Friedman & Schwartz v. Temin

advertisement

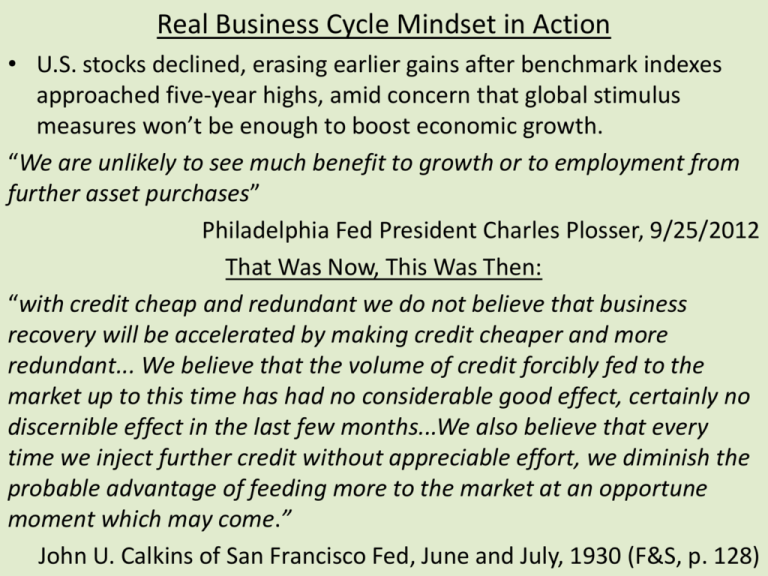

Real Business Cycle Mindset in Action • U.S. stocks declined, erasing earlier gains after benchmark indexes approached five-year highs, amid concern that global stimulus measures won’t be enough to boost economic growth. “We are unlikely to see much benefit to growth or to employment from further asset purchases” Philadelphia Fed President Charles Plosser, 9/25/2012 That Was Now, This Was Then: “with credit cheap and redundant we do not believe that business recovery will be accelerated by making credit cheaper and more redundant... We believe that the volume of credit forcibly fed to the market up to this time has had no considerable good effect, certainly no discernible effect in the last few months...We also believe that every time we inject further credit without appreciable effort, we diminish the probable advantage of feeding more to the market at an opportune moment which may come.” John U. Calkins of San Francisco Fed, June and July, 1930 (F&S, p. 128) Understanding the Great Depression The “Holy Grail” of Macroeconomics Why did a garden-variety downturn become the Great Depression? Austrian “Malinvestment” Keynesian Monetarist Von Mises Deficient Demand Fisher Keynes Friedman&Schwartz Hayek Galbraith Bernanke Robbins [Samuelson/Phillips] Golden Fetters Rothbard Kindleberger Temin Supply Side Temin Eichengreen Lucas-Rapping Eggertsson Bernanke Vedder-Galloway • Cole and Ohanian Real Wage Cole-Ohanian • Eggertsson Real Interest Rate • Friedman and Schwartz set the bar • Temin, sets the non-Monetarist tone Milton Friedman and Anna Schwartz, The Great Contraction (Chapter 7 of A Monetary History of the United States) Lessons learned: Money Matters • Fluctuations in Ms growth Fluctuations in output & price • Too often, the Fed gets things wrong Policy errors Great Contraction Great Depression • A fractional reserve banking system propagates errors …small events at times have large consequences. A liquidity crisis in a fractional reserve banking system is precisely the kind of event that can trigger – and often has triggered – a chain reaction. And economic collapse often has the character of a cumulative process. Let it go beyond a certain point, and it will tend for a time to gain strength from its own development as its effects spread and return to intensify the process of collapse. Because no great strength would be required to hold back the rock that starts a landslide, it does not follow that the landslide will not be of major proportions. Money Multiplier = 1/[c + θ (1 – c)] c = Currency/Money θ = Reserves/Deposits Friedman and Schwartz Story: Ms Contraction • Death of Benj. Strong, 10/28 • He’d have been lender of last resort Shocks Changes in Ms • Fed credit outstanding Ms • Stock Market Crash, 10/29 • 1st Banking Crisis, 10/30 • Anti-Semitism Bank of US failure Bank runs followed by stabilization • Friedman & Schwartz: Restrict! • 2nd Banking Crisis, 3/31 • KreditanstaltDANATUS Banks c and θ rise Ms • Britain off Gold, 9/31 • Perverse Fed Response: Hold Gold Hoover: RFC lending/Congress:FHLB • Large-Scale Open Market Purchases, 4/32 • Banking Panic of 1933 • Congressional pressure i • Congressional recess buying stops • Fear of Roosevelt/Devaluation Discount rate up: Hold Gold Hoover: The Fed was a weak reed for the nation to rely on in a time of trouble. Liquidationist Mindset [my] directors were “not inclined to countenance much interference with economic trends through artificial methods to compose situations that in themselves grow out of events recognized at the time as being fallacious”—the stock market speculation of 1928–29. Resented New York’s failure to carry the day in 1929 and the felt that existing difficulties were the proper punishment for the System’s past misdeeds in not checking the bull market: “If a physician either neglects a patient, or even though he does all he can for the patient within the limits of his professional skill according to his best judgment, and the patient dies, it is conceded to be quite impossible to bring the patient back to life through the use of artificial respiration or injections of adrenalin.” Lynn P. Talley of the Dallas Fed, 7/15/30 (F&S, p.128) And from Philadelphia: ...”the fruitlessness and unwisdom of attempting to depress still further the abnormally low interest rates now prevailing...” The Philadelphia Bank objects to “the present abnormally low rates for money” as an interference “with the operation of the natural law of supply and demand in the money market ...” George W. Norris of the Philadelphia Fed 7/8/30 and 9/25/30 (F&S, p. 129) Fed Follies • Failure of Bank of the United States shook confidence in the Fed. – Fed officials blamed bad bank management for bank failures. • Believed they were not responsible for non-member banks • Didn’t care much about small member banks. – F&S: Banks failed because of decline in prices of their assets • a debt-deflation vicious spiral • Injection of high powered money to meet currency demands would have stemmed the downward spiral • Power struggle between Board and Federal Reserve Bank of New York – New York wanted to buy and expand in wake of the Crash – Other district banks bemoaned that “natural liquidation did not take its course.” » Stalemate in the System • Bank holdings of excess reserves viewed as a sign of monetary ease – The mentality: There’s no demand for loans...you can’t push on a string – The reality: Banks held excess reserves because they couldn’t count on a lender of last resort Fed Follies • Fed sterilized gold inflows...Ms declined despite inflows – Other countries faced US deflation with reduced gold supplies – Their financial difficulties fed back on the United States – F&S: Countries that abandoned gold standard recovered sooner. • When Britain left gold (September 1931) – Currency withdrawals from banks reduced bank reserves – Banks tried to hold their Deposit/Reserve ratios steady • Required a 14-fold reduction in deposits for each $ of reduced reserves – F&S: Fed should have provided high powered money to offset the reserve drain – The Fed instead raised the discount rate by a historically great amount Peter Temin, Lessons from the Great Depression • Policy Regime Matters: Gold Standard Mindset Dictated Deflation • Deflation sucks • Deflationary expectations Mundell Effect: Wait to spend High real interest rates Wait to invest Increased burden of debt Debt deflation vicious circle • Great Depression an International Pathology BIG SHOCK (The Great War) Pre-War Relations Upset [ Docile Labor Militant Labor] ??? Classical Gold Standard Inappropriate Gold Standard Prescription: deflation, contraction for every problem • Gold Standard Mindset Propagated Depression • Just following the “rules” assured that things would get worse • • • • • • Temin as Contrarian Temin vs. Galbraith (stock market?) Been there—done that Temin vs. Friedman and Schwartz (lack of Strong’s leadership?) – Benjamin Strong was as committed to gold standard as anyone Temin vs. Friedman and Schwartz (bank failures?) – “First Banking Crisis”... i not up and Ms not down Temin vs. Bernanke (credit channel?) – Early downturn: industries populated by large firms declined more sharply than industries populated by small firms Access to credit not the problem Temin vs. Kindleberger (global commodity price decline?) – Expectation of deflation would reduce spending – But deflationary expectations date from mid-1931 (per Temin) Temin vs. James (German “financial fragility” crisis per Minsky?) – It was deflationary expectations of early 1930’s, not exuberance of 1920’s, that precipitated German banking crisis Temin: International Gold Standard Mindset Deflationary Policies + Deflationary Expectations Persistent Economic Contraction European Instability • Kreditanstalt/DANAT failures Capital flight by Germans – German bank reserves declined to dangerous levels – Reichsbank itself lacked reserves – Reichsbank raised interest rates ... but did not lend freely