ASC 740 Seminar - 11-21-14 - Tax Executives Institute, Inc.

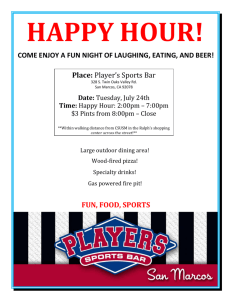

advertisement

NOTICE OF ASC 740 Seminar Featuring: KPMG Date: Friday, November 21, 2014 Place: Sportsmen’s Lodge 12833 Ventura Boulevard Studio City, CA 91064 7:45 - 8:30: Registration and Continental Breakfast 8:30 - 8:45: Introduction of Speakers & Agenda 8:45AM – 9:15AM: Accounting for Income Taxes - Overview 9:15AM – 9:45AM: Accounting for Uncertainty in Income Taxes Identification, Recognition, & Measurement of Uncertain Tax Positions Balance Sheet Classification and Disclosures 9:45AM – 10:00AM: **** Morning Break **** 10:00AM – 10:30AM: Valuation Allowances Requirements to Recognize Valuation Allowance Four Sources of Income and Weight of Evidence 10:30AM – 11:15AM: Business Combinations Summary of Acquisition Accounting Accounting for Valuation Allowances, UTPs, Goodwill and Transaction Costs 11:15AM – 12:00PM: Share Based Compensation Treatment of Equity Compensation (Including NQSO and ISO) Timing of Recognition Effects of Valuation Allowance and UTPs 12:00PM – 1:00PM: **** LUNCH **** 1:00PM – 1:45PM: Investment in Affiliates Equity Investments, Partnerships, and Minority Interest 1:45PM – 2:15PM: Intraperiod Allocation Definition of Intraperiod Allocation and General Rules Exceptions to the General Rules 2:15PM – 3:00PM: Presentation and Disclosures Disclosure Requirements for Public and Private Companies SEC Comments on Disclosures 3:00PM – 3:15PM: **** Afternoon Break **** 3:15PM – 3:45PM: Accounting for International Operations Outside Basis (Unremitted Earnings, Unborn FTC, & Withholding Tax) Indefinite Reinvestment Assertions 3:45PM – 4:30PM: Sarbanes Oxley Controls Discussions/PCAOB PCAOB Recent Interest in SOX Controls over Income Tax General Discussion over Expected Controls over Income Tax 4:30PM – 5:30PM: Current Event Topics & Potential Pronouncements ASU 2013-11 – Contingencies ASU 2014-02 – Goodwill Amortizable for Private Companies ASU 2014-01 - Investments — Equity Method and Joint Ventures Revenue Recognition ARB 51 – Changes in Current/Non-Current Year-End Readiness Registration Fees: If registered by the date noted below, the seminar is $250 for each TEI member, made payable to TEI-Los Angeles Chapter. Additional participants from the TEI member’s company are welcome at this member rate as well. The fee is $300 for non-members. Registration at the door is $300 for members and non-members alike. The fee includes course materials and lunch. Selfparking is included in the fee. Substitutions: Substitutions are permitted if your plans change and a last minute substitution is necessary. Please provide us the new participant’s name. Fees are non-refundable and may not be credited towards future events. Education Credits: This activity qualifies for Continuing Legal Education credit by the State Bar of California and continuing education credit by the California State Board of Accountancy. TEI certifies that this activity conforms to the standards for approved education activities prescribed by the rules and regulations of the State Bar of California governing minimum continuing legal education. Registration: Please RSVP with Pauline Pineda by e-mail at pauline.pineda@aecom.com or by phone at (213) 5938388 by no later than Tuesday, November 18th. Location and Directions: In the heart of the San Fernando Valley, the Sportsmen’s Lodge Events Center is located just off the Ventura/101 Freeway at the corner of Ventura Boulevard and Coldwater Canyon Avenue in Studio City. Please use the Coldwater Canyon Avenue entrance where there will be self parking. You will enter into our grand lobby entrance and be guided to the venue where your event will be held Payments made to Tax Executives Institute, Inc. are not deductible as charitable contributions for federal income tax purposes. They may, however, be deductible under other provisions of the Internal Revenue Code. The Los Angeles Chapter of Tax Executives Institute, Inc. certifies that TEI has been approved as a State Bar of California MCLE provider. Member Company Registration ($250) PLEASE INDICATE IF THE PARTICIPANT IS AN ATTORNEY Membership No. Telephone Name FAX Company E-Mail Street Address City, State, Zip Fee Additional Participants from Member Company ($250) Name E-Mail Name E-Mail Non-member Company Registration ($300) Name Telephone Company Fee E-Mail Credit Card payment Name (as it appears on card) _____________________________________________ Type of Credit Card and Number _________________________________________ Expiration date/CVV code _______________________________________________ Billing Zip code ______________________________________________________ Total Fee (make checks payable to TEI - L.A. Chapter) $ NOTE: Please send the completed registration and full payment (checks payable to TEI - L.A. Chapter) to: Pauline Cadle-Pineda AECOM 515 S. Flower St., 4th Floor Los Angeles, CA 90071 or email your registration to pauline.pineda@aecom.com