands, except per-share amnts)

Balance sheet data:

Working capital

Finance receivables held for sale

Finance receivables held for investment, net

Total assets

Current debt

Long-term debt

Total debt

Shareholder equity

2008 2007

5,594,307 5,726,848

3,663,488 3,612,748

1,930,819 2,114,100

376,970 416,196

294,205 204,027

82,765

654,718

212,169

984,560 900,708

1,029,024 1,425,561

9,495 22,258

4,542 0

1,033,977 1,447,819

379,259 513,976

933,843

234,225 249,205

234,477 249,882

2008

2.80

2.79

1.29

1.29

2007

3.75

3.74

1.06

1.06

2006

2,774,124 1,562,235 1,954,956

2,443,965 781,280 547,106

2,195,563 2,420,327 2,280,217

7,828,625 5,656,606 5,532,150

1,738,649 1,119,955 832,491

2,176,238 980,000 870,000

3,914,887 2,099,955 1,702,491

2,115,603 2,375,491 2,756,737

Number of shareholders of record

Harley-Davidson_Exhibit 5C

Assets, Depreciation & Capital

Expenditures

Yr Ending Dec 31 (Ammount In thousands)

2007 Identifiable Assets

Depreciation and Amortization

Net Capital Expenditures

2006 Identifiable Assets

Depreciation and Amortization

Net Capital Expenditures

2005 Identifiable Assets

Depreciation and Amortization

Net Capital Expenditures

89,298 90,748

Motorcycles

& Related

Finacial

Services

Products

1,804,202 3,447,075

197,655

232,139

6,517

9,974

1,683,724 2,951,896

205,954 7,815

209,055 10,547

2,845,802 2,363,235

198,833 6,872

188,078 10,311

88,995