Graduate School Bound Program

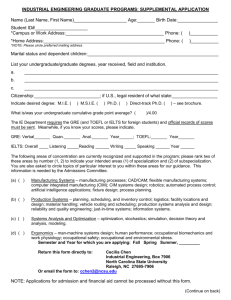

advertisement

Graduate School Bound Program Module #4 Financial Aid and Test Preparation Presented by: Amanda Carpenter, M.S. Coordinator for Career Development Center & Henry L. “Hank” Lacayo Institute Internship Program Graduate School Bound Program Objectives • To provide undergraduate CI students with assistance in the exploration and preparation process for graduate school through a series of online self-guided modules • To connect undergraduate CI students with the resources provided by Career Development Services Module #4 Learning Objectives 1. Identify the basic types of financial aid offered to graduate students. 2. Outline the purpose of graduate school admissions examinations. 3. List strategies to prepare for the test required for graduate school admission. Agenda During this module we will be covering the following topics: • Financial Aid Process • Test Preparation What is Financial Aid? It’s money for college! • Financial aid comes in various forms of monetary assistance including scholarships, grants, work, tuition waivers, loans, and family contributions. • The amount you receive in financial aid will depend upon the financial assistance you need to complete your program. • Scholarships may be based on grade point average and many other factors. • Financial aid is a partnership between you and the college you attend. The college acts as a flow-through for the funds provided to you. • The college you select will provide you with a percentage that shows the amount of expected personal/family contributions. • If you receive financial aid, it is expected that you will enroll fulltime in the courses needed to complete your chosen major. Types of Aid Available • Need based: Most Federal and State provided aid are based on student need. Need is determined by comparing the cost of the student’s education with his or her financial resources. • Merit based: Some financial aid is merit based, meaning you can receive scholarships and grants on the basis of your academic achievement and other factors. GPA and GRE are important factors in qualifying for merit based financial aid. Additional Types of Aid • Fellowships and Grants – Do not require repayment – Usually cover tuition and some of the student’s living expenses – Grants are usually based on student need. Fellowships are often limited to doctoral and post-doctoral students, though there are some that specifically target masters’ students in particular fields. • Fellowships generally are: – Short-term opportunities lasting from a few months to several years – Focus on the professional development of the fellow – Sponsored by a specific association or organization seeking to expand leadership in their field Additional Types of Aid (continued) • Fellowship programs can be designed to support a range of activities including: – graduate study in a specific field – research to advance work on a particular issue – developing a new community-based organization or initiative – training and reflection to support the fellow's growth – opportunities to further explore a particular field of work For more information visit: www.graduatecenter.com/schools/fellowships.php Fellowships 101 The Benefits of a Fellowship include: Experiential Learning • Fellowships are structured to provide significant work experiences, and fellows are often expected to take on a great deal of responsibility quickly • Fellows are provided with unique experiences that are not typically available to someone starting out in an entry-level position. Training and Professional Development • Fellowship programs are known for their commitment to the professional development of individual fellows and often include intensive training. Key elements of this training might include: – academic seminars to develop frameworks and apply theory – in-depth research and analysis of a particular issue area – a broad curriculum of skills development: leadership, community organizing, public speaking, grant writing, media relation Fellowships 101 (continued) Compensation • Compensation is often considered the biggest drawback of a fellowship. Although most fellowship programs do provide a living allowance or stipend, it is typically not comparable to the salary of a full-time job. This financial compensation varies greatly - stipends can range from $10,000 to up to $25,000 for a 9-12 month program. • Other incentives are often provided to fellows such as healthcare coverage, student loan repayment assistance, and housing stipends. Many fellowships at some institutions do not require work. It may simply be a “fellowship grant” with no strings attached. Assistantships 101 • Assistantships are the most prevalent and more desirable forms of financial aid. You can receive money for working as a graduate assistant and gain invaluable experience teaching or conducting research in your field. They require a form of service usually teaching or research. • A study grant of financial assistance to a graduate student that is offered in return for certain services in teaching or laboratory supervision as a teaching assistant, or for services in research as a research assistant. • In a graduate assistantship program, most assistants are required to work approximately 20 hours per week. In return, they will receive a small stipend that generally equates to the pay of an average part-time job, though this can vary in different universities. Tuition, room, and board will generally be paid in full, as long as the student maintains a specific grade point average. Assistantships 101 (continued) • When working as a graduate assistant, there are various duties that you will be expected to perform. These duties are based on the type of graduate assistantship you have received. – As a graduate teaching assistant, or TA, you will be required to teach some low-level classes, grade assignments, and work directly with students and professors – As a graduate research assistant, you will be required to perform and analyze research in a lab under the supervision of a professor • A graduate assistant works with various members of faculty in the department, grades assignments, fills in on classes when needed, runs study groups or lab groups with undergraduate students, and maintains office hours in which to meet with and assist other students • Though becoming a graduate assistant is a great deal of work on top of what is likely an already busy schedule, it is important to remember the value of the experience you are receiving. Financial Aid and Scholarship Search Scholarship Search Database There are several free scholarship databases available online. With more than 1.5 million scholarships worth more than $3.4 billion, the FastWeb scholarship search is the largest, most accurate and most frequently updated scholarship database. If you supply an email address, they will notify you when new awards that match your profile are added to the database.You can even submit an electronic application to some of the scholarships listed in the FastWeb scholarship database, saving you time and money. Other scholarship search databases are listed below: • www.fastweb.com • www.finaid.org/otheraid/#graduate • www.students.gov • www.studentsscholarshipsearch.com • www.scholarships.com • www.oedb.org/scholarship/graduate-school • www.graduatecenter.com/schools/scholarships.php As a prospective student you have the right to ask a school about the following criteria: 1. 2. Full cost of attendance and refund policy Financial assistance available • What financial assistance is available, including information on all federal, state, local, private, and school financial aid programs, including school based scholarships? 3. Procedures and deadlines • What are the procedures and deadlines for submitting applications for each of the financial aid programs being considered? 4. Criteria 5. Need calculation • How is individual financial need determined? How are costs for tuition and fees, room and board, transportation, books and supplies, and personal expenses considered in your budget? (continued) 5. Academic progress • How does the school determine whether you are making satisfactory academic progress? What happens if you are not? Do you need to maintain a certain grade point average (GPA) to continue to receive aid? 6. Repayment • What portion of the financial aid you receive must be repaid, and what portion is grant aid? If the aid is a loan, you have the right to know the interest rate, the total amount that must be repaid, pay back procedures, the length of time you have to repay the loan, and when repayment is to begin 7. Contact Information • Who are the school's financial aid personnel? Where are they located and how can they be contacted for information? Student’s Responsibilities 1. 2. 3. Enroll in and maintain the same number of credits/units as stated on the FAFSA Maintain satisfactory progress with a minimum overall GPA of a 2.0 (GPA requirement may vary depending on the school you are attending) Respond promptly to financial aid requests (not responding on time, can mean a loss of your financial aid package) You should also be aware that: • If you withdraw from school during a quarter or semester, you may be responsible for repayment of all or a portion of any financial aid received for that quarter or semester. • If you withdraw for other than compelling reasons, you may lose your eligibility for further financial assistance How to Apply We will be covering the following topics: 1. 2. 3. 4. Select Graduate Schools Contact Admission Offices Complete FAFSA- meet priority deadlines Scholarship and Grant Search How to Apply: Steps 1-12 STEP 1 • Select colleges that will fulfill your educational and career goals • If you are uncertain about the college you wish to attend, refer to www.eureka.org or www.myplan.com • Know the financial aid application procedures and deadlines for each school to which you are applying (These requirements may vary) STEP 2 • Write, call or email the Admissions Office of each college on your list • Ask about financial aid possibilities and application procedures, which forms to use, deadlines, and their school code. • Students and parents can learn more about financial aid sources and procedures at these workshops. You may also visit the FAFSA website, at www.fafsa.ed.gov for more information. How to Apply (continued) STEP 3 • Financial Aid requires students to be either a U.S. citizen or an eligible non-resident and to have a Social Security Number. Go to www.ssa.gov to learn more about how to get a Social Security Number. • In addition, if you are a male between the ages of 18-24, and not a current member of the active armed forces, you must register with the Selective Service. For more information go to www.sss.gov STEP 4 • For those who apply online, you need to request a Personal Identification Number (PIN) for yourself and your parents or guardians. You may get your PIN number at, www.pin.ed.gov/PINWebApp/pinindex.jsp • When you receive your PIN, you agree to not disclose or share your PIN with anyone.Your PIN serves as your electronic signature and provides access to your personal records. • Keep your PIN in a safe place. You can use the same PIN in the future to apply electronically for student aid and to access your U.S. Department of Education records. How to Apply (continued) STEP 5 • Obtain a copy of the Free Application for Federal Student Aid (FAFSA) form. The FAFSA comes in two versions, paper and electronic. • You may get a hard copy from the Financial Aid Office at your college • If you have access to a computer, you can download the forms or apply directly online at www.fafsa.ed.gov STEP 6 • Fill out the financial aid forms accurately and completely. Always use your full legal name and Social Security number. • List the schools you wish to attend. Do not send tax forms with the application. If you estimate the financial information you report, you will have to prove the accuracy of your estimate before you are awarded aid. • After submitting your FAFSA application, you will receive a form from the Department of Education. The form is called the Student Aid Report (SAR), and contains the data you entered on your FAFSA application. • Review the SAR carefully for errors (the form will highlight items that did not pass the edit) and follow directions for making and submitting corrections. How to Apply (continued) STEP 7 • Some schools may request additional information from you, such as copies of federal tax returns. • Learn what each school requires and provide the information by the deadlines. Each school that you applied to may offer you financial aid. They will also explain how much in money in grants, loans, scholarships, or work-study they can offer you. • You need to submit in writing whether or not you accept their financial aid packages. STEP 8 • Keep in mind the priority filing date for the school you plan to attend. • All students whose applications are received by the priority filing date will be notified about their applications prior to the beginning of the academic year. • Late applications will be processed subject to the availability of funds. How to Apply (continued) STEP 9 • Begin searching for scholarships and grants • Use the scholarships links in this guide for other local, college based, regional, and national listings in your scholarship search. STEP 10 • If you have specific questions concerning the status of your application, contact the Financial Aid Office at the college, university, or vocational school you plan to attend. Use your complete legal name and your Social Security number on all correspondence. How to Apply (continued) STEP 11 • Aid awarded for the academic year must be used during fall, winter, and spring terms. • Aid may also be available for the summer term. Ask your aid officer well in advance of summer enrollment if summer aid is available at your college. Some may have a separate summer application process. STEP 12 • Each January if you are planning to be in school the next academic year, you must apply for financial aid again. • Be sure to re-establish your PIN number if you are doing it online. (This is important for security purposes) For more information about student loans please go to the link listed below: http://www.graduatecenter.com/financialservices/graduate-school-financial-aid.php What is the GRE? • Verbal Reasoning – In a nutshell, can you read? Can you identify complex relationships between words and concepts? Do you understand the different parts of a sentence? Can you put together an answer from a passage you’ve dissected? For more information you may go to: http://testprep.about.com/od/thegretest/a/GRE_Verbal.htm • Quantitative Reasoning – In a nutshell, how is your algebra? Geometry? Arithmetic? Quantitative reasoning? If your skills are a little rusty since Algebra 101 in undergrad, you better brush up! For more information you may go to: http://testprep.about.com/od/thegretest/a/GRE_Quantitativ.htm What is the GRE? (continued) • Analytical Writing – In a nutshell, how good are you at explaining what you mean? Can you clearly support your ideas with evidence, reasons, and examples? Can you creatively focus your ideas into a well-organized, carefully-spelled, and grammatically correct composition? This section accounts for one hour and fifteen minutes of the test, so you should prepare yourself accordingly. For more information you may go to: http://testprep.about.com/od/thegretest/a/GRE_Writing.htm How to Prepare for the GRE ETS, the makers of the GRE, offer free test preparation materials to anyone who registers for the GRE. To access these materials go to, http://www.ets.org/ You can also try these options: • GRE Diagnostic Service – For the cost of a meal at Applebee’s (fifteen bucks), you can have ETS diagnose your strengths and weaknesses on a practice GRE. They will also compare your score to that of your peers. • Tutors – Kaplan offers an array of tutoring services. Try posting on Craig’s List for a tutor. Many teachers or professors are willing to tutor on the side for nominal fees. How to Prepare (continued) • Books – If you browse through the aisles of your local bookstores, you’ll be sure to find a test preparation booklet. For a cheaper approach, get the latest version on eBay or Amazon. Many wholesalers will give you big discounts on overstocked items. For more information on how to find a tutor visit: http://testprep.about.com/od/besttestprepresources/tp/Tutors.htm For more information on Kaplan you may go to: http://www.kaptest.com/enroll/GRE/34638/comprehensive Additional Test Preparation Services • • • • www.princetonreview.com www.gre.org www.kaptest.com www.youtube.com Questions on this Module? Preparing for graduate school is a multi-staged process. Visit Career Development Services during Drop-In Career Counseling to get your questions answered. Every Thursday 9:30 a.m. to 12:30 p.m. Career Development Center Bell Tower 1548 career.services@csuci.edu (805) 437-3270