ISU Alumni Day Presentation

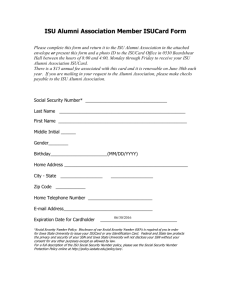

advertisement

ISU Alumni Day Presentation Carol Sorenson, FCAS, MAAA Workers' Compensation Pricing Agenda Introduce Myself, Zurich, and CAS What employers are looking for How to make the most of your time at ISU What I do Things I’ve learned on the job Case Study on Severity Trend Pricing 10/13/2010 ISU Alumni Day Presentation 2 About Me Graduated from ISU Actuarial Program in May of 2006 Started at Zurich North America in June of 2006 Earned ACAS Designation, Spring 2009 Earned FCAS Designation, Spring 2010 Currently focus on Pricing Workers’ Compensation Insurance Pricing 10/13/2010 ISU Alumni Day Presentation 3 About Zurich North America Subsidiary of Zurich Financial Service Group Headquartered in Zurich, Switzerland 60,000 employees serving customers in 170 countries Group has remained profitable throughout the financial crises ZNA: Commercial Property & Casualty Insurer Headquartered in Schaumburg, IL Products like: Property, Worker’s Compensation, General Liability, Auto Liability, Medical Malpractice, etc. Customers range from small to large and cross many industries Actuarial Approximately 200 actuaries and actuarial students in NA Actuarial Student Program provides study time and raises for passed exams Domestic and International Job Rotations Pricing 10/13/2010 ISU Alumni Day Presentation 4 Casualty Actuarial Society 2011 Exam Structure Associate VEE, Exams 1-4, CAS Professionalism Course Module 1: Risk Management and Insurance Operations Module 2: Insurance Accounting, Coverage Analysis, Insurance Law, and Insurance Regulation Exam 5: Basic Ratemaking and Reserving – 4 hours Exam 6-US: Regulation and Financial Reporting – 4 hours Fellowship Exam 7: Advanced Techniques in Unpaid Claim Estimation, Insurance Company Valuation, and Enterprise Risk Management – 3 hours Exam 8: Advanced Ratemaking – 3 hours Exam 9: Financial Risk and Rate of Return – 3 hours Pricing 10/13/2010 ISU Alumni Day Presentation 5 What employers are looking for: The best person for the job. Technical Skills High GPA Actuarial Exam Success Internship Experience Problem Solving Skills Computer Skills: Excel, VBA, SAS Non-technical Skills Communication Skills Leadership Skills Time Management Skills Personal Characteristics Enthusiasm Confidence Drive to Succeed Personality Pricing 10/13/2010 ISU Alumni Day Presentation 6 Get Involved at ISU! Gamma Iota Sigma Actuarial Club Benefits Improves Non-technical skills like communication, leadership, and time management Toastmasters Katie Insurance School Leadership Program International Internships Student Government Helps differentiate you from our candidates Gives you more material and increases your comfort in interviews Volunteering Pricing 10/13/2010 ISU Alumni Day Presentation 7 My Role at Zurich: Workers’ Compensation Pricing Trends Analysis Frequency, Severity, and Loss Ratio Trend Rate Indication Study Profitability Studies State Specific Analysis Research Industry Data Pricing 10/13/2010 ISU Alumni Day Presentation 8 Lessons from the Real World You’re never done learning. There is often no right answer. Work is a process of creation and improvement Peer Review produces a better work product Work projects often do not have a definite end point Pricing 10/13/2010 ISU Alumni Day Presentation 9 Case Study: Medical Severity Trend Unlimited Medical Severity 70,000 On-leveled Average Severity 60,000 50,000 40,000 30,000 20,000 10,000 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Accident Year Many actuarial analyses use loss trends to adjust a loss ratio to today’s level of losses. Prospective and historical trends can be hard to determine. Pricing 10/13/2010 ISU Alumni Day Presentation 10 Making a Trend Selection Year Begin Year End Year Begin Year End Year Begin Year End 2000 2008 2002 2007 2000 2009 Selected Trend 2000 9.5% 2001 9.5% 2002 9.5% 2003 9.5% 2004 9.5% 2005 9.5% 2006 9.5% 2007 9.5% 2008 9.5% 2009 9.5% 2010 9.5% Pricing 2011 9.5% 10/13/2010 Exponential Fit 10.0% R-Squared 97.6% 10.7% 96.8% 9.1% 95.9% Last Year Selected 9.4% 9.4% 9.4% 9.4% 9.4% 9.4% 9.4% 9.4% 9.4% 9.4% 9.4% Use the graph to determine appropriate range to run exponential regression Consider economic conditions and other data issue Consider last years analysis and changes since last year’s study Make selection, here our selection is close to last year’s trend and does not overreact to latest AY severities ISU Alumni Day Presentation 11 Q&A Pricing 10/13/2010 ISU Alumni Day Presentation 12