CDOs

advertisement

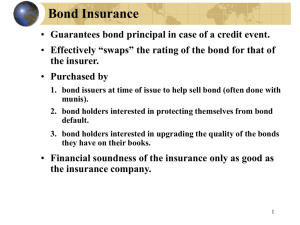

Financial Risk Management of Insurance Enterprises Collateralized Debt Obligations (CDOs) Overview • • • • • • • • • Introduction History Fundamentals Attributes Parties Credit Ratings Synthetic CDOs Valuation models Current events Introduction of CDOs • • • • Asset-backed security Structured credit product Portfolio of fixed-income assets Tranches History • First CDOs, 1987 – High yield bond portfolios • Next CDOs, 1989 – Mortgage Backed Securities – John Meriwether, Salomon Brothers • Liar’s Poker • Long Term Capital Management • • • • • Credit Risk Transfer (CRT) vehicles Loans Securitization CDOs Growth Synthetic CDOs Fundamental Concepts behind CDOs • Corporate entity raises capital • Invests in financial assets • Distributes cash flows Four Key Attributes of CDOs • • • • Assets Liabilities Purposes Credit Structure Assets • • • • Corporate bonds Residential Mortgage-Backed Securities Commercial Mortgage-Backed Securities Asset-backed Securities Liabilities • • • • Senior debt Junior debt Subordinated debt Equity Purposes • Balance sheet – Shrink balance sheet – Reduce required regulatory capital – Lower funding costs • Arbitrage – Asset manager increases fund size and fees • Origination – Issuing securities to CDO as CDO issues liabilities Structure • Market value CDOs – Enhance returns through trading – Credit quality derives from the ability to liquidate assets and repay debt tranches • Cash flow CDOs – Cash flows from assets pays the interest and principal of tranches Cash Flow CDOs • Distribution of cash flows: waterfall • Coverage test – Overcollateralization – Interest coverage Structural Matrix Parties • • • • Asset managers Asset sellers Investment bankers and structurers Monoline bond insurers and financial guarantors Credit Ratings • Collateral diversification • Likelihood of default • Recovery rates Synthetic CDOs • Does not own assets on which it bears the credit risk • Sells protection via Credit Default Swaps • Buys protection via tranches issued Valuation models • Gaussian copula model – Default correlation • Dynamic model – Hazard rates with deterministic drift with periodic impulses CDOs on CDOs • CDOs based on a tranche from a CDO • Example: – CDO^2 based on a tranche (e.g. BBB) of a CDO – CDO^n based on a tranche of a CDO^(n-1) • It gets very complicated very quickly Current events • • • • Subprime mortgage crisis Counterparty credit risk Liquidity issues Prices drops – ABX index • Rating agencies are blamed for inaccurate credit ratings Concerns with CRT vehicles • ‘Clean’ risk transfer • Risk of failure of market participants to understand associated risk • Potentially high concentration of risk • Adverse selection