CHAPTER 12 Cash Flow Estimation

advertisement

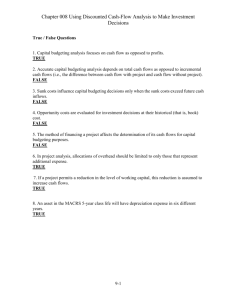

CHAPTER 12 Cash Flow Estimation and Risk Analysis Relevant cash flows Sunk cost Opportunity cost Incidental effect Risk Analysis By Donglin Li 11-1 Some points to remember in calculating cash flows Focus on incremental cash flows—the difference in cash flows because of this project Forget sunk costs– costs that have accrued in the past By Donglin Li 11-2 Some points to remember in calculating cash flows Include opportunity costs– costs of highest potential benefits forgone by taking this project Consider incidental effects—(also called side effects, externality) Positive side effects – benefits to other projects Negative side effects – costs to other projects Sounds abstract, but you all have applied these rules. By Donglin Li 11-3 Relevant (incremental) Cash Flows The cash flows that should be included in a capital budgeting analysis are those that will only occur if the project is accepted These cash flows are also called incremental cash flows We analyze each project in isolation from the firm simply by focusing on incremental cash flows By Donglin Li 11-4 Asking the Right Question You should always ask yourself “Will this cash flow occur ONLY if we accept the project?” If the answer is “yes”, it should be included in the analysis because it is incremental If the answer is “no”, it should not be included in the analysis because it will occur anyway If the answer is “part of it”, then we should include the part that occurs because of the project By Donglin Li 11-5 Sunk costs The sunk cost is past cost and irreversible. Since it cannot be affected by the decision to accept or reject the project, it should be ignored. Is your education cost so far at SFSU sunk cost? By Donglin Li 11-6 You plan to produce ice cream using some facility that you bought at $50,000 last year. Should this $50,000 cost from the previous year be included in the analysis? No, this cost is a sunk cost and should not be considered. By Donglin Li 11-7 Opportunity cost The highest benefit forgone when you take a project The opportunity cost may be relevant to the investment decision even when no cash changes hands. Give me an example about the opportunity cost of studying at SFSU? By Donglin Li 11-8 You plan to use the facility to produce ice creams. The facility could be leased out for $25,000 per year, would this affect the analysis? Yes, by accepting the project, the firm foregoes a possible annual cash flow of $25,000, which is an opportunity cost to be charged to the project. The relevant cash flow is the annual aftertax opportunity cost. A-T opportunity cost = $25,000 (1 – T) = $25,000(0.6) = $15,000 Opportunity cost is relevant. By Donglin Li 11-9 Incidental Effects (Externality) The “side effects” of taking a project. Give me an example of incidental effect if you got a degree from SFSU. By Donglin Li 11-10 If the ice cream production were to decrease the sales of the firm’s other lines (for example, Yogurt), would this affect the analysis? Yes. The effect on other projects’ CFs is an “externality.” Decreased CF per year on other lines would be a cost to this project. Externalities can be positive (in the case of complements) or negative (substitutes). Externality (also called incidental effect) is relevant. By Donglin Li 11-11 Evaluating NPV Estimates The NPV estimates are just that – estimates A positive NPV is a good start – now we need to take a closer look Forecasting risk – how sensitive is our NPV to changes in the cash flow estimates; the more sensitive, the greater the forecasting risk. By Donglin Li 11-12 Exercise Questions A cost that has already been paid, or the liability to pay has already been incurred, is a(n): a. Salvage value expense. b. Net working capital expense. c. Sunk cost. d. Opportunity cost. By Donglin Li 11-14 You bought some real estate 6 years ago for $25,000, and you are thinking of using this land for the construction of a new warehouse as part of a production expansion project. You include the $25,000 purchase cost of the land as an initial cost in the capital budgeting process. By doing so, you are making the mistake of in the decisionmaking process. a. b. c. d. e. including including including including including erosion costs opportunity costs sunk costs net working capital changes financing costs By Donglin Li 11-15 You bought some real estate 6 years ago for $25,000, and you are thinking of using this land for the construction of a new warehouse as part of a production expansion project. You do NOT consider the $25,000 purchase cost of the land as an initial cost in the capital budgeting process. You also ignore the fact that the land now can be sold at $28,000. By doing so, you are making the mistake of ______in the decisionmaking process. a. b. c. d. e. excluding erosion costs excluding opportunity costs excluding sunk costs including opportunity costs including sunk costs By Donglin Li 11-16 You bought some real estate 6 years ago for $25,000, and you are thinking of using this land for the construction of a new warehouse as part of a production expansion project. You correctly do NOT consider the $25,000 purchase cost of the land as an initial cost in the capital budgeting process. You also correctly consider the fact that the land now can be sold at $30,000. But you forget to consider the fact that the new warehouse will attract more customer in the region and your other business (retailing, for example) will be positively affected. By doing so, you are making the mistake of ____in the decision-making process. a. b. c. d. e. excluding excluding excluding excluding excluding erosion costs opportunity costs sunk costs incidental effects financing costs By Donglin Li 11-17 If two projects are independent, then: a. Accepting one automatically implies rejection of the other. b. If one is undertaken, the other must be undertaken as well. c. Both will be undertaken, assuming each has a positive NPV and the firm’s capital budget can afford to include both projects. d. All of the above By Donglin Li 11-18 Incremental cash flows refer to: a.The difference between after-tax cash flows and before-tax accounting profits. b. The additional cash flows that will be generated if a project is undertaken. c.The cash flows of a project, minus financing costs. d. The cash flows that are foregone if a firm does not undertake a project. By Donglin Li 11-19 Which of the following should be included in an analysis of a new project? a. Any sales from existing products that would be lost if customers were expected to purchase a new product instead. b. All financing costs. c. All sunk costs. d. All of the above. e. None of the above. By Donglin Li 11-20 Adams Audio is considering whether to make an investment in a new type of technology. Which of the following factors should the company consider when it decides whether to undertake the investment? a. The company has already spent $3 million researching the technology. b. The new technology will affect the cash flows produced by its other operations. c. If the investment is not made, then the company will be able to sell one of its laboratories for $2 million. d. Statements b and c should be considered. e. All of the statements above should be considered. By Donglin Li 11-21