Capital Planning (cont.) - Silver, Freedman, Taff & Tiernan LLP

advertisement

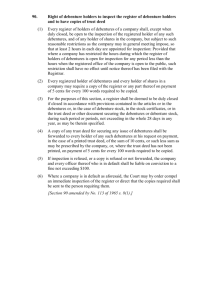

Raising Capital: How the Rules Have Changed Illinois Bankers Association, Capital Raising Forum, August 20, 2010 Presented By: Dave Muchnikoff, Silver, Freedman & Taff, L.L.P. (202) 295-4513 – dmm@sftlaw.com Allen Laufenberg, Stifel Nicolaus Weisel (312) 269-0381 – aglaufenberg@stifel.com 1 1 Where We Are Today Some signs of improvement but still many challenges expected: Recession behind us? How robust will the recovery be? FDIC insurance fund stabilized with special assessment and prepayments Macro-economic issues will continue to impact the industry More credit problems coming Housing prices – Where is the bottom? When will things start to improve? Many more bank failures expected At March 31, 2010, “Problem List” was at 15-year high of 775 institutions with total assets of $431.2 billion Many are facing slow balance sheet growth, flat fee revenue and rising regulatory expense burden Significant industry-wide capital need Regulatory reform has injected further uncertainty 2 2 Capital Planning Capital is King, and will be for the foreseeable future Bolster current capital position; don’t under-estimate need for capital Those with capital can be proactive, those without will be reactive Threshold question for regulatory permission to do anything is “what is your capital position?” What are your regulatory capital requirements and have you accounted for anticipated regulatory change? Tier 1 Leverage Ratio > 5% Tier 2 Risk-Based Capital Ratio > 6% Total Risk-Based Capital Ratio > 10% Counter-cyclical requirements? 3 3 Capital Planning (cont.) Survivability means capital and tangible book value How fast are you planning to grow and how will you achieve your growth? What are your potential sources of capital and how available are they? Risk profile matters: financial institutions with capital cushions, “clean” balance sheets and transparent, low-risk strategies have been, and will continue to be, rewarded by the markets relative to peers Are there risks within your balance sheet or operating strategies that could threaten your capital position? 4 Capital Planning (cont.) Position your company to take advantage of opportunities How can your capital position be improved without raising new capital? oRestructure balance sheet through shrinkage, securitization, asset sales, etc. oConstrain growth and build capital through retained earnings Improve earnings growth through efficiencies (cost cuts, product/service changes) Cut current cash dividend to conserve capital oConvert hybrid securities or other securities into common equity (e.g., warrants, convertible preferreds or convertible debt, stock options) oLock in fixed rates on existing floating rate securities at current low rates 5 5 Capital Planning (cont.) The type/structure of capital instrument will be influenced by many factors: oHow much additional capital is needed? Be aggressive in your assessment of existing balance sheet risk – investors will be oRegulatory requirements: what type of “qualified capital” do you need and at what level? oCurrent corporate structure, financial condition and capital structure oMarket conditions: Is there a market for the capital instrument? oCosts and impact on the organization 6 6 Types of Capital Being Raised by Banks & Thrifts o Common equity is taking an increased role in bank capital raising as regulatory agencies and investors focus on the TCE ratio TruPS market dislocation in 2008 and now the Collins Amendment eliminate the once popular source of Tier 1 Capital Since the beginning of the recession in 2008 5x as much common equity has been raised as was raised in the first 8 years of the decade combined Total Capital Raised by Banks & Thrifts Cumulative Capital Raised 2000 - Present 363.0 ($B) 400 350 300 210.4 250 166.3 200 150 100 50 2000 Source: SNL Financial 2001 2002 2003 2004 Trust Preferred Preferred 2005 2006 2007 2008 2009 Common Equity TARP Preferred 2010 Common & Trust TARP Preferred Preferred Preferred Common Equity Preferred 7 Capital Planning (cont.) Why Raise Capital Now? o Leverage “relationship based” community banking model by increasing market share through strategic acquisitions and organic growth. o Current market conditions will likely lead to increase failures, branch sales and whole bank/thrift mergers at attractive pricing levels. Augment potential strategic acquisitions with organic growth as distressed competitors are eliminated from the marketplace or have a decrease capacity to effectively compete. o Expansion capital investors are looking for management with extensive banking experience including in negotiating and integrating mergers and acquisitions and significant involvement in credit risk management and bank workout situations. o Take advantage of FDIC-assisted transactions, privately negotiated acquisitions or other business opportunities in your market area. 8 8 Investors Value Balance Sheet Strength Asset Quality Stratification 151% < 1.0% > 150% 135% 1.0% - 2.0% Reserves/NPLs % 105% 2.0% - 3.0% NPAs/Assets Reserve Coverage Stratification 96% 3.0% - 4.0% 4.0% - 5.0% 82% 5.0% - 6.0% 81% 0% 50% 125% - 150% 126% 100% - 125% 126% 75% - 100% 126% 101% 50% - 75% 77% 30% - 50% 49% > 6.0% 160% 56% < 30% 100% 150% Price/Tangible Book Source: SNL Financial. Data represents median values 200% 0% 50% 100% 150% 200% Price/Tangible Book 9 Investors Value Balance Sheet Strength TCE Ratio Stratification > 10.0% 123% 9.0% - 10.0% Texas Ratio % 99% 76% 5.0% - 6.0% 0% 50% 45% - 60% 57% 60% - 75% 54% 50% 75% - 90% 45% < 5.0% 94% 30% - 45% 110% 6.0% - 7.0% 114% 15% - 30% 128% 7.0% - 8.0% 144% < 15% 100% 8.0% - 9.0% TCE Ratio % Texas Ratio Stratification 39% > 90% 100% 150% Price/Tangible Book Source: SNL Financial. Data represents median values 200% 0% 50% 100% 150% 200% Price/Tangible Book 10 Types and Sources of Capital: Types: • Debt • Preferred Stock • Common Stock Sources: • Rights Offering • Private Offering • Regulation D or Rule 144A • Underwritten • Public markets • Private equity investors • Institutional investors • Correspondent banks Alternative Source: 11 • Sale of Assets / Franchise 11 Senior Debt Benefits Issued by HC with proceeds down-streamed to subsidiary bank Maturity typically up to 10 years Downstreamed proceeds count as Tier 1 capital at bank level, no capital treatment at holding company level Interest payments are taxdeductible No change to ownership structure Considerations Can you raise enough? Not permanent capital, must have ability to repay or refinance Must be able to dividend funds from bank to service debt Will not solve a capital issue at the holding company level Earnings dilutive unless leveraged to break even or better Limited market for small companies; usually obtained as a loan from another financial institution 12 12 Subordinated Debt Benefits May be issued by HC or Bank Maturity must be minimum of 5 years, typically 10-15 years If issued by HC, is considered Tier 2 capital at holding company level; proceeds can be contributed to bank as Tier 1 capital. If issued by bank, is considered Tier 2 capital Interest payments are taxdeductible No change to ownership structure Considerations Can you raise enough? Not permanent capital, must have ability to repay or refinance If Tier 2 capital, sub debt limit equals 50% of Tier 1 capital; capital qualification is reduced 20% annually during last 5 years to maturity Impact on earnings of interest cost; must be able to service debt at issuer level Limited market for small companies; usually privately placed with another community financial institution or a private 13 investor 13 Preferred Stock Benefits Increases tangible equity without increasing common shares Non-cumulative perpetual preferred counts as Tier 1 capital Can structure to be convertible into common stock, either mandatorily or at the option of the holder Considerations Higher current cash cost relative to issuance of common stock Dividends are paid in after-tax dollars Informal guidance from the Fed suggests that trust preferred and non-cumulative perpetual preferred securities should not exceed 40% of the pro forma Tier 1 capital Limited market for smaller companies 14 14 Common Stock – Follow-on Offering Benefits Provides Tier 1 capital in form most favored by regulators Represents permanent capital Can be issued using a variety of structures: •Private placements •“Overnight” public issuances (utilizing a shelf registration) •At-the-market transactions (ATMs) •Standard public offerings (not utilizing a shelf registration) •Rights offerings Considerations Concerns about dilution to existing shareholders Current stock prices at or near multi-year lows for most companies Potential concern over ability to effectively deploy “excess” capital Market conditions 15 15 Sale of Branches / Assets Benefits Creates common capital without diluting current shareholders Assets sold reduce risk-weighted assets providing relief in the denominator as well Allows management to focus on core assets in the future Examples: Branch Sales Sale of non-core business lines Considerations Buyers in franchise sales not acquiring non-performing assets, reducing near-term core profitability Will likely need to “right-size” operational infrastructure Buyers may ask for a discount even on performing assets Difference between assets acquired and liabilities assumed will need to be bridged with cash/securities, impacting the company’s future liquidity 16 16 Sale of Branches– Summary Statistics Since the beginning of 2009, there have been 127 announced branch sales, 66 of which have announced the deposit premium: oMedian premium to deposits of 3.44% 4.00% for 2010 4.05% for those transactions where loans were acquired o85 of the 127 transactions have involved loans and deposits Median loans transferred as % of deposits (for 66 deals with announced premiums) is only 41.45% Transferred loans have been performing loans, sometimes at a discount • CenterState transaction announced 8/8/10 involved $125M of performing loans at a 10% discount to par 17 Source: SNL Financial 17 Sale of Branches– Multiple History o As the table below highlights, multiples in branch transactions have declined to well below their historical levels during the recent recession # of Transactions 180 Deposit Premium Paid 8.00% 160 6.70% 140 5.78% 120 9.00% 7.92% 6.00% 7.26% 8.00% 7.00% 7.00% 5.64% 6.00% 5.00% 100 4.00% 3.40% 80 5.00% 4.00% 60 3.00% 40 2.00% 20 1.00% 0 0.00% 2000 2001 2002 2003 # of Transactions Source: SNL Financial 2004 2005 2006 2007 2008 2009 2010 YTD 18 Median Deposit Premium 18 Sample Term Sheet: Your Series A Non-Cumulative Perpetual Convertible Preferred Stock Issuer Your Bank (or Holding Company) Title of Securities X.XX% Series A Non-Cumulative Perpetual Convertible Preferred Stock (the “Preferred Stock”) Number of shares issued 10,000 shares of Preferred Stock Price to Public Anticipate 100% of liquidation preference ($1,000 per share) Aggregate liquidation preference offered $10,000,000 of liquidation preference Annual dividend rate (Non-Cumulative) X.XX% on the per share liquidation preference of $1,000 per share Dividend Payment Dates Quarterly Maturity Perpetual Liquidation preference per share $1,000 plus unpaid dividends, if any Liquidation Rights In the event of voluntary or involuntary liquidation, dissolution or winding-up, holders of the Preferred Stock will be entitled to receive, out of our assets that are legally available for distribution to stockholders, before any distribution is made to holders of our common stock or other junior securities, a liquidating distribution in the amount of $1,000 per share of the Preferred Stock plus any declared or unpaid dividends, without accumulation of any undeclared dividends (before any distributions to holders of any junior securities). Distributions will be made pro rata as to the Preferred Stock and any other parity securities and only to the extent of our assets, if any, that are available after satisfaction of all liabilities to creditors. 19 Your Series A Non-Cumulative Perpetual Convertible Preferred Stock (cont.) Voting Rights Except as otherwise required by law, a holder of Preferred Stock will have voting rights only in the case of certain dividend clearages under certain limited circumstances. In addition, holders of Series A Preferred Stock will also be entitled to vote separately as a class in connection with certain corporate events or actions. Specifically, the consent of the holders of at least a majority of the Series A Preferred Stock, voting as a class, is required to (i) amend, alter, repeal or otherwise change any provision of our Articles of Incorporation or Certificate of Determination in a manner that would adversely affect the rights, preferences, powers or privileges of the Series A Preferred Stock or (ii) create, authorize, issue or increase the authorized or issued amount of any class or series or equity securities that is senior or equal to the Series A Preferred Stock as to dividend rights, or rights upon our liquidation, dissolution or winding-up. Ranking The Preferred Stock will rank, with respect to the payment of dividends and distributions upon liquidation, dissolution or winding-up: •Junior to all our existing and future debt obligations •Junior to each class of capital stock or series of preferred stock, the terms of which expressly provide that it ranks senior to the Preferred Stock and •Senior to all classes of our common stock or series of preferred stock, the terms of which do not expressly provide that it ranks senior to or on a parity with the Preferred Stock. 20 20 Your Series A Non-Cumulative Perpetual Convertible Preferred Stock (cont.) Dividends Dividends are payable semi-annually, when, as and if declared, on the last day of March and September of each year, commencing March 31, 2011. Dividends are cumulative and are payable if, when and as authorized by our Board of Directions. Therefore, if no dividend is declared by our board of directors on the Series A Preferred Stock for a dividend period, dividends for that period will be accrued and payable when dividends are declared for any subsequent period. Dividends may not be paid on our common stock or any other capital security which ranks junior to the Series A Preferred Stock for any dividend period until full dividends with respect to the Series A Preferred Stock have been declared and paid or set apart for payment. [So long as any shares of Series A Preferred Stock are outstanding, if we declare any dividends on our common stock or make any other distribution to our common shareholders, the holders of the Series A Preferred Stock will be entitled to participate in such distribution on an as-converted basis.] Dividend Stopper So long as any share of Preferred Stock remains outstanding, No dividend will be declared and paid or set aside for payment and no distribution will be declared and made or set aside for payment on any junior securities (other than a dividend payable solely in shares of junior securities) and No shares of junior securities will be repurchased, redeemed, or otherwise acquired for consideration by us, directly or indirectly (other than (a) as a result of a reclassification of junior securities for or into other junior securities, or the exchange or conversion of one share of junior securities for or into another share of junior securities, (b) repurchases in support of our employee benefit and compensation programs and (c) through the use of proceeds of a substantially contemporaneous sale of other shares of junior securities), unless, in each case, the full dividends for the most recent dividend payment date on all outstanding shares of the Preferred Stock and parity securities have been paid or declared and a sum sufficient for the payment of those dividends has been set aside. 21 Lock-ups The Issuer and each of its executive officers and directors will agree not to sell any preferred stock or common stock for 90 days following the issuance date. 21 Your Series A Non-Cumulative Perpetual Convertible Preferred Stock (cont.) Redemption With prior regulatory approval, if required, the Preferred Stock is redeemable at the Bank’s option at any time, in whole or in part, on or after December 31, 2015, at $10.00 per share, plus accrued and unpaid dividends, if any. Holders of the Preferred Stock will have no right to require redemption of the Preferred Stock. Conversion right at Holder’s Option Each share of the Preferred Stock may be converted at any time, at the option of the holder, into shares of common stock (which reflects an approximate initial conversion price of $XX.XX per share of common stock) plus cash in lieu of fractional shares, subject to anti-dilution adjustments. Mandatory conversion at Issuer’s option On or after Month XX, 2013, the Bank may, at its option, at any time or from time to time cause some or all of the Preferred Stock to be converted into shares of common stock at the then applicable conversion rate if, for 20 trading days within any period of 30 consecutive trading days, including the last trading day of such period, ending on the trading day preceding the date the Bank gives notice of mandatory conversion, the closing price of common stock exceeds 130% of the then applicable conversion price of the Preferred Stock. 22 22 Your Series A Non-Cumulative Perpetual Convertible Preferred Stock (cont.) Anti-Dilution Adjustments The conversion rate may be adjusted in the event of, among other things: • dividends or distributions in common stock or cash, debts or other property; • certain issuances of stock purchase rights; • certain self tender or exchange offers; or • increases in cash dividends on our common stock; • subdivisions, splits and combinations of the common stock. Limitation on Beneficial Ownership No holder of the Preferred Stock will be entitled to receive shares of our common stock upon conversion to the extent (but only to the extent) that such receipt would cause such converting holder to become, directly or indirectly, a “beneficial owner” (within the meaning of Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder) or more than 9.9% of the shares of our common stock outstanding at such time. Any purported delivery of shares of our common stock upon conversion of the Preferred Stock shall be void and have no effect to the extent (but only to the extent) that such delivery would result in the converting holder becoming the beneficial owner of more than 9.9% of the shares of common stock outstanding at such time. 23 23 Your Series A Non-Cumulative Perpetual Convertible Preferred Stock (cont.) Reorganization Events Upon: (1) any consolidation or merger of us with or into another person in each case pursuant to which our common stock will be converted into cash, securities or other property; (2) any sale, transfer, lease or conveyance to another person of all or substantially all of our property and assets in each case pursuant to which our common stock will receive a distribution of cash, securities or other property; or (3) certain reclassifications of our common stock or statutory exchanges of our securities; each share of the Preferred Stock outstanding immediately prior to such reorganization event, without the consent of the holders of the Preferred Stock, will become convertible into the kind and amount of securities, cash and other property or assets that a holder (that was not the counterparty to the reorganization event or an affiliate of such other party) of a number of shares of our common stock equal to the conversion rate per share of Preferred Stock prior to the reorganization event would have owned or been entitled to receive upon the reorganization event. Preemptive Rights Holders of the Preferred Stock have no preemptive rights. 24 24 Sample Term Sheet: Your Corporation Senior Debt Debentures Offered Convertible Senior Debentures due 2030. Maturity Date December 1, 2030 Interest Payment Dates June 1 and December 1 of each year, commencing December 1, 2010. Conversion Rights The debentures are convertible into common stock at any time prior to maturity, unless previously redeemed. The debentures are convertible into our common stock at a conversion rate of 100 shares of common stock for each $1,000 principal amount of debentures (equivalent to a conversion price of $10.00 per share), subject to adjustment in certain events described herein, unless previously redeemed. Optional Redemption by us Subject to any required prior regulatory approval, the debentures may be redeemed at our option, whole or in part, at any time on or after December 1, 2020 at the redemption price equal to 100% of the principal amount of the debentures to be redeemed, plus accrued and unpaid interest, if any, to by excluding the redemption date. Mandatory Redemption None 25 25 Senior Debt (cont.) Fundamental change If at any time after the earlier of (i) December 19, 2013 and (ii) the date on which all of the shares of the TARP Preferred Stock have been redeemed by us or transferred by Treasury to third parties, we undergo a fundamental change (as defined below), holders may require us to repurchase all or a portion of their debentures at a repurchase price equal to 101% of the principal amount of the debentures to be repurchased plus any accrued and unpaid interest, if any, to, but excluding, the repurchase date. Ranking The debentures will rank: •Senior in right of payment to all our existing and future subordinated indebtedness; •Equal in right of payment to all of our present and future unsecured indebtedness that is not expressly subordinated; and •Effectively subordinated to all of our subsidiaries’ obligations (including secured and unsecured obligations) and subordinated in right of payment to our secured obligations, to the extent of the assets securing such obligations. As of June 30, 2010, we had no indebtedness senior or equal in right of payment to the debentures. While the indentures governing the terms and conditions of the debentures prohibits us from incurring unsecured indebtedness that would be senior in right of payment to the debentures, it does not preclude us from incurring indebtedness that is collateralized, regardless of whether ranking senior in right of payment to the debentures and does not otherwise prohibit or limit the incurrence of additional indebtedness. Because the Corporation is a corporation without significant assets, other than its equity interest in the Bank, in a bankruptcy or liquidation proceeding, claims of holders of the debentures may be satisfied solely from the equity interest in the Bank remaining after satisfaction of all claims of creditors of the Bank (including depositors). 26 26 Senior Debt (cont.) Sinking Fund None. Covenants The debentures and related indenture do not contain any financial maintenance or similar covenants. However, the indenture, among its other provisions, restricts our ability to grant liens, enter into certain transactions with affiliates, dispose of the Bank or its assets, pay dividends on, or repurchase our common stock under certain circumstances and incur non-collateralized indebtedness that ranks senior to the debentures and prohibits us from consolidating or merging with another entity unless: •the other entity assumes our obligations under the indenture, •immediately after the merger or consolidation takes effect, we will not be in default and no event which, after notice or lapse of time or both, would become a default, under the indenture, and •certain other conditions are met including delivery by us to the indenture trustee of an appropriate opinion of counsel. Rights of Acceleration If an event of default has occurred and is continuing, the trustee or the holders of at least 25% in principal amount of the then outstanding debentures may declare the principal amount of all the debentures, together with accrued but unpaid interest thereon, to be immediately due and payable, subject in certain circumstances to rescission or waiver by the holders of at least a majority in principal amount of debentures. 27 27 Senior Debt (cont.) Use of Proceeds We intend to utilize up to $XX million of the net proceeds to repay a line of credit with another financial institution. The unsecured line of credit has an interest rate equal to one month LIBOR plus 2.0% and matures October 1, 2010. At June 30, 2010 the interest rate was X.XX%. We intend to utilize any remaining net proceeds for general corporate purposes, which may include future acquisitions as well as investments in or extensions of credit to the Bank and our other existing or future subsidiaries. Common Stock Outstanding At June 30, 2010, there were XX shares of Your Corporation common stock issued and outstanding and YY shares of our preferred stock issued and outstanding, all of which consisted of our Series A Preferred Stock, which we issued, along with a ten-year warrant to purchase shares of our common stock, to Treasury pursuant to Treasury’s Troubled Asset Relief Program Capital Purchase Program. In addition, an aggregate of 100,000 shares of common stock were issuable upon exercise of outstanding stock options at June 30, 2010, none of which had an exercise price less than the market price of the common stock as of that date. Listing It is not our intention to list the debentures on any securities exchange. 28 28 Conversion Rights The debentures will be convertible into the common stock of Your Corporation at any time up to and including the maturity date (subject to prior redemption by Your Corporation on not less than 30 nor more than 60 days’ notice) at the principal amount thereof, at the initial conversion price (subject to adjustments as described below). The conversion price will be subject to adjustment upon the occurrence of certain events, including: • dividends (and other distributions) payable in common stock on any class of capital stock of Your Corporation; • the issuance to all holders of common stock of rights, warrants or options entitling them to subscribe for or purchase stock at less than the current price (determined as provided in the indenture); • subdivisions, combinations and reclassifications of common stock; • distributions to all holders of common stock of evidences of indebtedness or assets (including securities, but excluding those dividends, rights, warrants, options and distributions referred to above and dividends and distributions paid exclusively in cash) of Your Corporation; 29 29 Conversion Rights (cont.) • distribution consisting exclusively of cash in an aggregate amount within the preceding 12 months exceeds 10% of Your Corporation’s market capitalization (being the product of the current market price of the common stock on the date for the determination of holders of shares of common stock entitled to receive such distribution times the number of shares of common stock then outstanding); and • the purchase of common stock pursuant to a tender offer which involves an aggregate consideration that exceeds 10% of Your Corporation’s market capitalization on the expiration of such tender offer. • In case of certain consolidations or mergers to which Your Corporation is a party or the transfer of substantially all of the assets of Your Corporation, each debenture then outstanding would, without the consent of any holders of debentures, become convertible only into the kind and amount of securities, cash and other property receivable by common stock holders, as if the debenture converted. 30 30 Fundamental Change Permits Holders to Require Us to Repurchase Debentures If a fundamental change occurs, you will have the right, at your option, to require us to pay (the “fundamental change repurchase price”) 101% of the principal amount of the debentures to be repurchased plus accrued and unpaid interest, to but excluding the fundamental change repurchase date (unless the fundamental change repurchase date is between a regular record date and the interest payment date to which it relates, in which case we will pay accrued and unpaid interest to the holder of record on such regular record date). 31 31 Fundamental Change Permits Holders to Require Us to Repurchase Debentures (cont.) A “fundamental change” will be deemed to have occurred if any of the following occurs after the earlier of (i) December 19, 2012 and (ii) the date on which all of the shares of TARP Preferred Stock have been redeemed by us or transferred by Treasury to third parties: • • • • a “person” or “group” has become the direct or indirect “beneficial owner,” of more than 50% of the voting power of our common equity; consummation of (A) any recapitalization, reclassification or change of our common stock (other than changes resulting from a subdivision or combination) as a result of which our common stock will be converted into, or exchanged for, stock, other securities, other property or assets or (B) any share exchange, consolidation or merger of us pursuant to which our common stock will be converted into cash, securities or other property or any sale, lease or other transfer in one transaction or a series of transactions of all or substantially all of the consolidated assets of us and our subsidiaries, taken as a whole, to any person other than one of our subsidiaries; provided, however, that a share exchange, consolidation or merger transaction where the holders of more than 50% of all classes of our common equity immediately prior to such transaction own, directly or indirectly, more than 50% of all classes of common equity of the continuing or surviving corporation or transferee of the parent thereof immediately after such event will not constitute a fundamental change or if common stockholders receive publicly traded securities; continuing directors cease to constitute at least a majority of our board of directors (or, if applicable, a successor person to us); or our shareholders approve any plan or proposal for the liquidation or dissolution of us. 32 32 Ranking The debentures will be senior unsecured obligations of Your Corporation. The debentures will rank: • senior in right of payment to all our existing and future unsecured indebtedness if the appropriate instruments defining such indebtedness provide that such indebtedness is subordinate in right of payment to the debentures, including our $X.X million of floating rate junior subordinated deferrable interest debentures due 2036; • equal in right of payment to all of our present and future unsecured indebtedness that is not expressly subordinated; and • effectively subordinated to all of our subsidiaries’ obligations (including secured and unsecured obligation) and subordinated in right of payment to our secured obligations, to the extent of the assets securing each obligations. • Your Corporation may from time to time incur additional indebtedness constituting senior indebtedness. While the indenture prohibits us from incurring unsecured indebtedness that would be senior in right of payment to the debentures, it does not otherwise prohibit or limit the incurrence of additional indebtedness or indebtedness which is collateralized. We may incur substantial additional amounts of indebtedness in the future. 33 33 Optional Redemption The debentures are redeemable at Your Corporation’s option, subject to obtaining any required approval from the government agency having primary regulatory authority over Your Corporation. In whole or from time to time in part, upon not less than 30 nor more than 60 days’ notice on any date on or after December 1, 2020. Prior to maturity at a redemption price equal to 100% of the principal amount, together in the case of any such redemption with accrued interest to the redemption date (subject to the right of holders of record on the relevant regular record date to receive interest due on an interest payment date that is on or prior to the redemption date). 34 34 Limitations on Dividends, Redemptions, Etc. Upon a Default The indenture provides that Your Corporation will not: declare or pay any dividend or make any other distribution on any junior securities, except dividends or distributions payable in junior securities; or purchase, redeem or otherwise acquire or retire for value any junior securities, except junior securities acquired upon conversion thereof into other junior securities; or permit a subsidiary to purchase, redeem or otherwise acquire or retire for value any junior securities; if, at the time such dividend, distribution, purchase, redemption or other acquisition is effected, a default in the payment of any interest upon any debenture when it becomes due and payable or a default in the payment of the principal of (or premium, if any, on) any debenture at its maturity shall have occurred and be continuing. 35 35 Limitations on Dividends, Redemptions, Etc. Upon a Default (cont.) The term “junior securities” means: shares of common stock of Your Corporation; shares of preferred stock of Your Corporation; shares of any other class or classes of capital stock of Your Corporation; any other non-debt securities of Your Corporation (whether or not such other securities are convertible into junior securities); or unsecured debt securities of Your Corporation (other than the debentures) as to which, in the instrument creating or evidencing the same or pursuant to which the same is outstanding, it is provided that such debt securities do not rank equal in right of payment with the debentures. 36 36 Restrictions on Issuance and Sale of Capital Stock or Dispositions of the Bank The indenture provides that Your Corporation shall not: Sell, transfer or otherwise dispose of any shares of the capital stock of the Bank or permit the Bank to issue, sell or otherwise dispose of shares of its capital stock, unless the Bank remains a wholly-owned subsidiary of Your Corporation, Permit the Bank to merge or consolidate with any other entity (other than Your Corporation), unless the surviving entity is the Bank or a wholly owned subsidiary of Your Corporation, Permit the Bank to convey or transfer its properties and assets substantially as an entirety to any person, except to Your Corporation or any wholly owned subsidiary of Your Corporation, or Permit the Bank from issuing any of its capital stock, preferred or otherwise, which has a priority or preference senior to any capital stock of the Bank held by Your Corporation. 37 37 Events of Default The indenture defines an event of default with respect to the debentures as any one of the following events: certain events of bankruptcy of Your Corporation or receivership of any major depository institution subsidiary (as defined in the Indenture); default for 30 days in payment of interest on any debenture default in payment of principal of (or premium, if any, on) or the fundamental change repurchase price on any debenture when the same shall become due and payable, whether at stated maturity, by acceleration or otherwise; failure by Your Corporation for 60 days after due notice to remedy a default in performance or the breach of any material representation, covenant or warranty in the indenture; 38 38 Events of Default (cont.) failure by Your Corporation or any subsidiary to pay indebtedness for money borrowed in an aggregate principal amount exceeding $X.X million when due or upon the expiration of any applicable period of grace with respect to such principal amount; or acceleration of the maturity of any indebtedness of Your Corporation or any subsidiary for borrowed money in excess of $X.X million if such failure to pay or acceleration results from a default under the instrument giving rise to, or securing, such indebtedness and is not annulled within 10 days after due notice has been given, unless the validity of such default is contested by Your Corporation in good faith by appropriate proceedings; the failure of the Bank to meet criteria required for classification as an “adequately capitalized” insured depository institution under the regulations of the FDIC if such failure is not cured within a period of 90 days from the date of such failure or, if such failure is the result of a change in statute or regulation, such failure is not cured within a period of 180 days from the date of such failure; or at such time as the Bank becomes subject to statutory or regulatory prohibition against the payment of dividends or other capital distributions and such prohibition is not removed or otherwise made inapplicable within a period of 90 days from the date on which such limitation became effective. 39 39 Events of Default (cont.) The indenture provides that the trustee will give to the holders of the outstanding debentures notice within 90 days after the occurrence of any event of default (or any event which is, or after notice or lapse of time or both would become, an event of default) known to it if uncured or not waived; provided, that such notice shall not be given until at least 60 days after the occurrence of an event of default (or any even which is, or after lapse of time or both would become an event of default) in the performance or breach of any material representation, warranty or covenant in the indenture. If any event of default occurs and is continuing, either the Trustee or the holders of not less than 25% in principal amount of the outstanding debentures may declare the principal amount of all debentures to be due and payable immediately, but upon certain conditions such declaration may be rescinded and annulled and past defaults may be waived by the holders of a majority in principal amount of the outstanding debentures on behalf of the holders of all debentures. 40 40 Events of Default (cont.) The indenture provides that the holders of a majority in principal amount of the outstanding debentures may direct the time, method and place of conducting any proceeding for any remedy available to the trustee, or exercising any trust or other power conferred on the trustee, provided that the trustee may decline to act if such direction is contrary to law or the indenture and may take other action deemed proper that is not inconsistent with such direction. The indenture includes a covenant that Your Corporation will file annually with the trustee a certificate of no default, or specifying any default that exists. 41 41 Consolidation, Merger and Sales of Assets Your Corporation, without the consent of the holders of any of the debentures under the indenture, may consolidate with or merge into any other person or convey, transfer or lease its properties and assets substantially as an entirety to any person, provided that: the successor is a person organized and validly existing under the laws of any domestic jurisdiction; the successor person, if other than Your Corporation, assumes Your Corporation’s obligations with respect to the debentures and under the indenture, after giving effect to the transaction, no event of default, and no event which, after notice or lapse of time or both would become an event, shall have occurred and be continuing; and certain other conditions are met, including delivery by us to the indenture trustee of an appropriate opinion of counsel. Although these types of transactions are permitted under the indenture, certain of the foregoing transactions could constitute a fundamental change (as defined above) permitting each holder to require us to repurchase the debentures of such holder as described above. 42 42 Limitation on Suits No holder on any debenture shall have the right to institute any proceeding, judicial or otherwise, with respect to the indenture, or for the appointment of a receiver or trustee, or for any other remedy under the indenture, unless: • the holder has previously given written notice to the trustee of a continuing event of default; • the holders of not less than 25% in principal amount of the outstanding debentures shall have made written request to the trustee to institute proceedings in respect of such event of default; • the holder(s) shall have offered to the trustee reasonable indemnity against the costs, expenses and liabilities to be incurred in compliance with such request; • the trustee for 60 days after its receipt of such notice, request and offer of indemnity has failed to institute any such proceeding; and • no direction inconsistent with such written request has been given to the trustee during such 60-day period by the holders of a majority in principal amount of the outstanding debentures. 43 43 Limitation on Transactions with Affiliates Your Corporation and its subsidiaries will not directly or indirectly enter into any transaction or series of related transactions with any affiliate of Your Corporation (other than Your Corporation or any wholly-owned subsidiary) unless: • the transaction or series of related transactions is in writing and on terms that are no less favorable to Your Corporation or the subsidiary, as the case may be, than would be available in a comparable transaction in an arm’s-length on terms that in good faith would be offered to a person that is not an affiliate. • in the case of aggregate payments in excess of $1,500,000, Your Corporation must also deliver an officers’ certificate to the trustee certifying that the transaction or series of related transactions complies with the preceding paragraph and the transaction or series of related transactions has been approved by a majority of the disinterested directors of Your Corporation. 44 44 Limitation on Transactions with Affiliates (cont.) Where aggregate payments are in excess of $2,500,000 or, in the event no members of the board of directors of Your Corporation are disinterested directors with respect to any transaction or series of transactions involving aggregate payments in excess of $1,500,000 then: • in the case of a transaction involving real property, the aggregate rental or sale price of such real property shall be the fair market rental or sale value of such real property as determined by a written opinion from a certified expert with experience in appraising the terms and conditions of the type of transaction or series of transactions for which approval is required; and • in all other cases, Your Corporation delivers to the trustee a written opinion of a certified expert with experience in appraising the terms and conditions of the type of transaction or series of transactions to the effect that the transaction or series of transactions are fair to Your Corporation or such subsidiary from a financial point of view. An affiliate of Your Corporation generally includes any executive officer, director or 10% stockholder of Your Corporation or the Bank. 45 45 Additional Covenants The indenture contains a number of additional covenants and other provisions relating to the Corporation and its operations, including the following: Corporate Existence of the Corporation and its Subsidiaries. • keep in full force and effect the corporate existence, rights (charter and statutory) and franchises of Your Corporation and its subsidiaries; • keep in full force and effect the Bank’s status as a wholly owned subsidiary and an insured depository institution and do all things necessary to ensure that deposit accounts of the Bank are insured by the FDIC (or any successor organization) up to the maximum amount permitted by the Federal Deposit Insurance Act and regulations thereunder (or by any succeeding Federal law hereafter enacted). Maintenance of Insurance. • Your Corporation and its subsidiaries at all times maintain insurance on all of the properties against loss or damage from hazards and risks to the person, rights and property of others. Limitations on Liens on Bank Stock. • Your Corporation shall not create, assume, incur or suffer to exist any mortgage, pledge, encumbrance, lien or charge of any kind upon the capital stock of the Bank, including as security or collateral for indebtedness, or borrowed money or otherwise. 46 46 Additional Covenants (cont.) Books and Records. • Your Corporation and each subsidiary is required to, at all times, keep proper books of record and accounts in which proper entries shall be made in accordance with generally accepted accounting principles and, to the extent applicable, regulatory accounting. Maintenance of Office or Agency. • Your Corporation will maintain an office or agency in each place of payment where debentures may be presented or surrendered for payment, where debentures may be surrendered for transfer or exchange and where notices and demands to or upon Your Corporation in respect of the debentures and this indenture may be served. Limitation on Indebtedness Senior to Debentures. • Your Corporation shall not incur any indebtedness which would be senior in right of payment to the debentures; provided, however, this limitation shall not affect Your Corporation’s ability to incur indebtedness which is collateralized. 47 47 Additional Covenants (cont.) Payment of Taxes and Other Claims. • Your Corporation will pay or discharge or cause to be paid or discharged, before the same become delinquent, (1) all taxes, assessments and governmental charges levied or imposes upon it or upon its income, profits or property and (2) all lawful claims for labor materials and supplies which, if unpaid, might by law become a lien upon its property; provided, however, that Your Corporation shall not be required to pay or discharge or cause to be paid or discharged any such tax, assessment, charge or claim whose amount, applicability of validity is being contested in good faith by appropriate proceedings or any such tax assessment, charge or claim is not disadvantageous in any material respect to the holders of the debentures. Notice of Events of Default or Default. • Your Corporation will be required to provide the trustee prompt written notice of any event of default or any event that upon notice or the passage of time or both would become an event of default of which the Company has actual knowledge. 48 48 Modification and Waiver Modifications and amendments of the indenture may be made by Your Corporation and the trustee with the consent of the holders of not less than 66-2/3% in principal amount of the outstanding debentures; provided, however, that no such modification or amendment may, without the consent of the holder of each outstanding debenture affected thereby: change the stated maturity of the principal of, or time of payment on any installment of interest on, and debenture; reduce the principal amount of, or interest on, any debenture; change the currency of payment of principal of, or rate of interest on, any debenture; impair the right to institute suit for the enforcement of any payment on or with respect to any debenture; adversely affect the right to convert debentures; 49 49 Modification and Waiver (cont.) reduce the fundamental change repurchase price of any debenture or amend or modify in any manner adverse to the holders of debentures our obligations to make such payment, whether through an amendment or waiver of provisions in the indenture (including the definitions contained therein) or otherwise; change the ranking of the debentures in a manner adverse to the holders of the debentures; reduce the above-state percentage of outstanding debentures necessary to modify or amend the indenture; or reduce the percentage of aggregate principal amount of outstanding debentures necessary for waiver of compliance with certain provisions of the indenture or for waiver of certain defaults. 50 50 Modification and Waiver (cont.) The holders of not less than a majority in principal amount of the outstanding debentures may on behalf of the holders of all of the debentures waive any past default under the indenture, except a default in the payment of principal of (or premium, if any) or interest on any debenture or in respect of a covenant or provision which cannot be modified without the consent of each holder of debentures affected. Without the consent of any holder, we and the trustee may amend the indenture to: cure any ambiguity or correct any omission, defect or inconsistency in the indenture, so long as such action will not materially and adversely affect the interests of holders of the debentures; provided that any such amendment made solely to conform the provisions of the indenture to this prospectus supplement will be deemed not to adversely affect the interests of holders of the debentures; provide for the assumption by a successor corporation, partnership, trust or limited liability company of our obligations under the indenture; 51 51 Modification and Waiver (cont.) add a guarantee with respect to the debentures; secure the debentures; add to out covenants for the benefit of the holders or surrender any right or power conferred upon us; make any change that does not materially adversely affect the rights of any holder; or comply with any requirement in connection with the qualification of the indenture under the Trust Indenture Act. 52 52 Silver, Freedman & Taff, L.L.P. Who We Are Washington, D.C. based law firm specializing in financial institutions: • • • • • • • • • • • Mergers and Acquisitions Regulatory and Enforcement Matters Debt and Equity Securities Offerings Recapitalizations Compensation and Employee Benefit Matters Securitizations Credit Union to Thrift Conversions Mutual to Stock Conversions Charter Conversions Holding Company and MHC Formations/Reorganizations Bank and Thrift De Novo Formations Silver, Freedman & Taff, L.L.P. 53 Questions? 54 54 Appendix A State Non-Member Bank TOTAL CAPITAL Consists of Tier 1 and Tier 2. At least 50% of Total Capital must be Tier 1. TIER 1 Voting common stock must be the dominant form of Tier 1. Common stock All qualifies Noncumulative Perpetual Preferred Stock Cumulative Perpetual Preferred Stock Bank Holding Company All qualifies if: All qualifies if: 1.Maturity: No stated term. 2.Redemption: a. Never at option of holder. b. No term or provision requiring future redemption. c. No required or potential dividend increase that would effectively require redemption. d. Cannot be redeemable by Bank during first five years, unless approved by FDIC at time of issuance or redemption. 3.Dividends: a. Payment must be waivable with no right of accumulation or other contingent claim on the Bank. b. Rate may not be periodically reset based on credit standing (such as with auction rate, money market or remarketable preferred). Maturity: No stated term. 1.Redemption: a. Never at option of holder. b. No term or provision requiring future redemption. c. No required or potential dividend increase that would effectively require redemption. d. At option of Company only with Federal Reserve approval. 2.Dividends: a. Payment may be deferred or eliminated with no right of accumulation or other contingent claim on the Bank. b. Rate may not be periodically reset based on credit standing (such as with auction rate, money market or remarketable preferred). 3.Equity Status: Can absorb losses of Company as a going concern. Does not qualify. (Cumulative Perpetual Preferred plus Trust Preferred are limited to 25% of overall Tier 1 or onethird of the other elements of Tier 1.) Silver, Freedman & Taff, L.L.P. All qualifies if: 1.Maturity: No stated term. 2.Redemption: a. Never at option of holder. b. No term or provision requiring future redemption. c. No required or potential dividend increase that would effectively require redemption. d. At option of Company only with Federal Reserve approval. 3.Dividends: Payment may be deferred or eliminated. (Accumulation is permitted). 4.Equity Status: Can absorb losses of Company as a going concern. 55 TIER 2 Cumulative Perpetual Preferred Stock (For Holding Company, includes Trust Preferred that does not qualify for Tier 1) All qualifies if: 1.Maturity: No stated term. 2.Redemption: a. At option of holder with FDIC approval. b. No term or provision requiring future redemption. c. No required or potential dividend increase that would effectively require redemption. d. Cannot be redeemable by Bank during first five years, unless approved by FDIC at time of issuance or redemption. 3.Dividends: Must allow deferred payments. (Accumulation is permitted). 4.Equity Status: Can absorb losses of Bank as a going concern. Silver, Freedman & Taff, L.L.P. All qualifies if: 1. Maturity: No stated term. 2. Redemption: a. Never at option of holder. b. No term or provision requiring future redemption. c. No required or potential dividend increase that would effectively require redemption. d. At option of Company only with Federal Reserve approval. 3. Dividends: Payment may be deferred or eliminated. (Accumulation is permitted). 4. Equity Status: Can absorb losses of Company as a going concern. 56 TIER 2 Noncumulative Perpetual Preferred Stock with Credit Related Dividend Rate Adjustments (Including auction rate, Dutch auction, money market and remarketable preferred) All qualifies if: 1.Maturity: No stated term. 2.Redemption: a. At option of holder with FDIC approval. b. No term or provision requiring future redemption. c. No required or potential dividend increase that would effectively require redemption. d. Cannot be redeemable by Bank during first five years, unless approved by FDIC at time of issuance or redemption. 3.Dividends: Must allow deferred payments. (Accumulation is permitted). 4.Equity Status: Can absorb losses of Bank as a going concern. Silver, Freedman & Taff, L.L.P. All qualifies if: 1. Maturity: No stated term. 2. Redemption: a. Never at option of holder. b. No term or provision requiring future redemption. c. No required or potential dividend increase that would effectively require redemption. d. At option of Company only with Federal Reserve approval. 3. Dividends: Payment may be deferred or eliminated. (Accumulation is permitted). 4. Equity Status: Can absorb losses of Company as a going concern. 57 Long-Term Preferred Stock 1. 2. 3. 4. 5. Subject to the discount described below over the last five years of the term, all qualifies if: Maturity: At least 20 years. Redemption: a. At option of holder with FDIC approval. b. No term or provision requiring future redemption. c. No required or potential dividend increase that would effectively require redemption. d. Cannot be redeemed by Bank during first five years unless approved by FDIC at issuance or prior to redemption. Dividends: Must allow deferred payments. (Accumulation is permitted). Equity Status: Can absorb losses of Bank as a going concern. Discount: During last five years of the term, the amount included is reduced by a fifth of the original amount (less redemptions) each year with nothing included in regulatory capital during the last year before maturity. Silver, Freedman & Taff, L.L.P. 1. 2. 3. 4. 5. Subject to the discount described below over the last five years of the term, all qualifies if: Maturity: At least 20 years. Redemption: a. At option of holder, but maturity is adjusted to the first time the holder can require redemption. b. At option of Company only with Federal Reserve approval. Dividends: Payment may be deferred or eliminated. (Accumulation is permitted). Equity Status: Can absorb losses of Company as a going concern. Discount: During last five years of the term, the amount included is reduced by a fifth of the original amount (less redemptions) each year with nothing included in regulatory capital during the last year before maturity. 58 Intermediate-Term Preferred Stock (Intermediate-Term Preferred Stock plus Term Subordinated Debt included in Tier 2 may not exceed 50% of Tier 1.) 1. 2. 3. 4. 5. Subject to the discount described below over the last five years of the term, all qualifies if: Maturity: Original term of at least five years. Redemption: a. At option of holder with FDIC approval. b. No term or provision requiring future redemption. c. No required or potential dividend increase that would effectively require redemption. d. Cannot be redeemed by Bank during first five years unless approved by FDIC at issuance or prior to redemption. Dividends: Must allow deferred payments. (Accumulation is permitted). Equity Status: Can absorb losses of Bank as a going concern. Discount: During last five years of the term, the amount included is reduced by a fifth of the original amount (less redemptions) each year with nothing included the last year before maturity. Silver, Freedman & Taff, L.L.P. 1. 2. 3. 4. 5. Subject to the discount described below over the last five years of the term, all qualifies if: Maturity: Original weighted average maturity of at least five years. Redemption: a. At option of holder, but maturity is adjusted to the first time the holder can require redemption. b. At option of Company only with Federal Reserve approval. Dividends: Payment may be deferred or eliminated. (Accumulation is permitted). Equity Status: Can absorb losses of Company as a going concern. Discount: During last five years of the term, the amount included is reduced by a fifth of the original amount (less redemptions) each year with nothing included the last year before maturity. 59 Mandatory Convertible Debt 1. 2. 3. 4. Subject to the discount described below over the last five years of the term, if not already converted, all qualifies if: Maturity: Original term of no more than 12 years. Security and Subordination: Fully paid, not secured and subordinate to all claims of depositors and creditors. Holder must waive any right of set-off, if applicable. Redemption: a. At option of holder with FDIC approval. b. No acceleration except in bankruptcy, insolvency or reorganization. c. No term or provision requiring future redemption. d. Cannot be redeemed by Bank during first five years unless approved by FDIC at issuance or prior to redemption. Payments: Bank must have the option to defer principal and interest payments, if it reports no net income combined over the last four quarters and eliminates cash dividends on common and preferred stock. Silver, Freedman & Taff, L.L.P. Subject to the discount described below over the last five years of the term, if not already converted, all qualifies if: 1. Maturity: Original term of no more than 12 years 2. Security and Subordination: Fully paid, not secured and subordinate to all claims of creditors. 3. Redemption: a. May be redeemed only with the proceeds of a sale of common or preferred stock. Must state intention to use proceeds for this purpose during the same quarter as the sale or lose the right to apply the funds for this purpose. b. At option of holder with Federal Reserve approval. c. No acceleration except in bankruptcy, insolvency or reorganization. d. At option of Company only with Federal Reserve approval. e. No repurchases allowed. 60 Mandatory Convertible Debt (cont.) 5. Equity Status: Can absorb losses of Bank as a going concern because it is convertible to common or preferred stock when the Bank has negative unimpaired capital and surplus. 6. Conversion: Bank must be required to convert the debt to common or preferred stock by a set date or before the maturity of the debt. 7. Disclosure: a. Contains a boldface legend on its face that the obligation is not a deposit and is not insured by the FDIC. b. Must expressly state that it is subordinate and junior to claims of depositors and creditors. c. Must expressly state that it is not eligible as collateral for a loan from the Bank and may not be retired without FDIC approval. 8. Discount: During last five years, the amount included is reduced by a fifth of the original amount (less redemptions) each year with nothing included the last year before maturity. Silver, Freedman & Taff, L.L.P. 4. Payments: Company must have the option to defer interest payments, if it reports no net income combined over the last four quarters and eliminates cash dividends on common and preferred stock. 5. Equity Status: Can absorb losses of Company as a going concern, because it is convertible to common or preferred stock when the Company has negative retained earnings and surplus. 6. Conversion: Company must be required to convert the debt to common or preferred stock by a set date or before the maturity of the debt. 7. Credit Sensitivity: Payment may not be tied to financial condition of Company, including auction rate. Rate may not increase with late payment. 8. Safety and Soundness: May not impose limits on Company that are too restrictive, particularly as financial condition is impaired. Includes limits on asset sales, changes in control or that otherwise limit the ability to raise capital. Limits cannot restrict liquidity or management flexibility 9. Discount: During last five years, the amount included is reduced by a fifth of the original amount (less redemptions) each year with nothing included the last year before maturity. 61 Other Hybrid (Debt/Equity) Capital Instruments 1. 2. 3. 4. 5. Subject to the discount described below over the last five years of the term, if any, if not already converted, all qualifies if: Security and Subordination: Fully paid, not secured and subordinate to all claims of depositors and creditors. Holder must waive any right of set-off, if applicable. Redemption: a. At option of holder with FDIC approval. b. No term or provision requiring future redemption. c. No acceleration except in bankruptcy, insolvency or reorganization. d. Cannot be redeemed by Bank during first five years unless approved by FDIC at issuance or prior to redemption. Payments: Bank must have the option to defer principal and interest, if it reports no net income combined over the last four quarters and eliminates cash dividends on common and preferred stock. Equity Status: Can absorb losses of Bank as a going concern because it is convertible to common or preferred stock when the Bank has negative unimpaired capital and surplus. Discount: During last five years of the term, the amount included is reduced by a fifth of the original amount (less redemptions) each year with nothing included the last year before maturity. Silver, Freedman & Taff, L.L.P. Subject to the discount described below over the last five years of the term, if any, if not already converted, all qualifies if: 1. Security and Subordination: Fully paid, not secured and subordinate to all claims of creditors. 2. Redemption: a. At option of holder with Federal Reserve approval. b. No acceleration except in bankruptcy, insolvency or reorganization. c. At option of Company only with Federal Reserve approval. 3. Payments: Company must have the option to defer interest payments, if it reports no net income combined over the last four quarters and eliminates cash dividends on common and preferred stock. 4. Equity Status: Can absorb losses of Company as a going concern, because it is convertible to common or preferred stock when the Company has negative retained earnings and surplus. 5. Conversion: Company must be required to convert the debt to common or preferred stock by a set date or before the maturity of the debt. 6. Discount: During last five years, the amount included is reduced by a fifth of the original amount (less redemptions) each year with nothing included the last year before maturity. 62 Perpetual Debt Does not qualify. Silver, Freedman & Taff, L.L.P. Subject to the discount described below over the last five years of the term, if not already converted, all qualifies if: 1.Maturity: Original term of no more than 12 years 2.Security: Not secured. 3.Redemption: a. At option of holder with Federal Reserve approval. b. No acceleration except in bankruptcy, insolvency or reorganization. c. At option of Company only with the proceeds of a sale of common or preferred stock or with Federal Reserve approval. 4.Payments: a. Company must have the option to defer interest payments, if it eliminates cash dividends on common and preferred stock. b. Nonpayment of interest may not trigger repayment of principal of this or any other obligation of the Company and may not be deemed prima facie bankruptcy. 5.Equity Status: Can absorb losses of Company as a going concern, because it is convertible to common or preferred stock when the Company has negative retained earnings and surplus. 6.Conversion: Company must be required to convert the debt to common or preferred stock when the Company’s retained earnings and surplus are negative. 7.Credit Sensitivity: Payment may not be tied to financial condition of Company, including auction rate. Rate may not increase with late payment. 8.Safety and Soundness: May not impose limits on Company that are too restrictive, particularly as financial condition is impaired. Includes limits on asset sales, changes in control or that otherwise limit the ability to raise capital. Limits cannot restrict liquidity or management flexibility 9.Discount: During last five years, the amount included is reduced by a fifth of the original amount (less redemptions) each year with nothing included the last year before maturity. 63 Term Subordinated Debt (Intermediate-Term Preferred Stock plus Term Subordinated Debt included in Tier 2 may not exceed 50% of Tier 1.) Subject to the discount described below over the last five years of the term, all qualifies if: 1. Maturity: Original term of at least five years or, if there are principal payments during the term, an average maturity of at least five year, unless a shorter average maturity is approved by the FDIC. 2. Security: Not secured. 3. Redemption: a. At option of holder with FDIC approval. b. No term or provision requiring future redemption. c. Cannot be redeemed by Bank during first five years unless approved by FDIC at issuance or prior to redemption. 4. Disclosure: a. Contains a boldface legend on its face that the obligation is not a deposit and is not insured by the FDIC. b. Must expressly state that it is subordinate and junior to claims of depositors and creditors. c. Must expressly state that it is not eligible as collateral for a loan from the Bank and may not be retired without FDIC approval. 5. Discount: During last five years of the term, the amount included is reduced by a fifth of the original amount (less redemptions) each year with nothing included the last year before maturity. Silver, Freedman & Taff, L.L.P. 1. 2. 3. a. b. c. 4. 5. 6. 7. Subject to the discount described below over the last five years of the term, all qualifies if: Maturity: Original weighted average maturity of at least five years. Security and Subordination: Not secured and no sinking fund for payment. Subordinate to all claims of creditors. Redemption: At option of holder, but maturity is adjusted to the first time the holder can require redemption. No acceleration except in bankruptcy, insolvency or reorganization. At option of Company only with Federal Reserve approval. Disclosure: Must expressly state that the obligation is not a deposit and is not federally insured. Credit Sensitivity: Payment may not be tied to financial condition of Company, including auction rate. Rate may not increase with late payment. Safety and Soundness: May not impose limits on Company that are too restrictive, particularly as financial condition is impaired. Includes limits on asset sales, changes in control or that otherwise limit the ability to raise capital. Limits cannot restrict liquidity or management flexibility. Discount: During last five years of the term, the amount included is reduced by a fifth of the original amount (less redemptions) each year with nothing included the last year before maturity. 64