Food integrity is our promise that Hebrew National products are “fit

advertisement

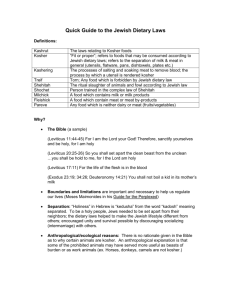

Final Marketing Plan Hank Ingram Clark Jernigan Drew Martin Stephen Stites Stephen Twining 1 World Communications Drive Omaha, NE 68107 11/25/2011 Executive Summary The kosher advantage is our differentiating characteristic, and the center of our marketing strategic plan. Due to a supremely strict certification process, the kosher label offers a level of food integrity and safety that is unmatched by our competitors. Analysis of our competition allows us to develop the rest of our brand meaning to include our customizability, consumption at home, and ability to feed a group, and relative affordability. Further, by using the positioning bases of quickness/ease and food integrity, our kosher label allows us to find open market space amongst all of our competition. In order to achieve high margins and strengthen our brand image, we must further entrench ourselves as the premium brand within the market. While our price will remain constant, we need to magnify the perceived benefits of our products in order to increase our value ratio. We will expand into the deli meat market by offering more options. This will take advantage of market trends and cultivate brand loyalty. We will make packaging changes to offer eight hot dogs per pack instead of seven. Buns are sold in packages of eight, so this will reduce consumer frustration with leftover buns. We will practice benefit segmentation to offer an affordable, easy meal that does not sacrifice food integrity to the following target markets: o Those who look for healthfulness in their meal o Those who want a quick and easy meal o Those who want an affordable meal Promotion to all of these segments will address our current problem with the hierarchy of communications effects. In order to achieve success for our brand, we must make the word kosher more widely understood and accepted. Consumers are not aware of the benefits kosher products offer. By touting kosher’s integrity and safety, we will provide consumers with knowledge about the kosher advantage. Promotion to each segment will focus primarily on creating an understanding of the kosher advantage. However, each segment shows differential responsiveness, thus will receive messages that boast other aspects of our brand meaning. Advertising is expensive, but will be our best option due to our dire need to inform a large audience. By investing in advertising up front, we will be able to markedly increase our sales in the long run. Our goals are a 35% increase in deli meat sales and a 30% increase in hot dog sales. The Kosher Advantage For over a century, Hebrew National has been providing consumers with kosher hot dogs and deli meats. Despite our good bone structure and steady growth, Hebrew Hebrew National Final Marketing Plan 1 National is under-utilizing its most valuable asset— its kosher certification. The kosher advantage is our differentiating characteristic and the heart of our strategic marketing plan. Our essential task is to convince consumers that this kosher certification makes our products better than those of our competitors. In order to accomplish our aim, we must enforce the idea that kosher epitomizes food integrity and safety. This section will outline exactly what is meant by “the kosher advantage”, as it is an important message to clearly convey to consumers. Food Integrity & Safety Food integrity is our promise that Hebrew National products are “fit to eat.” It means that we produce honest products held to high ethical and quality standards in order to maximize consumer confidence in our brand. On one hand, honesty requires that we remain transparent in our sourcing, production, and transportation processes. On the other hand, our ethical and quality standards ensure environmentally friendly operations, the ethical treatment of animals raised for slaughter, and cleanliness and soundness of product. Our bona fide kosher certification allows us to offer our customers this integrity guarantee. Hebrew National is supervised by Triangle K, the most respected and reliable kosher certification organization in the world. In general, such a kosher certification is extremely difficult to obtain; rigorous postmortem tests of animals performed by rabbis are required. In fact, 60% of animals cleared by the USDA do not meet kosher standards.i Consumers can be assured that food sourcing is not a concern with kosher products because they are taken only from specific parts of animals; meat from the hindquarters and scrap meat are prohibited. Moreover, animals are raised without hormones and killed in a manner that minimizes suffering. Kosher practices require that raw meat and vegetables be kept separately, which prevents cross-contamination and lowers the incidence of food-borne illness. In addition, the use of milk is closely monitored and labeled in products, as dairy and meat cannot be consumed together. The end result is that kosher products offer the consumer unparalleled food safety. In turn, those who are lactose intolerant, food allergic, vegetarian, or concerned with general health often turn to kosher foods to satisfy their needs.ii The Other Guys Other healthful food classifications, such as natural and organic, do not face such strict regulations. In fact, use of the term natural requires no certification whatsoever.iii While organic faces some certification standards, there is no regulation of which part of animal is used in production, meaning consumers could be eating “lips and assholes.” By highlighting the food sourcing and selectivity of kosher in comparison to all non-kosher foods, Hebrew National can make kosher represent food integrity in the mind of the consumer. Market Space Hebrew National faces a vast array of competitors who fulfill the generic need definition of a quick, easy, and relatively inexpensive meal. We can benefit from opening up the Hebrew National Final Marketing Plan 2 market with the positioning bases of quickness/ease and food integrity. By emphasizing the kosher advantage, Hebrew National can fill a void in the market. Further, examination of the market allows Hebrew National to develop a brand meaning that encompasses quickness, ease, affordability, customizability, consumption at home, and ability to feed a crowd. The following positioning map provides detailed analysis of our brand’s positioning using the bases of quickness/ease and food integrity. Fast Food Competition Hebrew National competes with a variety of classic fast food options, such as McDonald’s, Subway, Arby’s. These brands are positioned as cheap, easy, accessible, and tasty. As of recent, many have tried to make a feeble push for healthfulness, but only Subway has realized success in this endeavor. Slightly more upscale fast food restaurants such as Chipotle and Five Guys also provide competition and pride themselves on better ingredients, but are prepared noticeably slower. Nevertheless, the food integrity of all fast food brands does not match up with the kosher standards of Hebrew National. Further, we can position ourselves as quicker and easier than these options. Our products do not require a trip across town; they can be enjoyed from the comfort of the consumer’s home. Also, these brands provide very cookie cutter-like foods. Our brand provides opportunity for customizability. Hebrew National Final Marketing Plan 3 At Home Competition Once a consumer has decided to eat a quick meal at home, Hebrew National faces its next wave of competition. Frozen dinners such as Lean Cuisine, as well as soup options such as Campbell’s provide similarly quick and easy experiences from the confines of the consumer’s home. However, we are different. Our hot dogs and deli meats provide meals that are just as easy to prepare as these options, but offer a unique sense of integrity that accompanies kosher. Also, our products are more customizable and are easier to feed to groups. Lastly, we have the kosher advantage over our direct competition in the deli meat and hot dog markets (Oscar Mayer, Boar’s Head, Ball Park, etc.). Brand Meaning Implications These positioning bases allow Hebrew National to further expand its overall brand meaning to include quickness and ease. Comparing Hebrew National to all competition allows it to be positioned as having high integrity through its kosher certification, but also as quick, easy, affordable, customizable, enjoyable from consumers’ homes, and capable of feeding a group. The following table outlines how our brand’s meaning can be positioned as different from its diversity of competitors. Benefits Concerns Separating H.N. Fast, affordable, drivethrus, good taste Poor food integrity, unhealthy, consumers must leave their home, hard to feed large group, no customizability Higher food integrity, at home, faster, more affordable, better for feeding a group, customizability Upscale Fast Food Somewhat fast, better integrity than other fast food Consumers must leave home and endure a longer process, more expensive, similar concerns to other fast food Same as above Soups Fast, warm, comforting, easy to make, affordable Questionable food integrity, no customizability, hard to feed large group Higher food integrity, the kosher advantage, customizability, feeding larger groups Frozen Dinners Fast, easy, at home, less expensive than fast food Questionable food integrity, no customizability, can’t feed large group Same as above Other Hot Dogs and Deli Meats Fast, easy, at home, can feed many, cheap Bad stigma of “processed”, food sourcing concerns Higher food integrity, the kosher advantage Classic Fast Food Hebrew National Final Marketing Plan 4 Pricing In setting our price, we aim to achieve good margins, while assuming premium positioning in the market to strengthen our brand image. This will keep us where we are currently priced: slightly more expensive than direct hot dog and deli meat competitors. Additionally, because the production of kosher products causes us to incur higher costs than our competitors, this higher price is necessary to cover our operations. While we can assume premium positioning within the market, realities only allow us to set our price as slightly more expensive. The demand curves for hot dog and deli meats are relatively elastic, meaning pricing options are rather inflexible. Additionally, our products are in the maturity stage of the product lifecycle curve, for the perceived price and benefits of hot dogs and deli meats are deeply entrenched in the consumer’s mind. Consequently, if we price our products too high, consumers will not buy them, no matter how clearly we explain our benefits. Further, 45% of non-kosher buyers believe that kosher products are too expensive.iv This proves that our consumers make value-based judgments in choosing foods. Our entire marketing plan centers around magnifying the benefits associated with kosher, thus largely increasing our perceived value. While our price will not change, our product’s benefits will be more clearly articulated, increasing our value ratio. Lastly, we will maintain a one-price policy in order to be consistent with our unvarying brand message. Product Expansion & Packaging Changes In the deli meat market, Hebrew National can benefit by expanding deli meat options. Currently, we only offer sliced beef salami and beef bologna. Of households that purchase deli meats, 49% eat bologna and only 37% eat salami.v There is more opportunity for growth in turkey (79% of households), chicken (33% of households), and roast beef (41% of households).vi Because these product can be made kosher and are unlikely to cannibalize sales of our existing products, Hebrew National can expand without diluting our brand meaning or falling victim to typical line extension problems. Ultimately, this expansion will lead to a strong increase in total sales, as well as increased share in the growing deli meat market. Ultimately, we need consumers to trust Hebrew National for all of their deli meat needs. In the age of increasing brand loyalty, consumers tend to look to as few brands as possible to satisfy their needs. With such a slim offering of deli meats, Hebrew National is unlikely to be any consumer’s go-to option for deli meats. For example, when stocking up on deli meat, a consumer is unlikely to buy bologna and salami from Hebrew National if they already get their turkey and roast beef from another brand. A wider product offering can appeal to more consumers and foster greater brand loyalty. In terms of packaging, our regular beef frank packages have seven franks, but buns are Hebrew National Final Marketing Plan 5 usually sold in packages of eight. To reconcile this incongruence, we will begin to produce our regular beef franks in packages of eight. Initial Marketing Objectives: A Bigger Piece of a Bigger Pie By 2013, we intend to realize a three point increase in market share, a 30% increase in hot dog sales, and a 35% increase in deli meat sales. These figures were derived from a close analysis of the historical performance of Hebrew National and competing brands and with respect to market and environmental trends. Hot Dog Market Share By 2013, we believe Hebrew National can increase its share of the beef hot dog market by three percentage points, considering Hebrew National’s two-point increase in beef hot dog market share from 2007 to 2010.vii We believe our brand can sustain and markedly improve past levels of growth due to increased household penetration and the aforementioned favorable market trends. Additionally, we aim to increase the overall size of the market by broadening the appeal of hot dogs. We may be able to regain the trust and money of tuned-out, health-conscious consumers by remaining transparent about the production process and content of our products. Hot Dog Sales Since 2000, Hebrew National has recognized a nearly 60% increase in hot dog sales (from $49.6m to 79.2m).viii Additionally, our competitor, Ball Park, was able to realize a 40% increase in hot dog sales over the past 3 years.ix With respect to these historical growth rates and our anticipated increase in market share, we aim realize a 30% increase in sales dollars by 2013. Deli Meat Sales Another big area for potential growth for Hebrew National is in the deli meat area of the market. Currently, deli meats account for approximately 45% of our sales.x By 2013, we would like to see them account for 50% of our sales, which, with our anticipated 30% increase in hot dog sales, means at 35% increase in deli meat sales. While the deli meat market is currently flat, Mintel predicts market sales to trend upward. xi Additionally, we may increase sales by enhancing our brand meaning and offering a wider range of kosher products to consumers, such as chicken, turkey, and roast beef. Segmenting & Promoting to Market This section will outline appropriate segments, and explain effective ways to promote to each. Segmentation Outlook With kosher as a differentiating characteristic, and the rest of our brand meaning and Hebrew National Final Marketing Plan 6 positioning falling into place, we need to find appropriate audiences to receive our messages. Segmenting the market by the benefits people seek from their products can help Hebrew National market to people based on their causal reasons for choosing meals. Three effective and legitimate benefits segments prove to be healthfulness, quickness/ease, and affordability. Using these segments can take advantage of the economic downturn, health-conscious movement, and growing kosher market. Promotional Outlook Our overarching challenge is a hierarchy of communication effects issue. Consumers have heard the word “kosher”, but do not understand the benefits associated with it. In fact, 87% of households are not aware of what kosher is, and the remaining two-thirds say they don’t have the knowledge to understand the benefits associated with it.xii When it comes to the word kosher, consumers are mired in the cognitive stages of the hierarchy of communication effects. Success of our brand hinges on our promotion’s ability to take consumers through the entire hierarchy. In order to make consumers purchase Hebrew National, we first need them to understand kosher, then come to like, prefer, and have conviction about it. All of our promotion will primarily focus on the making the kosher advantage clear to consumers, but different nuances will be employed to engage each market segment. The first step will be replacing the religious connotations with those of integrity and safety. With significant ground to make up in educating consumers about our brand, advertising will be our main form of promotion. It is effective throughout the entire hierarchy of communication effects, and will allow us to reach a large audience while enabling us to have control over the content to deliver an unvarying message. Advertising will help us inform our target markets of our differentiating characteristic, as well as the benefits that go along with the rest of our brand meaning. The first goal of our advertising will be to spread awareness and knowledge about the kosher advantage. Justifying Our Promotion Advertising is expensive and can fall victim to wasted coverage, but the ability to spread our brand meaning to large audiences will more than make up for this financially. Hebrew National’s sales are increasing every year, and our plan for advertising will expedite this process, justifying the money spent to get our message to the public. Advertising that effectively takes people through the hierarchy of communication effects will lead to a significant increase in Hebrew National Sales. Healthful Segment Segmentation The current health-conscious movement in America ensures that this segment is substantial in size and potential profitability. Consumers are becoming more healthconscious every day, and 38% of people say the federal government does not have adequate food safety systems in place for processing red meat.xiii With the movement gaining strength, health concerns are here to stay. This, along with the rapid 15% annual growth rate of the kosher market, guarantees the durability of this segment.xiv Hebrew National Final Marketing Plan 7 These health conscious people will undoubtedly respond differently to certain marketing mixes that highlight healthfulness, as it is their primary objective in choosing foods. Existing studies that show that 41% of households purchase natural foods, 33% organic, and 13% kosher, as these comprise the majority of the healthful food market.xv An overwhelming majority of these consumers, 83%, cite a health related reason as their motivation for purchasing, making them recognizable and measurable.xvi Families with children also report elevated levels of purchasing, and with more mouths to feed this is especially true for value-oriented products. This group is accessible through multiple channels. They can be reached through mainstream media, especially by using specific programming to target households with children. Moreover, this group has high accessibility through social and other online media. Variance in data from online and offline sources suggests that Internet users are much more likely to purchase natural and organic, which provides us with an excellent channel for accessing this group.xvii Promotion Targeting this group will put our brand in direct competition with natural and organic products. Kosher is slightly more expensive than organic products, which are more expensive than natural products. Organic faces less strict certification standards than kosher, while natural requires no certification whatsoever.xviii Understanding this competition by the positioning bases of strictness/legitimacy and price, the following positioning map displays market space that Hebrew National can take advantage of by stressing kosher as its differentiating characteristic. Hebrew National Final Marketing Plan 8 With this positioning map in mind, advertising to the healthful segment of our market should focus on the strict standards and food integrity of the kosher label. As far as execution, storyline and comparative advertising are two attractive options in targeting this segment. In light of Hebrew National’s 106-year history, a storyline execution similar to that of Gatorade’s commercials can create a sense of reliability with our brand. Stressing the kosher advantage and cultivating this sense of trust due to our long history is sure to strike a chord with this target market. The goal is to bring new consumers into the hot dog and deli meat markets that normally would consider these foods low in quality and integrity. On the other hand, comparative advertising aims to directly steal market share from natural and organic. It can clearly and plainly describe and display the advantages kosher has over natural and organic and especially over meats with no healthful claim or certification. Further, comparative advertising will allow Hebrew National to lump all of its competitors as non-kosher, adopting a Taco Bell strategy to further separate itself. While this segment is accessible through traditional television advertising, we will also utilize social and online media to attract this segment. Research shows they are becoming increasingly accessible through these mediums.xix In addition, several daily deal sites (similar to Groupon) with focus on organic or natural products could be utilized to reach the most loyal of healthful food consumers. While this coupon promotion may drive some consumers to buy hot dogs and deli meats, the true purpose Hebrew National Final Marketing Plan 9 would be to raise awareness about the kosher advantage among a group of loyal organic and natural consumers. The ad on the following page is an example of how we can shift the loyalties of these consumers. Hebrew National Final Marketing Plan 10 Affordability Segment Segmentation The affordability segment is composed of people whose primary concern is finding inexpensive meal options. In light of the recent economic downturn, 68% of U.S. adults say they have changed their eating habits in order to save money.xx However, even in hard financial times, many consumers are reluctant to sacrifice the integrity of their diet. Within their tightening budget, 45% of U.S. adults say they want to find ways to incorporate healthy foods.xxi While Hebrew National products are pricier than other hot dogs and deli meats, they are less expensive than fast food and other meal options. Boasting “the kosher advantage” as our differentiating characteristic, Hebrew National is poised to capture the attention of this tight-fisted, health-conscious consumer. Overall, with millions of Americans struggling to maintain financial buoyancy, the affordability segment is sure to be durable and substantial. Cash-strapped consumers are measurable and recognizable through measurements of social welfare, such as average disposable income, the consumer confidence index, and the unemployment rate. With the economic downturn tightening the food budgets of even those making over $150K per year,xxii this group can be accessed everywhere, through all means of communication. Promotion From a strategic standpoint, we need to convince thrifty consumers looking to buy hot dogs or deli meat that our slightly higher price correlates with a massive increase in benefits. We can target this segment by stressing the kosher advantage, while alluding to Hebrew National’s relative affordability. Slice of life execution can grab the attention of the frugal yet health-minded consumer. Hebrew National can present an advertisement of a real-life, believable situation in which a cash-strapped family wants to maintain the integrity of its diet while still saving money. Our target market will immediately identify with the plight, and identify our products as solutions. The core message is that consumers won’t find another product of such integrity at such a low price. Since consumers in this segment make value-based judgments, this message will promote the value of our products by magnifying benefits. This will be a first step in educating consumers about the kosher advantage. Quickness/Ease Segment Segmentation Recent research points out that 51% of Americans are eating at home more often due to the economic crisis.xxiii This speaks strongly to the durability and substantiality of this segment. Clearly, the segment will have an overlap with the affordability segment. But since these consumers seek our products primarily for its quickness and ease, they will show differential responsiveness to advertising that highlights these characteristics. Accordingly, fast food market data is relevant in studying this segment. According to Mintel, 60% of adults that have children eat fast food because of the convenience.xxiv Similarly, 25% of adults with children said that in the last year they started going to fast Hebrew National Final Marketing Plan 11 food restaurants instead of casual dining restaurants.xxv Combined, these two statistics show a measurable shift in preferences of families. Adults with children are increasingly choosing to eat fast food over casual dining, and they are doing so because of the convenience it offers. Families choose to eat at fast food restaurants more than any other dining out option, highlighting their preference for quick, convenient meals.xxvi Further, 67% of adults with kids say they want to see healthier food options on the kids’ menu when dining out.xxvii These people that want to eat fast also want to eat healthy. We can offer them everything they need. Families are increasingly accessible through the Internet and social media. A Mintel survey of adults who eat out, found that 86% of people with kids have visited a website in the past 30 days, and 58% have visited a social networking site.xxviii This is compared to just 80% of adults with no kids who have visited a website in the past 30 days, and 43% who have used a social networking site.xxix This shows that we can use social media and the web to convey our brand meaning and convenience to those with kids. Promotion By emphasizing the kosher advantage and the quickness and ease of our products, we can make strides in stealing market share from fast food and other restaurants. These advertisements will use the execution tactic of problem solution and comparative advertising. By depicting Hebrew National as an easy solution to finding a quick and easy meal, we can appeal to the practical consumer. Further, by directly comparing our quickness, ease, and kosher advantage to fast food restaurants, we can become the more attractive choice for this segment. With 64% of adults eating out with the goal of having a quick meal, we can steal market share from out of home dining through this marketing mix.xxx The following table provides condensed analysis of our segments and our goals in targeting each. Healthful Segment Benefits Sought Consumption Level of Hot Dogs and Deli Meats Goals Demographics Nutritious food without food sourcing concerns, no artificial ingredients, etc. Very low (especially hot dogs) We want to expand this market, increase consumption levels, and steal overall market share from natural and organic products. Younger, Have children, Higher income Affordable Segment Relatively cheap meals that don’t break the bank High Quick/Easy Segment Meals that are easy to prepare and don’t take time out of a busy day Very High (especially deli meats) We want to steal market share from other affordable options consumed at home. We want to steal market share from fast food restaurants as well as at home meals. Lower income, Larger families Younger, Younger Children, All Incomes Hebrew National Final Marketing Plan 12 i Allen, Jane E. Turning to kosher cuts. n.d. SimpleToRemember.com. 9 Oct. 2011 <http://www.simpletoremember.com/articles/a/kosher-health/>. ii Allen, Jane E. Turning to Kosher cuts. iii Mintel. "Kosher Foods--U.S." Jan. 2009. Mintel. Washington and Lee University, Lexington, VA. 6 Oct. 2011. iv Mintel. “Kosher Foods—U.S.” v Mintel. "Lunch Meats--U.S." May. 2011. Mintel. Washington and Lee University, Lexington, VA. 5 Oct. 2011. vi Mintel. "Lunch Meats--U.S." May. 2011. vii "Brand Book." ConAgraFoodscareers.com. Con Agra, 1 Apr. 2011. Web. 3 Nov. 2011. <(www.conagrafoodscareers.com/pdf/Brand_Book.pdf).>. viii Petrak, L. (2002, July 1). The missing link. Retrieved November 2, 2011, from AllBusiness.com: <http://www.allbusiness.com/manufacturing/food-manufacturing/2377721.html#ixzz1d04ZYQ8v>. ix Nielsen. Nielsen Insights in Action: New Markets, Beefed Up Sales. N.p.: n.p., 2011. The Nielsen Company. 5 Nov. 2011 <http://www.nielsen.com/content/dam/corporate/us/en/public%20factsheets/Case%20Studies/C aseStudy-BallPark-GrowthandDemand.pdf>. x "Brand Book." ConAgraFoodscareers.com. xi Harper, Roseanne. “Sliced Thin.” Supermarket News. 12 July 2010. <http://supermarketnews.com/In-Store_Bakery_Deli_Meals/sliced-thin-0712/index.html>. xii Mintel. "Kosher Foods--U.S." Jan. 2009. Mintel. Washington and Lee University, Lexington, VA. 6 Oct. 2011. xiii Mintel. "Lunch Meats--U.S." May. 2011. xiv Severson, Kim. “For Some, ’Kosher’ Equals Pure.” New York Times 12 Jan. 2010: D1. Date xv Mintel. "Kosher Foods--U.S." xvi Mintel. “Natural and Organic Food and Beverage (NOFB): The Consumer--U.S..” Nov. 2011. Mintel. Washington and Lee University, Lexington, VA. 30 Nov. 2011. xvii Mintel. “Natural and Organic Food and Beverage (NOFB): The Consumer--U.S..” xviii Mintel. "Kosher Foods--U.S." xix Mintel. “Natural and Organic Food and Beverage (NOFB): The Consumer--U.S..” xx “Survey: More people eating at home.” (2009, September 4). Retrieved November 1, 2011, from UPI.com: <http://www.upi.com/Health_News/2009/09/04/Survey-More-people-eating-athome/UPI-65581252086536/>. xxi “Survey: More people eating at home.” xxii Mintel. “Budget Shopper--U.S.” Oct. 2010. Mintel. Washington and Lee University, Lexington, VA. 1 Dec. 2011. xxiii Lasson, K. (2009, July 10). The Tisch. Retrieved October 30, 2011, from Rabbicreditor: <http://rabbicreditor.blogspot.com/2009/07/baltimore-jewish-times-hebrew-national.html>. xxiv Mintel. “Quick Service Restaurants--U.S.” Sept. 2011. Mintel. Washington and Lee University, Lexington, VA. 29 Nov. 2011. xxv Mintel. “Quick Service Restaurants--U.S.” xxvi Mintel. “American Families and Dining Out--U.S.” Feb. 2011. Washington and Lee University, Lexington, VA. 30 Nov. 2011. xxvii Mintel. “American Families and Dining Out--U.S.” xxviii Mintel. “American Families and Dining Out--U.S.” xxix Mintel. “American Families and Dining Out--U.S.” xxx Mintel. “American Families and Dining Out--U.S.” Hebrew National Final Marketing Plan 13