The Economic Outlook Mark Schniepp Director February 24, 2012

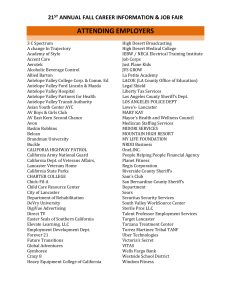

advertisement

The Economic The Nation, State and Outlook the Antelope Valley February 24, 2012 Mark Schniepp Director Economic Outlook Not Quite through the tunnel yet When is the recession over ? February 24, 2012 Mark Schniepp, Director Recent Economic Evidence • Significant improvement - last 10 weeks - most indicators now rising steadily index October 2001=100 Rasmussen Consumer Confidence Index February 2008 - February 20, 2012 95 90 85 80 75 70 65 60 55 Feb-08 Aug-08 Feb-09 Aug-09 Feb-10 Aug-10 Feb-11 Aug-11 Feb-12 Real Retail Sales / U.S. billions of 2011 dollars SAAR January 2006 - January 2012 410 400 390 380 370 360 350 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 millions of vehicles New Auto and Light Truck Sales / U.S. January 2009 - January 2012 14 13 12 11 10 9 8 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Index of Industrial Production / index January 2002 - January 2012 101 98 95 92 89 86 83 Jan-02 Jan-04 Jan-06 Jan-08 Jan-10 Jan-12 Index Dow Jones Industrial Average November 23, 2010 - February 23, 2012 . 13,000 12,500 12,000 11,500 11,000 10,500 Nov-10 Feb-11 May-11 Aug-11 Nov-11 Feb-12 index 2004 = 100 Index of Leading Indicators / U.S. January 2002 - January 2012 120 117 114 111 108 105 102 99 96 Jan-02 Jan-04 Jan-06 Jan-08 Jan-10 Jan-12 Existing Home Sales / U.S. millions of sales, SAAR 5.5 January 2009 - January 2012 5.0 4.5 4.0 3.5 3.0 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Housing Starts / U.S. millions of units, SAAR January 2002 - January 2012 2.2 1.9 1.6 1.3 1.0 0.7 0.4 Jan-02 Jan-04 Jan-06 Jan-08 Jan-10 Jan-12 Los Angeles Times, February 8, 2012, Page B2 index NAHB Housing Market Index / U.S. February 2007 - February 2012 40 35 30 25 20 15 10 5 Feb-07 Feb-08 Feb-09 Feb-10 Feb-11 Feb-12 Recent Economic Evidence • Significant improvement - last 3 months - most indicators now rising steadily • Despite modestly growing GDP, the labor market unimpressed in 2011 • Though the nation created 1.6 million jobs, unemployment remains high • 25 million Americans seek full time work • How is the momentum going into 2012 ? 8.3% Los Angeles times, January 7, 2012, front page Unemployment Rate / US. seasonally adjusted percent January 2006 - January 2012 10 9 8 7 6 5 4 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 month-over-month change (thousands of jobs) Private Sector Job Creation / US. December 2009 - Jnuary 2012 300 0 23 months = 3.5 million jobs -300 -600 -900 Jan-09 8.8 million jobs Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 U.S. Economic Summary • Consumers are feeling better and spending more • Factories are producing more goods • Autos are selling again; U.S. automakers reported their three best months of sales (post recession) in November, December, January • The stock market has rallied sharply • Business is hiring more / the u-rate is . . . . U.S. Consumer Price Inflation percent January 2006 - January 2012 6 2.7 % 4 2 0 -2 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 What about California ? Job Creation / California. June 2009 - December 2011 jobs seasonally adjusted 60,000 40,000 20,000 0 -20,000 -40,000 327,000 jobs -60,000 -80,000 -100,000 -120,000 Jun-09 Dec-09 Jun-10 Dec-10 Jun-11 Dec-11 Recent Evidence / California • • • • • Technology sector leading the charge Exports were explosive in 2011 Tourism also rising in all major markets Manufacturing growing again, but slowly Hiring is picking up, mostly in coastal markets but recently, inland areas are creating jobs • Demographics are largely responsible for the abnormally high unemployment rates • . . . and will also be responsible for the Value of Exports / California Ports billions of dollars 2001 Q1 - 2011 Q4 50 45 40 35 30 25 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 thousands of jobs Employment in Technology Services / California December 2005 - December 2011 580 Scientific and technical services 560 540 520 500 480 460 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Employment in Computer Products Manufacturing California jobs December 2005 - December 2011 49,000 47,000 45,000 43,000 41,000 39,000 37,000 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 thousands of jobs Manufacturing Employment / California December 2005 - December 2011 1,500 1,400 1,300 1,200 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 thousands of jobs Leisure & Hospitality Employment / California December 2005 - December 2011 1,600 1,575 1,550 1,525 1,500 1,475 1,450 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Average Hotel Occupancy Rate / Santa Clara County Seasonally Adjusted November 2006 - November 2011 percent 73 69 65 61 57 53 Nov-06 Nov-07 Nov-08 Nov-09 Nov-10 Nov-11 Average Hotel Occupancy Rate / Orange County Seasonally Adjusted November 2006 - November 2011 percent 76 72 68 64 60 Nov-06 Nov-07 Nov-08 Nov-09 Nov-10 Nov-11 Disneyland Attendance / Anaheim millions of visitors 17 1991 - 2011 16 15 14 13 12 11 10 9 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 Los Angels Times, December 17, 2011, B1 Los Angels Times, January 21, 2012, front page Population Age 18 to 24 / California. millions of people 1970 - 2010 4.3 4.1 3.9 3.7 3.5 3.3 3.1 2.9 2.7 2.5 1970 1975 1980 1985 1990 1995 2000 2005 2010 Population Growth / California percent change 1988 - 2010 2.5 2.0 1.5 1.0 0.5 0.0 88 90 92 94 96 98 00 02 04 06 08 10 New Housing Production / California thousands of units permitted November 2005 - November 2011 20 16 12 8 4 0 Nov-05 Nov-06 Nov-07 Nov-08 Nov-09 Nov-10 Nov-11 persons per house Average Household Size / California 1989 - 2011 3.00 2.96 2.92 2.88 2.84 2.80 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 Question? • If the state is still growing, and housing inventories are low, then why is there no new construction? • Household formation has dried up - unemployed move in with Mom/Dad - or they never moved out ! • This is an employment induced temporary problem • … with growing likelihood that a dramatic breakout in housing Summary / California Technology, Exports, and Tourism are the current engines of growth Construction and Manufacturing show little recovery to date Public sector employment in decline Hotel occupancy now at pre-recession levels Commercial real estate slowly rebounding Inland counties have lagged the recovery in California but have recently joined with sharp increases in employment since the summer Cumulative Job Growth by County percent 2.0 December 2010 through December 2011 San Diego Ventura Inland Empire Los Angeles 1.5 Orange 1.0 0.5 0.0 -0.5 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Antelope Valley Growth In California Fastest Growing Counties / California 2008 - 2011 County Placer Riverside Imperial Antelope Valley Tulare Kern Fresno San Joaquin Contra Costa Population Growth 5.3 4.9 4.7 4.5 4.1 3.5 3.1 2.7 2.7 2.7 Population Growth / Antelope Valley people 1991 - 2011 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 Quiz part I: What is the Population of California? (census estimate) (a) 34.3 million (b) 37.3 million (c) 40.5 million (d) Just tell us the answer and get on with it . . . . ! Quiz part II: What will be the Population of California in 2020 ? (a) 38 million (b) 40 million (c) 42.8 million (d) Who cares? Quiz part III: Where are these 5.4 million people going to live? (a) (b) Orange County Santa Clara County (c) Coachella Valley (d) Victor Valley (e) Antelope Valley (f) San Joaquin Valley (g) Sacramento Valley dollars Home Price Advantage: Antelope Valley and Southern California Markets 2011 $600,000 $514,386 $500,000 $387,500 $400,000 $419,873 $305,955 $300,000 $200,000 $157,400 $100,000 Antelope Valley Los Angeles Santa Clarita County Valley Ventura County Orange County thousands of people Population Gain / Southern California 1990 - 2020 500 450 150,000 - 250,000 people per year 400 350 300 250 200 150 100 50 0 1990 1995 2000 2005 2010 2015 2020 units permitted New Housing Units / Southern Califonria. 1990 - 2020 120,000 100,000 80,000 60,000 40,000 20,000 0 1990 1995 2000 2005 2010 2015 2020 2011 Economic Smmary Antelope Valley • Recent job loss was deep and broad based • Construction, manufacturing, and the retail sector experienced the greatest loss of jobs • Unemployment leaped to an estimated 16 % • Commercial markets weakened in tandem with the labor markets • The retail fallout has been sharp • Home production . . . well, negligible There is good news on the homeowner Recent Evidence / Antelope Valley The regional economy is slowly recovering – like other inland areas of California Population growth remains positive Job creation has been intermittent Residential entitlements are prolific Home prices have finally stabilized Affordability is extremely high relative to surrounding communities percent change 15 Real Retail Sales Growth / Antelope Valley 1995 - 2011 10 5 0 -5 -10 -15 -20 1995 1997 1999 2001 2003 2005 2007 2009 2011 Labor Markets Job Creation / Antelope Valley monthly job creation . December 2006 - December 2011 600 400 200 0 -200 -400 10 of 24 months = net loss of 100 jobs -600 -800 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Total Jobs Created / Antelope Valley. number of... jobs created .. 2000 - 2011 . 4,000 2,000 0 -2,000 -4,000 -6,000 00 01 02 03 04 05 06 07 08 09 10 11 Employment in Healthcare / Antelope Valley jobs September 2006 / September 2011 8,750 8,500 8,250 8,000 7,750 7,500 7,250 7,000 6,750 Sep-06 Sep-07 Sep-08 Sep-09 Sep-10 Sep-11 Employment in Educational Services Antelope Valley jobs September 2006 - September 2011 800 750 700 650 600 550 500 450 400 Sep-06 Sep-07 Sep-08 Sep-09 Sep-10 Sep-11 jobs Financial Activities Employment / Antelope Valley . September 2006 - September 2011 3,200 3,100 3,000 2,900 2,800 2,700 2,600 Sep-06 Sep-07 Sep-08 Sep-09 Sep-10 Sep-11 Manufacturing Employment / Antelope Valley. jobs September 2006 - September 2011 . 9,100 8,800 8,500 8,200 7,900 7,600 7,300 Sep-06 Sep-07 Sep-08 Sep-09 Sep-10 Sep-11 jobs Professional and Business Services Employment . Antelope Valley September 2006 - September 2011 5,000 4,500 4,000 3,500 3,000 Sep-06 Sep-07 Sep-08 Sep-09 Sep-10 Sep-11 Construction Employment / Antelope Valley... jobs September 2006 - September 2011 7,000 6,000 5,000 4,000 3,000 2,000 Sep-06 Sep-07 Sep-08 Sep-09 Sep-10 Sep-11 New Residential Units / Antelope Valley units permitted 1991 - 2011 5,000 4,000 3,000 2,000 1,000 0 91 93 95 97 99 01 03 05 07 09 11 millions of dollars New Commercial and Industrial Investment Antelope Valley 1997 - 2011 100 80 60 40 20 0 97 99 01 03 05 07 09 11 Employment in State and Local Government Antelope Valley. .. jobs September 2006 - September 2011 15,250 14,750 14,250 13,750 13,250 Sep-06 Sep-07 Sep-08 Sep-09 Sep-10 Sep-11 Residential Real Estate The most frustrating sector of the economy Existing Home Sales / California thousands of sales December 2007 - December 2011 600 500 400 300 200 Dec-07 Jun-08 Dec-08 Jun-09 Dec-09 Jun-10 Dec-10 Jun-11 Dec-11 thousands of dollars Median Home Selling Price / California December 2007 - December 2011 450 400 350 300 250 200 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Median Home Selling Prices California Counties December 2011 County San Diego Orange Los Angeles Inland Empire Ventura Antelope Valley San Fernando Valley California Price $359,930 % change -4.2 -3.7 -7.3 $484,630 -3.3 $306,950 -11.4 -5.8 $172,430 -10.1 -6.2 $391,060 % Change From Peak -42.2 -37.5 -51.0 -55.7 -45.0 -61.4 -45.6 -51.9 Median Home Selling Price . thousands of dollars December 2006 - December 2011 375 325 Palmdale 275 225 175 Lancaster 125 75 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Existing Home Sales / Antelope Valley sales 2001 - 2011 10,000 8,000 6,000 4,000 2,000 01 02 03 04 05 06 07 08 09 10 11 Los Angeles Times, February 18, 2011, page B2 Los Angeles Times, April 20, 2011, page B1 Foreclosures / California number 2006 Q1 - 2011 Q4 80,000 70,000 60,000 50,000 40,000 30,000 20,000 10,000 0 2006 2007 2008 2009 2010 2011 Notices of Default / California number 2006 Q1 - 2011 Q4 140,000 120,000 100,000 80,000 60,000 40,000 20,000 0 2006 2007 2008 2009 2010 2011 Foreclosures / Antelope Valley number October 2008 - February 2012 2,500 2,000 1,500 Lancaster 1,000 Palmdale 500 0 Oct-08 Mar-09 Aug-09 Jan-10 Jun-10 Nov-10 Apr-11 Sep-11 Feb-12 Los Angeles Times, January 12, 2012, page B3 Housing Summary / California • Values have stabilized ? • Purchase market held back by credit conditions and labor markets • Lack of demand along with distressed inventory keeps housing values from rising • Credit conditions are tight because values have yet to rebound • Catch 22: prices won’t rise until credit markets loosen; credit markets won’t loosen until values start rising again • Distressed inventory will begin to subside in The Forecast 5 year Outlook QuickTime™ and a TIFF (Uncompressed) decompressor are needed to see this picture. 2012 Antelope Valley Forecast Summary • 2011 was a transition year: the economic recovery will be more convincing in 2012 throughout Southern California • Though labor markets are already adding jobs, the pace of expansion will accelerate and broaden • Home sales finally improve in 2012 due to high affordability, and more new jobs • Job creation, home sales, and consumer spending return to more normal levels in 2013 thousands of jobs Total Job Creation / Antelope Valley . 1996 - 2016 4 3 2 1 0 -1 -2 - 6,700 jobs -3 -4 -5 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 Unemployment Rate / Antelope Valley. 2000 - 2016 percent 16 14 12 10 8 6 4 2000 2002 2004 2006 2008 2010 2012 2014 2016 Population Growth / Antelope Valley people 1996 - 2016 12,000 10,000 8,000 6,000 4,000 2,000 0 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 inmigrants minus outmigrants Net Migration / Antelope Valley 1996 - 2016 10,000 8,000 6,000 4,000 2,000 0 -2,000 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 Population / Antelope Valley. thousands of persons 1996 - 2016 420 40,000 390 432 392 356 360 330 304 300 284 270 1996 2001 2006 2011 2016 thousands of jobs Professional Services Employment / Antelope Valley 1996 - 2016 5.0 4.5 4.0 3.5 3.0 2.5 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 New Housing Production / Antelope Valley . homes permitted 1996 - 2016 5,000 10,50 0 4,000 3,000 2,000 1,000 0 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 Average Household Size / Antelope Valley people per house 1996 - 2016 3.50 3.45 3.40 3.35 3.30 3.25 3.20 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 Existing Home Sales / Antelope Valley sales 2000 - 2016 10,000 8,000 6,000 4,000 2,000 2000 2002 2004 2006 2008 2010 2012 2014 2016 thousands of dollars Median Home Selling Price / Antelope Valley. 1996 - 2016 350 300 250 200 150 100 50 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 Real Retail Sales / Antelope Valley billions of constant 2010 dollars 1996 - 2016 3.3 3.1 2.9 2.7 2.5 2.3 2.1 1.9 1.7 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 Southern California Forecast Summary The recovery will lag in the inland areas, but over the long run growth will be stronger A much stronger expansion of labor markets will occur by 2013, reaching a peak in 2014 The unemployment rate will remain high for years to come as more new workers enter the labor force Population grows slightly faster, inland areas grow much faster than the coast Home prices rise in 2012 ? …… or beyond ? Prices rise when distressed properties account for a smaller share of total transactions Housing production ultimately increases throughout the The Economic Timeline • U.S. economic expansion underway now • Regional expansion more evident by Q3 or Q4 • Solid job creation sustainable: 2012 Q4 • Unemployment rate falling throughout year • Foreclosures subsiding by 2012 Q4 • More new housing underway this year, with breakout in 2013 • Fed raises rates: late 2014 / early 2015 Antelope Valley 2012 Economic Outlook