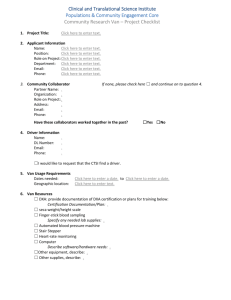

VAT AUDIT Requirements

advertisement

Date: To, Dinesh Goyal & Co., Chartered Accountants, Indore. Subject: Submission of information and documents in respect of VAT audit for F.Y. 2012-13. Dear Sir, We are pleased to inform you that you have been appointed as auditor under MP VAT Act for the F.Y. 2012-13. In this regard, we submit following information/documents: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Name of the dealer TIN Address of regd. office Tax audit report and Statutory audit report. Balance Sheet and Profit & Loss account generated by accounting software. Detailed Trial Balance with opening balance, transactions and closing balance. VAT accounts (VAT collected and VAT Input accounts) Access to accounting software data for F.Y. 2012-13 (Tally/ other) Copy of MPVAT and CST RC. Address of branch(es), godown(s), manufacting unit(s) in MP. Sl.No. Address I. Branches 1. 2. II. Godowns 1. 2. III. Manufacturing units 1. 2. 11. Address of branch(es), godown(s), manufacting unit(s) oustide MP along with copy of TIN certificate in that state. 12. Sl.No. Address I. Branches 1. 2. II. Godowns 1. 2. III. Manufacturing units 1. ATTACHED ATTACHED ATTACHED Hard Copy/ Soft Copy/ Both Attached 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 2. PAN (copy of relevant supporting to be attached) Excise Reg. No (copy of relevant supporting to be attached) Service Tax Reg. No. (copy of relevant supporting to be attached) SSI No. (copy of relevant supporting to be attached) Export Import Code (copy of relevant supporting to be attached) Name, address and share of interest of partners/ proprietor/ directors. Sl. Name of partner/ Address Extent of interest No. proprietor/ director As on last day of As on last day of previous F.Y. current F.Y. 1. 2. Particulars of all bank accounts: Name of the bank, branch, account number, type of account Sl. Bank Name Branch Type of Account Number No. account 1. 2. Registers of Form 49, C form, F form, H form, E1 & E2 forms, TDS Maintained in hard copy/ certificates. Maintained in soft copy/ Not maintained Name of goods manufactured/ traded and rate of tax applicable thereon. Sl. Name of Goods Rate of tax Schedule No. (if Entry No. (if known) No. known) 23. List of purchases in following categories Sl. Particulars Provided in No. Hard Copy a. Tax-free Provided in Soft Copy Taxable purchase within state i. Entry Tax Paid ii. Entry Tax Not Paid c. URD Purchases d. Interstate Purchases e. Stock Transfer Inwards f. Import out of India g. Any Other list 24. Details of purchases/ sales of fixed assets and other assets Sno. Asset Dt. of Amt of Amt Rate of purchase Purch of tax Sale 1. 2. Tick appropriate field Both Not Provided/ N.A. b. Tax Whether tax already paid on sale/ ITR claimed on purchase 25. Details of DEPB sales and purchases 26. VAT return summary along with acknowledgements of returns filed and challans paid. 27. Dealer-wise of local sales list above 25,000/- in following format. Name of Dealer Address TIN Total sales net of VAT Amount of VAT 28. Dealer-wise of local purchase list above 25,000/- in following format. Name of Dealer Address TIN Total sales net of VAT Amount of VAT 29. List of sales to SEZ units (within M.P.) in following format: Name of Purchaser Address TIN Decl. Form No. (if any) Amount of Declaration Form 30. List of sales to SEZ units (outside M.P.) in following format: Name of Purchaser Address TIN Form ‘I’ No. Amount of Form ‘I’ 31. Summary of direct exports in following format: Name of Purchaser Address Bill of lading No. Date Amount 32. Summary of exports against Form ‘H’ in following format Name of Purchaser Address TIN Form ‘H’ No. Amount of Form ‘H’ 33. Summary of interstate sales against C-Form in following format: Name of Purchaser Address TIN Form ‘C’ No. Amount of Form ‘C’ 34. Summary of E1 and C transactions in following format: (a) Sales Name of Purchaser Address TIN Form ‘C’ No. Amount of Form ‘C’ Address TIN Form ‘E1’/ ‘E2’ No. Amount of Form ‘E1’/ ‘E2’ (b) Purchase Name of Seller 35. Summary of inter-state branch transfer/ consignment sales in following format: Attached/ Pending Attached/ Already with you/ Pending [ ] Soft Copy [ ] Hard Copy [ ]Both [ ] Pending [ ] Not Applicable [ ] Soft Copy [ ] Hard Copy [ ]Both [ ] Pending [ ] Not Applicable [ ] Soft Copy [ ] Hard Copy [ ]Both [ ] Pending [ ] Not Applicable [ ] Soft Copy [ ] Hard Copy [ ]Both [ ] Pending [ ] Not Applicable [ ] Soft Copy [ ] Hard Copy [ ]Both [ ] Pending [ ] Not Applicable [ ] Soft Copy [ ] Hard Copy [ ]Both [ ] Pending [ ] Not Applicable [ ] Soft Copy [ ] Hard Copy [ ]Both [ ] Pending [ ] Not Applicable [ ] Soft Copy [ ] Hard Copy [ ]Both [ ] Pending [ ] Not Applicable [ ] Soft Copy [ ] Hard Copy Name of Consignee/ Purchaser Address TIN Form ‘F’ No. Amount of Form ‘F’ 36. List of sales to entry exempted units against declaration forms along with purchase values and copies of declaration forms in prescribed format obtained 37. Purchase bill files 38. Sale Bill Counterfoils 39. Copy of all C-forms received along with of summary of forms pending to be recieved 40. Copy A of all F-forms received along with of summary of forms pending to be recieved 41. Copy of all H-forms received along with of summary of forms pending to be recieved 42. Copy of all I-forms received along with of summary of forms pending to be received 43. List of Purchase return with date of original purchase and date of return 44. List of Sale return with date of original sale and date of return 45. Ledger printouts of purchase account, sale account, consignment inward account, consignment outward account and VAT accounts [ ]Both [ ] Pending [ ] Not Applicable Attached/ Pending/ N.A. Attached/ Pending/ N.A. Attached/ Pending/ N.A. Attached/ Pending/ N.A. Attached/ Pending/ N.A. Attached/ Pending/ N.A. [ ] Hard Copy [ ] Soft Copy [ ] Both [ ] Pending 46. Any other information that may be relevant for the purpose of VAT audit We declare that all the information furnished is true and correct to the best of our knowledge and belief. Thanking you, For_______________________ (Prop./Partner/Director)