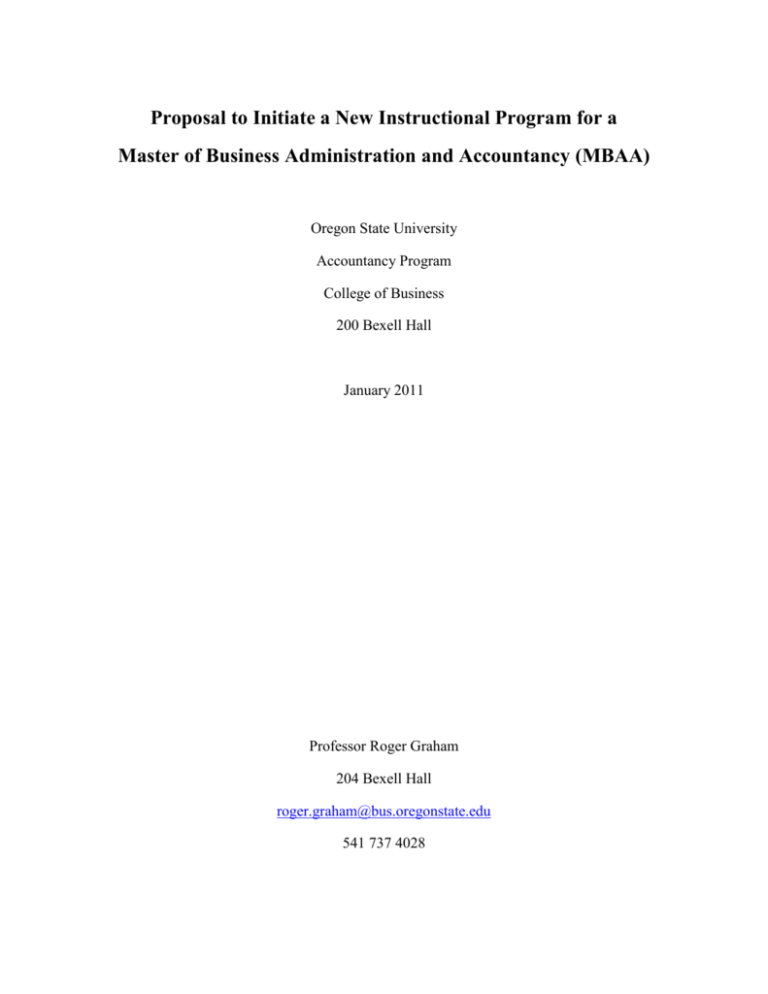

CIP - Oregon State University

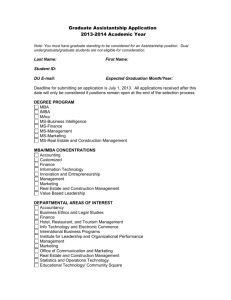

advertisement