Meeting 10/7/2015

advertisement

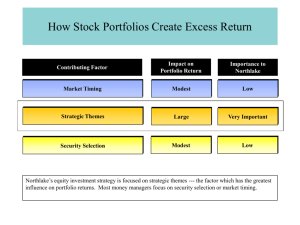

THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION DISCUSSED DURING HAWKTRADE MEETINGS. Past performance does not guarantee future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost. Investing in any financial instruments does not guarantee that an investor will make money, avoid losing capital, or indicate that the investment is risk-free. There are no absolute guarantees in investing. HAWKTRADE and its members do not bear any responsibility for losses or gains made by members trading on their personal accounts based on analysis from HAWKTRADE meetings. HawkTrade will be having an event on October 14th at 6:30pm in W10 PBB There will be a lot of food (Airliner’s and China Star) Reminder: Applications due October 23rd. Read instructions of Application for details What is an ETF: An Exchange Traded Fund that owns a basket of stocks under one security Usually tracks and index and is passively managed ▪ For example, the SPDR Shares ETF, SPY, is an index that tracks the S&P 500 (which is the largest 500 US companies) Excellent way to buy into a sector or market inexpensively Easily craft a well-diversified portfolio Easy to Manage on your own The largest difference between an ETF and a Mutual Fund is that ETFs are traded like securities. I can buy the SPY ETF like a stock, but I can only purchase into a Mutual Fund at the end of the market close (purchase NAV) ETFs NAV can differ from its market price ETFs have NO MINIMUM BUY-Ins ETFs have lower net expense ratios (generally) Less risky than holding individual stocks To really analyze a company takes A LOT of time (I am talking months here…) 99% of Americans do not have the time to do this Always a chance you could be holding the next Enron… More Diversification Easy to manage (sit back, relax, and let your portfolio do the work!) A few Main components have a statistically significant effect on your stock return when purchasing ETFs Annual Turnover Expense (hidden killer of returns) Net expense ratio (be aware of gross expense ratio) How the ETF is weighted (becoming a big-deal) Composition of ETF (i.e. Geography, Sectors, & Market Cap) Track record Annual Turnover ratio: # of times a portfolio churns (sells) stocks in its portfolio Ex. An ETF holds 10 stocks and sells 5 of those stocks within the fiscal year for the ETF. Result: Annual Turnover is 50%. What if all 10 stocks were sold and then 10 more stocks were bought and then sold within year. ATO = 200% Problem with high ATO: commission cost, bid-ask spread cost, “hidden” cost of just holding the stocks instead of selling Net expense ratio: the % cut that management receives for “managing” the portfolio Ex. Net expense ratio = .1% (annual) Means if the index it tracks returns 11% for the year, your return is 10.9% for the year Not a problem if Net Expense low, but what if it is not? A 1% net expense ratio (for one etf) will kill your portfolio return over the long-term Invest $10,000 in ETF with 1% Net expense ratio. Market returns 10% per year Yr 1: You lose out on $100 (#’s may vary widely if distributions re-invested) Yr 2: $219 (total loss of return from Yr 1-2, etc.) Yr 3: $359.71 Yr 30: $41,817 !!! From Yr 1 to Yr 30 Importance of buying low cost ETFs self-prevalent Majority of ETFs weighted according to Market Capitalization of stocks Pros: easy to implement and potential for 0% turnover. Essentially, how the market moves, is how your ETF will move Cons: Your ETF will be weighted based on what OTHER investors think of the market (Have other investors been the best at pricing companies correctly or at avoiding bubbles….) New Trend in ETF Weightings: Fundamental weightings (i.e. based on revenue, dividend-yield, profit margins, market share, etc.) ▪ Pros: If you believe that markets are even semi-inefficient and that fundamental analysis can buy better companies then this is your pipe-dream-come-true ▪ Cons: Often comes with HUGE expense ratios that wipe out almost any return you would have had above the markets Defeats purpose of index investing? Depends, but generally yes. Show example of RSP vs SPY Geography, Sector, & and market capitalization size matter US returns vs Developed Countries vs Emerging markets (volatility and risk differences) Sectors: Utilities vs Health Care returns Capitalization: Large vs Small-cap Without a track record… Less proven results (high returns now may be unsustainable in future) ETFs that fail to lure more Net Assets can (and often are) pulled from the market (i.e. whatever price that is last traded is the price you will be paid if fund closes out!) Walkthrough of ETF & Stock Screener on Fidelity A lot of Argument/Theory surrounds Portfolio Composition: How much bonds vs stocks? REITs? Currencies, derivatives, options, etc.? Large vs Small Cap? Low-Volatility vs High Volatility? Dividends vs high-growth? 60% Stocks 30-60% US & 60-30% International with 10% EM 30-40% Bonds (mixture of corp., muni, & gov) 10% REITs (US and International) 30s on up 60/40 split between stocks & bonds give or take 10% for REITs 20-early 30’s 80-100% Stocks (general set up with US, INTL, and EM okay) 10-20% REITs Why No Bonds? Over every 30 year period over the last 200 years, stocks have outperformed bonds and have a 99.6% chance to continue to do so REITs (in this low interest rate environment) have fairly high DivYields (usually 3-5%) & have pretty low correlation w/equities. Good supplement to Bonds 30s-40s 60-70% stocks ▪ All depends on family, lifestyle, job occupation etc. Consult FIN Advisor 20-30% Bonds (more stable income) 10% REITs 50s-whenever you croak 50-60% Stocks 30-40% Bonds 10% REITs Volatility of markets due to fed indecision Banks affected even more so Glencore credit downgrade TPP trade deal cuts exclusivity period for biotech drugs Correction continues “Godfather of Biotech” says IPO’s heating up too much American Apparel files for bankruptcy Pepsi affected by devaluation of the Bolivar Miller-Busch merger updates Stocks down on the week 10/14 final day to reach decision Harley Davidson recalls Average of 94,000 a year since 2003! Google becomes Alphabet