Games for Judges - School of Physics

advertisement

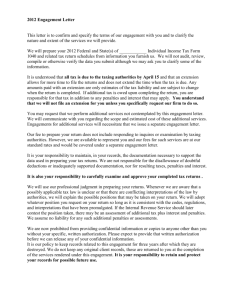

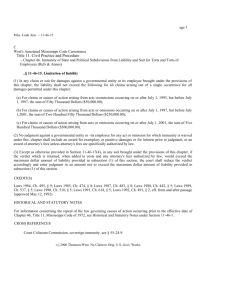

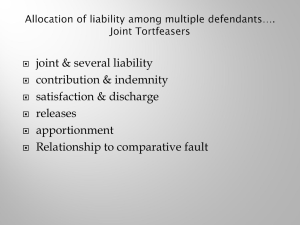

Games for Judges: An Approach to the Design of Legal Liability Rules Sergey Knysh, Paul M. Goldbart & Ian Ayres Department of Physics University of Illinois Yale Law School New Haven, CT Michigan Law Review,100 (Centenary Volume), 1-79 (2001) Preprints (2002): Design of Efficient Legal Liability Rules: I. Continuous Extension of Multistage Rules II. Comparison of Discrete Vanilla and Exotic Variants goldbart@uiuc.edu w3.physics.uiuc.edu/~goldbart Outline Property rules & liability rules Nuisance dispute settings Options view of liability rules Optimizing liability rules Continuum liability rules Game-theoretic viewpoint Practical advice for courts Property rules & liability rules Property Liability rules: protect by deterrence rules: protect by compensation Property rules & liability rules Example: Abbott breaks Costello’s arm Intentionally? focus on taker’s welfare (a criminal offence) traditionally protect via a property rule Through negligence? focus on takee’s welfare (compensatory damages) traditionally protect via a liability rule Property rules & liability rules But property rules are not very efficient Example: Laurel steals Hardy’s hat? Property rule: Hardy can sue to recover hat (replevin) Liability rule: Can also sue for value of hat (trover) Advantage? If hat is worth $10 to Laurel, $5 to Hardy? Property rules & liability rules Liability rules are more efficient Example: Fred holds over in Barney’s apartment Barney can sue for trespass or to force Fred to rent for another year Goal of liability rules: Add efficiency—by compensating initial entitlement holder for transfer of entitlement (goes beyond mere deterrence) Concerns of judges re liability rules Traditional view: identity of the initial entitlement holder compensation as deterrence Modern view: identity of the more efficient chooser decouple allocative and distributional concerns liability rules: a means by which an imperfectly informed court can delegate choice to private litigants thus harnessing their superior information Central aims Focus on nuisance dispute settings Provide courts with liability rules that are economically efficient cheap to implement Examples of nuisance disputes A/c noise reduced value of adjacent residence Estancias Dallas Corp. v. Shultz (Tex. App. 1973) Hotel addition obstructed view of adjacent hotel Fontainbleu Hotel v. Twenty-Five Twenty-Five Inc. (Fl. 1959) Dog-track lights interfered w/ drive-in movie theater Amphitheaters, Inc. v. Portland Meadows (Or. 1948) Pollution from Con Ed plant disrupted new car preparation business Copart Indus. v. Con. Ed. Co. (N.Y. 1977) Property rules & liability rules What might courts do in nuisance disputes? E.g. Boomer v. Atlantic Cement (N.Y. 1970) Resident/Plaintiff (Boomer): discomforted by pollution Polluter/Defendant (Atl. Cem.): factory operator After Calabresi & Melamed (’72): Rule 1: nuisance injunction on Polluter (stop!) Property rule Rule 2: nuisance Polluter pays damages to continue Liability rule Rule 3: not a nuisance Polluter continues Property rule Rule 4: nuisance? Resident pays Polluter damages to stop Liability rule Options: Calls and Puts Call option choice of whether or not to pay a nonnegotiated amount to purchase entitlement choice of forcing seller to sell (be paid) Put option choice of whether or not to be paid a nonnegotiated amount to sell entitlement choice of forcing buyer to buy (pay) Liability rules as options (Morris ’93) Call: seller forced to sell Put: buyer forced to buy Rule 2: Polluter can pay damages to continue Liability rule: initial entitlement to Res; call option to Pol Rule 4: Resident can pay damages to stop Polluter Liability rule: initial entitlement to Pol; call option to Res Rule 5: Polluter can require damages & stop Liability rule: initial entitlement to Pol; put option to Pol Rule 6: Resident can require dam’s & allow Polluter Liability rule: initial entitlement to Res; put option to Res Who pays? Who chooses who pays? Realizations Rule 2: Entitlement to Resident; call to Polluter Boomer v. Atlantic Cement (N.Y. 1970) Rule 4: Entitlement to Polluter; call to Resident Spur Indus., Inc. v. Del E. Webb Dev. Co. (Ariz. 1972) Rule 6: Entitlement to Resident; put to Resident Thelma builds an encroaching wall on Louise’s land; Louise can sue Thelma to remove the wall or to force Thelma to buy the encroached land permanently Basic ingredients for analyzing liability rules Imperfectly informed court Explore classes of rules Which to use? Ex post efficiency as criterion Vanilla rules Exotic rules dual-chooser rules (vetos, higher-order,…) Emerging guidelines for courts Imperfectly informed courts value of asset to defendant D is higher valuer VD VP VD In any given instance Plaintiff P Defendant D j.p.d. P is higher valuer value of asset to plaintiff VP P alone knows her valuation, VP D alone knows his, VD P, D & court know j.p.d. f (VP ,VD ) i.e. joint probability distrib. of valuations (possibly correlated) Imperfectly informed courts: Property rule value of asset to defendant D is higher valuer mean values VD V P , VD What might the court do? P is higher valuer value of asset to plaintiff VP compute means w.r.t. f : VP & VD allocate asset to higher mean valuer (here: D) What can the court do to promote better efficiency? Imperfectly informed courts: Liability rule One stage / Call flavour The court could… allocate asset to P give call option to D set damages (C,VD C ) if D exercises VD C How would D respond? Resp. profits (to P, to D)? by exercising option when worth it to him How to set damages? to elicit a response that maximizes the expected total value (VP ,0) if D doesn’t VP So… where to arrange the bar? Imperfectly informed courts: Liability rule One stage / Call flavour Upshot… optimally efficient (i.e. best mean total profit) if D “pivots” at nonchooser’s mean Resp. profits to P & D ? (C,VD C ) if D exercises VD (rational) D does this if damages are also at nonchooser’s mean C VP (VD C ) (VD C ) (VP ,0) if D doesn’t VP Imperfectly informed courts: Liability rule One stage / Put flavour allocate asset to P give put option to P set damages if P does put Resp. profits (to P, to D)? VD C How would P respond? (C,VD C ) The court could… by exercising option when worth it to her (VP ,0) if P doesn’t put How to set damages? to elicit a response that maximizes the expected total value VP So… where to arrange the bar? Imperfectly informed courts: Liability rule One stage / Put flavour (C,VD C ) Upshot… optimally efficient (i.e. best mean total profit) if P “pivots” at nonchooser’s mean (rational) P does this if damages are also at nonchooser’s mean C VD (VP C ) (VP C ) if P does put Resp. profits (to P, to D)? VD (VP ,0) if P doesn’t put VP Imperfectly informed courts: Veto rule (VP ,0) The court could… allocate asset to P give call option to D at damages C give call option to P at same damages (C,VD C ) VD D takes but P doesn’t take back D takes and P takes back Transfer to D can be vetoed by D or P (VP ,0) Resp. profits (to P, to D)? D doesn’t take VP So… where to arrange the bars? Imperfectly informed courts: Veto rule (VP ,0) Upshot… efficient for D to pivot at damages C efficient for P, too (C,VD C ) VD D takes but P doesn’t take back D takes and P takes back Optimal damages obey straightforward formula VD C (VD C ) (VP C ) C VP (C VP ) (VD C ) (VP ,0) D doesn’t take VP “Phase diagram” for rules …roughly SCR: select more volatile valuer as chooser DCR: select lower mean valuer as vetoee SCR v. DCR: select SCR if diff. in var’s exceeds diff. in means Simplest setting… uniform rectangular j.p.d., 1/t is the golden ratio P , range 2 ; D mean , range 2 mean rules: property (Pr), one-stage liability (Li), veto (Ve) Multi-stage liability rule: Call flavour The court could give… call option to D at damages C D1 call-back option to P at damages C P1 call-back option to D at damages C D2 call-back option to P at damages C P2 asset to P VD (CD2 ,VD CD2 ) (VP CP2 , CP2 ) (CD1 ,VD CD1 ) (VP CP1 , CP1 ) (VP ,0) VP ….. How to choose the damages? Resp. profits (to P, to D)? So… where to arrange the bars? Multi-stage liability rule: Call flavour Find pivots that max. expected total value Set damages to elicit these responses Strategic over-bidding (pivots smaller than damages) Note: shrinking areas of inefficiency VD (CD2 ,VD CD2 ) (VP CP2 , CP2 ) (CD1 ,VD CD1 ) (VP CP1 , CP1 ) (VP ,0) VP Infinite-stage liability rule: Call flavour Discrete pivots pivot functions VP( k ) vP (q) , VD( k ) vD (q) Optimal pivot functions converge to diagonal perfect efficiency VD vP (q) vD (q) Reparametrization can take vP (q) vD (q) q Discrete damages damages functions CP( k ) cP (q) , CD( k ) cD (q) VP Infinite-stage liability rule: Call flavour Rational D & P pivot optimally, provided damages functions obey simple ODE’s simple BC’s Solvable (to quadratures) for any j.p.d. (including arbitrary correlations) dcP P (q) ( q ) (c P c D q ) dq dcD D (q) ( q ) (c P c D q ) dq cP (qmin ) 0 cP (qmax ) cD (qmax ) qmax P (q) (VP q) (VD q) D (q) (VD q) (VP q) (q) (VD q) (VP q) Infinite-stage liability rule: Call flavour General distributions… what aspects of j.p.d feature? simple geometry if j.p.d. uniform (even if shape gives corr’s) P ( s) (VP s) (VD s ) D ( s) (VD s ) (VP s ) ( s) (VD s) (VP s) Illustrative example uniform triangular (correlated) readily solvable Infinite-stage liability rule: Call flavour How to use the results Court computes parametric damages curve And requires D & P to “bid” bids separate call-exercise from non-exercise ranges Asset goes to higher bidder cD (q) for damages projected from lower bid (to higher bidder’s axis) Asset ends up in hands of higher valuer cP (q) Infinite-stage liability rule: Call example j.p.d. a uniform “2 x 1” rectangle (no correlations) VD VP Use? Litigants issue bids Asset goes to higher bidder At damages set by lower bid Game-theoretic aspects SD SP SD Introduce generalized damages functions CD (S P , S D ) And strategy functions what P & D bid, given their private valuations CP (S P , S D ) S P (VP ) SP S D (VD ) P’s expected profit VP CP ( S P , S D ) ( S P S D ) C D ( S P , S D ) ( S D S P ) D’s expected profit C P ( S P , S D ) ( S P S D ) VD C D ( S P , S D ) ( S D S P ) Game-theoretic aspects Seek Nash Equilibrium (my strategy is optimal for me if you fix yours, & vice versa) P' s expected profit 0 S P (VP ) D' s expected profit 0 S D (VD ) Make simple choice for damages functions CD ( S P , S D ) CD ( S P ) Demand that the N-E strategies be “revealing” S P (VP ) VP CP ( S P , S D ) CP ( S D ) S D (VD ) VD Upshot: previous call-option damages conditions Court has made it so that it pays not to lie! Emerging guidelines Explore classes of liability rules single-chooser, veto, continuous decouple allocational & distributional concerns Property rules give entitlement to (estimated) higher valuer suggested as a general practice, but… Liability rules do better—by harnessing private information continuous versions can be fully efficient go to end-stage, limit transaction costs