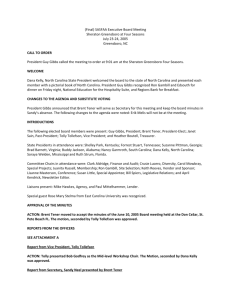

February 11, 2006 Board Meeting

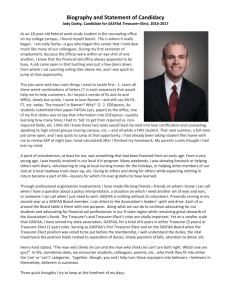

advertisement