Sanders - How to Develop Effective Shrink Analytics

advertisement

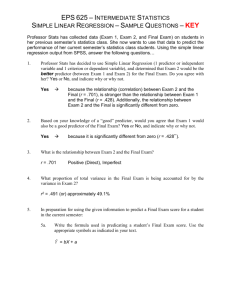

Shrink Analytics Michael Sanders Shrinkage Control Analyst J.C. Penney Company, Inc. $18B 1093 Stores 147K Associates Basic Correlations and Flaws Audit Average Median Shrink Range Score 90's 80's Failures Shrink 1.69 1.83 1.93 Shrink 1.73 1.83 1.90 Low 0.09 0.14 0.48 *Shrink results grouped by audit score range High 9.08 10.03 6.98 Quartiles Shrink Shrink Audit Score Quartile 1 2 3 4 Average 0.93 1.55 2.11 3.34 Ave 88 87 87 85 * Shrink quartiles with average audit score Regression Analysis Result Audit Baseline or Slope Score "Intercept" Slope times Estimated AuditScore Shrink 95 3.15% -0.0130% -1.24% 1.92% 94 3.15% -0.0130% -1.22% 1.93% 93 3.15% -0.0130% -1.21% 1.94% 92 3.15% -0.0130% -1.20% 1.96% 91 3.15% -0.0130% -1.19% 1.97% 90 3.15% -0.0130% -1.17% 1.98% 89 3.15% -0.0130% -1.16% 1.99% 88 3.15% -0.0130% -1.15% 2.01% Regression Analysis on the NFL INT Take INT Give Fumble Take Fumble Give Penalty YDS Pass YD/ATT Rush YT/ATT Completion % Rush YPG, Pass Yards PG 3rd Down Conversions 4th Down Conversions Pearson Correlation • A technique that determines the strength of a relationship between two variables. • +1 indicates they are perfectly related in a positive linear sense. Example: Caloric intake increases, weight increases. • -1 indicates they are perfectly related in a negative linear sense. Example: Car price goes down, as age goes up. • “zero” indicates there is no correlation. Example: The number of Red Sox fans named Steve to the number of wins the Red Sox win have this year. Defense & Offensive Stats -1 0 +1 Pearson Correlation (Positive) – Wins/RSH YPG 0.48 RUSH Team Wins YPG Titans 13 137 Colts 12 80 Giants 12 157 Panthers 12 152 Steelers 12 106 Dolphins 11 119 Falcons 11 153 Patriots 11 142 Ravens 11 149 Vikings 10 146 Bears 9 105 Buccaneers 9 115 Cardinals 9 74 Cowboys 9 108 Eagles 9 106 Jets 9 125 Broncos 8 116 Chargers 8 108 Redskins 8 131 Saints 8 100 Texans 8 115 49ers 7 100 Bills 7 115 Packers 6 113 Jaguars 5 111 Raiders 5 124 Bengals 4 95 Browns 4 100 Seahawks 4 111 Chiefs 2 113 Rams 2 103 Lions 0 83 .48 Rush Yards PG Correlation to Wins -1 0 +1 Pearson Correlation (Negative) – INT (Give) 0.48 -0.43 RUSH INT Team Wins YPG Give Titans 13 137 9 Colts 12 80 12 Giants 12 157 10 Panthers 12 152 12 Steelers 12 106 15 Dolphins 11 119 7 Falcons 11 153 11 Patriots 11 142 11 Ravens 11 149 12 Vikings 10 146 17 Bears 9 105 14 Buccaneers 9 115 13 Cardinals 9 74 15 Cowboys 9 108 20 Eagles 9 106 16 Jets 9 125 23 Broncos 8 116 18 Chargers 8 108 11 Redskins 8 131 6 Saints 8 100 18 Texans 8 115 20 49ers 7 100 19 Bills 7 115 15 Packers 6 113 13 Jaguars 5 111 13 Raiders 5 124 11 Bengals 4 95 15 Browns 4 100 20 Seahawks 4 111 15 Chiefs 2 113 16 Rams 2 103 19 Lions 0 83 19 -1 .48 Rush Yards PG -.43 INT Give Correlation to Wins 0 +1 Pearson Results 0.48 -0.43 0.30 0.35 -0.18 -0.24 0.03 RUSH INT PASS INT FUM FUM PENALTY YPG Give YPG (Take) (take) Give YDS Wins Team 7 49ers 100 19 211 12 6 16 732 9 Bears 105 14 191 22 10 13 610 4 Bengals 95 15 150 12 12 11 591 7 Bills 115 15 190 10 12 15 538 8 Broncos 116 18 279 6 7 12 739 4 Browns 100 20 149 23 8 6 669 9 Buccaneers 115 13 226 22 8 13 834 9 Cardinals 74 15 292 13 17 15 781 8 Chargers 108 11 241 15 9 9 748 2 Chiefs 113 16 196 13 16 8 645 12 Colts 80 12 256 15 11 5 619 9 Cowboys 108 20 237 8 14 13 952 11 Dolphins 119 7 227 18 12 6 669 9 Eagles 106 16 244 15 14 10 635 11 Falcons 153 11 209 10 8 10 591 12 Giants 157 10 199 17 5 3 821 5 Jaguars 111 13 208 13 4 11 813 9 Jets 125 23 206 14 16 8 569 0 Lions 83 19 185 4 16 10 729 6 Packers 113 13 238 22 6 8 984 12 Panthers 152 12 197 12 13 7 637 11 Patriots 142 11 223 14 8 10 501 5 Raiders 124 11 148 16 8 12 823 2 Rams 103 19 184 12 14 12 718 11 Ravens 149 12 176 26 8 9 785 8 Redskins 131 6 189 13 5 12 644 8 Saints 100 18 311 15 7 8 797 4 Seahawks 111 15 164 9 11 12 601 12 Steelers 106 15 206 20 9 10 812 8 Texans 115 20 267 12 10 12 664 13 Titans 137 9 176 20 11 8 855 10 Vikings 146 17 185 12 13 14 692 0.48 -0.43 0.30 Wins Team 7 49ers 9 Bears 0.35 -0.18 -0.24 0.03 RUSH INT PASS INT FUM FUM PENALTY YPG Give YPG (Take) (take) Give YDS 100 19 211 12 6 16 732 105 14 191 22 10 13 610 -1 0 .55 3rd down conversions .56 Pass YD/ATT .48 Rush Yards PG .49 Completion % .03 Penalty YDS .04 4th down conversions .15 Rush YT/ATT .21 INT Take .30 Pass Yards PG -.18 Fumble Take -.24 Fumble Give -.43 INT Give Correlation to Wins +1 Multiple Buckets Financial Bucket • • • • • • Cash Loss % Refund % Chargeback % Scrap % Markdowns On-Hand Adjustments / Scrap Merchandise Trends Bucket • • • • Months On Hand (COGS / Ending Inventory) Inventory Turn Markdowns On-hand / Not Sold • Many of these can be evaluated as “whole store” or even more granular “by merchandise category” Human Bucket • • • • • • • Customer Survey Scores (total and by question) Turnover Tenure (Manager / Non-manager) Training/Certification Compliance Rates Workers Comp Rates Payroll to plan (LP and sales separately) Engagement Scores LP Statistics LP Staff • Internals • Externals • LP Productivity POS Exceptions • Voids • Dummy SKU usage • No receipt refunds • Line item voids Technology • EAS Activations Compliance / Process • Store Self Inspection Score • LP Audit Score Completing A Regression Analysis Regression Overview • Define Regression Analysis • Everyday life examples • Making the transition to Loss Prevention • Running a regression to predict shrink • Questions Regression A method used to identify and measure the relationship between two or more variables In regression there is always one “dependent” variable, and one or more “independent” variables. The benefit of using regression, is that you can make reasonable estimates about expected results. Regression in Everyday Life Pearson = -.844 Dependent Independent Mileage Independent Price Pearson = -.734 Price Dependent Lower - Higher Age Lower - Higher Less - More Newer - Older Regression in Everyday Life Regression in Everyday Life USED CAR ADS List Price Miles Notice that both vehicles are listed at $17,499. Year Make Model 2007 Honda Accord $20,599 18,998 2007 Honda Accord $18,499 18,205 2007 Honda Accord $17,499 15,155 Lowest Mileage 2007 Honda Accord $17,499 34,802 Highest Mileage Regression in Everyday Life • It appears that at least one of the prices is too high. • How can we determine what the correct price should be? • We can pull sample data and run a regression analysis in Excel! Regression in Everyday Life Pulling Sample Data The order of the data is important. In Excel Regression always put the dependent (price) variable to the left of the independent variables. The independent variables (age and miles) should be placed in the columns next to the dependent variable. Regression in Everyday Life Start by selecting Tools on the top menu Then select Data Analysis… Regression in Everyday Life The Data Analysis dialogue box will open. Scroll down in the dialogue box and select Regression. Regression in Everyday Life The Regression dialogue box will open up. In the box Input Y, we will define the range of our dependent variable including the title. Price is in column B. Next, in the Input X box we will select the range for the independent variables. Age and mileage are in columns C and D. Finally. Check the Labels Box Regression in Everyday Life Here we can see the “Multiple R” is .859. Like the Pearson Correlation coefficient, the closer to 1 this number is, the more accurate the estimations made below. The area that we want to focus on is right here. Regression in Everyday Life The Honda Accord Coefficients Intercept Age Miles (K's) Coefficients 20100.06127 -964.6729734 -28.76870811 Start with baseline price. Each year old subtract. Each 1K miles subtract. So how much should we expect to pay for a 2007 Honda Accord with no more than 20,000 miles on it? Regression in Everyday Life A 2007 Honda Accord is 2 years old and has 20,000 miles on it. •Per the Regression we should start with $20,100 as a base price. •For each year old the vehicle is we should subtract $964.67. In this case our vehicle is two years old which equates to = - $1,929 (2 * -$964.67). •Finally for each 1,000 miles we should subtract -$28.77. For 20K miles we estimate on our vehicle, this would equate to $575 (20 * -$28.77). •Therefore a 2007 Honda Accord with 20,000 miles should cost us about $20,100 - $1,929 - $575 or $17,596. Regression in Everyday Life What is it really worth? USED CAR ADS List Price Miles FMV Year Make Model 2007 Honda Accord $20,599 18,998 $17,624 2007 Honda Accord $18,499 18,205 $17,647 2007 Honda Accord $17,499 15,155 $17,735 2007 Honda Accord $17,499 34,802 $17,170 How many games should a team win? Rushing YPG INT Give Pass YD/ATT 3rd Down Conversions Defensive Sacks Predicting Wins using Excel Regression PEARSON Team 49ers Bears Bengals Bills Broncos Browns Buccaneers Cardinals Chargers Chiefs Colts Cowboys Dolphins Eagles Falcons Giants Jaguars Jets Lions Packers Panthers Patriots Raiders Rams Ravens Redskins Saints Actual Wins 7 9 4 7 8 4 9 9 8 2 12 9 11 9 11 12 5 9 0 6 12 11 5 2 11 8 8 RUSH YPG 0.48 INT Give -0.43 RUSH YPG 100 105 95 115 116 100 115 74 108 113 80 108 119 106 153 157 111 125 83 113 152 142 124 103 149 131 100 INT Give 19 14 15 15 18 20 13 15 11 16 12 20 7 16 11 10 13 23 19 13 12 11 11 19 12 6 18 PASSING YDS/ATT 3RD DOWN CONVERSION 0.56 0.55 Passing Yards/Att 6.0 5.5 4.3 5.9 7.1 4.7 6.1 7.1 7.7 5.4 6.8 6.6 7.0 6.2 7.4 6.1 5.8 5.9 5.3 6.6 7.3 6.1 5.2 5.2 6.0 5.5 7.7 3rd down Conversion 37.9 35.6 34.7 39.9 47.5 34.0 38.4 41.9 45.9 38.3 50.2 42.9 37.0 41.3 43.4 43.1 40.8 41.1 28.8 44.2 39.3 43.2 28.5 31.9 40.9 35.2 48.5 DEF SACKS 0.56 Defensive Sacks 30 28 17 24 26 17 29 31 28 10 30 59 40 48 34 42 29 41 30 27 37 31 32 30 34 24 28 Predicting Wins Output SUMMARY OUTPUT Regression Statistics Multiple R 0.870646627 R Square 0.75802555 Adjusted R Square 0.711492002 Standard Error 1.786591886 Observations 32 Looking at the Multiple R we can see that the value is .870 which is very close to 1 and indicates that these five metrics combined have a strong correlation to victories. ANOVA df Regression Residual Total Intercept RUSH YPG INT Give Passing Yards/Att 3rd down Conversion Defensive Sacks 5 26 31 SS 259.9790753 82.98967472 342.96875 MS F Significance F 51.99581506 16.28987216 2.69281E-07 3.191910566 Coefficients Standard Error t Stat P-value -8.624953688 3.640415735 -2.369222175 0.025534715 0.031743312 0.017309459 1.833870807 0.078144635 -0.269060522 0.088673509 -3.034283032 0.005414563 0.152764983 0.59142283 0.258300788 0.798208539 0.285355841 0.093728168 3.044504617 0.005281274 0.142335589 0.034024835 4.183285167 0.000289462 Lower 95% Upper 95% Lower 95.0% Upper 95.0% -16.10793533 -1.141972048 -16.10793533 -1.141972048 -0.003836791 0.067323415 -0.003836791 0.067323415 -0.451331528 -0.086789517 -0.451331528 -0.086789517 -1.062922042 1.368452008 -1.062922042 1.368452008 0.092694834 0.478016848 0.092694834 0.478016848 0.072396539 0.212274639 0.072396539 0.212274639 Again we only want to focus here. Predicting Wins Regression Intercept RUSH YPG INT Give Passing Yards/Att 3rd down Conversion Defensive Sacks Coefficients -8.624953688 0.031743312 -0.269060522 0.152764983 0.285355841 0.142335589 Baseline Predicting Wins Regression • Pittsburgh won the Super Bowl. • According to the regression how many wins should Pittsburgh have gotten based on the following information? • How many should the Lions have won? Team Steelers Lions RUSH YPG 105.6 83.3 Passing 3rd down INT Give Yards/Att Conversion 15 5.95 41.1 19 5.28 28.8 Defensive Sacks 51 30 Predicting Wins Regression RUSH YPG INT Give 105.6 15 83.3 19 Team Steelers Lions Basis Steelers Lions Start (Intercept) Rush YPG INT Give -8.625 0.032 -0.269 -8.625 3.352 -4.036 -8.625 2.644 -5.112 Passing 3rd down Yards/Att Conversion 5.95 41.1 5.28 28.8 Defensive Sacks 51 30 Passing Yards/Att 0.153 0.909 3rd Down Conversion 0.285 11.728 Defensive Sacks 0.142 7.259 0.807 8.218 4.270 Predicted Wins 11 2 Predicting Wins Regression JCP LOSS PREVENTION NFL WINS PREDICTOR MODEL Team 49ers Bears Bengals Bills Broncos Browns Buccaneers Cardinals Chargers Chiefs Colts Cowboys Dolphins Eagles Falcons Giants Prediction 5 6 3 7 9 2 8 7 10 4 10 11 11 10 12 13 Actual 7 9 4 7 8 4 9 9 8 2 12 9 11 9 11 12 Var 2 3 1 0 -1 2 1 2 -2 -2 2 -2 0 -1 -1 -1 Team Jaguars Jets Lions Packers Panthers Patriots Raiders Rams Ravens Redskins Saints Seahawks Steelers Texans Titans Vikings Prediction 8 8 2 9 11 11 6 4 10 8 9 6 11 6 11 10 Actual 5 9 0 6 12 11 5 2 11 8 8 4 12 8 13 10 Var -3 1 -2 -3 1 0 -1 -2 1 0 -1 -2 1 2 2 0 Transitioning to Loss Prevention Dependant (Predicted) Variables • Price, Wins, Shrink % Independent (Data) Variables • Age, Miles, Rush YPG, Def Sacks, Refunds, Over-Short Cash Predicting Shrink • Myths 1. You can predict shrink with 100% accuracy. 2. There are too many variables to provide an accurate prediction. • Where do I start? Shrink Predictor Tool Independent Variables Dependent Variable External Apps per 100 Hours Over/Short Cash Customer Survey…Variety of Merchandise Store Associate Turnover Shrink % Shrink Predictor Tool Shrink Predictor Tool - RILA 2008 Regression Analysis PEARSON Region Dist -0.162 Store 2008 Shrink Rate Ext Apps Per 100 LPO HRS 0.411 O/S Cash % -0.164 0.145 Customer Survey..Variety of Merch Store Associate Voluntary Turnover Shrink Predictor Tool Shrink Predictor Tool - RILA 2008 Regression Analysis PEARSON Region 3 1 7 7 3 3 1 Dist 4111 4053 4210 4215 4106 4112 4053 -0.162 Store 2063 2039 524 170 1020 1552 714 2008 Ext Apps Shrink Per 100 LPO HRS Rate 2.24% 2.05 2.70% 1.67 1.99% 3.08 1.08% 1.76 1.68% 2.53 0.82% 2.52 1.39% 1.43 0.411 O/S Cash % 0.0125% 0.0465% 0.0299% 0.0204% 0.0181% 0.0158% 0.0187% -0.164 0.145 Customer Survey..Variety of Merch 0% 38% 41% 0% 0% 46% 36% Store Associate Voluntary Turnover 44% 67% 78% 85% 65% 87% 77% Build your own Shrink Predictor Report Update your information in these 5 columns Shrink Predictor Tool SUMMARY OUTPUT Regression Statistics Multiple R R Square Adjusted R Square Standard Error Observations 0.441283549 0.194731171 0.177506169 0.00604101 192 From the Summary Output, Copy the highlighted cells and paste them into the Coefficient Updater Tab in the Shrink Predictor Workbook. ANOVA df Regression Residual Total Intercept Internal Apps per $1M Sales O/S Cash % Customer Survey..Variety of Merch Store Associate Voluntary Turnover 4 187 191 SS MS F Significance F 0.001650271 0.000412568 11.30514669 3.08277E-08 0.006824341 3.64938E-05 0.008474612 Coefficients Standard Error 0.012501899 0.002179971 -0.000411294 0.000291278 17.06975635 3.18630046 -0.004943738 0.002577291 0.001559057 0.002519633 t Stat 5.734891415 -1.412032782 5.357233745 -1.918191974 0.618763313 P-value 3.8634E-08 0.159602203 2.46469E-07 0.056610062 0.536825302 Lower 95% 0.008201402 -0.000985907 10.78404269 -0.010028039 -0.003411502 Upper 95% 0.016802396 0.000163319 23.35547001 0.000140563 0.006529615 Lower 95.0% 0.008201402 -0.000985907 10.78404269 -0.010028039 -0.003411502 Upper 95.0% 0.016802396 0.000163319 23.35547001 0.000140563 0.006529615 Here we will take the information from the Summary Output and paste it into the yellow boxes on the Coefficient Updater tab. Once you paste the information in the shaded boxes click on the Shrink Predictor tool tab. When you click on the Shrink Predictor Tool tab you will see that the Predicted Shrink column is filled out. This means that the equation to predict shrink is now functional. Equation With Current based Data on Historical - After Data Shrink Predictor Tool • The true value of a Shrink Predictor is to identify stores which are predicted to be materially higher than their past results or to identify outliers in the current model. Not to identify the highest shrink stores. • In the sample data we provided there are 192 stores. Of the 192 stores, 42 had variances that were greater than the standard deviation of .60 or 21% of the sample. 79% of the stores fell within one deviation. • In most cases, the more metrics you use, the lower the standard deviation and subsequently the more accurate your prediction will be. Recap of Steps 1. Collect Historical Data (Monthly trickles, not annual) • Test with old data (2007 or 2008) • Run Pearson Correlation to select strongest metrics. 2. Run Regression Analysis on 4 strongest 2007 or 2008 metrics using the tool we provided. • Establish Intercept, MultipleR and Coefficients 3. Apply Regression Results (Intercept, MultipleR and Coefficients) to current 2009 monthly metrics to predict future shrink using the tool provided. Roll-out • Selling point, “Predict versus React”. • One version of the truth, one focus. Focus on Exceptions Region Dist 1 Total 3 Total 5 Total 7 Total 9 Total Grand Total Store 2008 Shrink Rate Internal Apps per O/S Cash $1M Sales % Customer Survey..Variety of Merch Store Associate Voluntary Turnover Predicted Shrink Variance To 2008 -7.47% 0.58% 7.43% -3.75% 3.21% 0.00% Focus On Exceptions Dist 4207 4207 4207 4207 4207 4207 4207 4207 4207 4207 4207 4207 Store 747 778 875 893 1014 1406 1457 1469 1996 2117 2119 2129 2008 Internal Shrink Apps per $1M Sales Rate 1.30% 1.83 1.13% 2.21 1.17% 5.77 1.20% 1.12 0.37% 2.12 0.61% 1.43 1.32% 1.91 2.28% 1.71 1.73% 0.96 1.40% 2.67 1.43% 0.12 1.13% 1.77 O/S Cash % 0.02% 0.01% 0.03% 0.04% 0.02% 0.02% 0.04% 0.06% 0.03% 0.03% 0.01% 0.01% Customer Store Survey.. Associate Variety of Voluntary Predicted Merch Turnover Shrink 36% 81% 1.44% 39% 66% 1.26% 36% 47% 1.42% 35% 85% 1.88% 38% 65% 1.35% 39% 57% 1.42% 0% 102% 2.03% 0% 129% 2.34% 37% 75% 1.71% 37% 98% 1.56% 40% 71% 1.39% 41% 57% 1.26% Variance To 2008 0.14% 0.13% 0.25% 0.68% 0.98% 0.81% 0.71% 0.06% -0.02% 0.16% -0.05% 0.13% Additional Considerations • Segment stores if diversity is pronounced, consider: • Box size • Box format • Volume • Risk Rating • Brand • Technology (CCTV / EAS) • Major event (remodel, crisis event) • Use the same methodology to create Risk Ratings on static data. (crime index, census info, 3YR shrink, etc.) Questions Michael Sanders Shrinkage Control Analyst J.C. Penney Company, Inc. msande45@jcpenney.com • • • • • To download the Shrink Predictor Tool, visit: http://www.rila.org/protection/resources/Documents/SHRINKPRE DICTORTOOL.xls To view the help guide for the Shrink Predictor Tool, visit: http://www.rila.org/protection/resources/Documents/SHRINKPRE DICTORTOOLHELPGUIDE.pdf Google “Regression Analysis” or “Pearson Correlation” Search Excel Help for “Regression Analysis” or “Pearson Correlation” www.visualstatistics.net