Leading US Life

Insurance Provider

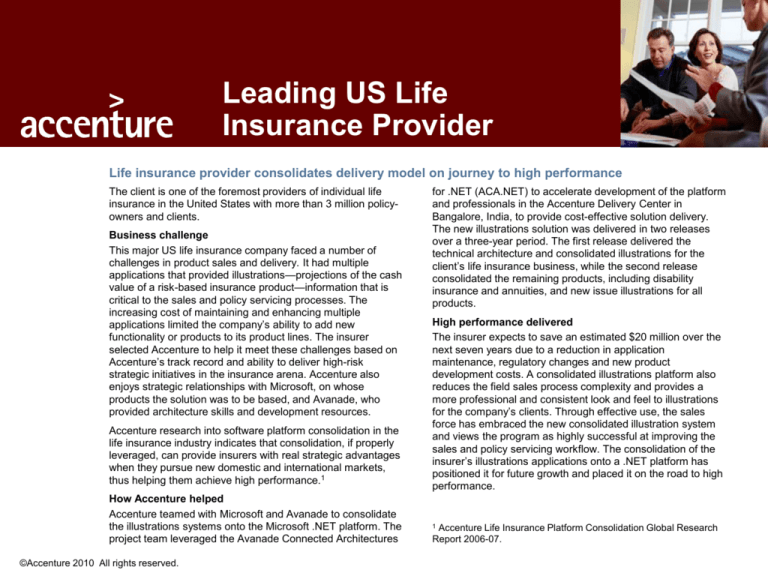

Life insurance provider consolidates delivery model on journey to high performance

The client is one of the foremost providers of individual life

insurance in the United States with more than 3 million policyowners and clients.

Business challenge

This major US life insurance company faced a number of

challenges in product sales and delivery. It had multiple

applications that provided illustrations—projections of the cash

value of a risk-based insurance product—information that is

critical to the sales and policy servicing processes. The

increasing cost of maintaining and enhancing multiple

applications limited the company’s ability to add new

functionality or products to its product lines. The insurer

selected Accenture to help it meet these challenges based on

Accenture’s track record and ability to deliver high-risk

strategic initiatives in the insurance arena. Accenture also

enjoys strategic relationships with Microsoft, on whose

products the solution was to be based, and Avanade, who

provided architecture skills and development resources.

for .NET (ACA.NET) to accelerate development of the platform

and professionals in the Accenture Delivery Center in

Bangalore, India, to provide cost-effective solution delivery.

The new illustrations solution was delivered in two releases

over a three-year period. The first release delivered the

technical architecture and consolidated illustrations for the

client’s life insurance business, while the second release

consolidated the remaining products, including disability

insurance and annuities, and new issue illustrations for all

products.

High performance delivered

The insurer expects to save an estimated $20 million over the

next seven years due to a reduction in application

maintenance, regulatory changes and new product

development costs. A consolidated illustrations platform also

reduces the field sales process complexity and provides a

more professional and consistent look and feel to illustrations

for the company’s clients. Through effective use, the sales

force has embraced the new consolidated illustration system

and views the program as highly successful at improving the

sales and policy servicing workflow. The consolidation of the

insurer’s illustrations applications onto a .NET platform has

positioned it for future growth and placed it on the road to high

performance.

Deutsche Telekom

Accenture research into software platform consolidation in the

life insurance industry indicates that consolidation, if properly

leveraged, can provide insurers with real strategic advantages

when they pursue new domestic and international markets,

thus helping them achieve high performance.1

How Accenture helped

Accenture teamed with Microsoft and Avanade to consolidate

the illustrations systems onto the Microsoft .NET platform. The

project team leveraged the Avanade Connected Architectures

©Accenture 2010 All rights reserved.

1

Accenture Life Insurance Platform Consolidation Global Research

Report 2006-07.

Leading US Life

Insurance Provider

Company overview

• One of the foremost providers

of individual life insurance in

the United States.

• More than 3 million policyowners and clients.

Choice of Accenture

• Successful track record and

ability to deliver high-risk

strategic initiatives in the

client’s environment.

• Strategic relationships with

Microsoft and Avanade.

• Global Delivery Network.

Staffing and experience

• Team comprised of 20

Accenture, 8-10 Avanade and

two Microsoft professionals.

• All user interface and

calculations development

work done in the Accenture

Delivery Center in Bangalore,

India.

Engagement scope

• Consolidate multiple, productsilo systems into one sales

solution on a Microsoft.NET

platform.

• Reduce cost of system

maintenance.

• Improve timeliness of new

product delivery.

©Accenture 2010 All rights reserved.

Engagement timeframe

• October 2003 - March 2006

Delivery methods

• Accenture Delivery Methods

Services provided

• Define overall business

architecture.

• Define future state business

processes.

• Define high level and detailed

requirements for the solution.

• Define and complete technical

architecture and design.

• Develop system test strategy.

• Execute systems test.

• Support user acceptance test.

• Support overall deployment.

Technology components

• Microsoft .NET

• Avanade Connected

Architecture for .NET

(ACA.NET)

• [Microsoft Visual] C#

• PL/1

Key success factors

• Synergies from the alliance of

Accenture, Avanade and

Microsoft.

• Accenture’s expertise in

delivering large-scale

programs.

• Accenture’s Global Delivery

Network.

Business challenge

• The client had multiple, product-specific illustration systems for life

products and secondary product lines.

• Both maintenance cost and cost of introducing new products were

growing.

• The field force was demanding technology to produce illustrations in

real-time during sales meetings, instead of returning to the office and

producing hard-copy illustrations that had to be mailed to prospects.

• The client identified a need to crate a single illustration system,

economical to maintain to support field representatives whether

disconnected or connected.

How Accenture helped

• Teamed with Avanade and Microsoft to give client the benefit of

alliance synergies: Accenture was responsible for overall program

management, business architecture, and testing resources; Avanade

was responsible for the architecture and C# development; Microsoft

assisted with the conference room pilot, and technical architecture

design.

• Delivered program in three releases over a three-year period. The

first release delivered the technical architecture and consolidated the

Illustrations for Life, Disability Insurance and Annuities. Release 2

consolidated the remaining products and all new-issue Illustrations.

Release 3 integrated the Illustrations platform with other front-end

distribution systems.

High performance delivered

• The insurer expects to save an estimated $20 million over the next

seven years due to a reduction in application maintenance,

regulatory changes and new product development costs.

• Client eliminated eight applications in favor of one.

• Field agents gained capability to do illustrations in real time.

Efficiency of field agents improved because they could prepare

illustrations faster, reusing information and case data from prior

illustrations, easily share illustrations information across sales teams,

etc.

• Brand consistency improved because the new system presented

information uniformly across products.