PowerPoint File, 488 KB

advertisement

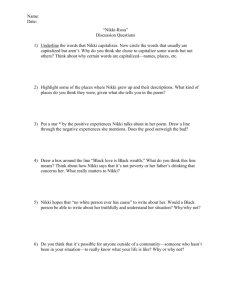

Completing the Accounting Cycle By Rachelle Agatha, CPA, MBA Slides by Rachelle Agatha, CPA, with excerpts from Warren, Reeve, Duchac After studying this chapter, you should be able to: 1. Describe the flow of accounting information from the unadjusted trial balance into the adjusted trial balance and financial statements. 2. Prepare financial statements from adjusted account balances. 3. Prepare closing entries. After studying this chapter, you should be able to: 4. Describe the accounting cycle. 5. Illustrate the accounting cycle for one period. 6. Explain what is meant by the fiscal year and the natural business year. Objective 1 Describe the flow of accounting information from the unadjusted trial balance into the adjusted trial balance and financial statements. 4-1 Account Title Cash Cleaning supplies Prepaid insurance Equipment Accumulated depr. Accounts payable Nikki Capital Nikki, Drawing Revenue Rent expense Wages expense Utilities expense Misc. expense Supplies expense Insurance expense Depreciation exp. Wages payable Trial Balance Dr. Cr. 6,600 11,000 2,700 103,000 37,050 3,720 67,800 27,000 77,610 14,250 19,860 d 1,065 705 186,180 186,180 a b c Nikki Cleaners Work Sheet For Year Ended December 31, 2008 Adjustments Adj. T/Balance Dr. Cr. Dr. Cr. 6,600 0 a 1,625 9,375 0 b 900 1,800 0 103,000 0 c 10,800 0 47,850 0 3,720 0 67,800 27,000 0 0 77,610 14,250 0 915 20,775 0 1,065 0 705 0 1,625 900 10,800 d 14,240 Net income 915 14,240 1,625 900 10,800 0 197,895 0 0 0 915 197,895 4-1 Income Statement Dr. Cr. Balance Sheet Dr. Cr. 6,600 9,375 1,800 103,000 47,850 3,720 67,800 27,000 77,610 14,250 20,775 1,065 705 1,625 900 10,800 50,120 27,490 77,610 77,610 0 77,610 147,775 0 147,775 915 120,285 27,490 147,775 4-1 Spreadsheet (Work Sheet) Trial Balance Accounts Dr Cr Adjustments Dr Cr Adjusted TB Dr Accounts are listed in the Trial Balance column using the ending balance found in the general ledger. Cr 4-1 Spreadsheet (Work Sheet) Trial Balance Accounts Dr Cr Adjustments Dr Cr Adjusted TB Dr Cr Adjustments are entered here. Two possibilities: 1. Deferrals – Existing balances are changed. 2. Accruals – New information is entered. 4-1 Spreadsheet (Work Sheet) Trial Balance Accounts Dr Cr Adjustments Dr Cr Adjusted TB Dr Cr Adjustments are combined with the trial balance. Account balances are now adjusted. 4-1 Spreadsheet (Work Sheet) Adjusted TB Accounts Dr Cr Income State. Dr Cr Balance Sheet Dr Cr Revenue and expense balances in the Adjusted Trial Balance column are extended to the Income Statement column. 4-1 Spreadsheet (Work Sheet) Adjusted TB Accounts Dr Cr Income State. Dr Cr Balance Sheet Dr Cr Asset, liability, owner’s equity, and drawing balances in the Adjusted Trial Balance column are extended to the Balance Sheet column. 4-2 Objective 2 Prepare financial statements from adjusted account balances. Account Title Cash Cleaning supplies Prepaid insurance Equipment Accumulated depr. Accounts payable Nikki Capital Nikki, Drawing Revenue Rent expense Wages expense Utilities expense Misc. expense Supplies expense Insurance expense Depreciation exp. Wages payable Trial Balance Dr. Cr. 6,600 11,000 2,700 103,000 37,050 3,720 67,800 27,000 77,610 14,250 19,860 d 1,065 705 186,180 186,180 a b c Nikki Cleaners Work Sheet For Year Ended December 31, 2008 Adjustments Adj. T/Balance Dr. Cr. Dr. Cr. 6,600 0 a 1,625 9,375 0 b 900 1,800 0 103,000 0 c 10,800 0 47,850 0 3,720 0 67,800 27,000 0 0 77,610 14,250 0 915 20,775 0 1,065 0 705 0 1,625 900 10,800 d 14,240 Net income 915 14,240 1,625 900 10,800 0 197,895 0 0 0 915 197,895 4-1 Income Statement Dr. Cr. Balance Sheet Dr. Cr. 6,600 9,375 1,800 103,000 47,850 3,720 67,800 27,000 77,610 14,250 20,775 1,065 705 1,625 900 10,800 50,120 27,490 77,610 77,610 0 77,610 147,775 0 147,775 915 120,285 27,490 147,775 4-2 Nikki Cleaners Income Statement For the Year Ended December 31, 2008 Revenue Expenses: $77,610 Wages Rent Depreciation Supplies Utilities Insurance Miscellaneous Net income $20,775 14,250 10,800 1,625 1,065 900 705 50,120 $27,490 4-2 Nikki Cleaners Statement of Owner's Equity For the Year Ended December 31, 2008 Balance, January 1, 2008 Net income Less: Withdrawls Balance, December 31, 2008 $ 67,800 27,490 (27,000) $ 68,290 4-2 Nikki Cleaners Balance Sheet December 31, 2008 Assets Cash Cleaning supplies Prepaid insurance Current assets Equipment Acc. Depreciation Fixed assets Total assets $6,600 9,375 1,800 $17,775 $103,000 47,850 $55,150 $72,925 Liabilities Accounts payable Wages payable Total liabilities Owner's Equity Nikki, Capital Total Liability & Owern's Equity $3,720 915 $4,635 $ 68,290 $72,925 4-2 A classified balance sheet is a balance sheet that was expanded by adding subsections for current assets; property, plant, and equipment; and current liabilities. 4-2 Cash and other assets that are expected to be converted into cash, sold or used up usually within a year or less, through the normal operations of the business are called current assets. Cash Accounts Receivable Supplies 4-2 Notes receivable are written promises by the customer to pay the amount of the note and possibly interest at an agreed rate. 4-2 Owner’s equity is the owner’s right to the assets of the business. Owner’s equity is added to the total liabilities, and the total must be equal to the total assets. 4-3 Objective 3 Prepare closing entries. 4-3 After the closing entries are posted, all of the temporary accounts have zero balances. 4-3 Accounts that are relatively permanent from year to year are called real or permanent accounts. Accounts that report amounts for only one period are called temporary accounts or nominal accounts. 4-3 To report amounts for only one period, temporary accounts should have zero balances at the beginning of the period. At the end of the period the revenue and expense account balances are transferred or closed to Income Summary. 4-3 The balance of Income Summary is then transferred to the owner’s capital account. The balance of the owner’s drawing account is also transferred to the owner’s capital account. The entries that transfer these balances are called closing entries. JOURNAL Date 2008 Closing Entries Dec 31 Revenue Income Summary Debit Credit 77,610 77,610 31 Income Summary Salary Expense Rent Expense Supplies Expense Depeciation. Expense - Equipment Utilities Expense Misc Expense Insurance Expense 50,120 31 Income Summary Nikki, Drawing 27,490 31 Nikki, Capital Nikki, Drawing 27,000 20,775 14,250 1,625 10,800 1,065 705 900 27,490 27,000 After the closing entries are posted, all of the temporary accounts have zero balances. Nikki Cleaners Work Sheet For Year Ended December 31, 2008 Account Title Cash Cleaning supplies Prepaid insurance Equipment Accumulated depr. Accounts payable Wages Payable Nikki Capital Post Closing Trial Balance Dr. Cr. 6,600 9,375 1,800 103,000 47,850 3,720 915 68,290 $ 120,775 $ 120,775 4-2 4-4 Objective 4 Completion of the accounting cycle. 4-4 The accounting process that begins with analyzing and journalizing transactions and ends with preparing the accounting records for the next period’s transactions is called the accounting cycle. There are ten steps in the accounting cycle. Accounting Cycle 1. Transactions are analyzed and recorded in journal 2. Post Transaction from the Journal to the General Ledger 3. Prepare the Unadjusted Trial Balance 4. Adjustment data is gathered & Analyzed balance. 31 Accounting Cycle, cont 5. Optional end-of-period worksheet 6. Record Adjusting Entries 7. Prepare the Adjusted Trial Balance 8. Prepare Financial Statements 9. balance. Record Closing Entries & Post 10. Prepare a Post Closing Trial Balance 32 Accounting Periods The annual accounting period adopted by a business is known as its fiscal year. When a business adopts a fiscal year that ends when business activities have reached the lowest point in its annual operation, such a fiscal year is also called the natural year. 33 Annual Accounting Period An annual accounting period is 12 months and can be a calendar year or a fiscal year. 34 Lecture Summary • Optional end-of-period worksheet • Record Adjusting Entries • Prepare the Adjusted Trial Balance • Prepare Financial Statements • balance. Record Closing Entries & Post • Prepare a Post Closing Trial Balance 35